-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US MARKETS ANALYSIS - CNY Tests Trading Band for Second Session

Highlights:

- Powell and several Fed speakers top docket, with the Fed chair to comment on the economic outlook

- CNY, INR lead losses for emerging market currencies

- Equities hold week's losses, but steadier open expected Wednesday

US TSYS: Early Losses Pared, ISM Services and Powell In The Spotlight

- Cash Tsy yields sit 1-1.5bp higher on the day, within yesterday’s range as they mostly consolidate the twist steepening that has pushed 2s10s up to -33.5bps.

- TYM4 at 109-22+ (-00+) is off earlier lows of 109-18 after another overnight of above average volumes, currently at 380k. Yesterday saw clearance of the bear trigger at 109-24+ (Mar 18 low) before a test of next support at 109-14+ (Nov 28 low). Further support is seen nearby at 109-12+ (1.764 proj of Dec 27 – Jan 19 – Feb 1 price swing).

- ADP could offer some volatility before the main data focus on ISM Services after a large reaction to Easter Monday’s ISM Mfg beat. Attention then shifts to Chair Powell’s remarks.

- Data: Weekly MBA mortgage data (0700ET), ADP employment Mar (0815ET), S&P Global US Serv/Comp PMI Mar f (0945ET), ISM services Mar (1000ET)

- Fedspeak: Bostic on CNBC (0830ET), Bowman on regulatory matters (0945ET), Goolsbee opening remarks (1200ET), Powell on economic outlook (1210ET), Barr on Community Reinvestment Act (1310ET), Kugler on economic and mon pol outlook (1630ET).

- Bill issuance: US Tsy $60B 17W Bill auction (1130ET)

STIR: Fed Rate Path Within Tuesday’s Range With Heavy Fedspeak Eyed

- Fed Funds implied rates sit within the middle of yesterday’s range, consolidating Monday’s shunt higher on a stronger than expected ISM manufacturing survey.

- Cumulative cuts from 5.33% effective: 2bp May, 16bp Jun, 24bp Jul, 41bp Sep and 68bp Dec.

- Today sees a heavy schedule for Fedspeak, headlined by Powell on the economic outlook at 1210ET including text. His remarks are likely to followed Friday’s appearance and not stray too far from the Mar 20 FOMC press conference considering a lack of major releases in the interim. We’ll have more to say on Powell nearer the time.

- Beyond Powell, from a mon pol angle we pick out Bostic and especially Kugler even if she speaks late in the session. Bostic has already revealed himself as one of the two dots looking for just one cut in 2024 as he is less confident on inflation than he was in Dec. Kugler meanwhile last spoke on Mar 1, saying she was optimistic disinflation progress will continue with the Fed laser-focused on bringing inflation down to 2%.

- 0830ET - Bostic (’24) on CNBC at 0830ET

- 0945ET - Bowman (voter) again speaks on regulatory matters at 0945ET (incl text)

- 1200ET - Goolsbee (’25) opening remarks

- 1210ET - Powell (voter) on economic outlook (incl text)

- 1310ET - Barr (voter) on Community Reinvestment Act

- 1630ET - Kugler (voter) on economic and mon pol outlook (incl text)

US TSYS: OI Suggests Short Setting Dominated On Tuesday

The combination of yesterday’s sell off in most Tsy futures and preliminary OI data points to net short setting across most of the curve.

- The only exceptions to the wider theme seemed to come via some net long setting in TU futures and very modest net long cover in US futures.

- FV futures saw the largest OI DV01 equivalent swing.

| 02-Apr-24 | 01-Apr-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,802,695 | 3,782,294 | +20,401 | +766,771 |

| FV | 6,089,865 | 6,003,608 | +86,257 | +3,634,926 |

| TY | 4,384,868 | 4,373,840 | +11,028 | +715,165 |

| UXY | 2,047,568 | 2,042,974 | +4,594 | +401,760 |

| US | 1,526,142 | 1,526,732 | -590 | -76,396 |

| WN | 1,589,813 | 1,585,179 | +4,634 | +933,665 |

| Total | +126,324 | +6,375,892 |

OI Points to Mix Of SOFR Futures Positioning Swings On Tuesday

The combination of yesterday’s twist steepening of the SOFR futures strip and OI data points to a mix of positioning swings, with net short cover seemingly dominating in the whites and reds. Net short setting seemingly dominated in the greens, while net long cover was seen in the blues.

