-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

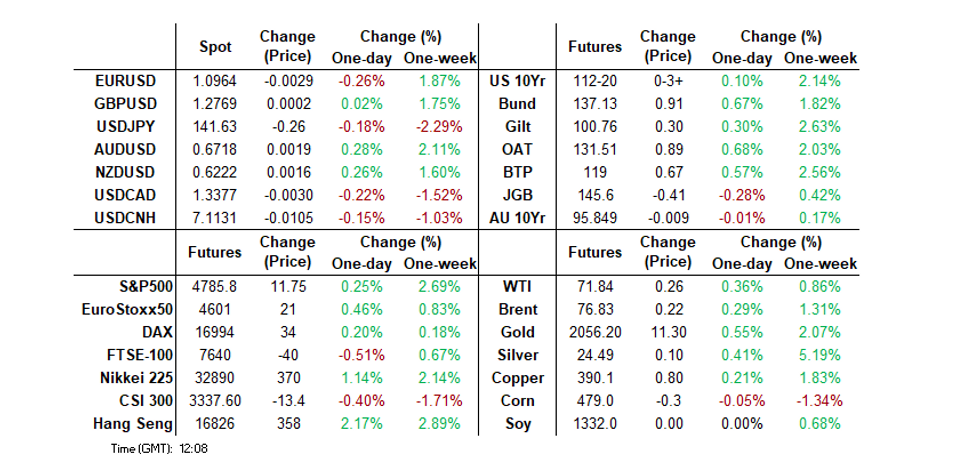

MNI US MARKETS ANALYSIS: EUR Pressured By Flash PMIs

- EUR struggles in wake of flash PMI data, EUR short end prices over 150bp of '24 ECB cuts once again.

- OI points to notable long setting in Tsy futures post-Fed.

- Fedspeak from Williams, a raft of ECB speak and flash U.S. PMI data is due later today.

US TSYS: Tsys Track EGBs After Soft PMIs, NY Fed Williams Resumes Fed Speak

- Cash Tsys firmer at the moment -- following EGBs lead after mildly softer European PMI data -- with the exception of UK Flash Services PMI (52.7 vs. 51.0 exp).

- Tsys inside relatively narrow overnight range and near Thursday's midday highs. March'24 10Y futures (TYH4) currently +2 at 112-18.5 vs. 112-22 intraday high, moderate volume at just over 370k. Focus on technical resistance at 112-28.5 (1.618 proj of the Oct 19 - Nov 3 - Nov 13 price swing). Initial support well below at 111-09+ (High Dec 7 and a recent breakout level).

- Projected rate cuts for early 2024 mostly softer vs. Thursday highs with the short end futures weaker: January 2024 cumulative -3bp at 5.302%, March 2024 chance of rate cut climbs to -76.5% vs. -81.9% late Thursday w/ cumulative of -22.1bp at 5.111%, May 2024 chances -92.3% after fully pricing in the first cut yesterday with cumulative -44.5bp at 4.888%, while June'24 climbs to -99.2% vs. -96.9%, cumulative -69.5bp at 4.637%. Fed terminal at 5.33% in Feb'24.

- Friday Data Calendar: Fed Speak Returns with NY Fed President John Williams on CNBC Squawk at 0830ET, IP/Cap-U at 0915ET, S&P PMI at 0945ET, TIC Flow at 1600ET.

US TSY FUTURES: OI Points To Sizeable Long Setting Across Curve On Thursday

Post-Fed feedthrough continued to dominate on Thursday, with the combination of the outright richening on the Tsy futures curve and preliminary OI data pointing to a net DV01 adjusted net long addition of nearly $10mn across the major futures contracts.

- Apparent long setting was seen across the board.

| 14-Dec-23 | 13-Dec-23 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,923,630 | 3,905,851 | +17,779 | +691,378 |

| FV | 5,705,997 | 5,688,391 | +17,606 | +774,807 |

| TY | 4,516,869 | 4,492,507 | +24,362 | +1,598,619 |

| UXY | 2,005,872 | 1,994,112 | +11,760 | +1,101,099 |

| US | 1,343,076 | 1,326,698 | +16,378 | +2,288,007 |

| WN | 1,599,395 | 1,583,904 | +15,491 | +3,473,515 |

| Total | +103,376 | +9,927,425 |

STIR: OI Indicates Post-Fed Short Cover & Long Setting On SOFR Strip On Thursday

The combination of the richening on the SOFR strip and Thursday's preliminary OI data points to short cover as the dominant positioning swing on the SOFR strip on Thursday, as the post-FOMC adjustments continued.

- The whites, reds and blues seemed to see net short cover on a pack basis, while the greens appeared to break the trend, via a modest round of apparent net long setting.

