-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - ECB Speakers a Highlight Amid Quiet Calendar

Highlights:

- Treasuries see muted trade, with curve a touch bull flatter

- AUD on top as trimmed mean CPI tops expectations

- Data dearth keeps focus on speakers, with ECB's Rehn and de Cos on the docket

US TSYS: Bull Flattening With 10Y Supply Headlining Otherwise Light Docket

- Cash Tsys have set about unwinding yesterday’s bear steepening with a bull flattening today, with major benchmark yields broadly in the middle of yesterday’s ranges across the curve at typing. Fed expectations are little changed and a lack of data and Fedspeak could leave flow or headlines as a main driver until the 10Y auction, albeit in tomorrow’s CPI shadow (full preview here).

- On the 10Y reopen, JPM noted late yesterday that with intermediate Treasuries looking rich to fair value and our Treasury Client Survey showing the most net longs in three months, demand is likely to remain muted and require a further concession from current levels.

- 2YY -1.3bps at 4.235%, 5YY -3.8bps at 3.692%, 10YY -4.6bps at 3.572% and 30YY -5.7bps at 3.697%.

- TYH3 trades 9+ ticks higher at 114-09+, moving further off yesterday’s low of 113-26+ (with support at the 50-day EMA of 113-12) but below resistance at Monday’s high of 114-23+.

- Data: MBA weekly mortgage apps/rates (1200ET)

- Bond issuance: US Tsy $32B 10Y Note reopen (91282CFV8) – 1300ET

- Bill issuance: US Tsy $36B 17W bill auction – 1130ET

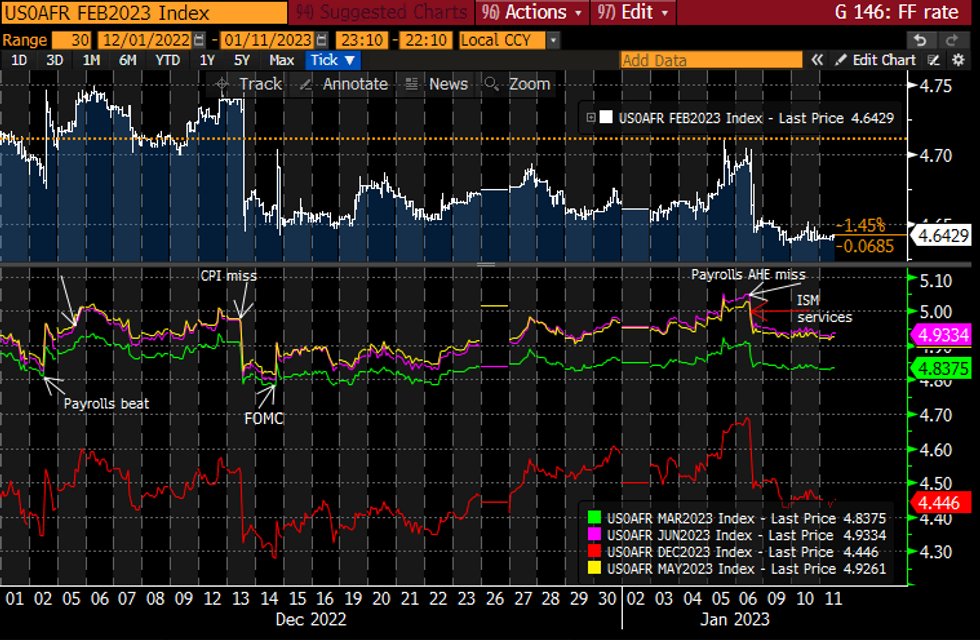

STIR FUTURES: Fed Rate Path In Week’s Tight Range

- Fed Funds implied hikes little changed with 31bp for Feb 1 (+0.5bp), cumulative 50.5bp to 4.84% Mar (unch), terminal 4.94% Jun (unch) and 4.45% Dec (-1bp).

- The terminal holds circa 10bps lower than shortly before Friday’s payrolls/ISM services hit, awaiting tomorrow’s CPI.

- No Fedspeak today. No spillover from ECB’s Holzmann or Villeroy earlier with Rehn and De Cos still to come.

