-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Inside Range Ahead Key Inflation Data

MNI BRIEF: EU Calls Feb 3 Summit To Brainstorm Defence

MNI US MARKETS ANALYSIS - BoE In Focus

HIGHLIGHTS:

- Markets awaits BoE decision, with risk other MPC members could join Haldane in voting for taper

- USD/JPY trades to a new 2021 high

- Plentiful Fedspeak, with Barkin, Bostic, Harker, Williams, Bullard, and Kaplan due

US TSYS SUMMARY: Edging Lower Ahead Of Busy Thursday Schedule

Treasuries have edged lower overnight Thursday, as we await a swathe of data releases, multiple Fed speakers, bank stress test results, and 7Y Tsy supply.

- Sep 10-Yr futures (TY) down 2/32 at 132-04 (L: 132-01 / H: 132-07), once again on light volumes (<220k). The 2-Yr yield is up 0.4bps at 0.2661%, 5-Yr is up 2.3bps at 0.9038%, 10-Yr is up 0.7bps at 1.4919%, and 30-Yr is up 0.3bps at 2.1117%.

- Equity futures touching fresh all-time highs; dollar a little weaker.

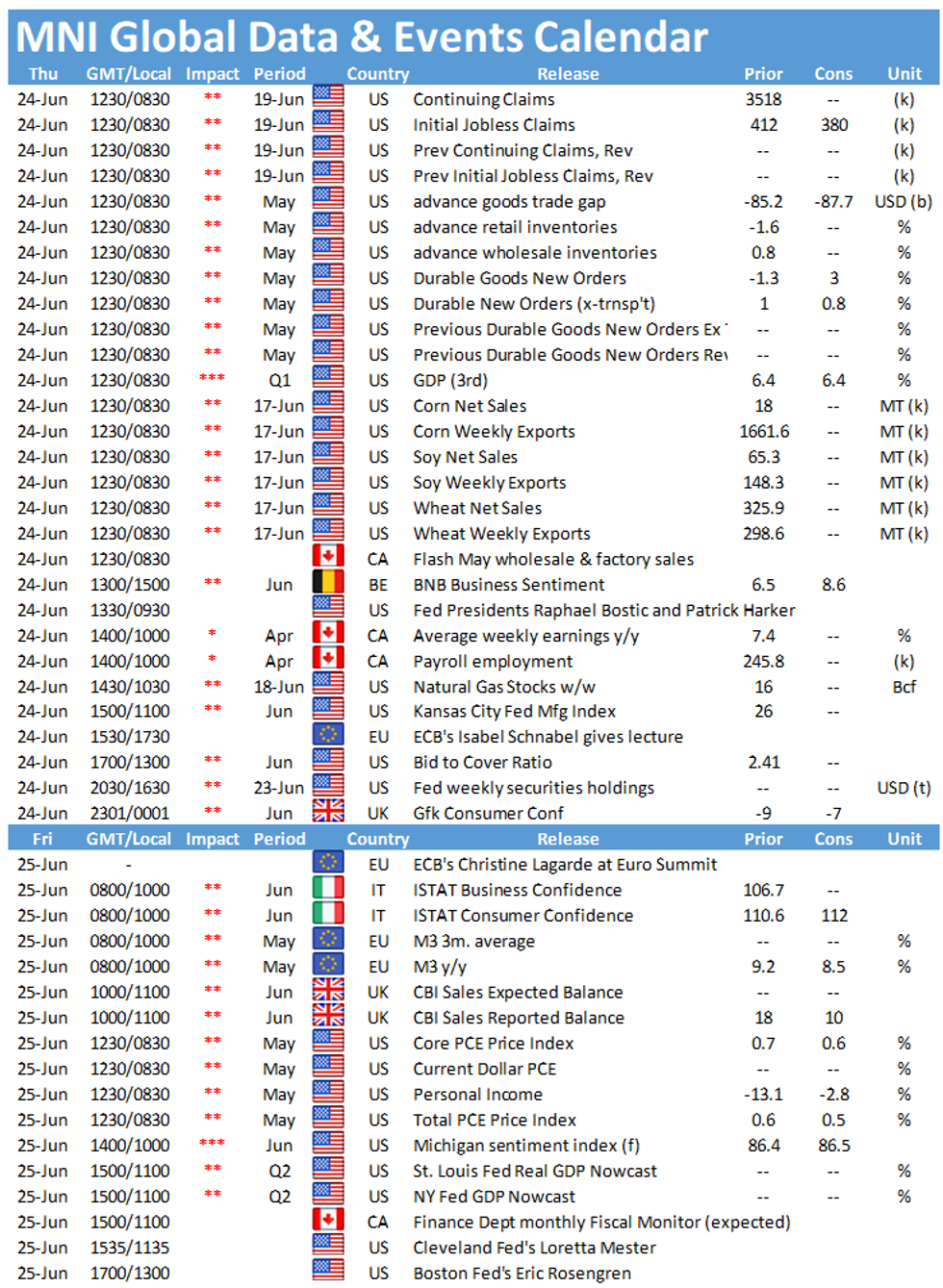

- In data: durable goods orders, wholesale inventories, jobless claims, final 1Q GDP, and trade balance data feature at 0830ET, while we get KC Fed manufacturing later in the morning (1100ET).

- Plenty of Fed speakers once again. Richmond's Barkin appears twice (0900ET and 1600ET). We get Atl's Bostic and Philly's Harker at 0930ET; NY Fed's Williams at 1100ET; St Louis's Bullard and - separately - Dallas's Kaplan at 1300ET.

- Then at 1630ET, the Fed releases bank stress test results.

- In supply, 1130ET brings $80B combined in 4-/8-week bill auctions, while 1300ET sees $62B 7Y note auction. NY Fed buys ~ $2.025B of 22.5-30Y Tsys.

- In Washington, bipartisan senators will brief Biden on a tentative agreement on infrastructure reached yesterday.

EGB/GILT SUMMARY: Gilt Curve Flattens Heading Into BoE

The gilt curve has flattened heading into the midday BoE decision, while EGBs have broadly traded weaker alongside a soft dollar.

- The Bank of England decision is due at the top of the hour. No major change in policy is expected, but the vote composition will be closely watched to see whether there are any further dissenters joining Haldane in calling for a reduction in the QE target.

