-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: Chinese Equities Bid, Worrying European PMI Picture Remains

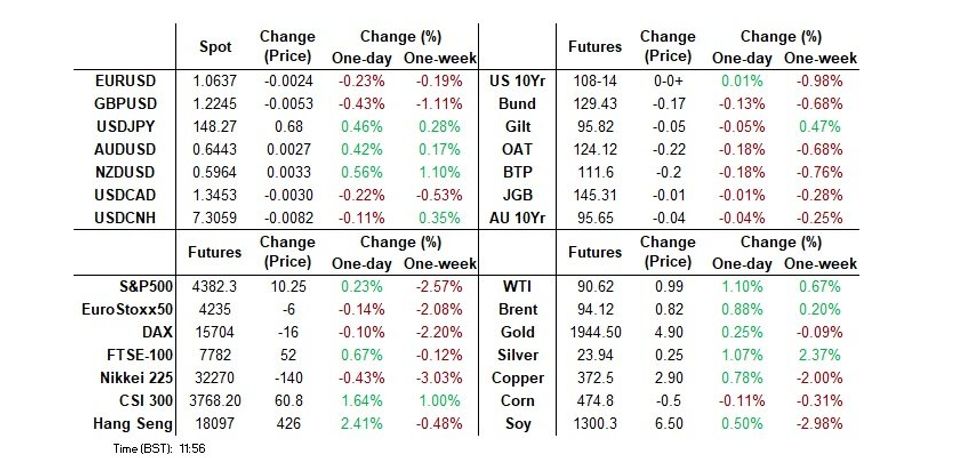

- Core global FI sees two-way trade around European flash PMIs.

- BBDXY settles just shy of yesterday's multi-month high, Chinese stocks end the week on the front foot.

- U.S. flash PMIs, Canadian retail sales, comments from ECB’s de Guindos and the first round of post-FOMC Fedspeak (Cook, Cook, Collins, Daly & Kashkari) are slated ahead of the weekend.

US TSYS: Mild Bull Flattening Only Chips Away At Significant Twist Steepening

- Tsys have leant on a dovish BoJ’s Ueda and softer than expected French flash PMI data for support, with the bid then capped by stronger than expected German PMIs in London trade (albeit with mfg still sub-40).

- Cash benchmark yields sit 1bp to 2bp richer with 2s10s at -66bps off overnight highs of -63bps but still notably steeper than the -76bp at the close after Wednesday’s hawkish FOMC dot plot following yesterday's large twist steepening.

- It sets up today’s preliminary US PMIs at 0945ET, headlining an otherwise light data docket, with conflicting signs so far from regional Fed mfg surveys and a welcome look at service activity in September. First post-FOMC Fedspeak rounds out the session.

- TYZ3 trades towards the middle of a relatively narrow 10+ range currently at 108-14+, under decent volumes of 350k. It remains close to initial support at yesterday’s low of 108-08, after which lies the round 108-00.

- Fedspeak: Cook at AI conference (0850ET), Daly fireside chat (1300ET), Kashkari fireside chat (1300ET) and possibly Collins (1000ET).

US TSY FUTURES: Short Setting Seemed To Dominate On Thursday

The combination of yesterday’s cheapening and preliminary open interest data points to short setting as the dominant net positioning factor on the Tsy futures curve on Thursday.

- A relatively sizable net ~$8.4mn of DVO1 equivalent OI was added across the curve, with TU leading the swing.

- WN futures were seemingly the only contract that saw longs cover in net terms.

| 21-Sep-23 | 20-Sep-23 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,877,288 | 3,806,319 | +70,969 | +2,691,144 |

| FV | 5,526,886 | 5,508,879 | +18,007 | +757,694 |

| TY | 4,753,374 | 4,726,628 | +26,746 | +1,721,829 |

| UXY | 1,846,058 | 1,824,682 | +21,376 | +1,929,359 |

| US | 1,382,932 | 1,371,462 | +11,470 | +1,496,320 |

| WN | 1,534,818 | 1,535,969 | -1,151 | -227,644 |

| Total | +147,417 | +8,368,702 |

STIR: Fed 2024 Cuts Hold Close To Post-FOMC Lows

- Fed Funds implied rates are near unchanged for near-term meetings and nudge 1-2bp higher further out except for the Dec’24 which is unchanged, with the level of implied cuts through 2024 close to lows seen after Wednesday’s FOMC decision.

