-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - CB Pricing Backtracks as PMIs Begin to Crack

Highlights:

- ECB implied pricing backtracks as rate hikes bite into PMI

- EUR/GBP reverses toward recent lows on EU PMIs, resilient UK retail sales

- US sovereign curve bull flatter on perceived medium-term econ weakness

US TSYS: Risk-Off Rally Ahead Of PMIs

Treasuries are slightly off overnight highs but comfortably stronger overall in European morning trade Friday.

- Weak flash June PMIs in Europe, which also showed signs of price pressures easing, spurred bull flattening in Bunds and Gilts, leading to a similar move in the Treasury curve.

- With global growth concerns regaining ground, the broader picture is risk-off, with S&P futures reversing Thursday's gains and the US dollar index +0.5%.

- US 2s10s are comfortably through -100bp, with March's -111bp post-1980 low in sight.

- Prelim PMIs are the highlight of the US calendar at 0945ET, followed by KC Fed Services at 1100ET.

- The only scheduled FOMC speaker is Cleveland's Mester (1340ET, with text).

- There is no Treasury supply today.

- The 2-Yr yield is down 3.5bps at 4.7563%, 5-Yr is down 5.3bps at 3.9892%, 10-Yr is down 5.4bps at 3.7405%, and 30-Yr is down 4.4bps at 3.825%.

- Sep 10-Yr futures (TY) up 12/32 at 113-3.5 (L: 112-22 / H: 113-7)

STIR FUTURES: Fed Terminal Pricing Shrugs Off Large Swings In Europe

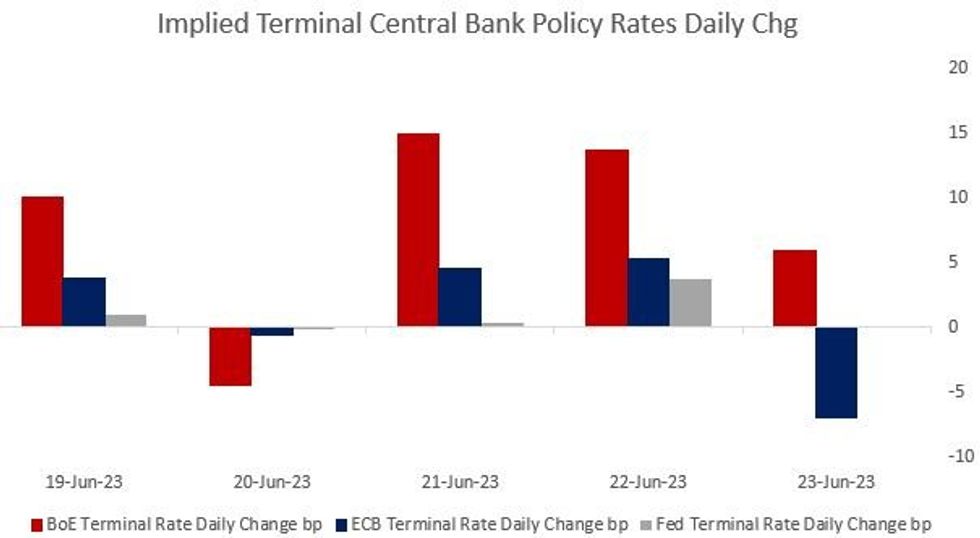

Fed terminal hike pricing is marginally higher on the day (+0.2bp, with 26bp seen for the rest of the cycle), shrugging off much larger moves for European counterparts Friday (ECB peak pricing -7bp, BoE +6bp) amid weak PMI readings/strong UK retail sales data.

- Fed Chair Powell's 2nd day of congressional commentary yesterday did little to change the July FOMC meeting outlook: hike pricing remains 19bp, basically unchanged from Thursday (pulling back a couple of basis points from post-BoE 50bp hike surprise levels), with the rest of the near-term path looking similar including 23bp cumulative through Sep and 26bp to the Nov peak.

- Rate spreads continue to point to cuts of ~145bp next year, and ~155bp between Sep'23 and Dec'24.

- US PMI data at 0945ET is the most closely eyed potential rate catalyst on the schedule, with Cleveland Fed's Mester up later.

EGBs: Expect Increased Focus On Spanish Politics During Election Run-Up

One to keep on the radar as our political risk team note that the “inability of the conservative People's Party (PP) and right-wing nationalist Vox to reach an agreement on forming a governing coalition in the western autonomous community of Extremadura could be viewed as a harbinger of political paralysis at the national level after the upcoming 23 July general election.”

- When it comes to wider market focus, the Spanish election hasn’t generated much noise/ interest as of yet.

- The 10-Year SPGB/Bund spread recently showed below the February lows (in closing terms), as part of the general round of peripheral tightening, but failed to see a meaningful extension beyond there, at least partly owing to the latest leg of the hawkish ECB re-pricing in the STIR space.

Fig. 1: 10-Year SPGB/Bund spread (bp)

EGBs: GGB/Bund & GGB/BTP Spreads Stabilise Around Cycle/All-Time Tights

Our political risk team highlight the likelihood of the ND Party achieving a majority in the upcoming second-round of the Greek election (voting takes place on Sunday).

- When it comes to ND’s policy direction, a broadly pro-business environment would be maintained while seeking to ensure Athens remains on the EU’s good side with regards to keeping a close eye on the budget deficit and government debt levels.

- This has allowed the idea that Greece could quickly achieve IG status via sovereign rating upgrades to become more forceful in recent weeks, although the related review calendar suggests that such a move wouldn’t be imminent (we could get some ad-hoc adjustments).

