-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Eyes on the Details in CAD CPI

Highlights:

- Canadian CPI expected to moderate further, with eyes on the details

- Bearish JPY bias remains, with EUR/JPY narrowing in on cycle highs

- Cash Treasuries inch higher, holding close to Friday's Pre-PPI levels

US TSYS: Tsys Return to Pre-PPI Levels Ahead Wednesday's FOMC Minutes

- Cash Tsys modestly firmer, off recent highs but holding near last Friday's pre-PPI levels as US desks return from extended holiday weekend.

- Mirroring modest support in EGBs overnight followed larger than expected 25bp reduction in 5Y LPR during Asia-Pac hours, muted react to softer ECB Q4 negotiated wages to 4.5% from 4.7%.

- TYH4 currently +4.5 at 109-28.5 vs. 109-30.5 high. Nearing initial technical resistance at 110-17 (Feb 15 high), support below at 109-17/15 (50.0% of Oct 19 - Dec 27 climb / Low Feb 16).

- Limited data ahead: Philadelphia Fed Non-Manufacturing Activity kicks things off at 0830 followed by Leading Index at 1000ET.

- No scheduled Fed speakers on today's docket, holding to the sidelines ahead of the Jan 31 FOMC minutes release tomorrow at 1400ET.

- US Treasury auction supply: US Tsy $79B 13W, $70B 26W bill auctions at 1130ET followed by $46B 52W bill auction at 1300ET.

STIR: Fed Pricing Little Changed Vs. Late Friday Levels

FOMC-dated OIS pricing sees a modest dovish move in pre-NY trade, with the deeper-than-expected cut in China’s 5-Year LPR fixing and BoE rhetoric driving things thus far.

- The first 25bp cut is discounted through the end of the June ’24 FOMC.

- ~92bp of cuts are priced through the Dec ’24 meeting vs. ~90bp late on Friday.

- We still sit some distance away from recent dovish extremes after the aggressive unwind of rate cut pricing witnessed YtD.

- A reminder that markets did not want to challenge pricing of 75bp of cuts post-PPI (the move halted at ~78bp).

- this has some importance as 75bp of ’24 cuts lines up with the median Fed dot for ’24, as of the Dec ’23 SEP.

- Lower tier local data present the only points of note on the NY docket, with the Philly Fed non-manufacturing release and leading index due.

- Fedspeak is skewed towards the back end of the week, with much of that rhetoric due beyond Wednesday’s release of the Jan FOMC meeting minutes.

| Fed Meeting | Fed-Dated OIS (%) | Difference Vs. Current Effective SOFR Rate (bp) |

| Mar-24 | 5.302 | -0.8 |

| May-24 | 5.225 | -8.5 |

| Jun-24 | 5.063 | -24.7 |

| Jul-24 | 4.903 | -40.7 |

| Sep-24 | 4.705 | -60.5 |

| Nov-24 | 4.564 | -74.6 |

| Dec-24 | 4.391 | -91.9 |

CANADA: January CPI Expected to Moderate, Focus to Look Beyond Median and Trim Measures

- Markets expect Canadian CPI to moderate in January – with headline Y/Y at 3.3% (Prev. 3.4%), 0.4% M/M NSA (Prev. -0.3%). The trim core measure is expected to slow to 3.6% from 3.7% prior.

- BoC communications from late January centred on how the discussion is shifting away from whether the policy rate is restrictive enough to how long it needs to stay at the current level, a point reiterated by Dep Gov Mendes on Tuesday. Mendes added that inflation is still too high and underlying inflation pressures are still too broad.

- This brings us to Gov. Macklem’s remarks at the January press conference when MNI asked about the shift in language to underlying rather than core inflation. “It’s more of a concept than a measure and reflects a number of things. The Bank's preferred measures of core inflation (CPI-trim, CPI-median) are a very important element), but we also look at other measures such as CPIxFE, CPIX and the breadth of price gains. Those are some of the key things we’re looking at as we assess the trend - we’re looking for continued evidence that inflationary pressures are easing with clear downward momentum.”

- To this end, we expect focus on metrics beyond just the BoC’s previously preferred median and trim measures. Different metrics have been pointing to a wide range recently, with the average of median and trim at 3.8% annualized over six months and CPIxFE at 3.7%, but CPIX within the 1-3% target band at just 2.5%.

