-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI US Markets Analysis: BOE Widens Bond Purchase Programme

Highlights:

- BOE widens bond purchase programme to include 3+ year linkers - and pauses corporate bonds sales.

- Number of CB speakers due up later including BOE Governor Bailey.

Key Links: BOE APF Indemnity to Trigger Gilt Issuance Surge / US Employment Insight

US TSYS: Post-Holiday Bear Steepening With 3Y Supply, Mester In Focus

- Cash Tsys see a sizeable bear steepening from Friday’s close after the Columbus Day holiday, despite 10Y yields pulling back after an earlier test of 4%. The moves see a catching up with a Gilts-led significant cheapening in European FI. 3Y supply and Fedspeak headline the docket ahead of PPI/FOMC minutes tomorrow and then CPI on Thu.

- A small beat for the NFIB small business optimism survey didn’t move the needle although a reduced share of those raising selling prices and fewer difficulties filling positions suggest some progress in rebalancing at least at the margin.

- 2YY +0.6bps at 4.314%, 5YY +3.5bps at 4.177%, 10YY +6.2bps at 3.943%, and 30YY +7.1bps at 3.912%.

- TYZ2 trades 1 tick higher at 111-01+ with above average volumes after yesterday’s thin holiday session, off overnight lows of 110-21+ that came close to support at the bear trigger of 110-19 (Sep 28 low).

- Fedspeak: Mester (’22 voter) at 1200ET – text + Q&A tbd

- Bond issuance: US Tsy $40B 3Y Note auction (91282CFP1) – 1300ET

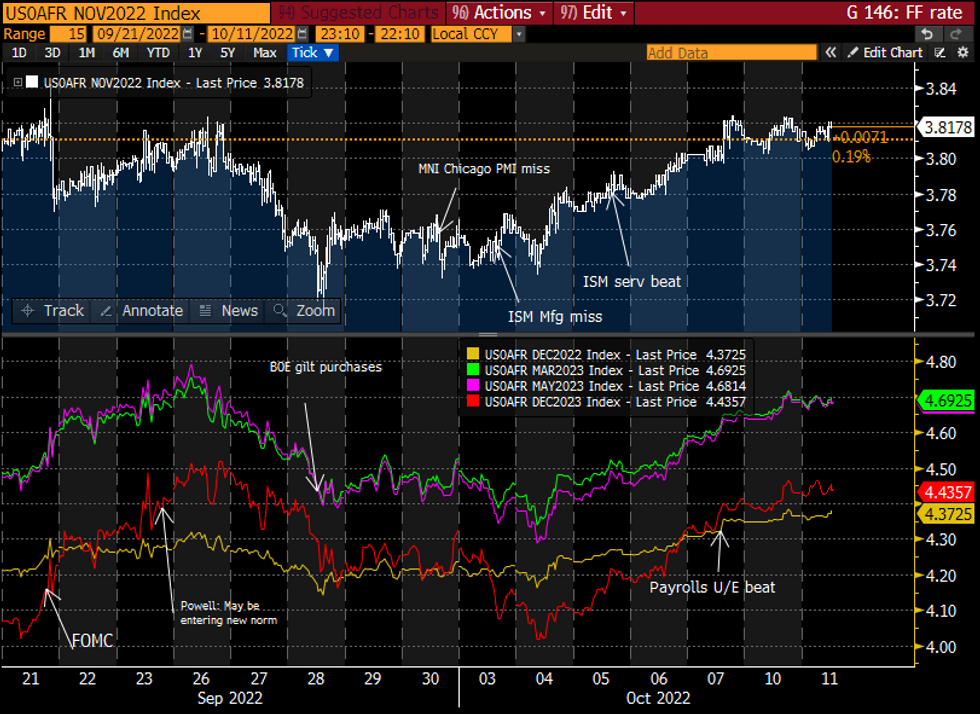

STIR FUTURES: Fed Path Holding Yesterday’s Holiday Increase

- Fed Funds implied hikes so far keep to yesterday’s Columbus Day increases for meetings from Dec onwards as terminal and Dec’23 rates move back within 10bps of cycle highs in the days following the Sep FOMC.

