-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EGBs Weaken Towards Year End

MNI US MARKETS ANALYSIS - EGBs Weaken Towards Year End

HIGHLIGHTS:

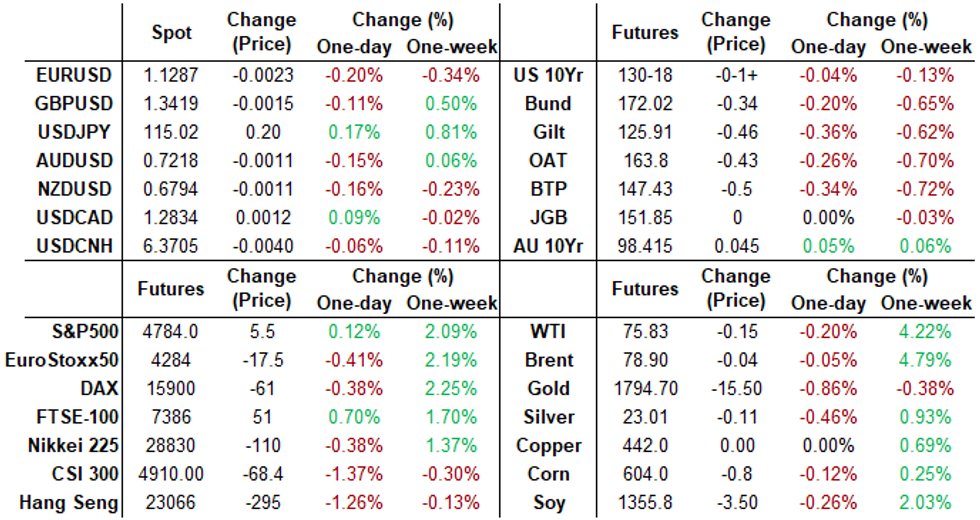

- European government bonds have sold off this morning with gilts underperforming EGBs

- The dollar has held firm against G10 FX

- There are no tier one data releases or scheduled CB speakers today

US TSYS SUMMARY: Twist Steepening On Surging But Milder Omicron Cases

- Cash Tsys have twist steepened today, led by the longer end, as markets weigh up the impact of surging but seemingly less severe Omicron cases.

- 2Y yields are -0.8bps at 0.742%, 5Y -0.2bps at 1.258%, 10Y +1.2bps at 1.493% and 30Y +1.6bps at 1.916%.

- Tsys outperform core Europe in 10Y space, with the +1.2bps sell-off vs Bunds +1.7bps, OATs +2.6bps and Gilts +4.8bps.

- TYH2 has sold off with London coming in, unwinding a small rally overnight to leave it -0-01+ at 130-18, a level close to where it has found some support over the past four trading days amidst low volumes.

- A string of non-tier one data releases today: wholesale and retail inventories, advanced trade and pending home sales all for Nov.

- US Tsy $40B 119D bill CMB auction and $24B 2Y FRN note auction re-open (1130ET) before $56B 7Y Note auction (1300ET). There was a second consecutive auction tail with yesterday's 5Y note.

EGB/GILT SUMMARY: Still Offered

European government bonds have sold off this morning with gilts leading the charge. Absent any obvious catalysts, the move likely reflects a reassessment of the Omicron variant.

- Gilt yields are now 4-5bp higher with the curve slightly bear steepening.

- The long-end of the bund curve has similarly underperformed with the 2s30s spread widening 5bp.

- The OAT curve has steepened further as a result of the short-end going bid and the longer-end selling off. 2s30s is now 7bp wider.

- BTPs have similarly traded weaker with cash yields 3-5bp higher on the day and the belly of the curve slightly underperforming.

- Speaking to Sky News earlier, UK PM Boris Johnson stated that the Omicron variant appears to be milder than the Delta strain of Covid-19, reiterating recent indications that the current wave may be less severe than initially feared.

- Greece sold EUR487.5mn of 6-month bills at an average yield of -0.46% and bid-to-cover of 2.98x.

- The Netherlands announced that it will sell up to EUR1.5bn of 4-month DTCs and EUR1.55bn of 6-month DTCs at the scheduled Jan 3 auction.

EUROPEAN SOVEREIGN ISSUANCE UPDATE

Greece Sells EUR487.5mn of 6-Month Bills

- Average yield -0.46%, bid-to-cover 2.98x

FOREX: Dollar Holds Firm

While the USD has gained across the board against DM FX, price action has been relatively contained during the European morning session.

- Dollar gains come amid a mixed performance in equities and a sell-off in European government bonds, with the latter potentially reflecting a shift in sentiment with respect to the Omicron variant, which now appears less deadly than initially feared despite surging case volumes.

- Scandinavian currencies have marginally underperformed, while USDCAD is close to flat on the day.

- In the EM space, TRY remains under pressure and off 5% against the dollar. The most recent weekly FX reserve data showing that the CBRT has been drawing down foreign currency holdings through the end of November and into December.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.