-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - China Rout Puts Markets on Cautious Footing

HIGHLIGHTS:

- China stock rout puts markets on cautious footing

- Busiest week for corporate earnings, Tesla, Lockheed Martin due today

- Focus is on the Fed, with decision and presser due Wednesday

US TSYS SUMMARY: Stronger But Off Overnight Highs, With 2-Yr Supply Ahead

Treasuries are stronger though off overnight highs, ahead of 2Y supply and as Fed week gets underway.

- Curve bull flattening: the 2-Yr yield is down 0.6bps at 0.1921%, 5-Yr is down 1.8bps at 0.694%, 10-Yr is down 2.7bps at 1.2495%, and 30-Yr is down 2.7bps at 1.8879%. Some headlines made as US 10Yr real yields touched record lows (-1.1269%).

- Sep 10-Yr futures (TY) up 7.5/32 at 134-12 (L: 134-04.5 / H: 134-19), ~340k volume. Trading in mirror image to equity futures (S&P eminis off lows but still slightly in the red).

- Risk-off headlines overnight centered around China, with a regulatory crackdown on education companies spurring equity weakness; note also US-China talks not particularly warm.

- Attention of course on Wednesday's FOMC decision - MNI's preview will be out later today.

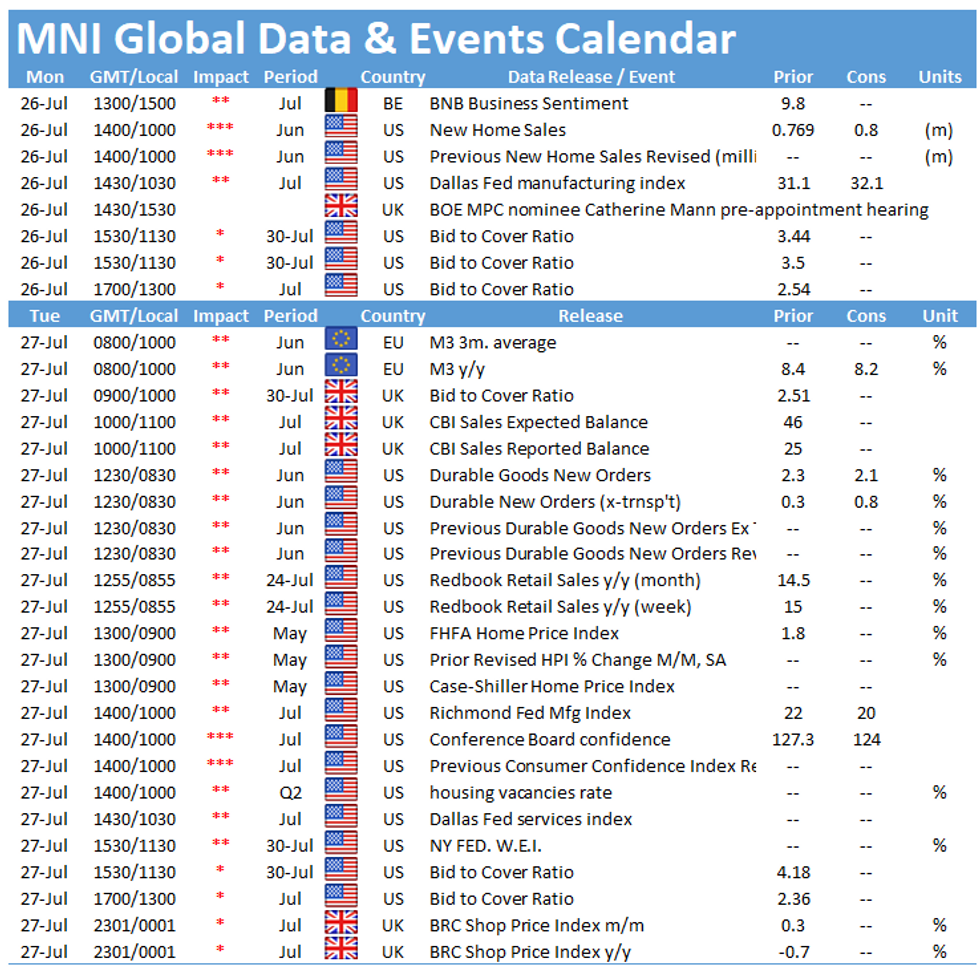

- Data consists of Jun new home sales (1000ET) and Jul Dallas Fed manufacturing (1030ET).

- A decent supply slate as well: combined $105B in 3-/6-month bills at 1130ET, with main event being $60B 2-Yr note auction at 1300ET. NY Fed buys ~$2.025B of 1-7.5Y TIPS.

- The biggest week of the quarter for S&P earnings begins today, with 49% of market cap due to report - today is Tesla and Lockheed Martin.

- Multiple reports out that US infrastructure talks are nearing a deal.

EGB/GILT SUMMARY: Giving Up Early Gains

The early bid in European sovereign bonds has unwound, while USTs are holding on to gains.

- Having started on a firm footing, gilts sold off through the morning with the short-end of the curve underperforming. Bear flattening has driven the 2s30s spread down 2bp.

- Bunds have similarly given up the early gains to now trade close to flat on the day.

- OATs have underperformed bunds on the day with long end yields 1-2bp higher.

- Supply this morning came from Germany (Bubills, EUR3.587bn) and Belgium (OLOs, EUR3.101bn). France will come to market this afternoon to sell BTFs.

- Beyond the German IFO update for July (weaker than expected), there was little to note this morning on the data front. It is similar a quiet day for European central bank speakers with just the BoE's Gertjan Vlieghe talking on demographics, debt and income at 1200BST.

