-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EGB Spreads Wider on Election Risks

Highlights:

- EUR spot breaks lower as Macron calls for shock election

- EGB spreads blown wider as political risk premium weighs

- Treasury yields build on post-NFP gains, top 4.45%

US TSYS: Tsy Ylds Higher as EU Political Uncertainty Roils Ahead Wed CPI, FOMC

- Carry-over after Friday's strong employment data decline, Treasuries are mirroring weaker EGBs after France President Macron called for snap election following weekend parliamentary elections.

- While far-right forces made strong gains vs. the majority center-right European People’s Party (EPP) in EU elections, Treasury futures have pared losses, intermediates back near the middle of the overnight range.

- Limited US data today and tomorrow, this week's main focus is on Wednesday's May CPI and FOMC policy announcement.

- Rush of US Treasury auctions ahead the midweek event risk: $70B each 13- and 26W bills at 1130ET, $58B 3Y Note auction (91282CKV2) at 1300ET.

- Sep'24 10Y Treasury futures are currently trading -6 at 109-04 -- inside 6.5-tic range: 109-02 low/109-08.5 high. Friday's sharp sell-off undermines the recent bullish theme, highlighting a potential bearish reversal. The TYU4 contract breached both the 50- and 20-day EMA, while continued decline would strengthen a bearish threat at at 108-27.5 (June 3 low).

- Cash yields are currently mildly higher: 5s +.0159 at 4.4784, 10s +.0256 at 4.4591%, 30s +.0277 at 4.5824%, while curves are running steeper: 2s10s +2.358 at -43.181, 5s30s +1.185 at 10.215.

US TSY FUTURES: OI Points To Mix Of Long Cover & Short Setting In Wake Of NFPs

The combination of Friday’s move lower in Tsy futures and preliminary OI data points to a mixture of net short setting (TU, FV & WN) and net long cover (TY, UXY & US), as the latest monthly labour market report triggered a hawkish repricing in FOMC-dated OIS and weighed on Tsy futures.

- Long cover provided the dominant positioning factor in net curve DV01 equivalent terms.

- Wednesday's FOMC decision & CPI readings present the next major risk events.

| 07-Jun-24 | 06-Jun-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,906,780 | 3,876,161 | +30,619 | +1,186,196 |

| FV | 6,292,492 | 6,272,545 | +19,947 | +847,395 |

| TY | 4,349,769 | 4,397,307 | -47,538 | -3,061,477 |

| UXY | 2,025,573 | 2,029,694 | -4,121 | -365,752 |

| US | 1,646,794 | 1,656,973 | -10,179 | -1,321,609 |

| WN | 1,682,099 | 1,675,860 | +6,239 | +1,235,163 |

| Total | -5,033 | -1,480,084 |

STIR: OI Points To Mix Of Net Short Setting & Long Cover In SOFR Futures Following NFPs

The combination of Friday's post-payrolls hawkish repricing and preliminary open interest data points to a mix of net short setting and long cover across the SOFR strip ahead of the weekend.

- The whites seemingly saw short setting in net pack OI terms, with more modest rounds of net short setting seen in both the greens and blues (pockets of net long cover were also witnessed in all 3 packs).

- Meanwhile, the reds seemed to see net long cover in most contracts, biasing the net pack OI swing in that direction.

- Interestingly, there was no sign of cover from the sizeable long that was built in SFRM4 on Thursday (when over 200K of the contract was lifted in short order during the NY afternoon).

- FOMC-dated OIS moved to priced ~36bp of cuts through year end in the wake of the jobs report vs. ~49bp at the close on Thursday.

- The first 25bp move is no longer fully discounted come the end of the Nov FOMC.

- Wednesday's FOMC decision & CPI readings present the next major risk events.

| 07-Jun-24 | 06-Jun-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 903,546 | 905,972 | -2,426 | Whites | +17,260 |

