-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - European data strong, US data in focus

Highlights:

- Strong data across Europe reverses some of yesterday's JOLTS-induced moves, particularly in European FI.

- Markets will be looking ahead to more US data today: ADP and the ISM services prints are the highlights for the data calendar.

US TSYS: Bear Flattening With Data Keenly Watched

- Cash Tsys see a bear flattening as front end yields push off yesterday’s low but increasingly less so further out the curve after the post-JOLTS rally. The magnitude of the reaction to the JOLTS miss (10Y intraday swing of 15bps) suggests scope for further large moves ahead with data releases including ISM services and ADP employment ahead of payrolls on Friday.

- 2YY +5.1bp at 3.877%, 5YY +4.1bp at 3.429%, 10YY +2.4bp at 3.363% and 30YY +0.4bp at 3.601%.

- TYM3 trades 8+ ticks lower at 115-31 amidst below average volumes of 225k, close to session lows of 115-29 as it only slightly pulls back off yesterday’s high of 116-09 (initial resistance). A key short-term resistance is seen at 117-01+ (Mar 24 high) whilst support is seen at yesterday’s low of 115-02+.

- Data: ADP employment Mar (0815ET), Trade balance Feb (0830ET), S&P Global US Service PMI Mar final (0945ET) and ISM Services Mar (1000ET) plus weekly MBA mortgage data (0700ET).

- Bill issuance: US Tsy $36B 17W bill auction (1130ET)

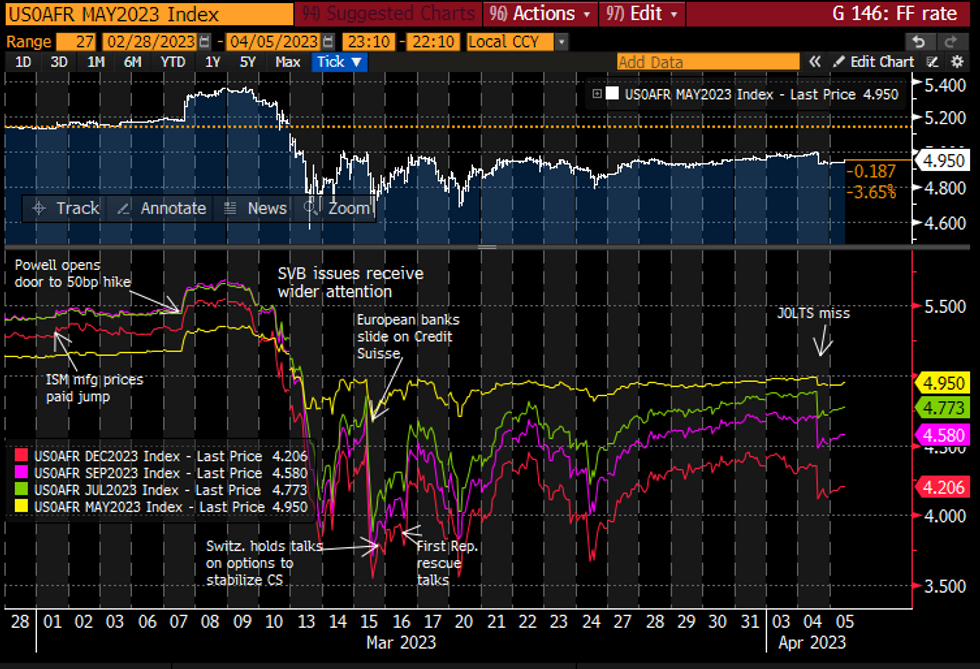

STIR: Fed Rate Path Only Slowly Retracing Yesterday’s JOLTS Hit

- Fed Funds implied rates continue an overnight increase but remain in the lower half of yesterday’s range.

- Based off an effective 4.83%, showing an 11.5bp hike for May (+1bp), the first full cut with -26bp to 4.57% in Sep (+6bp) and -63bp of cuts to year-end with 4.20% (+7bp).

- No scheduled Fedspeak today. Mester (’24) late yesterday: sees the Fed Funds rate above 5% and holding there for some time, the Fed will weigh credit conditions as it ponders further hikes.

Source: Bloomberg

Source: Bloomberg

EGB / GILTS: Strong European data unwinds some of yesterday's post-JOLTS rally

- This morning core fixed income has come under a bit of pressure, partially reversing some of yesterday's JOLTS-inspired rally. We were already a little off the highs seen in late trading yesterday by the time Europeans got to their desks but the German curve took another leg lower (and bear flattened) on the back of stronger-than-expected German factory orders data, pulling other core FI lower with it. French IP data was also stronger-than-expected before the Spanish and Italian services PMI data both came in stronger-than-expected. Of the final service PMI releases only France saw a notable revision (lower) - although this could have potentially been skewed by the strikes.

- Bund futures are down -0.31 today at 135.98 with 10y Bund yields up 4.3bp at 2.289% and Schatz yields up 6.4bp at 2.652%.

- Gilt futures are down -0.60 today at 103.67 with 10y yields up 6.0bp at 3.491% and 2y yields up 5.8bp at 3.393%.

EGB / GILTS: Bear Threat In Bunds Remains Present

- In the FI space, despite recent gains, Bund futures maintain a softer tone following last week’s move lower. Price has traded below the 20-day EMA which intersects at 135.72. It represents an important pivot level and a clear break would strengthen a bearish threat. 134.80, the Mar 22 low, has also been tested. A breach of this level would open 134.15, 61.8% retracement of the Mar 2 - 20 rally. Initial resistance is at 136.77, the Mar 30 high.

