-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI US MARKETS ANALYSIS - Bear-Steepening the Theme Across Europe & US

HIGHLIGHTS:

- Reflationary theme persists as AUD, commodities hit new cycle highs

- US real yields continue to rise

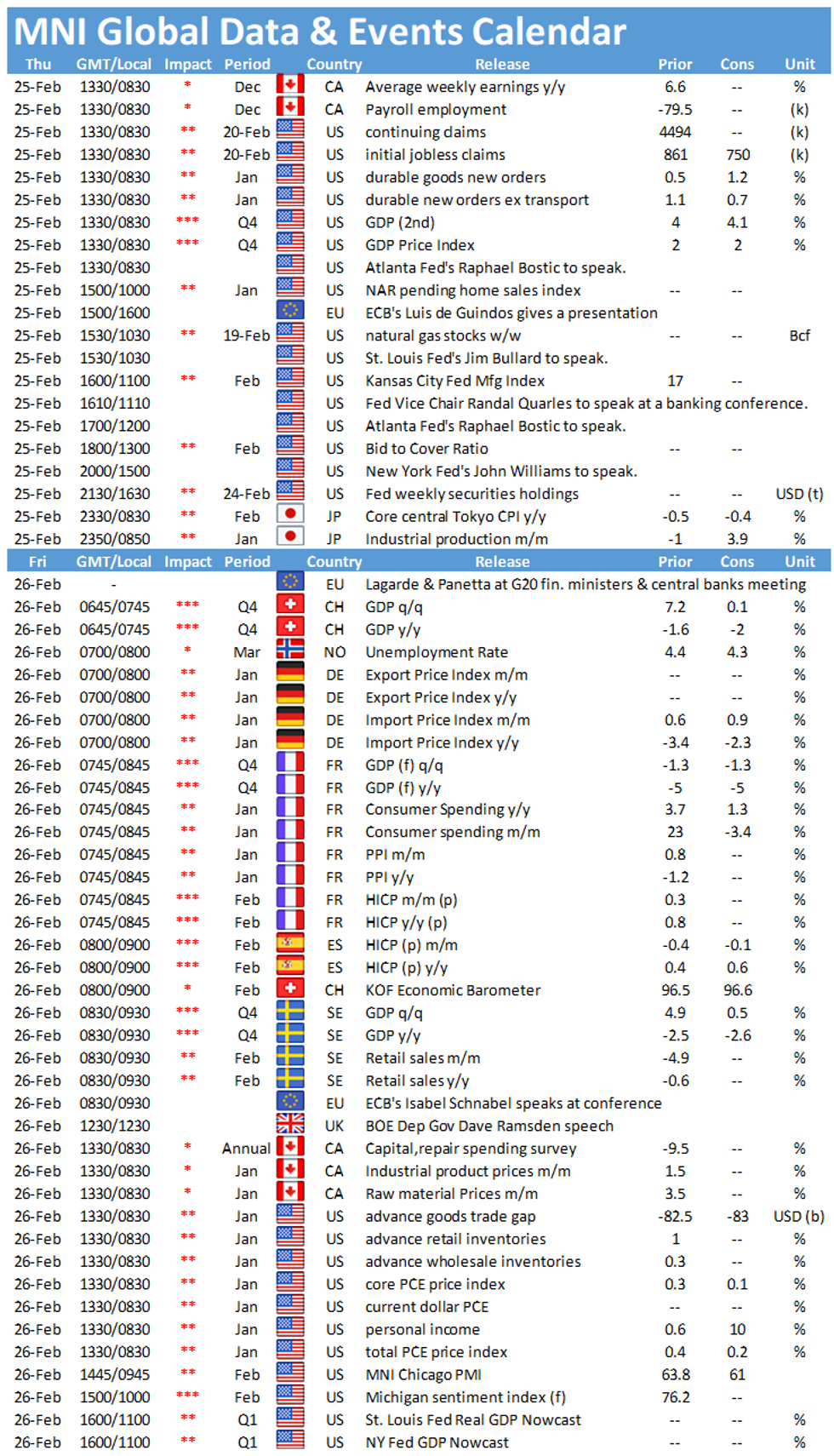

- Data deluge, with jobless claims, durable goods, GDP & pending home sales all due

US TSYS SUMMARY: Real Yields Continue To Rise Ahead Of Data

There was no let-up to Tsy weakness in overnight trade, with the long end getting hit once again. Double-digit rises in Aussie and Kiwi yields seen as the catalyst in Asia-Pac trading, with weakness continuing in the European session.

- The 2-Yr yield is up 1bps at 0.1328%, 5-Yr is up 6bps at 0.6608%, 10-Yr is up 6.7bps at 1.4424%, and 30-Yr is up 6.2bps at 2.2949%.

- 10-Yr real yields hit the highest levels since Jul 2020 (albeit still negative w 10 TIPS at -0.7316%); 2s30s nominal since 2015, 5s30s since 2014.

- 0830ET data: jobless claims alongside Jan prelim durable goods orders and second reading of Q4 GDP. Pending Jan home sales at 1000ET, with KC Fed Mfg at 1100ET.