- Cumulative hikes from 5.33% effective: +6.5bp Nov (-0.5bp), +13bp Dec (unch), +13.5bp to terminal 5.465% Jan (+0.5bp).

- Cuts from terminal: 21bp to Jun’24 (from 23bp yesterday) and 75bp for Dec’24 (unch).

- First post-FOMC Fedspeak is kicked off by Gov. Cook (voter) giving the keynote address at a NBER conference albeit on AI, before both Daly (’24 voter) and Kashkari (’23) have separate fireside chats at 1300ET. Collins (non-voter) is also seen speaking at 1000ET. The dispersion of dots in this week's SEP suggests a potential wide range of views across these speakers.

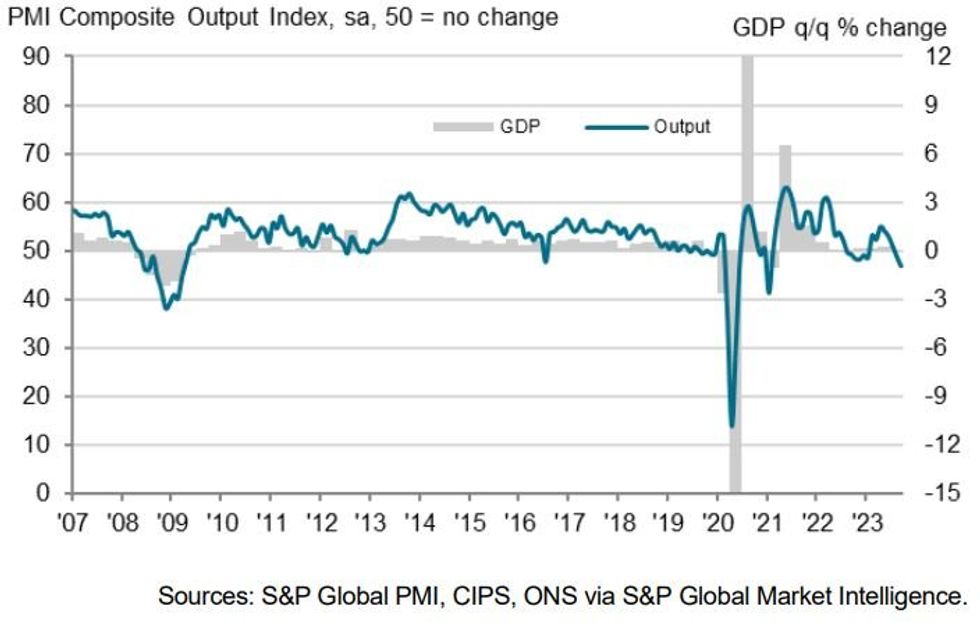

EUROZONE DATA: Services PMI Less Weak Than Feared, But Demand Poor Overall

The Eurozone September flash composite PMI was 47.1 (vs 46.7 prior; 46.5 expected). Services printed at 48.4 (vs 47.9 prior; 47.6 expected) while manufacturing was 43.4 (vs 43.5 prior; 44.0 expected). Of particular note was the better than expected services print which followed the unexpected uptick in Germany's figures earlier, offsetting a French miss. Key comments from the release are:

- "Central to the latest reduction in business activity was a further deterioration in customer demand, as highlighted by a fourth successive monthly decrease in new orders."

- "New export orders declined even more quickly than total new business in September."

- "Although on balance firms continued to predict a rise in activity over the coming 12 months, sentiment dipped to the lowest since November last year."

- "As well as scaling back staffing levels, manufacturers in the eurozone also cut their purchasing activity sharply." - "Input costs increased at the fastest pace in four months"…"Inflation was driven by the service sector, where prices were up sharply amid higher wages and rising fuel costs."

- "Despite the steeper pace of input cost inflation, a weakening demand environment meant that companies increased their selling prices to a lesser extent than in August."

UK DATA: Soft PMIs Reflect Weak Demand

The UK September flash composite PMI was 46.8 (vs 48.6 prior; 48.7 expected) - a 32-month low. Services printed at 47.2 (vs 49.5 prior; 49.4 expected) - also a 32-month low - while manufacturing was 44.2 (vs 43.0 prior; 43.2 expected).

