-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI US MARKETS ANALYSIS - Equity Progress Hampered by Evergrande Headlines

HIGHLIGHTS:

- Evergrande risks swell, with local governments primed for group's downfall

- Bank of England in focus

- Norges Bank exit emergency pandemic policy stance

US TSYS SUMMARY: FOMC in Rear View, Evergrande Headlines Still Roiling

Tsys trading mixed but off lows, equities higher but paring gains last half hour after as China's Evergrande making headlines again this morning. Markets still trading with a risk-on tone scaled back slightly after headlines that Chinese officials told "local governments to prepare for downfall" (DJ) of real-estate developer.- Otherwise, mkts ruminating over timing and speed of tapering as precursor to lift-off. Main takeaway from Fed Chair Powell's presser: reinforcement that taper very likely annc in Nov barring a poor Sep jobs report (mark your calendar for Fri October 8). Re: Sep payrolls report, Powell actually said he's looking for a "reasonably good one" and later a "decent" one, and NOT a "knockout, great, super strong employment report".

- Carry-over bid for bonds resumes, outpacing short end while yield curves unwind portion of post-FOMC flattening in short end, 5s30s still well below 100bp around 95. Decent volumes, TYZ1>460k, some deal-tied flow and option hedging ahead Fri's October serial option expiry.

