-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equities Ride Earnings Wave to New Highs

HIGHLIGHTS:

- Equities crest at new highs as market rides earnings wave

- Treasury curve tentatively flattens as market mulls Thursday volatility

- Final Fedspeak as FOMC head into media blackout

US TSYS SUMMARY: Tentative Early Flattening As Previous Session's Moves Mulled

A light schedule Friday offers the opportunity to digest Thursday's large Tsy swings, with the curve a little flatter vs overnight but nowhere near Thurs's flattest levels.

- Explanations for Thursday's rally /flattening post-strong data ranged from short covering / over-wrought pricing in of econ recovery expectations / US-Russia tensions / foreign buying / good data = bad news for fiscal stimulus / suddenly taking the FOMC's dovishness at face value.

- The subsequent post-1500ET long-end sell-off /steepening likewise attributed to multiple factors, including that the rally had gone too far too fast / US-Russia tensions not quite as bad as feared; aided by a round of selling in futures, covering maturities from FV right out to US & WN.

- As it stands, 5s30s are trading around where they were pre-0830ET Thurs data dump: 2-Yr yield is up 0.2bps at 0.1612%, 5-Yr is up 0.2bps at 0.8194%, 10-Yr is down 0.3bps at 1.5728%, and 30-Yr is down 1bps at 2.2595%. Jun 10-Yr futures (TY) down 8.5/32 at 132-12.5 (L: 132-08.5/ H: 132-16)

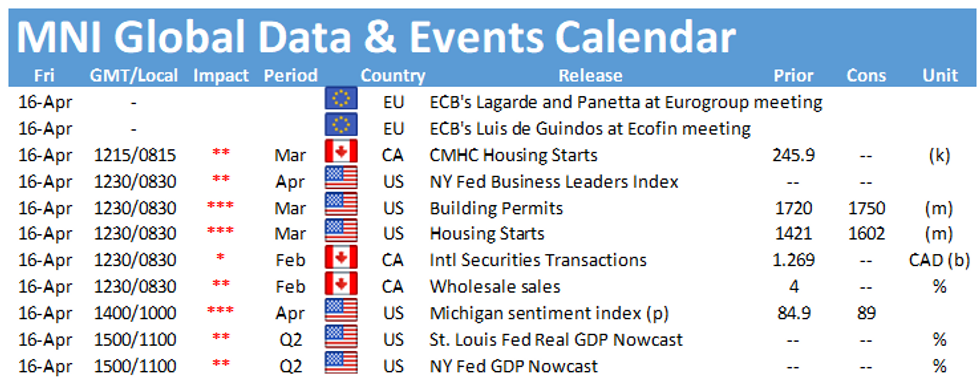

- Mar housing starts out at 0830ET, and prelim April UMich Sentiment at 1000ET rounds out the week's data. Dallas Fed Pres Kaplan is the final scheduled Fed speaker before the pre-FOMC blackout period begins this weekend. He appears twice, at 1045ET and 1230ET. Fed Gov Waller appears on CNBC at 1010ET.

- No supply. NY Fed buys ~$1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY: Risk-On Following Strong Chinese GDP Data

Record economic growth for China in the first quarter has underpinned the risk-on theme this morning. European sovereign bonds have sold off alongside gains for equities.

- Gilts have traded weaker, but have only partially retraced yesterday's rally. Cash yields are 1-3bp lower on the day with the curve 2bp steeper.

- The bund curve has similarly bear steepened with the 2s30s spread 1bp wider.

- OATs have traded weaker, with the belly of the curve marginally underperforming.

- BTPs trade broadly in line with core EGBs. The curve is 1bp steeper on the day.

- The DMO earlier sold GBP3.5bn of 1/3/6-month bills.

- The final Eurozone CPI estimate for March matched the initial reading (0.9% Y/Y)

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

OEM1 135.00^ bought for 52 in 1k

OEM1 134.75/135.00/135.25/135.75 call condor bought for 5 in 1k

RXK1 171.00/170.00 1x1.5 put spread sold at 23 in 1.5k

RXK1 170.00/169.00 1x2 put spread bought for 1.5 in 2.5k

RXM1 171.00/172.00/173.00 call ladder bought for 24 in 1.25k

UK:

0LN1 99.75^ bought for 11.5 in 2k

FOREX: GBP Softens, Erasing Week's Stronger Start

- Having outperformed during the first half of the week, GBP slipped to the bottom of the G10 pile early Friday, with decent volumes going through on the fall from ~1.3760 to ~1.3735 and from ~1.3740 to the day's lows of 1.3717.