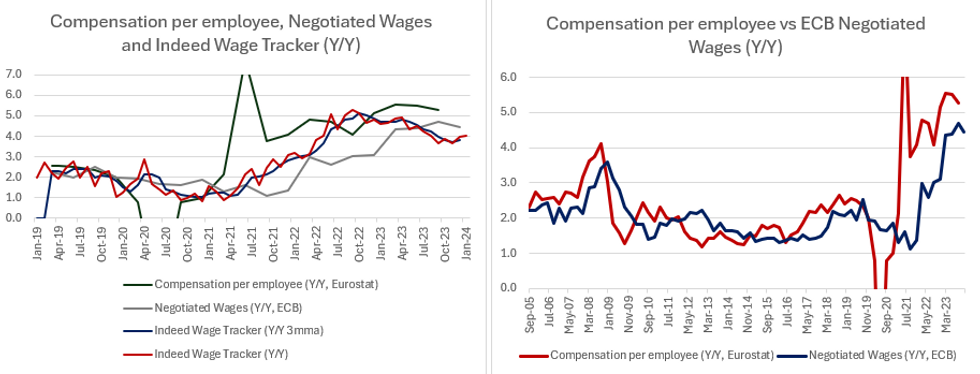

EUROZONE DATA: Negotiated Wage Growth Decreases After 5 Consecutive Upticks

Eurozone negotiated wages for Q4 2023 came in at +4.46% Y/Y (vs +4.69% prior).

- This is the first time the growth rate declined after 5 consecutive increases, and will be seen rather favourably by the ECB, as indicated by recent comments by the likes of President Lagarde and Schnabel. A wider set of Q1 2024 wage data will be accessible to the ECB's governing council by its June meeting.

- Even if the wages developments are less of a concern, the growth rate is still nominally high, particularly in the light of weak productivity developments in the Eurozone, so Q4's slowdown in wage growth may not move the needle strongly towards earlier rate cuts.

- Conversely, the indeed.com wage tracker covering the same time period, was broadly flat in the last few months of '23, if not in a slight uptrend. For January, the tracker printed an uptick, coming in at 4.05% Y/Y (vs 3.95% prior) and 3.89% Y/Y 3MMA (vs 3.83% prior), implying some wage growth upside momentum at its highest value since five months for the less volatile 3M moving average measure.

MNI, ECB, Eurostat, indeed.com

MNI, ECB, Eurostat, indeed.com

EUROZONE ISSUANCE UPDATE:

UK Gilt auction results:

- That was a decent 40-year gilt auction with a tail of 0.6bp (the 4.00% Oct-63 gilt represented the first time since March last year that the DMO had sold a longer-than-30 year gilt via a conventional auction.

- The price climbed just ahead of the closing time, and the LAP of 90.369 was close to the highs seen over the auction window (apart from the last minute or so).

- GBP1.75bln of the 4.00% Oct-63 Gilt. Avg yield 4.518% (bid-to-cover 2.92x, tail 0.6bp).

- E1.035bln of the 0.80% Oct-28 CCTeu. Avg yield 4.84%.* E1.965bln of the 1.65% Mar-32 BTP. Avg yield 3.61%.

- E5bln (E4.138bln allotted) of the 2.50% Mar-26 Schatz. Avg yield 2.79% (bid-to-offer 1.58x; bid-to-cover 1.91x).

- E751mln of the 2.875% Apr-29 RFGB. Avg yield 2.694% (bid-to-cover 1.58x)

- E751mln of the 3.00% Sep-33 RFGB. Avg yield 2.833% (bid-to-cover 1.95x)

- E7bln WNG of the new Dec-34 EU-bond. Spread set at MS+29bps, books above E67bln.

FOREX: EUR Tilted to New Weekly Highs; CAD CPI on Tap

- EUR has been in demand across the European morning, helping tip EUR/USD through both the Monday and Friday highs with relatively little resistance. Markets moves came ahead of the release of the ECB's Euroarea negotiated wages release for Q4'23, which showed wages slowing to 4.5% from 4.7% in the prior quarter.

- The JPY is the poorest performing currency across G10, keeping the bull cycle in EUR/JPY, AUD/JPY and others intact. EUR/JPY now trades solidly above the mid-January highs, opening further progress toward the cycle best posted in November at 164.30.

- NZD/USD's short-term bounce extends, tipping NZD/USD to print higher highs and higher lows for a fifth consecutive session. This tilts prices toward first key resistance at the 50-dma of 0.6183, a break above which would extend the bounce off the February lows to near 150 pips.