| SFRM4 | 1,357,737 | 1,349,739 | +7,998 | Reds | -17,537 |

| SFRU4 | 1,202,797 | 1,168,343 | +34,454 | Greens | +1,499 |

| SFRZ4 | 1,105,001 | 1,127,767 | -22,766 | Blues | +2,496 |

| SFRH5 | 808,268 | 806,901 | +1,367 | ||

| SFRM5 | 794,592 | 804,549 | -9,957 | ||

| SFRU5 | 742,970 | 743,273 | -303 | ||

| SFRZ5 | 809,361 | 818,005 | -8,644 | ||

| SFRH6 | 560,388 | 563,233 | -2,845 | ||

| SFRM6 | 504,456 | 500,300 | +4,156 | ||

| SFRU6 | 414,526 | 405,187 | +9,339 | ||

| SFRZ6 | 386,284 | 395,435 | -9,151 | ||

| SFRH7 | 257,395 | 249,478 | +7,917 | ||

| SFRM7 | 193,888 | 194,740 | -852 | ||

| SFRU7 | 160,187 | 159,452 | +735 | ||

| SFRZ7 | 163,435 | 168,739 | -5,304 |

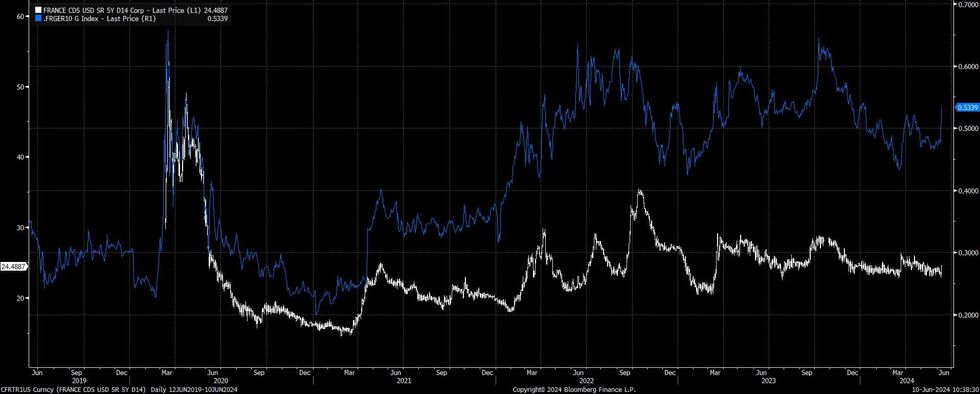

FRANCE: /OATS: CDS Sticks To Recent Range, 10-Year OAT/Bund Spread Above April Closing Wides

Benchmark French CDS reaction to the EU election results and the subsequent calling of a French snap election generally encapsulates the broader prevailing view.

- Ultimately, markets seem to hold limited long-term worry surrounding the French political situation, albeit with short-term uncertainty heightened.

- 5-Year CDS widens by a little over 1bp to trade at ~25bp, shy of the March ’24 highs

- OATs have been more sensitive, with the 10-Year OAT/Bund spread showing above the early April '24 closing highs.

- Fiscal worry was already evident in France.

- A reminder that policymaker rhetoric and tabled actions seemed to prevent the worst-case sovereign rating scenario as France avoided negative action from Fitch & Moody’s, allowing OAT spreads to move off early April wides.

- Still, the country received a one-notch downgrade from S&P in late May (placing that rating on an equal footing with the Fitch equivalent).

- Different forms of Iberian/IRISH tighteners vs. OATs remain a favoured sell-side call.

- When it comes to the upcoming French election, our political risk team has already noted that “the most likely outcome is for RN to increase its seat total but fall short of an overall majority. RN President Jordan Bardella has said that he would serve as Macron's PM, and the prospect of RN becoming the largest party cannot be ruled out.”

- Markets are therefore contemplating the issue of 'Cohabitation' (PM and President from different parties), which is rare in France and would likely limit policymaking capabilities during a period of already heightened fiscal uncertainty.

Fig. 1: French 5-Year CDS Vs. 10-Year OAT/Bund Spread

source: MNI - Market News/Bloomberg

source: MNI - Market News/Bloomberg

Macron Gambles On Snap Legislative Election

French President Emmanuel Macron's decision to dissolve the National Assembly and call snap legislative elections following the poor performance from his centrist Renaissance-led alliance in the European Parliament election is a significant gamble. In the EP election, Renaissance and its allies came in a distant second with 14.6% support, well behind the right-wing nationalist Rassembelement National (National Rally, RN) of Marine Le Pen on 31.5%. Even prior to the calling of the snap vote, Macron's group did not hold a majority in the National Assembly, with PM Gabriel Attal reliant on the backing of other parties to pass legislation.

- For Macron, the hope will be that the two-round system used in French elections (first round 30 June, second 7 July) blunts the increased support for RN, with voters from across the political spectrum banding together to back the non-RN candidate should they make it through to the second round.

- At present the most likely outcome is for RN to increase its seat total, but fall short of an overall majority. RN President Jordan Bardella has said that he would serve as Macron's PM, and the prospect of RN becoming the largest party cannot be ruled out.

- 'Cohabitation' (PM and president from different parties) is rare in France, and often hampers policy making and enactment.

- The election will be closely watched in Brussels, with the risk of an increased role for RN in French national politics a major cause for concern given the party's anti-EU, anti-NATO, anti-Ukraine funding stances.

EUROPE ISSUANCE UPDATE:

- "The EU (EUROPEAN UNION) has mandated Barclays, Deutsche Bank, HSBC, J.P. Morgan and Nordea as Joint Lead Managers for its upcoming EUR Fixed Rate RegS Bearer new 15-year benchmark due 4th October 2039. No further group. The transaction will be launched tomorrow, subject to market conditions." - market source

- We had noted since last month's EU-bond syndication that we expected a 15-year launch in June. We look for a transaction of E5-8bln.

FOREX: Renewed Political Risk Premium Presses EUR/GBP to Multi-year Low

- European markets have been left reeling by a bruising set of European Parliamentary election results, with right-wing parties across the continent surging ahead in the polls and triggering a wholly unexpected election call from the French President Macron. As such, markets trade with a heavy dose of political risk premium, tipping yields to rise across Europe and weighing on the single currency.