EUROPE ISSUANCE UPDATE

Belgium Sells E3.101bn of OLOs:

- E1.419bn of the 1.00% Jun-31 OLO: Average yield -0.187%, Bid-to-cover 1.49x

- E0.842bn of the 3.00% Jun-34 OLO: Average yield 0.023%, Bid-to-cover 1.44x

- E0.840bn of the 0.40% Jun-40 OLO: Average yield 0.387%, Bid-to-cover 1.68x

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

DUU1 112.20/112.10 put spread bought for 1 in 5k

DUU1 112.30/112.20/112.10 put fly bought for 2.5 in 7k

2RZ1 100.375^ sold at 11.75 in 2k

3RU1 100.25/100.125 1x2 put spread bought for 0.5 in 4.5k (underlying: ERU4 100.325). Note that this a reduction in premium vs trades last week at 1 in ~25k

US:

TYU1 132.50 puts bought for '11 in 5k (delta -16% - expiry in 32 days)

FOREX: China Stock Slide Prompts Risk-Off Start to Week

- A sharp drawback in China and Hong Kong equities has gotten risk sentiment off to a poor start Monday, with core European indices and US futures all in negative territory. This has helped underpin have currencies, with JPY, USD and EUR among the strongest in G10.

- AUD, NZD and other commodity-tied currencies are on the backfoot, with a soft start for oil benchmarks and industrial metals undermining recent progress. AUD/USD trades in closer proximity to the key support at the Jul 21 low of 0.7290.

- GBP trades well, with local press highlighting the recent downtick in case growth despite economic re-opening. Showing the effectiveness of vaccines, case growth has slowed before any catch-up in hospitalisation or fatality statistics, helping GBP/USD rise further above the 200-dma at 1.3719.

- It's a quieter data slate, with just US new home sales on the docket. This will likely keep focus on the earnings schedule this week, which kicks off today with reports from Tesla and Lockheed Martin among others.

FX OPTIONS: Expiries for Jul26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-55(E667mln), $1.1830(E622mln), $1.1860(E584mln)

- USD/JPY: Y111.50($510mln)

- GBP/USD: $1.3895-00(Gbp561mln)

- AUD/USD: $0.7330-35(A$555mln)

- USD/CAD: C$1.2570-75($542mln), C$1.2690-00($595mln)

Price Signal Summary - ESU1 Resumes Its Uptrend

- In the equity space, the S&P E-minis closed Friday at another all-time high. The outlook remains bullish despite today's pullback. The focus is on 4415.48, 1.00 projection of Mar 25 - May 10 - 13 price swing. EUROSTOXX 50 futures traded above the important 4101.50 resistance, Jul 1 high. An extension would open the 4153.00 key resistance, Jun 17 high.

- In FX, the USD outlook remains bullish. EURUSD is consolidating. The focus remains on 1.1704, Mar 31 low and a key support. GBPUSD is holding onto recent gains. The move higher from 1.3572, Jul 20 low is likely a correction. The resistance to watch is 1.3806, the 20-day EMA. USDJPY continues to trade above 109.07, Jul 19 low. This represents a key short-term support and bear trigger. Near-term resistance is at 110.70, Jul 14 high. A break would be a bullish development.

- On the commodity front, Gold is consolidating and maintains a bullish tone with the focus on the bull trigger at $1834.1, Jul 15 high. Key short-term support is at $1791.7, Jul 12 low and was tested and briefly probed Friday but has provided support. A clear break of this level would however be bearish. Brent (U1) is testing $73.87, 61.8% of the Jul 6 - 20 downleg. A clear breach would open $75.39, the 76.4% level. WTI (U1) is holding onto the bulk of last week's gains. An extension would open $73.46, 76% of the Jul 6 - 20 downleg.

- Within FI, Bund futures remain firm following last week's clear break of 174.77, Jul 8 high. Sights are on 176.64, the Feb 11 high (cont). Gilts maintain a bullish tone despite the recent pullback. The break of 129.92, Jul 8 high opens 130.72, 2.236 projection of the May 13 - 26 - Jun 3 price swing. We are however still monitoring a bearish candle pattern, an evening star reversal following the Jul 21 close . A deeper pullback would expose support at 128.54, low Jul 14.

EQUITIES: Distinct Underperformance in Chinese Stocks Bleeds into European Open

- Cash equity markets across Europe are in negative territory early Monday, with mainland indices off 0.4-0.7%. French, German and Spanish firms are the notable underperformers, with consumer discretionary and financials leading losses.

- US futures are also lower, with the e-mini S&P retreating off of the all-time highs struck late Friday, trading lower by around 18 points at pixel time.

- The weakness across European indices follows on from the distinct weakness in Chinese and Hong Kong listed stocks overnight, which prompted the Hang Seng Index to close lower by over 4% to touch the lowest level of 2021.

- Weakness across Hong Kong / Chinese stocks follows the crackdown on education-linked stocks, effectively banning for-profit school tutoring programmes. The likes of New Oriental Education and Koolearn Technology fell close to 50% in overnight trade, with fears that the authorities could target other 'hot' sectors in a similar fashion.

COMMODITIES: Oil Benchmarks Off Highs on China Stock Rout

- Acute weakness across Chinese equities early this week has bled into broader risk-off, prompting oil benchmarks to roll off last week's highs. WTI and Brent crude futures are lower by close to 1% apiece, but still hold well within the range from the latter half of last week.

- Gold and silver are both in minor positive territory with spot gold back above the $1800/oz level to briefly trade above the Friday highs.

- Focus for the coming session rests on US new home sales, but the progress of the key US infrastructure bill could prove more influential over prices, with US lawmakers struggling to make headway on the key legislation ahead of the Summer recess.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.