| 02-Apr-24 | 01-Apr-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 963,009 | 965,890 | -2,881 | Whites | -23,912 |

| SFRM4 | 1,200,372 | 1,212,803 | -12,431 | Reds | -2,830 |

| SFRU4 | 992,698 | 1,006,611 | -13,913 | Greens | +14,333 |

| SFRZ4 | 1,144,731 | 1,139,418 | +5,313 | Blues | -12,722 |

| SFRH5 | 718,503 | 721,903 | -3,400 | ||

| SFRM5 | 783,525 | 795,938 | -12,413 | ||

| SFRU5 | 667,969 | 658,773 | +9,196 | ||

| SFRZ5 | 657,535 | 653,748 | +3,787 | ||

| SFRH6 | 494,214 | 490,433 | +3,781 | ||

| SFRM6 | 521,029 | 514,295 | +6,734 | ||

| SFRU6 | 371,330 | 371,224 | +106 | ||

| SFRZ6 | 344,263 | 340,551 | +3,712 | ||

| SFRH7 | 233,845 | 236,286 | -2,441 | ||

| SFRM7 | 193,252 | 200,013 | -6,761 | ||

| SFRU7 | 157,220 | 157,111 | +109 | ||

| SFRZ7 | 196,288 | 199,917 | -3,629 |

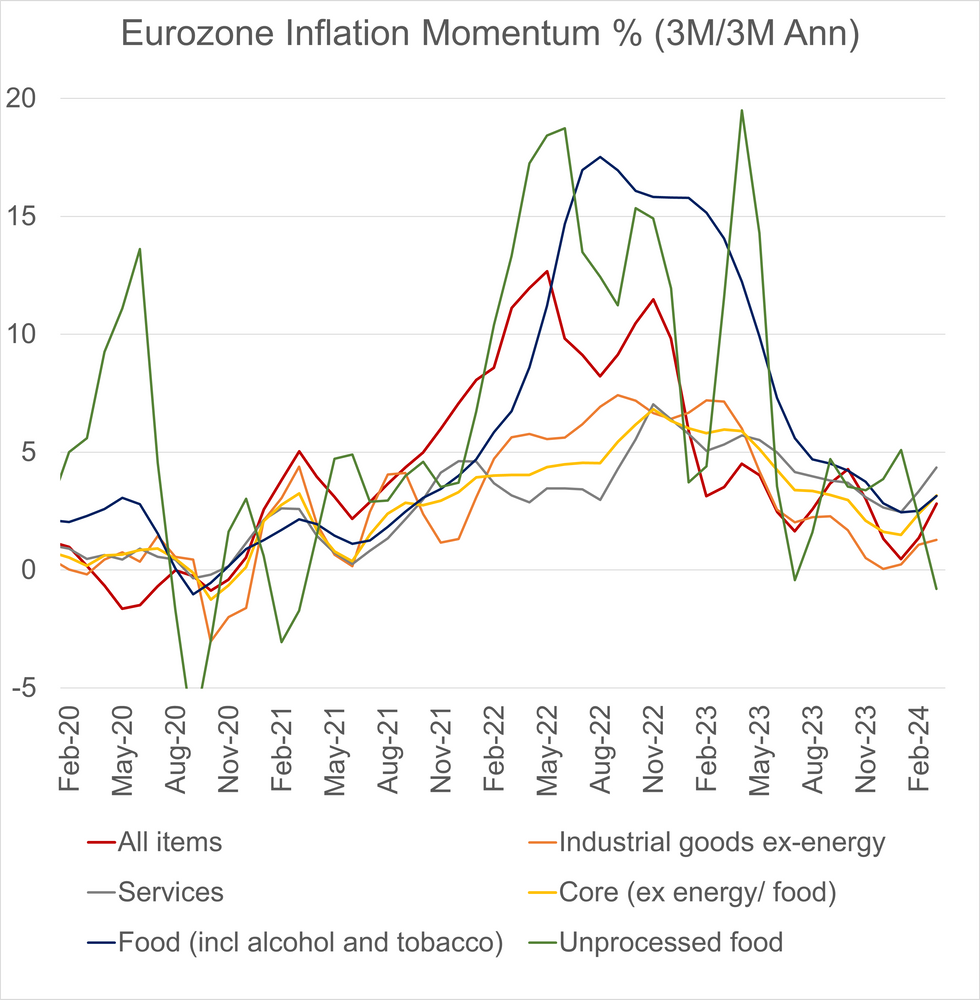

EUROZONE: Pickup In Core Momentum Clouded By Easter Effect

The ECB’s seasonally adjusted data indicates that core and headline inflation momentum rose for the second consecutive month in March. However, sequential monthly inflation was lower than February across core categories.

- On a SA sequential monthly basis, core inflation was 0.24% M/M (vs 0.38% prior), with services (0.42% M/M vs 0.46% prior) and NEIG (-0.02% M/M vs 0.12% prior) also moderating.