- EUR/GBP has cracked lower, breaking support to print a new multi-year low at 0.8453 and putting EUR/USD on course for a test of last month's low. The pair's two-day decline now amounts to close to 150 pips after Friday's solid NFP release, opening 1.0724 as the next key support.

- Front-end vols are well bid ahead of a tricky week to navigate for markets. The Fed and BoJ decisions as well as US CPI should keep markets busy as curves trade steeper in the US and Fed pricing for 2024 remains toward the tighter end of the series.

- Antipodean currencies outperform, with AUD, NZD firming. CFTC CoT data from Friday shows markets built the NZD net position in the latest week, swinging to a net long of 13.2% of OI, second only to GBP in G10 currencies.

- The calendar ahead is typically light for a Monday, with just the NY Fed's inflation expectations survey due. As a result, the central bank speaker slate should be of more consequence, with ECB's Holzmann and Nagel appearing later today. Holzmann was reportedly the only dissenter at the ECB's decision to cut rates last week, meaning his appearance today could carry more weight.

Political Risk Drives Surge in EUR Options Activity, Downside in Focus

- Given the sharp uptick in volatility and breakout in EUR spot, no surprise to see EUR hedges trading in size and well ahead of average for this time of day. Notably, the break to multi-year lows in EUR/GBP has helped drive demand for downside exposure, led by 0.8375 vanilla puts and trades consistent with a sizeable 0.8300/0.8396 put spread rolling off in early August, thereby capturing the fallout of both the UK and French elections.

- No surprise to see the uptick in front-end vols across G10, and this is most clearly seen in EUR/GBP as the 1m contract captures both votes. 1m vols added 0.8 points today to touch the highest since mid-January, marking the biggest one-day gain since March last year (triggered by concerns surrounding the sustainability of Credit Suisse).

- This theme is mirrored in EURJPY options trade, as Y160 puts tip the put/call ratio over 2.00, however there are some signs of steadier EUR/USD markets, with near E3bln in calls trading across 1.0775, 1.0800, 1.0900 and 1.1125 strikes this morning alone.

Recent Weakness in Eurostoxx 50 Futures Appears Technically Corrective

- Recent weakness in Eurostoxx 50 futures appears to have been a correction. The recovery from 4947.00, the Jun 4 low, signals the end of the corrective cycle and attention is on key resistance and the bull trigger at 5110.00, the May 16 high. Clearance of this level would confirm a resumption of the uptrend. On the downside, a break of 4947.00 would instead expose 4894.90, a Fibonacci retracement.

- The uptrend in S&P E-Minis remains intact and last week’s gains reinforce this set-up. The contract has traded above 5368.25, the May 23 high and bull trigger. The move confirms a resumption of the uptrend. A continuation higher would signal scope for a climb towards the 5400.00 handle next. On the downside, key short-term support has been defined at 5205.50, the May 31 low. Clearance of this level is required to signal a short-term reversal.

Sharp Sell-Off in Gold Friday Reinforces Short-Term Bearish Theme

- Despite the latest recovery in WTI futures, a bearish theme remains in play. Price has recently cleared $73.24, the 76.4% retracement of the Dec 13 - Apr 12 bull leg. This reinforces the current bearish theme and signals scope for a continuation. Note that moving average studies are in a bear-mode position too, highlighting a downtrend. Sights are on $71.33 next, the Feb 5 low. Initial resistance is at $77.10, the 20-day EMA.

- A sharp sell-off in Gold Friday reinforces a short-term bearish theme. The yellow metal has cleared support around the 50-day EMA, at 2313.6. The break confirms a resumption of the reversal that started May 20 and signals scope for a deeper correction near-term. This has opened $2277.4, the May 3 low. Clearance of this price point would strengthen a bearish theme. Initial resistance to watch is $2387. 8, Friday’s high.

| Date | GMT/Local | Impact | Country | Event |

| 10/06/2024 | - | Economy Watchers Survey | ||

| 10/06/2024 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 10/06/2024 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 10/06/2024 | 1700/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 11/06/2024 | 0600/0700 | *** | Labour Market Survey | |

| 11/06/2024 | 1000/0600 | ** | NFIB Small Business Optimism Index | |

| 11/06/2024 | 1100/1300 | ECB's Lane chat at Banking and Payments Federation Conference | ||

| 11/06/2024 | - | *** | Money Supply | |

| 11/06/2024 | - | *** | New Loans | |

| 11/06/2024 | - | *** | Social Financing | |

| 11/06/2024 | 1230/0830 | * | Building Permits | |

| 11/06/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 11/06/2024 | 1400/1000 | * | Services Revenues | |

| 11/06/2024 | 1530/1130 | ** | US Treasury Auction Result for 52 Week Bill | |

| 11/06/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 11/06/2024 | 1645/1845 | ECB's Elderson at Annual Banking Supervision Conference | ||

| 11/06/2024 | 1700/1300 | ** | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.