- Gilt futures traded higher Monday and price remains above 102.74, the Mar 31 low. However, a short-term bearish threat is present - last week’s move down resulted in a break of support at the 20-day EMA which intersects at 103.82. A clear break of the EMA would signal scope for a continuation lower towards 102.31 next, a Fibonacci retracement. Initial resistance is seen at 105.04, 50.0% of the Mar 20 - 31 downleg.

European Issuance Update

Gilt auction result

- This morning's 0.50% Jan-29 gilt auction was strong, with the 0.2bp tail matching the tightest tail seen on a short-dated gilt auction since August 2020.

- The LAP of 84.328 was comfortably above the 84.280 pre-auction mid-price and a level not seen in the market for the 7 minutes preceding the auction cutoff time.

- With general downward pressure over the few minutes following the auction, the 0.50% Jan-29 gilt continued to trade below the auction's LAP in post-auction trading.

- GBP3.5bln of the 0.50% Jan-29 Gilt. Avg yield 3.497% (bid-to-cover 2.67x, tail 0.2bp).

German auction result

- It was a decent 7-year Bund auction with the average price and lowest accepted price both coming in at 98.88, similar to levels seen around 7-15 minutes ahead of the auction close (and above the dip seen in the price going into the auction cutoff).

- Shortly after the auction, we were trading back above the price achieved at auction.

- E4bln (E3.346bln allotted) of the 2.10% Nov-29 Bund. Avg yield 2.28% (bid-to-cover 1.44x).

FOREX: USD is back in the Green against G10s

- After a steadier overnight session, the USD is in the green against most G10, and leads against the NOK and the AUD.

- AUD has been under pressure this morning in part following some decent selling against the NZD after the RNBZ hiked rates by 50bps vs the 25bps expected by Economists, and Risk tilted to the downside.

- EURAUD is in turn trading at its highest level since August 2021, with rnext resistance seen at 1.64372, the 2021 peak and highest print since November 2020.

- Final French, German, EU final services PMIs were revised lower, but had little impact in FX.

- EUR is similar to the Dollar in G10, and leads against the NOK and the AUD, up 1.02% and 0.98% respectively.

- As such EURUSD trades flat and in a tight 29 pips range.

- Note that there are really large option expiry for the pair set to expire today at 15.00BST, with 12.45bn between 1.0900 and 1.1000.

- Looking ahead, US final services PMI and US ADP/ISM services are the notable data releases.

FX OPTIONS: Large Expiry for EURUSD

LARGE for EURUSD today, expiry at 15.00BST.

Of note:

EURUSD 12.45bn at 1.0900/1.1000.

GBPUSD 845mln at 1.2500.

USDCAD 1.47bn at 1.3455 (thu).

AUDNZD 1.09bn at 1.0650 (tue).- EURUSD: 1.0900 (4.29bn), 1.0925 (1.52bn), 1.0950 (2.34bn), 1.9070 (937mln), 1.0975 (356mln), 1.0985 (837mln), 1.1000 (2.17bn).

- GBPUSD: 1.2455 (300mln), 1.2500 (845mln).

- USDJPY: 131.00 (1.17bn), 132.00 (244mln), 133.00 (1.32bn).

- AUDUSD: 0.6700 (559mln).

EQUITIES: Uptrend In S&P E-Minis Remains Intact

- In the equity space, S&P E-Minis maintains a bullish tone. Price has recently breached resistance at 4119.50, reinforcing bullish conditions. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4036.58, the 50-day EMA.

- EUROSTOXX 50 futures maintain a firmer tone. The contract traded higher last week and is holding on to the bulk of its latest gains. Price has pierced resistance at 4268.00, the Mar 6 high and a key hurdle for bulls. A clear break of this level would strengthen bullish conditions and open 4300.00 next. Initial firm support lies at 4166.50, the 20-day EMA.

COMMODITIES: Gold Clears Key Resistance And Resumes Its Uptrend

- On the commodity front, the trend condition in Gold remains bullish and Tuesday’s resumption of the uptrend reinforces current conditions. The yellow metal has cleared resistance at 2009.7, the Mar 20 high, to post fresh YTD highs and signal scope for a climb towards $2034.0 next, the 2.00 projection of the Sep 28 - Oct 4 rally from Feb 28. On the downside, key support has been defined at $1918.3, the Mar 17 low - a break would highlight a potential reversal.

- In the Oil space, WTI futures remain in a bull cycle and Monday’s gap higher strengthens this current condition. The contract has touched a high of $81.81, above key resistance at $81.04, the Mar 7 high. A clear break of $81.04 would signal scope for a continuation higher and open $83.04, the Jan 23 high. Key support is seen at $75.72, the Mar 31 high and the gap low on the daily chart. A pullback, if seen, would be considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2023 | 0900/1100 | * |  | IT | Retail Sales |

| 05/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Panellist at RES Conference | |

| 05/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/04/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/04/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2023 | 1400/1600 |  | EU | ECB Lane Lecture at University of Cyprus | |

| 05/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/04/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 06/04/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/04/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 06/04/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/04/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 06/04/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/04/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/04/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2023 | 1400/1000 |  | US | St. Louis Fed's James Bullard | |

| 06/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.