- A reminder that Bundesbank’s estimate of SWDA German CPI saw sequential services CPI at 0.4% M/M (as in February) while NEIG pulled back to 0.0% M/M (vs 0.4% prior).

- Core inflation momentum, measured as the 3m/3m saar, was 3.16% in March (vs 2.40% in February), the highest since September 2023.

- This was driven by rises in both services (4.35% vs 3.33% prior) and NEIG (1.29% vs 1.07% prior) momentum.

- The ECB’s data is working day and seasonally adjusted, but there remains some uncertainty as to how well the Easter-related calendar effects have been accounted for.

- In their inflation preview, JP Morgan, found that “the [ECB’s] seasonal adjustment (unsurprisingly) does not correct the noise generated by the early timing of Easter”.

- Nonetheless, the strength in services inflation (on an annual NSA and inflation momentum basis) may prompt the ECB to tone down expectations of a June rate cut at next week’s meeting and continue to maintain a data dependent approach until key Q1 macroeconomic data is released.

CANADA: Apr Inflation Watch: Downward CPI Pressure Weighs Against Enduring Strength

- BoC said April rate decision would focus on: evolution of excess demand, inflation expectations, wage growth, and corporate pricing power.

- Headline CPI eased more than expected for a second time in a row in Feb at 2.8% YOY and is tracking below the Bank's estimate for 3.2% in Q1. The BoC's preferred core measures are also the lowest in 2 years.

- TD, CIBC, and Desjardins have called for the Bank to consider alternate measures of inflation such as CPIX. CPIX, the Bank's former preferred core figure, strips out volatile components like shelter and is running at 2.1% YOY.

- Macklem says economy has moved into modest excess supply. GDP is currently running ahead of the Bank's forecast for 0.5% annualized in Q1; JP Morgan updated their forecast to 2% while CIBC says Q1 growth is tracking at 3.5%.

- Consumer inflation expectations remain elevated as Q1 expectations for 1Y ahead were little changed from the previous quarter at 4.9%.

- Business inflation expectations moderated slightly as the proportion of firms expecting inflation to be over 3% over the next 2Y are at the lowest levels since Q2 2021 at 40%.

- Unemployment ticked up to 5.8% in Feb but wage gains are still running at 5% YOY. Consumer wage growth expectations are at a high in BOC survey of 2.8% while businesses plan for 4.1% raises.

- Corporate pricing behavior is normalizing as the share of firms planning unusually large or frequent price increases is declining steadily. The Bank noted that slow moderation in wage growth and pass-through of high costs are keeping output price growth elevated.

- Global oil prices have risen faster than the BoC expected in the Jan MPR. Prices recently spiked as a result of escalation in the Middle East and ongoing impact assessments of Ukrainian drone strikes on Russian refineries.

EUROPE ISSUANCE UPDATE:

German 10y Bund auction:

- Looking at the bid-to-covers on the 10-year Bund auction, it was a slightly softer 10-year Bund auction for the 2.20% Feb-34 Bund than the two previous reopenings but was strong than both the January auctions. However, the lowest accepted price of 98.41 is higher than the secondary market had traded in almost 3 hours. So overall we would say this is a decent auction. This has helped the price move higher post-results (although not quite exceeding the intraday high seen just after the open this morning).

- E4.5bln (E3.682bln allotted) of the 2.20% Feb-34 Bund. Avg yield 2.38% (bid-to-offer 1.62x; bid-to-cover 1.98x)

- 30-year Jun-55 USD bond. Spread set at 4.25% Feb-54 UST + 39bps.

FOREX: CNY in Focus as Spot Tests Trading Band for Second Session

- JPY is among the poorest performers in G10 headed into the NY crossover. This keeps USD/JPY well within range of the cycle highs and bull trigger at 151.97 - a level flirted with last week and helping draw the ire of Japanese authorities. Trade has so far favoured GBP and the USD, which fare better and keep EUR/GBP underpinned.

- Much of the focus in Asia-Pac has been on the persistent weakening of the CNY, which approaching the upper-end of the 2% trading band for a second consecutive session on Wednesday. The PBOC's statement reiterated their stance that they would "resolutely" correct pro-cyclical behaviour and prevent the risk of the FX rate overshooting. The volatility in spot markets is helping stimulate demand for CNY hedges, resulting in solid CNY options demand across both Asia-Pac and European hours.

- AUD/USD remains within the week's range, however short-term momentum continues pointed lower. Both the 50- and 200-dmas are trending downwards, keeping key support and the bear trigger within view at 0.6481.

- The ISM Services Index and final US March PMI data take focus going forward, with markets expecting headline activity to tick higher, while the prices paid sub-gauge stays stubbornly above 58.0. The central bank speaker slate will be of note, with Fed's Powell speaking on the economic outlook from Stanford, while Bostic, Bowman, Goolsbee, Barr and Kugler are also set to make appearances.

