-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI US MARKETS ANALYSIS - ECB Members Stress Likelihood of Post-March Hikes

Highlights:

- Cash Treasuries sit modestly richer ahead of another busy session

- Markets expect payrolls gains to moderate to +189k

- ECB members out in force to stress more hikes to come after March

US TSYS: Modestly Richer Ahead Of Payrolls, ISM Services and first Fedspeak

- Cash Tsys sit modestly richer on the day and also from Wednesday’s post-FOMC close, with yields within yesterday’s ECB-induced ranges. Data is firmly in focus with payrolls and additional attention on ISM services after last month’s largest miss since 2008 and the service sector caught up with manufacturing weakness at a much faster pace than expected.

- 2YY -1.9bp at 4.085%, 5YY -1.4bp at 3.474%, 10YY -0.8bp at 3.385%, 30YY -0.8bp at 3.537%. 2s10s are within recent ranges at -70bps.

- TYH3 trades just half a tick higher at 115-18 on modestly below average volumes. Yesterday’s highs of 116-00 pushed the contract closer to key resistance at the bull trigger of 116-08 (Jan 19 high).

- Data: Payrolls, Jan (0830ET), S&P Global Service PMI, Jan final (0945ET) and ISM services, Jan (1000ET)

- Fedspeak: Daly, ’24 voter (1430ET)

- No issuance

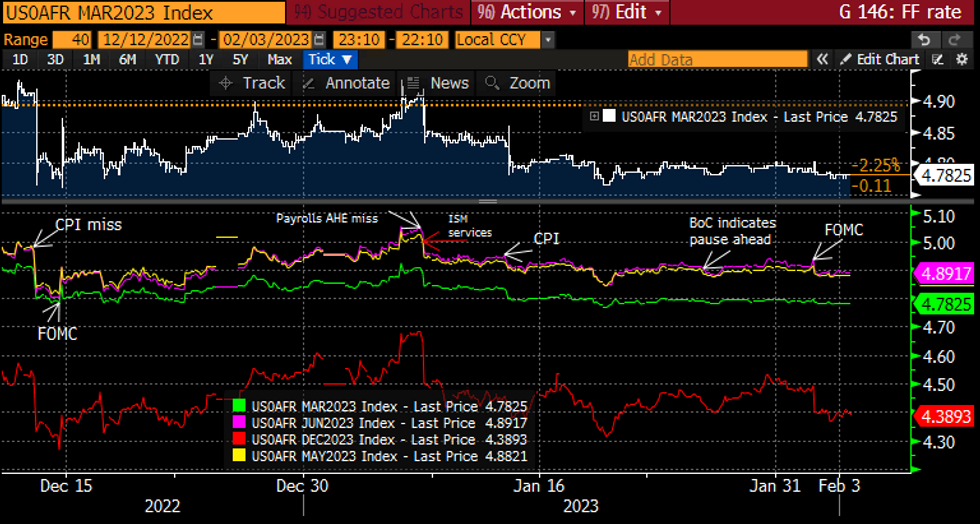

STIR FUTURES: Fed Path Holding Post-FOMC Levels Ahead Of Payrolls, ISM

- Fed Funds implied hikes are little changed from post-FOMC levels after reversing a further dip with the ECB.

- 20bp priced for March, a cumulative 30/31bps to May/Jun with a terminal of 4.89% before 50bps of cuts to 4.39% end-2023.

- Cuts have built from 44bps just prior to the FOMC but remain within ranges seen since last month’s miss for AHE and ISM services, both of which are due ahead.

- First out of the FOMC blackout, SF Fed’s Daly (’24 voter) is due at 1430ET with scope for earlier pop-ups post-payrolls.

Source: Bloomberg

Source: Bloomberg

FOREX: EUR/USD Staging Shallow Post-ECB Bounce

- The EUR is on the front foot early Friday as markets recover their ECB-induced losses posted into the Thursday close. EUR/USD has bounced off the overnight low at 1.0882 to trade either side of the 1.09 handle. The pullback in the pair is deemed corrective from a technical perspective, with the broad trend direction remains up for now - resistance at 1.0929, the Jan 26 high, has been cleared. This maintains the bullish price sequence of higher highs and higher lows and clears the way for a climb towards 1.1054, a Fibonacci projection.

- High beta and growth proxy currencies are slightly lower to start the final session of the week, as equities maintain a modest risk-off tone after poorly received earnings from megacap firms Apple, Amazon and Alphabet after-market Thursday. As a result, AUD and CAD make up the worst performers among G10 FX.

