-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US MARKETS ANALYSIS - BoJ Step in to Steady Bond Markets

Highlights:

- BoJ steady bond markets with unscheduled buy operation, first since February

- USD/JPY through resistance, narrows gap with June peak

- US SLOOS takes focus, with BoE later in the week

Modest Cheapening With MNI Chicago PMI and SLOOS Ahead

- Cash Tsys are off overnight lows but still trade slightly cheaper across the curve with yields 1-3bp higher on Friday’s close, with the sell-off still led by 10s despite a block buy in TY futures of ~$402k DV01 earlier helping stabilise the cheapening.

- Chicago Fed’s Goolsbee (’23 voter) is the second FOMC speaker post the decision blackout, although increased data dependency should see greater focus on the MNI Chicago PMI and SLOOS.

- 2YY +1.3bp at 4.887%, 5YY +2.5bp at 4.202%, 10YY +2.8bp at 3.979% and 30YY +1.8bp at 4.029%.

- TYU3 trades 2+ ticks lower at 111-08+ but remains within Friday’s range, with Friday’s low of 110-25+ providing initial support whilst resistance is seen at 112-07 (Jul 27 high). Volumes at 260k are below the recent average for the time of day, which was skewed higher by last week's BoJ reaction, but in keeping with more typical levels.

- Data: MNI Chicago PMI Jul (0945ET), Dallas Fed Mfg. Activity Jul (1030ET), SLOOS (1400ET)

- Fedspeak: Chicago Fed Goolsbee, Yahoo interview (0920ET)

- Bill issuance: US Tsy $65B 13W, $58B 26W Bill auctions (1130ET)

- Recall that Fed Chair Powell provided a preview of the SLOOS last week, noting "I would just say it's broadly consistent with what you would expect. You've got lending conditions tight and getting a little tighter. You've got weak demand. And you know, it gives a picture of pretty tight credit conditions in the economy. I think it's really hard to tease out whether, how much of that is from this source or that source, but I think what matters is the overall picture is of tight and tightening lending conditions."

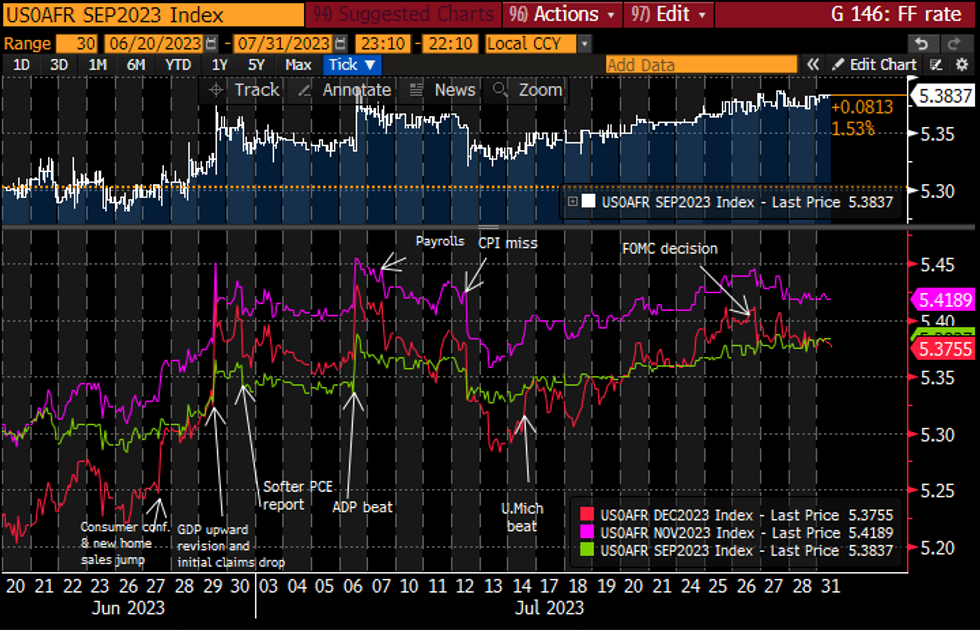

STIR: Little Impact From Kashkari Sunday, Goolsbee Next Up

- Fed Funds implied rates have nudged up marginally since Friday’s close, with still only a cumulative 9bp of tightening priced over the two meetings to November for a terminal 5.42% vs the median June dot showing another hike. It’s then followed by 52bp of cuts to Jun’24 and a cumulative 122bps to Dec’24.