- The BoE MPC noted in its September meeting minutes that they had access to these flash figures prior to public release. The miss in the services print may have been a contributing factor to their decision to hold rates yesterday. Key notes from the release are:

- "Weaker demand due to cost-of-living pressures and higher borrowing costs were cited by survey respondents, alongside cutbacks to spending among clients in the real estate and construction sectors"

- "Manufacturing production continued to decrease more quickly than service sector output, but the gap narrowed considerably in September."

- "Service providers reported the steepest fall in new work since November 2022. Subdued business and consumer demand was attributed to elevated economic uncertainty, rising interest rates, and constraints on nonessential spending."

- "A number of firms continued to cite staff shortages and recruitment difficulties as factors that had limited their business capacity."

- "Solid declines in staffing levels were seen in both the manufacturing and service sectors, with the respective index for the latter posting in negative territory for the first time in 2023 to date."

- "September data pointed to the slowest rise in private sector business expenses since January 2021."

- "Average prices charged by private sector companies increased at a robust pace in September. This was driven by the service sector and mostly linked to higher operating costs, especially salary payments."

FOREX: BBDXY A Touch Firmer Post European & UK PMIs, Antipodeans Outperform

The BBDXY sits a little higher on the day, although a French PMI-driven move to session bests failed to test yesterday’s multi-month peak in the index, as the German and Eurozone PMI readings provided some counter.

- USD is mid-pack in G10 FX.

- EUR/USD only managed a shallow look through yesterday’s multi-month low on the French data, before rebounding, although bulls have failed to retake pre-data levels.

- GBP/USD is threatening to cleanly break yesterday’s worst levels, with a softer-then-expected UK services PMI, pointing to increased recession worry and continued loosening in the labour market.

- JPY was pressured as BoJ Governor Ueda stuck to a dovish script in his post-meeting address, although USD/JPY has failed to test yesterday’s high as of yet, backing away from best levels in recent trade.

- The Antipodeans outperform G10 FX peers, probably looking to firmer Chinese equities as a source of support.

- U.S. flash PMIs, Canadian retail sales, comments from ECB’s de Guindos and the first round of post-FOMC Fedspeak (Cook, Cook, Collins, Daly & Kashkari) are slated ahead of the weekend.

EQUITIES: S&P E-Minis Trade Through A Key Support

- A bear cycle in the E-mini S&P contract remains in play and this week’s break lower reinforces current conditions. Thursday’s sell-off resulted in a break of support at 4397.75, the Aug 18 low. The breach reinforces bearish conditions. Sights are on 4352.50, the Jun 8 low. Further out, scope is seen for a move to 4318.00, the Jun 2 low. Initial firm resistance is 4502.22, the 50-day EMA.

- EUROSTOXX 50 futures maintain a softer tone following this week’s move lower and today’s gains are considered corrective. Attention is on key support at 4210.00, the Sep 8 low. This level has been pierced, a clear break would confirm a resumption of the downtrend that started late July and open 4163.00, the 1.00 projection of the Aug 10 - 18 - 30 price swing. Key short-term resistance has been defined at 4359.00, the Sep 15 high. A break would be bullish. INitial resistance is at 4294.20, the 20-day EMA.

COMMODITIES: Gold Remains Below Resistance

- Gold traded higher Wednesday but quickly pulled back from the session high. The recent breach of the 50-day EMA does highlight a possible developing bullish threat. Key resistance is at $1953.0, the Sep 1 high where a break is required to confirm a bullish theme. On the downside, $1901.1, the Sep 14 low, marks a key near-term support. A breach of this level would strengthen a bearish theme and expose $1884.9, the Aug 21 low.

- In the oil space, the uptrend in WTI futures remains intact, however, the contract remains in a short-term bearish corrective cycle. The trend condition is overbought and a move lower would allow this to unwind. The first key support to watch lies at $86.58, the 20-day EMA and is a potential short-term objective. On the upside, clearance of Tuesday’s $92.43 high would confirm a resumption of the uptrend and open $94.66, the 2.236 projection of the Jun 28 - Jul 13 - Jul 17 price swing.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/09/2023 | 1100/1300 |  | EU | ECB's de Guindos Speaks at Event | |

| 22/09/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/09/2023 | 1250/0850 |  | US | Fed Governor Lisa Cook | |

| 22/09/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/09/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/09/2023 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 22/09/2023 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 22/09/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 25/09/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/09/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/09/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/09/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Lagarde speaks at ECON Hearing | |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Schnabel speaks at JHvT Lecture | |

| 25/09/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/09/2023 | 2200/1800 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.