- Note that long setting appeared to be seen in both the SFRU3 and SFRZ3 contracts although it is hard to be certain on the former given its unchanged price status on the day.

| 14-Dec-23 | 13-Dec-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRU3 | 1,114,373 | 1,091,169 | +23,204 | Whites | -30,931 |

| SFRZ3 | 1,605,741 | 1,582,793 | +22,948 | Reds | -39,739 |

| SFRH4 | 1,096,216 | 1,129,977 | -33,761 | Greens | +9,544 |

| SFRM4 | 1,022,937 | 1,066,259 | -43,322 | Blues | -13,499 |

| SFRU4 | 950,869 | 980,221 | -29,352 | ||

| SFRZ4 | 967,701 | 973,446 | -5,745 | ||

| SFRH5 | 573,630 | 580,148 | -6,518 | ||

| SFRM5 | 605,301 | 603,425 | +1,876 | ||

| SFRU5 | 596,391 | 603,517 | -7,126 | ||

| SFRZ5 | 580,288 | 562,377 | +17,911 | ||

| SFRH6 | 408,805 | 411,580 | -2,775 | ||

| SFRM6 | 377,779 | 376,245 | +1,534 | ||

| SFRU6 | 312,356 | 316,512 | -4,156 | ||

| SFRZ6 | 243,050 | 243,015 | +35 | ||

| SFRH7 | 143,942 | 150,463 | -6,521 | ||

| SFRM7 | 137,133 | 139,990 | -2,857 |

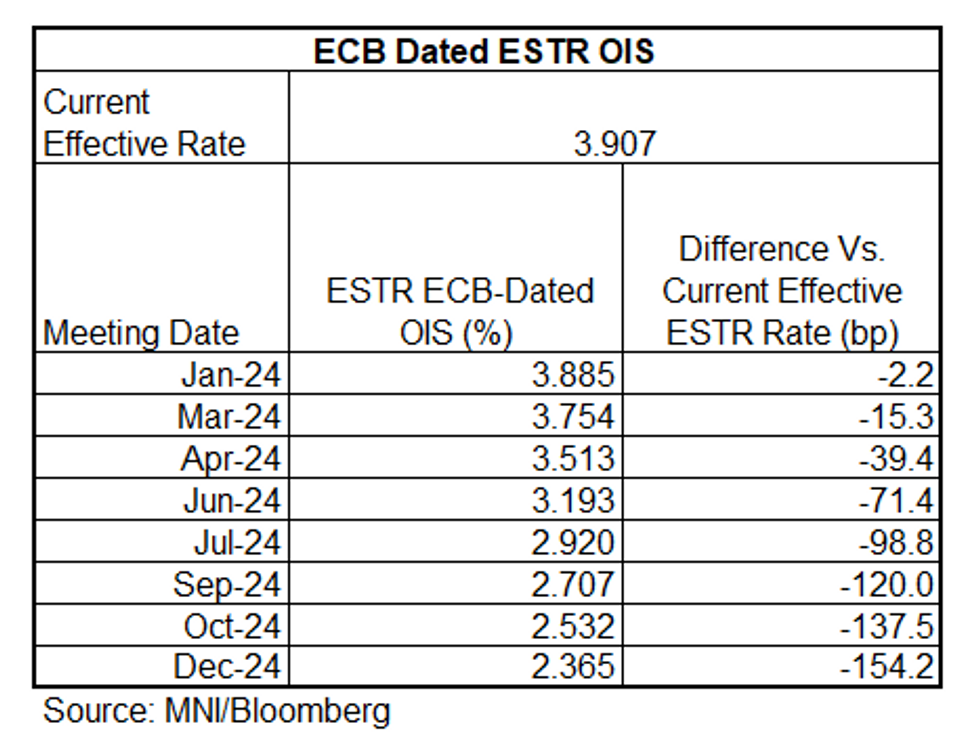

STIR: Over 150bps of 2024 ECB Cuts Priced Again

The weak run of December flash PMIs allows for deeper 2024 ECB cuts to be priced back into the market.

- ECB-dated OIS contracts now show 154bps of cuts through 2024 - up from 146bps before the PMIs but still shy of dovish extremes seen Wednesday.

- There continues to be around 2-2.5bps of cuts priced for the next ECB meeting in January.

- Data-derived impetus leaves Euribor futures little changed to +5.0 through the Blues, with a pullback from best levels in core EGBs helping cap the rally for now.

MNI Norges Bank Review: December 2023 - The Insurance Hike

EXECUTIVE SUMMARY

- The Norges Bank followed through with its softened November policy guidance and hiked the policy rate 25bps to 4.50%. The decision was unanimous among the Executive Board.

- Dovish impulses from the Q4 Regional Network Survey, November CPI and the December Fed decision in the run-up to the announcement meant the hike caught markets off guard. NOK strengthened considerably following the decision (EURNOK and USDNOK were almost 1.5% lower in the hour following, while NOK/SEK posted its largest daily gain of 2023) and the Dec 23 – Mar 24 FRA contract rose 17bps.

- Analysts generally agree that the December hike was the Norges Bank’s last, and most reviews we have seen expect cuts to start from June 2024.