- Cumulative hikes from 5.33% effective: +5.5bp Sep (+1bp), +9bp Nov (unch).

- Cuts from Nov terminal: 4bp to Dec’23 (unch), 52bp to Jun’24 (from 53bp Fri close), 122bp to Dec’24 (from 124bp).

- Kashkari (’23 voter) kickstarted post-FOMC Fedspeak yesterday with balanced rather than outright hawkish comments on CBS (inflation outlook “quite positive” but “if we need to hike, raise rates further from here, we will do so”). A typically more dovish Chicago Fed’s Goolsbee (’23 voter) is next up at 0920ET in a Yahoo Finance interview.

Source: Bloomberg

Source: Bloomberg

Mix Of Fresh Longs & Short Cover Drove SOFR Positioning Swings On Friday

The combination of Friday’s price action (richer on the day, excluding SFRM3) and preliminary open interest data pointed to a combination of fresh longs being added and short covering across the strip. The whites saw short cover in net terms, as did the greens, while the reds and blues saw fresh longs added in net terms. As a reminder, U.S. data (once again leaning into the “Goldilocks” scenario) and the rally in equities provided the key events during Friday’s NY session.

| 28-Jul-23 | 27-Jul-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM3 | 1,114,788 | 1,113,722 | +1,066 | Whites | -8,262 |

| SFRU3 | 1,111,996 | 1,115,057 | -3,061 | Reds | +17,381 |

| SFRZ3 | 1,267,345 | 1,276,161 | -8,816 | Greens | -5,700 |

| SFRH4 | 861,237 | 858,688 | +2,549 | Blues | +12,876 |

| SFRM4 | 805,343 | 799,301 | +6,042 | ||

| SFRU4 | 747,414 | 754,006 | -6,592 | ||

| SFRZ4 | 778,166 | 761,459 | +16,707 | ||

| SFRH5 | 525,108 | 523,884 | +1,224 | ||

| SFRM5 | 511,611 | 511,569 | +42 | ||

| SFRU5 | 438,606 | 444,870 | -6,264 | ||

| SFRZ5 | 348,335 | 347,202 | +1,133 | ||

| SFRH6 | 249,949 | 250,560 | -611 | ||

| SFRM6 | 181,480 | 178,521 | +2,959 | ||

| SFRU6 | 155,331 | 150,924 | +4,407 | ||

| SFRZ6 | 175,952 | 172,622 | +3,330 | ||

| SFRH7 | 126,444 | 124,264 | +2,180 |

FOREX: JPY Slips as BoJ Step in to Contain Yields

- JPY is softer against all others in G10, falling on the back of an unexpected BoJ operation to curb a rise in local bond yields. The Bank's operation was the first of its kind since February, intervening by buying as much as $2bln in JGBs at market rates. USD/JPY spiked to 142.49 in response, the highest since early July to narrow the gap with the key bull trigger at 145.07.

- Eurozone flash inflation numbers came in well within the range of expectations, leaving little wake across currency markets. EUR/USD continues to very gradually retrace the sharp Thursday pullback, making 1.1047 and 1.1150 the next upside levels.

- Antipodean currencies are trading well, with both AUD and NZD higher ahead of this week's RBA rate decision, at which the bank are seen raising rates by 25bps to 4.35%. The moves also follow the more mixed China PMI releases, with manufacturing PMI beating expectations, but non-manufacturing coming in just below forecast.