- The short end of the gilt curve has weakened a touch with the 2-year yield up 1bp while the longer end trades marginally below yesterday's close.

- German IFO data for June came in slightly stronger than expected and comes on the heels of yesterday's robust preliminary PMI prints for the same month.

- Bunds have weakened and the curve has marginally bear steepened with the 2s30s spread 1bp wider.

- OATs are similarly soft, while trading near yesterday's closing levels.

EUROPE ISSUANCE UPDATE

Italy syndicates: 7Y CCTeu Final Spread / Books > E11.5bln

Final spread set at 6 month Euribor + 69bp (vs +70bp area guidance)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ1 173c, sold at 35 in 1k

UK:

0LN1 99.50p sold at 1.5 in 7k

0LN1 99.62p sold at 6.75 in 4.5k (ref 99.57)

0LV1C 99.62c vs 2LV1C 99.50, sold the 1yr at 0.5 and 0.25 in 7k

2LZ1 99.37c v 3LZ1 99.25c, bought the 2yr for -075 in 2k. This was also bought yesterday in 5k

FX:

EURUSD (UEAZ1) 1.2600c trades 0.0024 in 1.65k

Underlying is at 1.19695, Expiry 03/12/21.

FOREX: USD/JPY Inches to New 2021 Highs Overnight

- The greenback trades slightly softer as markets resume their overall bullish poise. Stock futures are extending their recovery, with the e-mini S&P within 15 points of the alltime highs.

- USD/JPY inched higher to touch a fresh 2021 high of Y110.21 in Asia-Pac hours, before prices faded into minor negative territory ahead of the NY crossover.

- NOK is stronger for a fourth session, with USD/NOK trading either side of the 8.50 level as a solid oil price performance underpins the currency. EUR/NOK eyes support at the 10.1276 100-dma, and a break below here would open the 10.09 50-dma and the 2021 lows of 9.8998.

- Focus turns to the Bank of England rate decision, with markets on watch for any signs of other MPC members joining outgoing Chief Economist Andy Haldane in voting for a slowdown in QE purchases. Data includes weekly US jobless claims, prelim durable goods orders and the tertiary reading for Q1 GDP.