MNI SNB Review: December 2023 - Shifting Into Neutral

- Bank held policy rates unchanged at 1.75%, as expected

- Inflation forecasts revised downwards, with growth seen sluggish

- Clear change in communications over CHF approach, FX selling bias removed

EUROPEAN ISSUANCE UPDATE

BELGIUM AUCTION RESULTS: ORI Operation

- E276mln of the 5.00% Mar-35 OLO. Avg yield 2.732% (bid-to-cover 1.54x).

- E225mln of the 1.90% Jun-38 OLO. Avg yield 2.896% (bid-to-cover 1.56x).

FOREX: EUR Struggles Post PMIs

The USD has struggled to register any meaningful upward momentum with e-mini equity futures and the Euro Stoxx trading on the front foot.

- Still, the EUR finds itself at the foot of the G10 FX table after a softer-than-expected run of flash PMI data out of the Eurozone, as the EUR short-end prices in over 150bp of ’24 ECB cuts once again. This has allowed EUR/USD to trade back towards the middle of the $1.09 handle, after some limited forays above $1.10 over the last 24 hours.

- GBP failed to meaningfully benefit from a mixed set of UK PMIs that provided a stronger-than-expected, expansionary outcome for the composite reading (headline services PMI topped expectations, while manufacturing saw a deeper-than-expected round of contraction). The data helped cable away from session lows, before bulls ran out of momentum ahead of yesterday’s high and $1.2800.

- The NOK has extended on yesterday’s run of outperformance (which stemmed from the ‘surprise’ Norges Bank hike and a bounce in crude oil prices). USD/NOK is through yesterday’s base, although EUR/NOK has failed to challenge yesterday’s low.

- The SEK is only bettered by the NOK amongst G10 peers. The latest round of Riksbank data indicated a completion rate of 68% of its USD8bn hedging activity and 33% of its EUR2bn hedging activity.

- U.S. industrial production and flash PMI data is due in early NY hours. Meanwhile, we are set to receive comments from NY Fed President Williams, a raft of ECB speak and comments from BoC Governor Macklem.

FX OPTIONS: Expiries for Dec15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.3bln), $1.0740-50(E1.4bln), $1.0840(E1.3bln), $1.0900-20(E2.6bln), $1.0950(E1.3bln)

- USD/JPY: Y142.00($581mln), Y143.50($790mln), Y144.00($624mln), Y144.85-00($1.2bln), Y146.00($1.7bln), Y148.00($1.3bln)

- EUR/GBP: Gbp0.8600-05(E521mln), Gbp0.8620-25(E717mln)

- AUD/USD: $0.6650-60(A$1.3bln)

- USD/CAD: C$1.3400($736mln), C$1.3420-30($1.4bln), C$1.3500-10($1.9bln), C$1.3650-65($1.0bln)

- USD/CNY: Cny7.1400($536mln), Cny7.1500($1.3bln)

EQUITIES: S&P 500 Bulls Remain In The Driver’s Seat

- A bullish theme in S&P E-Minis remains intact. The rally this week confirms a resumption of the uptrend that started Oct 27. Note too that resistance at 4738.50, the Jul 27 high, has been cleared, reinforcing current positive trend conditions. This signals scope for a climb towards 4800.00 next. Initial firm support lies at 4632.25, the 20-day EMA.

- A bullish theme in EUROSTOXX 50 futures remains intact and the contract traded to a fresh trend high yesterday. This confirms, once again, a resumption of the uptrend. Moving average studies are in a bull-mode position too, signalling a rising cycle. The focus is on 4608.00, the Jun 2007 high and a key resistance. Support to watch is at 4434.40, the 20-day EMA.

COMMODITIES: Bounce In Oil Futures Appears To Be A Correction

- Gold traded sharply higher Wednesday. This signals a short-term reversal and the end of the recent Dec 4 - 13 corrective pullback. Moving average studies remain in a bull-mode position, highlighting an uptrend. A continuation higher would signal scope for a climb toward key resistance and the Dec 4 all-time high of $2135.4. Initial firm support lies at $1973.2, the Dec 13 low.

- In the oil space, bearish conditions in WTI futures remain intact. The contract has cleared $68.80, the Dec 7 low, to confirm a resumption of the downtrend. This maintains the price sequence of lower lows and lower highs. The focus is on $67.28, Jun 23 low. Gains are considered corrective. Resistance to watch is $73.30, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/12/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/12/2023 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 15/12/2023 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 15/12/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/12/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 15/12/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 15/12/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 15/12/2023 | 1630/1630 |  | UK | BoE announce APF Sales schedule for Q124 | |

| 15/12/2023 | 1725/1225 |  | CA | BOC Governor Macklem speech/press conference | |

| 15/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 15/12/2023 | 2100/1600 | ** |  | US | TICS |

| 18/12/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 18/12/2023 | 1030/1030 |  | UK | BOE's Broadbent speech at London Business School | |

| 18/12/2023 | 1330/1430 |  | EU | ECB Schnabel Lectures On EU Fiscal Policy And Governance | |

| 18/12/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/12/2023 | 1500/1600 |  | EU | ECB Lane Chairs Panel on EMU Reforms |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.