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

MNI CPI PREVIEW: Core Services Ex Shelter Keenly Watched

- Core CPI inflation is seen nudging up to 0.3% M/M in December after surprising lower with 0.20% in November when the three main areas of core - shelter, services ex shelter and goods - all moderated.

- OER and tenants’ rents could see a modest dip but barring no surprises there, attention is likely most firmly on core services excluding shelter with its continued FOMC focus, and then any further goods deflation.

- We see high sensitivity to surprises in either direction, especially if in stickier, less idiosyncratic categories.

- The historically low u/e rate gives hawks something to build upon if an upside surprise, but might need to be followed by strong composition-adjusted wage growth in measures released later this month to lock in another 50bp hike, whilst a downside surprise could further cement a 25bp hike with a resulting relief rally.

RUSSIA: Markets Look Through Ceasefire Headlines

- Reuters cites RIA in reporting that Russia's Rights Commissioner said important ceasefire proposals have been made during her meeting with Turkish and Ukrainian colleagues in Turkey.

- Some context for these Russia/Ukraine headlines - rights commissioners are meeting on the sidelines of an international ombudsman conference today and tomorrow, with Russian / Turkish / Ukrainian representatives to meet bilaterally in Turkey Jan 12-14 to discuss humanitarian aid. So worth taking note these are not senior ministers from government, nor defence ministry representatives.

- Deals have been struck in the past for grain corridors and key exports and the like, so the context suggests these discussions could be concerning similar deals.

GILTS: Curve flattens as terminal rate moves lower and FinStab sales are strong

- Gilts today have been pulled higher by two aspects: first they have been pulled higher from a reduction in terminal pricing globally following less hawkish-than-usual comments from ECB's Holzmann. Second, there has been continued (but slow) follow through from yesterday's BOE Financial Stability sales operation in which the vast majority of remaining gilts bought for the "temporary" programme have now been sold back to the market.

- 2y yields down -4.5bp today at 3.403%, 5y yields down -8.3bp at 3.374%, 10y yields down -9.0bp at 3.465% and 30y yields down -10.6bp at 3.798% as the curve flattens: 2s10s is 4.6bp flatter today at -0.1.bp and while 10s30s is 1.6bp flatter at 33.3bp.

- Yesterday's BOE Financial Stability Portfolio sales saw huge takeup. In nominal terms only GBP210mln of long-dated gilts (of which GBP180mln is the 0.875% Jan-46 gilt) and GBP363mln of linkers (of which GBP169mln is the 1.25% Nov-27 I/L gilt) remain to be sold. This compares to initial nominal holdings of GBP17.2bln for longs and GBP6.1bln for linkers.

- Another Financial Stability Portfolio sales operation is due to be held today (results shortly after 15:30GMT) and it is now just a matter of time before the Bank will have completely unwound its holdings.

- Looking ahead, we will hear from external MPC member Catherine Mann tomorrow as she is due to give a lecture at the Manchester Business School on Thursday entitled “Challenges facing the UK economy, challenges facing monetary policy: a comparative look.” There is no text due to be released from the event, and Mann was the sole hawkish dissenter in December looking for a 75bp hike, so even if she still sounds hawkish it would not necessarily be a concern for the market. It might be more significant if she was to sound less hawkish, however.

- We also have November activity data due for release on Friday (including monthly GDP).

EUROPE ISSUANCE UPDATE

German auction result

- E5bln (E4.508bln allotted) of the new 2.30% Feb-33 Bund. Avg yield 2.25% (bid-to-cover 1.26x).

FOREX: AUD Favoured as Hotter CPI Bakes In RBA Action for February

- Currency markets have picked up where they left off early Wednesday, with risk proxies moderately outperforming and EUR/USD holding well above the 1.07 handle.

- AUD's outperformance follows a modest beat on expectations for November CPI this morning, which edged higher to 7.3% Y/Y and 5.6% on a trimmed mean basis. This keeps a bullish theme intact, with the pair having cleared 0.6893, the Dec 13 high this week to confirm a resumption of the uptrend that started Oct 13. The focus is on 0.6976, a Fibonacci projection. Key support lies at 0.6688, the Jan 3 low.