CNY Hedging Demand Firms Further as Pressure Builds

- We wrote yesterday of the demand for USD/CNY upside via options, and the pressure clearly remains on the currency – evident in these headlines flagging CNY weakened to approach the 2% trading band from the daily CNY fix.

- There remains firm demand for CNY hedges today, with the more salient trades including a 7.2325 straddle rolling off at the end of April, as well as large interest in longer-dated USD/CNY 7.0000 put strikes that traded mid-China hours, rolling off at the beginning of July 2025.

- While today marks the second session of USD/CNY approaching the top-end of the trading band, worth recalling upcoming market holidays may be complicating matters. Bloomberg wrote yesterday that some participants had been blocked from entering into specific CNY swap trades – potentially implying that demand for USD/CNY to trade outside of trading band is building – but the Tomb Sweeping Festival taking place from April 4 – 6 will interrupt market hours for the rest of this week.

Expiries for Apr02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750(E554mln), $1.0780-81(E580mln), $1.0815-25(E1.7bln)

- USD/JPY: Y150.00($626mln), Y151.50-54($600mln), Y152.40($608mln)

- GBP/USD: $1.2400(Gbp542mln)

- AUD/USD: $0.6510-20(A$1.0bln), $0.6350(A$1.1bln)

CHINA: Most Lower, Mainland Now Closed Until Next Week

The negative lead from the U.S. and worry surrounding the Taiwan earthquake weighed on Chinese & HK equity benchmarks on Wednesday.

- Elsewhere, desks flagged profit taking/book squaring activity ahead of the elongated weekend (mainland markets are now closed until Monday, HK markets are closed Thursday).

- That left the CSI 300 0.4% lower on the day, with bulls still unable to force a test of technical resistance at the 200-DMA.

- The Hang Seng was also lower on the day, shedding ~1.2%.

- Weakness in Xiaomi was noted, although headline news was lacking. The name saw the heaviest net selling via the southbound HK-China Stock links.

- HK-China Stock Connect links saw ~CNY2.3bn of net outflows from mainland shares.

- Yuan weakness, with USD/CNY moving towards the 2% limit of the trading band for a second consecutive day (see earlier bullets for further colour), will also have factored into the weakness in mainland stocks.

- Names related to Taiwanese construction bucked the broader trend, rallying given rebuild expectations post-earthquake.

- Looking forwards, signs of a Chinese economic uptick will continue to be assessed, with participants still looking for deeper macro policy support.

EQUITIES: Bullish Theme Intact Despite Tuesday Pullback

- The trend condition in S&P E-Minis is unchanged and remains bullish, however, the move lower yesterday highlights a corrective cycle that suggests potential for a bearish extension. The contract has breached bull channel support - at 5282.02 - drawn from the Jan 17 low.

- A bullish trend condition in Eurostoxx 50 futures remains intact and the latest pullback appears to be a correction. Yesterday’s fresh cycle highs confirms once again an extension of the uptrend and maintains the price sequence of higher highs and higher lows.

COMMODITIES: Gold's Bullish Trend Remains Firm

- A bull theme in WTI futures remains intact and this week’s move higher reinforces current conditions and confirms a resumption of the uptrend. The contract has traded through $84.87, the Sep 15 ‘23 high, paving the way for a climb towards the $90.00 handle further out.

- The trend condition in Gold remains bullish and the yellow metal has traded to fresh all-time highs once again this week. The climb maintains the price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/04/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 03/04/2024 | 1345/0945 |  | US | Fed Governor Michelle Bowman | |

| 03/04/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/04/2024 | 1600/1200 |  | US | Chicago Fed's Austan Goolsbee | |

| 03/04/2024 | 1610/1210 |  | US | Fed Chair Jerome Powell | |

| 03/04/2024 | 1710/1310 |  | US | Fed Governor Michael Barr | |

| 03/04/2024 | 2030/1630 |  | US | Fed Governor Adriana Kugler | |

| 04/04/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 04/04/2024 | 0630/0830 | *** |  | CH | CPI |

| 04/04/2024 | 0830/0930 |  | UK | BOE's Decision Maker Panel Data | |

| 04/04/2024 | 0900/1100 | ** |  | EU | PPI |

| 04/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 04/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 04/04/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 04/04/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/04/2024 | 1400/1000 |  | US | Philly Fed's Pat Harker | |

| 04/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/04/2024 | 1615/1215 |  | US | Richmond Fed's Tom Barkin | |

| 04/04/2024 | 1645/1245 |  | US | Chicago Fed's Austan Goolsbee | |

| 04/04/2024 | 1800/1400 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.