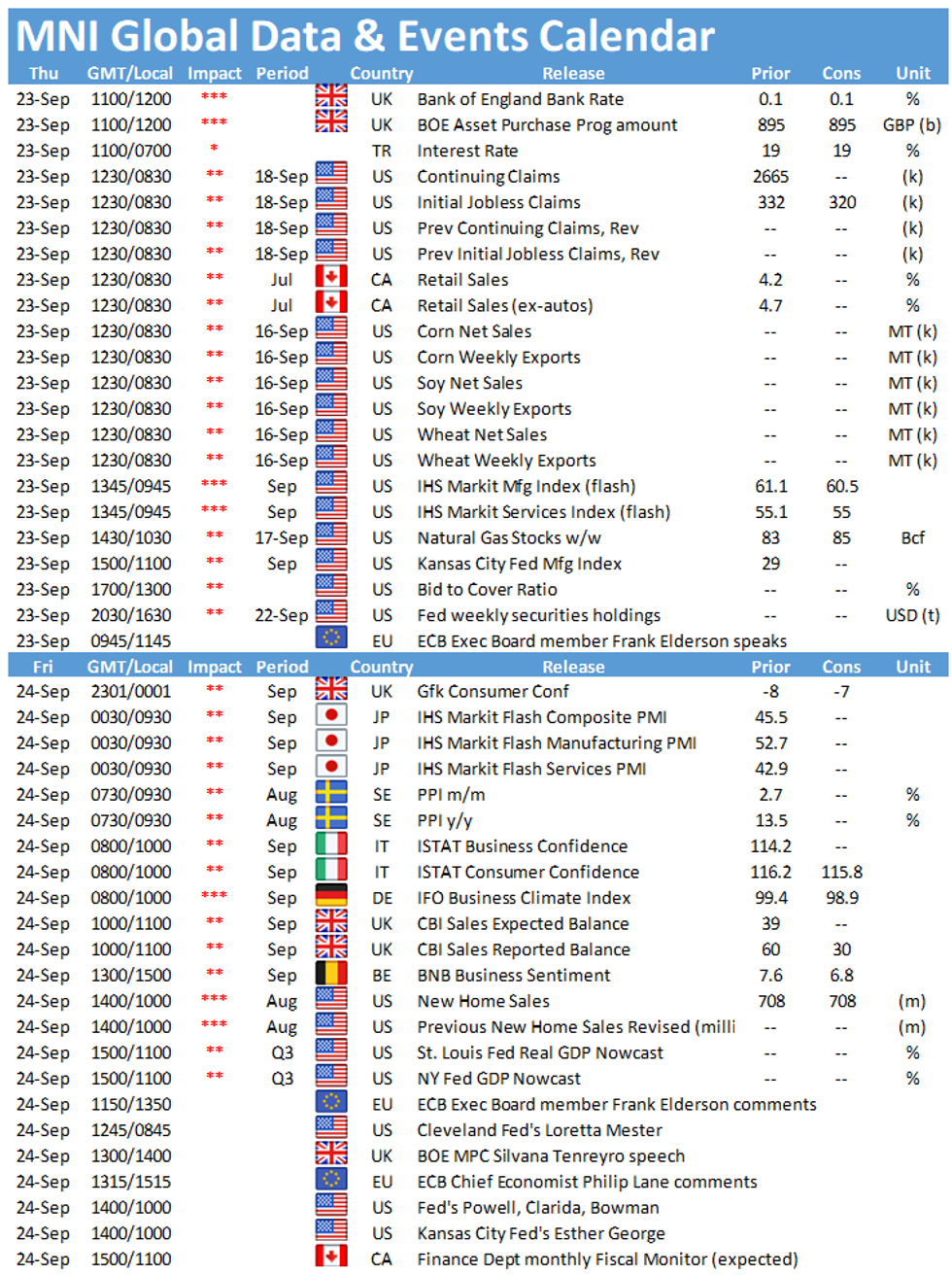

- Upcoming data includes weekly claims (+320k est vs. 332k prior), Markit PMIs, Fed exits blackout Thu evening. US Tsy auctions: $35B total 4W/8W bills and $14B 10Y TIPS auction re-open.

- Currently the 2-Yr yield is up 0.6bps at 0.2425%, 5-Yr is up 2.6bps at 0.8765%, 10-Yr is up 3.1bps at 1.3311%, and 30-Yr is up 2.7bps at 1.8351%.

EGB/Gilt: Focus Shifts To BoE Following Yesterday's Fed Taper Signal

European sovereign bonds have traded weaker today with equities pushing higher in the aftermath of yesterday's FOMC meeting. Focus now turns to the BoE at midday.

- Gilts have traded weaker heading into the BoE meeting with the short-end/belly of the curve marginally underperforming on the day.

- Bunds have similarly sold off with cash yields 1-2bp higher across the curve.

- OATs trade in line with bunds. Yields have similarly pushed up 1-2bp.

- BTPs are a touch weaker, with the curve trading close to flat overall.

- Preliminary European PMI data for September disappointed markets. The German prints, in particular, missed by a considerable margin with the services PMI reading 56.0 (vs 60.3 expected) while the manufacturing PMI came in at 58.5 (vs 61.4 consensus).

- The Norges Bank raised its main policy rate by 25bp to 0.25%, effectively ending the pandemic emergency policy stance.

EUROPE OPTION FLOW SUMMARY

Eurozone:

0RZ1 100.50/100.37/100.25p fly 1x3x2, sold at 3 in 1.5k

3RZ1 100.12/100ps 1x2, bought for 0.25 in 1k

SX7E 17th Dec expiry. 102c, bought for 1.90 in 10k

FOREX: NOK on Top as Norges Bank Drop Emergency Policy Stance

- The Norges Bank raised rates by 25bps to 0.25%, exiting their emergency pandemic policy stance. While the rate hike was expected, the bank also name-checked December as the next likely month to see a raise in rates, and also steepened the longer-end of the rate path projections - boosting the terminal rate to 1.68% from 1.56%.

- This worked in favour of NOK, pressuring EUR/NOK to new monthly lows and narrowing the gap with the bear trigger at the late April lows of 9.8998.

- Equities again trade firmer - following the lead of a solid Asia-Pacific session. Equity strength is working against haven currencies, pressing JPY to the bottom of the G10 pile. The greenback also trades weaker, despite the USD Index briefly showing above the Wednesday high in early trade.

- The Bank of England rate decision is up next, as well as rate decisions from the Turkish and South African central banks. Weekly US jobless claims and Canada's retail sales release for July are also due.

NORGES BANK: Bank Raises Rates as Expected, Name Checks December as Next Hike

Norges Bank raise rates by 25bps to 0.25%, exiting their emergency pandemic policy stance. While the rate hike was expected, the bank also name-checked December as the next likely month to see a raise in rates, and also steepened the longer-end of the rate path projections - boosting the terminal rate to 1.68% from 1.56%.

Key takeaways from the policy statement:- Capacity utilisation appears to be close to a normal level

- Increased activity and rising wage growth will help push inflation up towards the inflation target of 2 percent

- The policy rate will most likely be raised further in December

Policy assessment here: https://www.norges-bank.no/en/topics/Monetary-poli...