- There was no key headline driver for the move, but does coincide with EUR/GBP convincingly taking out 0.87 on the way higher to touch the best levels since late February.

- Elsewhere, USD underwent a spell of weakness, with the turnaround being felt most materially in EUR/USD. The pair narrowed in on yesterday's highs at 1.1993 to play catch-up with the earlier strength in EURGBP.

- Next resistance in EURUSD crosses at 1.2037, the 61.8% retracement of the Feb 25 - Mar 31 sell-off and a break through here would signal scope for an extension of recent gains. There was a decent uptick in EUR futures volumes on the move, with over 3,500 contracts changing hands inside 5 minutes (cash equivalent approx. E450mln).

- Focus turns to US Housing Starts/Building Permits data as well as prelim Uni. of Michigan Sentiment data for April. Fed's Kaplan has the final word ahead of the FOMC media blackout period, which begins this weekend ahead of the Apr 28 rate decision.

FX OPTIONS: Expiries for Apr16 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.00($545mln), Y108.95-00($837mln)

- GBP/USD: $1.3650-55(Gbp679mln)

- AUD/USD: $0.7550(A$519mln)

- USD/CAD: C$1.2480-85($1.1bln), C$1.2550-60($506mln)

Price Signal Summary - Gold and Oil Remain Firm

- In the equity space, S&P E-minis rallied again yesterday and bulls remain firmly in control. The focus is on 4195.50 next, 1.618 projection of the Feb 1 - Feb 16 - Mar 4 price swing.

- In the FX world, EURUSD has this week cleared the 50-day EMA and has probed resistance at 1.1990, Mar 11 high. A clear break of 1.1990 would reinforce current bullish conditions and open 1.2037, 61.8% of the Feb 25 - Mar 31 sell-off. The GBPUSD outlook remains bearish. Firm resistance is at 1.3919, Apr 6 high. The key support and bear trigger to watch is 1.3670/69, Mar 25 and Apr 12 low. EURGBP key near term resistance remains 0.8731, Feb 26 high. A break is required to suggest scope for an extension higher. USDJPY remains vulnerable, attention is on 108.41, Mar 23 low.

- On the commodity front:

- Gold is firmer and recent gains have confirmed a double bottom reversal. The focus is on 1784.8, 38.2% retracement of the Jan 6 - Mar 8 sell-off

- Brent (M1) has rallied this week. Resistance to watch is at $67.55, former trendline support drawn off the Nov 2 low and $67.76, the Mar 18 high

- WTI (K1) is firmer too. The next resistance is at $64.72/88, former trendline support and the Mar 18 high.

- In the FI space, key support to watch in Bunds (M1) remains 170.52, Mar 18 low. A break would signal scope for an extension lower and open 170.05, 76.4% of the Feb 25 - Mar 25 rally. Support to watch in Gilts (M1) is 127.81, Apr 14 low. Initial firm resistance is 128.93, Mar 25 high.

EQUITIES: Futures in Holding Pattern Below Yesterday's Record Levels

- US futures are mixed, but hold close to yesterday's particularly strong close. The e-mini S&P topped resistance at 4,160 to hit new all time highs Thursday at 4,166.50. Uni of Michigan sentiment and housing starts/building permits data crosses later today.

- German, UK and Spanish indices outperform, but gains are broad-based headed into the final session of the week.

- Across Europe, industrials and real estate are fuelling gains, with financials not far behind. Tech, staples and healthcare are the only sectors in the red, reinforcing the risk-on theme as defensive stocks trade poorly.

- Earnings season continues with Morgan Stanley, BNY Mellon and State Street due among others.

COMMODITIES: Gold Sees Further Support as Markets Anticipate China Buying

- WTI and Brent crude futures both trade moderately higher pre-NY hours, with a softer greenback and firmer equity outlook largely responsible. Geopolitical tensions continue to simmer, with Iran confirming this morning the enrichment of uranium closer to the levels needed for weaponization - a move likely to raise ire among international counterparts looking to revive the 2015 nuclear agreement.

- Having started the session well, spot gold saw some further support ahead of NY hours on the back of a Reuters report raising speculation that Chinese buyers could wade into the precious metals market in the coming months.

- Reuters sources cited a decision from Chinese authorities to allow domestic and international banks to import "large" amounts of gold into the country in the coming months. Strength Friday opens $1784.8 resistance, marking 38.2% retracement of the Jan 6 - Mar 8 sell-off.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.