- We also remind you that the major bond tracking indices have varying adjustment methods when it comes to index inclusion, meaning that one sovereign rating upgrade would not be enough for broader index inclusion for GGBs.

- This, coupled with the recent hawkish adjustment in ECB pricing and the already notable scope of GGB compression, has probably limited the 10-Year GGB/Bund spread from moving much below 125bp on a closing basis (the lowest level seen since ’21), while the 10-Year GGB/BTP spread operates a little above all-time tights as GGBs trade comfortably through their Italian counterpart.

- GGBs could come under further tightening pressure post-election, but it’s always hard to assess what is already priced on that front.

Fig. 1: 10-Year GGB/Bund & GGB/BTP Spreads (%)

Source: MNI - Market NEws/Bloomberg

Source: MNI - Market NEws/Bloomberg

FOREX: Central Bank Pricing Backtracks, Denting EUR

- The single currency is among the poorest performers in G10 so far Friday, following ECB market-implied pricing lower after a set of disappointing PMI releases from France and Germany.

- Prelim PMIs from both territories showed a distinct weakness in manufacturing relative to services, with both exhibiting a further pullback in price pressures as rate hikes begin to bite. The data knocked close to 10bps off peak ECB pricing, tiliting the implied peak rate back below 4.00% in deposit rate terms.

- Price action in EUR/USD extended the pullback from yesterday's high of 1.1012. The pullback is considered corrective - for now. Attention turns to support at 1.0853, the 20-day EMA. A clear break of this average would signal scope for a deeper pullback and this would open 1.0804, the Jun 15 low and 1.0733, the Jun 12 low.

- GBP trades more mixed - a softer PMI release initially dented the currency, but weakness was contained by evidence in the survey showing persistent strength in services prices - a key point of focus for the Bank of England. A firm set of May retail sales also got the currency off to a good start.

- US prelim PMIs take focus going forward, with markets expecting further weakness in manufacturing, and stubborn strength for services. CB speakers include Fed's Bullard & Mester as well as ECB's Vujcic, de Cos and Panetta.

FX OPTIONS: Expiries for Jun23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0855(E522mln), $1.0899-00(E507mln), $1.0940-60(E815mln), $1.1000(E669mln)

- USD/JPY: Y138.00($864mln), Y141.00($1.2bln), Y141.90($598mln), Y145.00($650mln)

- EUR/GBP: Gbp0.8640(E605mln)

- AUD/NZD: N$1.1040-50(A$1.0bln)

- AUD/USD: $0.6740-60(A$928mln)

- USD/CAD: C$1.3250($758mln)

- USD/CNY: Cny7.1500($523mln)

BONDS: Bull Flattening in Focus as Growth Concerns Re-Escalate

Below-expected preliminary European PMI readings, a pullback in equities and a stronger dollar have benefited global core FI in early trade Friday as growth slowdown fears resurface.

- Eurozone and UK flash June PMIs disappointed on both the services and manufacturing prints. Bunds have led the global bull flattening rally, with Gilts lagging them slightly after UK retail sales showed signs of strength.

- 2s10s inversions are in focus: US is below -100bp for the first time since March, while UK and German are at post-2000 and post-1990 lows, respectively.

- ECB peak depo rate pricing has dipped back below 4%, with BoE up slightly hitting a fresh peak above 6.2%, and Fed pricing flat.

- ECB speakers include Vujcic, de Cos and Panetta.

- Prelim PMIs are likewise the US highlight, with KC Fed Services rounding off the week's data calendar. FOMC speakers include Cleveland's Mester (Bullard is delivering the same speech he's delivered 2x before).

EQUITIES: Uptrend in Eurostoxx 50 Futures Intact Despite Bearish Corrective Cycle This Week

- The Eurostoxx 50 futures uptrend remains intact, however, a bearish corrective cycle this week has resulted in a correction. The contract has pierced support at 4301.00, the Jun 8 low. This is a key short-term support and a clear break would signal scope for a deeper retracement, exposing 4241.00, the May 31 low and a key support. Key resistance and the bull trigger has been defined at 4438.00, the Jun 16 high.

- A bull theme in S&P E-minis remains intact and this week’s pullback appears to be a correction. This is allowing a recent overbought condition to unwind. Initial key support lies at the 20-day EMA which intersects at 4356.07. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high. A break would open 4500.21, the top of a bull channel.

COMMODITIES: Sharp Sell-Off in WTI Futures Thursday Reinforces Bearish Theme

- WTI futures remain bearish and yesterday’s sharp sell-off reinforces this condition. Support at $67.21, May 31 low, has recently been pierced, a clear break would open $64.41, the May 4 low. Moving average studies are in a bear mode position highlighting a downtrend. The contract is trading below resistance at $75.70, the Jun 5 high. A break of this level would signal a reversal.

- The bear cycle in Gold remains intact and the yellow metal traded lower Thursday. Trendline support was breached last week - the line is drawn from the Nov 3 2022 low and the break reinforces a bearish condition. Furthermore, yesterday’s sell-off marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Key resistance is $1985.3, the May 24 high. Initial resistance is at $1951.7, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/06/2023 | 1315/1515 |  | EU | ECB Schnabel Panels Petersberger Sommer-Dialog | |

| 25/06/2023 | 1315/0915 |  | US | New York Fed's John Williams | |

| 26/06/2023 | 0700/0900 | ** |  | ES | PPI |

| 26/06/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/06/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/06/2023 | 1730/1930 |  | EU | ECB Lagarde Opens ECB Forum |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.