- Another busy schedule of Fed speakers today: 0830ET is Atlanta's Bostic, 1030ET StL's Bullard, 1110ET VC Quarles, 1500ET NY's Williams.

- In supply, 1130ET sees $65B of 4-/8-week bill auctions; 1300ET is $62B 7Y Note auction. NY Fed buys ~$1.75B of 20-30Y Tsys.

EGB/GILT SUMMARY: Bear Steepening Theme Continues

European sovereign bonds have sold off sharply this morning with curves continuing to bear steepen.

- Gilts have underperformed EGBs with yields 3-10bp higher on the day and the curve 7bp steeper.

- Ahead of the UK March budget, speculation is building on the possibility of gradual tax rises. Given the government's previous election promise not to raise income taxes or VAT in this parliament, attention is focused on the possibility of adjustments to corporate tax, capital gains and pension relief.

- Bunds have traded weaker with yields 2-5bp higher.

- OATs have marginally underperformed bunds with long end yield pushing up 6bp. Last yields: 2-year -0.6056%, 5-year -0.4934%, 10-year 0.0156%, 30-year 0.8180%.

- BTPs trade closer to gilt. Yields are up 6-9bp on the day.

- Supply this morning came from Italy (BTP/CCTeu, EUR6.25bn).

EUROPE OPTION FLOW SUMMARY

Eurozone:

Bund package:

RXJ1 170.50/168ps, bought for 67 in 20k

RXJ1 170p, sold at 66 in 5k

RXJ1 172c sold at 41 in 15k

DUJ1 112.10/20/30c fly, bought for 2 in 4k

DUJ1 112.20/10ps 1X2, bought for 1.5 in 1.25k

3RJ1 100.25/100.12ps, bought for 3.25 in 4k

UK:

3LZ1 99.37/99.12ps vs 0LZ1 99.75p, bought the 1yr for 1.5 in 2k

US:

TYJ1 134/133.50ps,sold 14 in 10kTYJ1 133/132.5ps, sold at 9 in 5k

EUROPE ISSUANCE: Italy Sale

Italy sells E6.25bln BTP/CCTeu vs E5.25-6.25bln target

E5.0bln of the new 0% Apr-26 BTP:

Average yield 0.11% (0.07%), Bid-to-cover 1.33x (1.48x)

E1.25bln of the 0% Dec-23 CCTeu

Average yield -0.19% (0.27%), Bid-to-cover 1.79x (2.06x)

FOREX: AUD Catching Up With Buoyant Commodities

The reflationary theme in currency markets continues, with AUD/USD shooting higher and topping $0.80 for the first time since 2018. The currency's taken the lead from commodity markets, whose persistent rally has extended this week and put AUD/USD within range of the key double top resistance from 2017/2018 at 0.8125/36.

The greenback is softer, but JPY is the weakest in G10 alongside CHF as risk sentiment and the reflationary theme continues to work against haven currencies.

Scandi currencies outperform, with NOK, SEK firmer. Both currencies are are new multi-month highs against the greenback.

Focus Thursday turns to weekly jobless claims, another revision for Q4 GDP data, prelim durable goods orders and January pending home sales data. The central bank speaker slate is once again busy, with comments scheduled from Fed's Bostic, George, Bullard, Quarles & Williams as well as ECB's Lane, Guindos and de Cos.

Expiries for Feb25 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E863mln), $1.2095-1.2115(E906mln), $1.2130-50(E1.3bln)

USD/JPY: Y104.25-30($775mln), Y105.00($623mln), Y105.40-50($551mln), Y106.65-80($718mln)

EUR/GBP: Gbp0.8600(E891mln-EUR puts)

AUD/USD: $0.7910(A$1.3bln), $0.7950(A$503mln)

NZD/USD: $0.7400(N$1.1bln)

USD/CAD: C$1.2624-25($1.0bln), C$1.2750-60($1.0bln)

USD/CNY: Cny6.4685-00($575mln), Cny6.7295($1.25bln)

EQUITIES: Stocks Solid, But Off the Day's Highs

US futures sit in minor positive territory, but are well off the session's best levels ahead of the NY open. Nonetheless, tech names continue to underperform as NASDAQ futures sit in minor negative territory.

- European cash markets look more solid, with gains of 0.2-0.5% for most core markets. German markets lag slightly, with the DAX broadly flat on the day.

- Energy names are fuelling the gains, with European refiners and oil services firms trading particularly well. Defensive consumer staples and healthcare names are the laggards in the Stoxx 600.

COMMODITIES: Bullish Price Sequence in Oil Extends

Oil markets remain supported, with both WTI and Brent crude futures inching higher still to secure another session of higher highs to keep the bull run in tact. For Brent crude futures, markets have extended the sequence of higher highs to 16 of the past 19 sessions. This has helped narrow the gap for Brent crude with the key resistance at the 2020 high of $71.75.

- EIA's NatGas storage change figures cross later today, with markets expecting a draw of around 328 BCF in the latest week of data.

- Precious metals are mixed, with gold slightly weaker while silver holds water. The gold/silver ratio remains close to cycle lows, with persistent gold underperformance likely to result in the lowest ratio since 2013.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.