- This leaves the greenback mixed-to-lower, but the uptrend posted off the July low remains intact for now. As a result, key resistance at the 100- and 50-dmas of 102.40 and 102.52 remain the levels to watch.

- The MNI Chicago PMI takes focus going forward, with Dallas Fed Manufacturing Activity also on the docket. The Senior Loan Officer Opinion Survey from the US could also draw some focus, after being referenced in the press conference with Fed chair Powell last week.

FX OPTIONS: Expiries for Jul31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E1.2bln), $1.1000(E1.3bln), $1.1085-00(E1.8bln)

- USD/JPY: Y138.00($2.5bln), Y139.00($1.2bln), Y140.00($1.2bln), Y141.00($778mln)

- EUR/JPY: Y153.50(E510mln)

GILTS: Wings Lead Weakness

Gilt futures have been happy to consolidate the early gap lower and last operate a touch above worst levels of the day, -40 or so, while cash trade sees the major benchmarks running 3.5-4.5bp cheaper, with the wings leading the weakness.

- SONIA futures are flat to -3.5 on the day.

- The space has looked through the latest round of tier 1 Eurozone data prints, with no meaningful cross-market impact observed.

- Local headline flow remains light, outside of slightly firmer than expected credit and mortgage lending data.

- This leaves local focus on Thursday’s BoE monetary policy decision.

- BoE-dated OIS continues to show ~35bp of tightening for this week’s meeting, while terminal policy rate pricing continues to hover around 5.90%. Both these measures are comfortably shy of the recent hawkish extremes on the back of broader market fluctuations and the recent run of tier 1 domestic data. Markets and the sell-side remain relatively non-committal re: the size of the Bank’s next policy step, we will provide much more colour on that in our full BoE preview later this week.

EQUITIES: E-Mini S&P Holds Onto Friday's Gains

- Eurostoxx 50 futures rallied late last week. This resulted in a break of key resistance at 4447.00, the Jul 3 high and a bull trigger. The rally has confirmed a resumption of the uptrend and marked the end of a broad sideways move that started May 19. Attention is on 4501.60 next, a Fibonacci projection. Key short-term support has been defined at 4331.00, the Jul 26 low. A break of this level would be a bearish development.

- The E-mini S&P contract traded to a high of 4634.50 Thursday before reversing. This highlights a possible short-term bearish signal. Price has found resistance at the top of a bull channel drawn from the Mar 13 low - the channel top is at 4643.65 today. A continuation lower would expose the 20-day EMA - at 4534.05 and a break of this level would strengthen bearish conditions. Clearance of the channel top is required to resume the uptrend.

COMMODITIES: Uptrend in WTI Futures Remains Intact

- The uptrend in WTI futures remains intact - last week’s gains confirmed a resumption of the bull cycle. The break above $77.15, the Jul 13 high signals scope for an extension towards the next key resistance at $81.44, the high on Apr 12 / 13. Moving average studies are in a bull-mode position, reinforcing current positive conditions. Key short-term support has been defined at $73.78, the Jul 17 low.

- Gold traded sharply lower last Thursday. The move down resulted in a break of support at the 50-day EMA - at $1951.4. A continuation lower would threaten the recent bullish theme and instead expose support at $1924.5, the Jul 11 low. Clearance of this level would expose key support at $1893.1, the Jun 29 low. Key short-term resistance has been defined at $1987.5, the Jul 20 high. A break of this hurdle is required to reinstate a bullish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/07/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 31/07/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/07/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/08/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 01/08/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 01/08/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/08/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 01/08/2023 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 01/08/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/08/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 01/08/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/08/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 01/08/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/08/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 01/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/08/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/08/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/08/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/08/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/08/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 01/08/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 01/08/2023 | 1400/1000 |  | US | Chicago Fed's Austan Goolsbee | |

| 01/08/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 01/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 02/08/2023 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.