- Showing 74bp for Nov (unch), 129bps to 4.37% for Dec’22 (+2.5bp from Fri close), a terminal 4.69% Mar’23/May’23 (+4bp) and 4.44% Dec’23 (+2.5bp).

- Sole Fedspeak from Mester (’22) at 1200ET. Said Friday not seen any evidence to warrant slowing the pace of hikes with more work to do whilst being ‘singularly focused’ on reducing inflation.

- VC Brainard yesterday saw mon pol as needing to be restrictive for some time and warned of easing prematurely, but equally continued to note external factors with “the combined effect of concurrent global tightening is larger than the sum of its parts” and a smaller than first thought buffer from household excess savings.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

BUNDS: Yesterday's low holds

- Bund is off the lows, after some of the moves lower were helped by the underperformance in BTP futures (on medium term growth outlook concerns).

- German newspaper Handelsblatt, also reported that the German Government expects 7% inflation 2023, and although a drop from the 8% seen in 2022, this is still elevated.

- The German 10yr Yield made another decade high, after future tested yesterday's low and initial support at 135.83 (did print 135.81 low).

- The early Schatz Auction kept the lid in Govie future on delta hedging.

- There's also plenty of Corp Issuance for today, and non swapped deal will weigh into respective duration at pricing.

BOE: New purchases of linkers announced; corp bond sales paused

The Bank of England has announced the following changes to this week's operations:

- Linkers will now be eligible in the daily gilt purchase operations for the remainder of this week. The BOE will purchase as a "backdrop" - in the same way it has acted as a backdrop for conventional purchases.

- Up to GBP5bln linkers will be eligible for purchase each day and GBP5bln of long conventional.

- Linker purchases will take place between 14:15-14:45BST.

- The long-dated conventional purchases will now take place between 15:15-15:45BST (an hour later than previous operations).

- The daily purchase amounts will be confirmed each morning at 9:00BST.

- Corporate bonds sales scheduled for today and tomorrow "will not take place". Confirmation of next week's operations will be made at 11:00BST next Monday (17 October).

European Auctions

EU syndication update

- 7-year 1.625% Dec-29 EU NGEU tap. Size set at E5bln, spread set at MS - 21bp, books in excess of E16.5bln (inc E850mln JLM interest)

- New 20-year Nov-42 NGEU/MFA. Size set at E6bln, spread set at MS + 32bp, books in excess of E27bln (inc E1.85bln JLM interest).

- New 30y 1.80% Aug-53 Bund. Size set at E4.0bln (plus issuer retention TBD), spread set at 0% Aug-52 Bund + 2.5bps, books over E5.9bln (inc E850mln JLM interest).

- E5.5bln (E4.372bln allotted) of the 0.40% Sep-24 Schatz. Avg yield 1.91% (bid-to-cover 1.06x).

- E2.1bln of the 0% Jan-29 DSL. Avg yield 2.403%.

- E900mln nominal of the 30-year 0.215% Mar-51 linker. Avg yield 1.551% (bid-to-cover 2.75x).

FI OPTIONS RECAP

OEX2 119/118ps, sold at 40 in 2.5k

ERU3 97.00^ sold in 50k vs 97.50c at 92 (traded last night)

FVZ2 107.25/106.25ps, sold at 28.5 in 17.5k

SX5E (15/12/23) 1900/1800ps, bought for 6.50 in 2.5kSX7E (17/03/23) 77.5^ trades 14.10 in 10k

FX OPTIONS EXPIRIES

Noteworthy:

- GBPUSD 1.33bn at 1.0925

- EURUSD 1.37bn at 0.9700 (Wed)

- USDCNY 1bn at 7.18 and 1.4bn at 7.20 (all Thurs)

- EURUSD: 0.9770 (413mln)

- USDJPY: 145 (351mln), 146 (470mln)

- GBPUSD: 1.0925 (1.33bn)

- USDCNY: 7.10 (1.28bn).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.