New Norges Bank rate path:

Source: MNI/Norges Bank

FX OPTIONS: Expiries for Sep23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E3.5bln), $1.1745-50(E2.3bln), $1.1790-00(E1.6bln), $1.1815-25(E850mln)

- USD/JPY: Y108.25-35($699mln), Y108.95-00($700mln), Y109.50-70($1.3bln), Y109.85-00($967mln)

- GBP/USD: $1.3600(Gbp576mln), $1.3700(Gbp533mln), $1.3800(Gbp718mln)

- AUD/USD: $0.7240-50(A$1.2bln)

- USD/CAD: C$1.2600($1.7bln), C$1.2620($920mln), C$1.2650($503mln), C$1.2705-25($840mln)

- USD/CNY: Cny6.4790-00($985mln), Cny6.50($762mln)

Price Signal Summary - S&P E-Minis Back Above The 50-Day EMA

- In the equity space, S&P E-minis continue to recover from Monday sharp sell-off and the low of 4293.75. The contract is testing a key short-term resistance at 4418.00, Sep 20 high. A clear break would suggest the tide has turned and signal scope for a stronger recovery. Note too that the price is back above the 50-day day EMA and this is a positive development. EUROSTOXX 50 started the week on a bearish note but sentiment has shifted and the contract has reversed higher and is climbing today. Price is pressuring resistance at 4184.00, Jul 17 high where a break would open the key bull trigger at 4223.00, Sep 6 high.

- In FX, EURUSD outlook remains bearish despite today's gains. Recent weakness suggests scope for a test and potential break of key support at 1.1664, Aug 20 low. GBPUSD outlook remains bearish. The next key support is at 1.3602, Aug 20 low. Note too that a triangle base intersects at 1.3633 and represents an important support. The triangle is drawn from the July 20 low. The base has been probed, a clear break would strengthen a bearish case. Recent gains in the USD Index (DXY) have exposed key resistance at 93.73, Aug 20 high and the bull trigger. A break would confirm a resumption of the uptrend that started May 25.

- On the commodity front, the Gold near-term outlook remains bearish. The focus is on $1724.5, 76.4% retracement of the Aug 9 - Sep 3 rally. Resistance is at $1787.4, Sep 22 high. WTI futures maintain a bullish outlook. Tuesday's price pattern was a bullish doji candle, reinforcing the current utrend. Initial support is seen at $69.39, Sep 21 low. The focus is on $73.58, Jul 6 high and the bull trigger

- In FI, Bund futures remain in a downtrend and recent weakness signals scope for a move towards 170.52, 3.00 projection of the Aug 5 - 11 - 17 price swing. Initial firm resistance is at 172.12, Sep 14 high. Gilt futures outlook remains bearish too. The focus is on 126.83, 2.00 projection of the Aug 20 - 26 - 31 price swing.

EQUITIES: Progress Hampered by China Headlines

- Stocks traded well across the European morning and Asia-Pacific session, feeding through into higher US futures ahead of the Thursday Wall Street opening bell. The e-mini S&P cleared the Monday open, touching 4424.75 at the intraday high.

- Equity progress faded slightly on WSJ reports surrounding Evergrande, however, with sources reporting that Chinese authorities had asked local governments to prepare for the potential downfall of the Evergrande group.

- Europe's gains are led by Italy's FTSE-MIB and Germany's DAX, both of which trade with gains of around 1% apiece. Tech and consumer discretionary names are leading progress, but all sectors are trading in the green.

COMMODITIES: Crude Rolls Off Week's Highs, Remains Bullish

- WTI and Brent crude futures both trade in minor negative territory, with profit-taking and the post-Fed USD rally largely responsible.

- Gold has erased the Fed-induced dip, with concerns surrounding China's Evergrande group the primary driver. WSJ sources cited the Chinese authorities as prepping local governments for a collapse of the group, raising concerns of a sizeable corporate default in China.

- Nonetheless, the bearish risk is still present. The move yesterday resulted in a break of support at $1774.5, Aug 19 low and a test of $1745.4, 61.8% retracement of the Aug 9 - Sep 3 rally. The retracement remains exposed and recent S/T gains are considered corrective. A resumption of weakness would open the key support at $1690.6 further out, Aug 9 low. Initial firm resistance has been defined at $1808.7, Sep 14 high. A break would ease bearish pressure.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.