- Speakers due Thursday include ECB's Panetta & Schnabel as well as Fed's Barkin, Bostic, Harker, Williams, Bullard and Kaplan.

FX OPTIONS: Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E1.8bln), $1.1840-50(E1.0bln), $1.1900-10(E1.1bln), $1.1920-25(E1.8bln), $1.1945-50(E713mln), $1.1975(E640mln), $1.2000-20(E1.1bln)

- USD/JPY: Y109.50($658mln), Y109.95-110.00($2.1bln), Y110.25-30($663mln), Y110.50($602mln), Y110.65-75($1.3bln-USD puts), Y111.20-30($1.8bln), Y111.75($1.4bln)

- GBP/USD: $1.3895-00(Gbp798mln), $1.4000(Gbp686mln)

- EUR/JPY: Y132.00(E556mln)

- AUD/USD: $0.7750-70(A$1.25bln)

- USD/CAD: C$1.2900($1.4bln)

- USD/CNY: Cny6.40($1bln)

Price Signal Summary - S&P E-Minis Bulls Targeting Recent High

- In the equity space, S&P E-minis needle still points north following the recent recovery from support around the 50-day EMA. Key support is unchanged at 4126.75, Jun 21 low. The bull trigger is 4258.25, last week's high.

- In FX, the EURUSD outlook is unchanged and remains bearish following last week's sharp sell-off. The focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. GBPUSD remains vulnerable following last week's bearish pressure and recent gains are considered corrective. Attention is on 1.3717 next, Apr 16 low. USDJPY traded higher yesterday and delivered fresh 2021 highs, with a print above Y110.97, Mar 31 high and the previous bull trigger. This cements the uptrend and maintains a bullish price sequence of higher highs and higher lows. Attention is on 111.30/32, the Mar 26, 2020 high and 1.0% 10-dma envelope.

- On the commodity front, Gold is consolidating. The outlook remains weak and the current consolidation appears to be a bear flag. This reinforces a bear theme and the focus is on $1756.2, low Apr 29. The Oil market remains firm and continues to trend higher. Brent (Q1) focus is $76.97, 1.23 projection of Mar 23 - May 18 - May 21 price swing. WTI (Q1) sights are set on $75.01, 1.382 projection of Mar 23 - May 18 - May 21 price swing.

- Within FI, Bund futures have this week probed support at 171.80, Jun 17 low. A stronger sell-off would expose 171.37, Jun 3 low and 170.99, Mar 31 low and a key short-term support. Key support to watch in Gilt futures is unchanged at 126.70, Jun 3 low.

EQUITIES: Stocks Within Range of ATH as Recovery Extends

- The equity recovery continues apace ahead of the Thursday open, with the e-mini S&P now within range of the all-time highs posted mid-June at 4258.25. The 50-day EMA remains a reliable trend indicator and continues to successfully identify where demand interest in this contract lies, once a corrective cycle is underway. Key short-term support has been defined at 4126.75. A break would signal scope for a deeper decline.

- Across Europe, stocks are uniformly higher, with the Spanish IBEX-35 outperforming to trade with gains of 1.3% at the mid-point of the session. UK's FTSE-100 lags slightly, trading with shallower gains of 0.3%.

- Europe's Tech sector is leading the way higher, with financials and consumer discretionary firms not far behind. The laggards Thursday are communication services and real estate names.

COMMODITIES: WTI, Brent Uptrend Remains Orderly

- WTI and Brent crude futures are rangebound early Thursday, but holding the bulk of the week's gains and sit just below the cycle highs. A bullish sequence of higher highs and higher lows remains intact and moving average studies are in a bull mode reinforcing the current bull trend conditions and market sentiment.

- It is worth noting that the trends in both Brent and WTI appear orderly and daily ranges highlight a low volatility environment as price gradually continues to climb. From a technical perspective, this reflects a healthy uptrend. Key short-term support levels to watch are: Brent (Q1) - $72.01, June 17 low and $69.26, the 50-day EMA. WTI (Q1) - $69.54, Jun 17 low and $66.51, the 50-day EMA.

- NatGas storage change data crosses later today, with markets expecting a build of 64BCF.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.