- The stronger EUR theme gathered pace somewhat on comments from ECB's Holzmann - a historically hawkish member of the governing council. Holzmann stressed the need for the bank to act cautiously in their approach to quantitative tightening - a comment that helped narrow IT-GE government bond yield spreads and thereby shore up the single currency.

- JPY and GBP are among the poorest performers so far. Moves have helped reinforce the bullish outlook for EUR/GBP, which eyes 0.8907 next, a Fibonacci retracement point. Note too that moving average studies highlight a bullish backdrop, reinforcing the current trend direction.

- Markets remain in a holding pattern ahead of Thursday's CPI release, with Wednesday seeing very little in terms of data. As such, more attention will likely be paid to the speaker slate, as ECB's Villeroy, Rehn and de Cos are all on the docket.

BONDS: Holzmann Comments Push Core FI Higher

Core fixed income has been moving higher through this morning as terminal rate expectations have shifted lower after comments from ECB's Holzmann which were considered less hawkish than his usual communication.

- Schatz yields are down 2.2bp on the day, dragging 2-year UST yields a similar amount, but it is 2-year gilt yields that have seen the biggest move at the short-end of the govvie curve, moving with a higher beta than Schatz.

- However, in the 10-year space there have been similar moves for both Bunds and gilts, with yields down around 8bp for both, more than the 5bp decrease in UST yields.

- This has therefore seen the biggest flattening of the 2s10s curve in Germany (around 5.5bp), with gilts and USTs seeing around 3.5bp of flattening.

- Looking ahead, markets already have one eye on tomorrow's US CPI print.

- TY1 futures are up 0-10 today at 114-010 with 10y UST yields down -5.1bp at 3.571% and 2y yields down -2.3bp at 4.227%.

- Bund futures are up 0.85 today at 137.05 with 10y Bund yields down -7.9bp at 2.225% and Schatz yields down -2.2bp at 2.618%.

- Gilt futures are up 0.88 today at 102.75 with 10y yields down -8.3bp at 3.472% and 2y yields down -4.9bp at 3.399%.

EQUITIES: Eurostoxx Futures Continues Climb Towards 4100.00 Handle

EUROSTOXX 50 futures bullish conditions remain intact and the contract is trading at its recent highs. Futures have cleared resistance at 4043.00, the Dec 13 high and a bull trigger. The clear break represents a key short-term positive development and paves the way for gains to 4100.00 next. Moving average studies are in a bull-mode condition, reinforcing the current positive trend condition. Initial support lies at 3927.00, the 20-day EMA. S&P E-Minis traded higher Monday but failed to hold on to the session high. Key resistance at 3918.27, the 50-day EMA, has been breached. A continuation higher and a clear break of this EMA would suggest potential for a stronger recovery and highlight a possible reversal that would open 4000.00 next. On the downside, a break lower would confirm a resumption of the downtrend - the bear trigger is 3788.50, the Dec 22 low.

COMMODITIES: Gold Approaches 1896.5 Retracement Level

WTI futures failed to hold on to Monday’s gains. A bearish theme remains intact following the sell-off on Jan 3 and 4. Key support and the bear trigger lies at $70.31, the Dec 9 low. A break of this level would confirm a resumption of the broader downtrend and maintain a bearish price sequence of lower lows and lower highs. This would open $68.19, a Fibonacci projection. On the upside, key resistance is at $81.50, the Jan 3 high. Trend conditions in Gold remain bullish and the yellow metal continues to trade higher, extending the current uptrend. The move higher maintains the positive price sequence of higher highs and higher lows and note that moving average studies are in a bull mode position - reflecting the current uptrend. The focus is on $1896.5, a Fibonacci retracement. On the downside, support to watch lies at $1825.2, Jan 5 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/01/2023 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/01/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/01/2023 | 0030/1130 | ** |  | AU | Trade Balance |

| 12/01/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 12/01/2023 | 0130/0930 | *** |  | CN | CPI |

| 12/01/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 12/01/2023 | 1230/0730 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 12/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/01/2023 | 1330/0830 | *** |  | US | CPI |

| 12/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 12/01/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2023 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2023 | 1700/1700 |  | UK | BOE Mann Lecture at University of Manchester | |

| 12/01/2023 | 1740/1240 |  | US | Richmond Fed President Tom Barkin | |

| 12/01/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/01/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.