- The January payrolls report is the highlight on the Friday calendar, with markets expecting 189k jobs added over the month of January - although the unemployment rate is seen ticking higher by 0.1ppts to 3.6%. Average hourly earnings will also be noted to gauge the scale or viability of any potential Fed easing into year-end.

- The ISM services index follows, with markets expecting the data to show a return to growth at 50.5.

FX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0770-75(E739mln), $1.0850-60(E1.4bln), $1.0950(E1.6bln), $1.0975-80(E640mln), $1.1000(E1.5bln)

- GBP/USD: $1.2325(Gbp1.5bln)

- EUR/GBP: Gbp0.8840(E673mln)

- USD/JPY: Y127.00($545mln), Y129.50-55($1.1bln), Y130.00($1.0bln)

- EUR/JPY: Y138.15(E500mln)

- USD/CAD: C$1.3300($960mln), C$1.3400-05($670mln), C$1.3500($3.0bln)

- USD/CNY: Cny6.8000($1.1bln)

EUROPE ISSUANCE

Belgian ORI facility results

- E200mln of the 4.25% Mar-41 OLO. Avg yield 3.041% (bid-to-cover 2.7x)

- E305mln of the 2.15% Jun-66 OLO. Avg yield 2.891% (bid-to-cover 1.68x).

BONDS: Partially Reversing Some of Yesterday's Huge Rally

- Core fixed income, particularly Bunds, is trading lower today following the huge rallies seen in both bunds and gilts yesterday. There have been no real headline drivers to the move, but some moves lower given the magnitude of yesterday's moves was to be expected.

- Looking ahead, the big release of the day is the US employment report at 13:30GMT / 8:30ET. Consensus looks for a slight moderation in payrolls growth in January to a still stronger than sustainable pace after last month’s broadly in line outcome. Annual benchmark revisions could make the initial read more complicated, but barring large surprises we suspect focus will be on AHE, which has abated a bit in the words of Powell after its own large revisions. Primary dealer analysts have an unusually distinct skew to a hawkish surprise from both AHE growth and the unemployment rate.

- We are also due to receive the ISM services report at 15:00GMT / 10:00ET

EQUITIES: E-Mini S&P Ease Off Thursday Highs

- The EUROSTOXX 50 futures trend needle points north. The contract has breached resistance at 4206.00, the Jan 18 high. The clear break of this level confirms a resumption of the current uptrend and paves the way for gains towards 4269.50, a Fibonacci projection. Note that the trend remains overbought. A pullback, if seen, would represent a healthy correction. A break of 4097.00, the Jan 19 low, would signal the start of a short-term bear cycle.

- S&P E-Minis traded higher Wednesday and in the process cleared recent highs to confirm a resumption of the current bull cycle that started Dec 22. A key resistance and a bull trigger at 4180.00, the Dec 13 high, has been pierced. A clear break of this level would confirm a resumption of a broader uptrend and open 4250.00, the Aug 26 2022 high. Initial firm support has been defined at 4007.50, the Jan 31 low.

COMMODITIES: Gold Prices Moderate, Erasing Post-Fed Gains

- A sharp sell-off on Wednesday and weakness Thursday in WTI futures has reinforced current bearish conditions. The contract has breached support at $78.45 this week, the Jan 19 low. The move lower undermines the recent bull theme and a continuation would signal potential for an extension to $72.74, the Jan 5 low. On the upside, the bull trigger has been defined at $82.66, Jan 18 high. A break of this level is required to reinstate the recent bullish theme.

- Trend conditions in Gold are bullish and Thursday’s move lower is considered corrective. This week’s print above 1949.20, the Jan 26 high, confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. The focus is on $1963.0, a Fibonacci retracement. Initial firm support to watch lies at $1907.40, the 20-day EMA and $1900.9, the Jan 31 low. A break of this zone would signal a short-term reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/02/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2023 | 1215/1215 |  | UK | BOE Pill & Shortall MPR National Agency Briefing | |

| 03/02/2023 | 1300/1400 |  | EU | ECB Elderson Speech at Climate Outreach Event | |

| 03/02/2023 | 1330/0830 | *** |  | US | Employment Report |

| 03/02/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 04/02/2023 | 1715/1215 |  | US | St. Louis Fed's James Bullard | |

| 06/02/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 06/02/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2023 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.