- Focus for the session ahead turns to the Canadian CPI release, with markets watching for headline inflation to slow by 0.1ppts for the Y/Y CPI as well as the core trim figure. Central bank speakers are few and far between, with no key Fed or ECB representatives on the docket. BoE's Bailey, Broadbent, Greene and Dhingra are set to testify in front of UK lawmakers, however few fresh policy signals are expected.

Expiries for Feb20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-80(E1.3bln), $1.0700-20(E1.2bln), $1.0740(E744mln), $1.0770(E784mln), $1.0790-00(E1.1bln), $1.0865(E833mln)

- USD/JPY: Y149.85-00($1.0bln), Y150.50($1.6bln)

- EUR/JPY: Y163.10-30(E620mln)

- NZD/USD: $0.6150(N$678mln)

- USD/CAD: C$1.3625($1.5bln)

- EUR/GBP: Gbp0.8530-50(E1.7bln)

- AUD/USD: $0.6400(A$1.1bln), $0.6475-85(A$1.1bln)

- USD/CNY: Cny7.1855($1.1bln)

EGBS: Off Highs But Remain Firmer Today; Little Impact From ECB Wage Data

Core/semi-core EGBs have moved away from intraday highs but remain firmer on the day.

- ECB Q4 negotiated wages softened to 4.5% (vs 4.7% prior), but markets were unmoved given the lagging nature of the indicator. For the ECB, the Q1 '24 data (due in May) will be most pertinent to gauge when the policy easing cycle can begin. ECB-dated OIS contracts currently price the first full 25bps rate cut by the June meeting, with 31bps of cuts priced.

- Otherwise, headline flow has been relatively light. Today's sovereign supply slate (GBP1.75bln 40y Gilt, E5bln 2y Schatz, Italian exchange auction and 10y EU bond syndication) will have helped cap rallies through the morning.

- In the Asia-Pac session, main impetus was the larger than expected 25bp reduction in the 5-Year LPR.

- Bunds are +36 ticks at 133.21 at typing. Schatz futures are just +3 ticks higher, with today's Schatz supply weighing at the short-end. The German cash curve has bull flattened as a result.

- Periphery spreads to Bunds are mixed, with the 10-year BTP/Bund spread -0.9bps tighter at 148.2bps and the 10-year PGB/Bund spread 1.1bps wider at 74.8bps.

- The remainder of today's regional docket is quite light, with today's BoE speakers at the Treasury Select Committee potentially garnering some cross-market interest.

EQUITIES: E-Mini S&P Trend Condition Bullish Despite Latest Pullback

- Eurostoxx 50 futures remain in a bull cycle. The contract has resumed its uptrend and traded to a fresh cycle high. This reinforces current conditions and the importance of the recent break of resistance at 4634.00, the Dec 14 high. Moving average studies are in a bull-mode position, highlighting positive market sentiment. Sights are on 4800.00 and 4848.00, a Fibonacci projection. Initial firm support lies at 4664.80, the 20-day EMA.

- The trend condition in S&P E-Minis is unchanged and remains bullish, despite the pullback off last week’s highs. The weakness off 5066.50 is considered corrective and support to watch lies at 4957.27, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. The trigger for a resumption of gains is 5066.50, the Feb 12 high.

COMMODITIES: WTI Futures Remain Close to Key Short-Term Resistance at $79.75

- Recent gains in WTI futures, since Feb 5, still appear to be a correction. Key short-term resistance has been defined at $79.75, the Feb 16 high. Clearance of this level would be a bullish development. On the downside, support to watch lies at $71.41, the Feb 5 low. A break of this level would reinstate the recent bearish theme and pave the way for a move towards $69.56, the Jan 3 low.

- Gold traded lower early last week and the sell-off resulted in a break of $2001.9, the Jan 17 low and a key short-term support. The breach highlights a resumption of the bear leg that started Dec 28. A continuation lower would open $1973.2, the Dec 13 low and the next key support. On the upside, the yellow metal needs to clear resistance at $2065.5, the Feb 1 high, to reinstate a bullish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/02/2024 | 1330/0830 | *** |  | CA | CPI |

| 20/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2024 | 2350/0850 | ** |  | JP | Trade |

| 21/02/2024 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 21/02/2024 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 21/02/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/02/2024 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 21/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/02/2024 | 1300/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/02/2024 | 1400/1400 |  | UK | BOE's Dhingra MNI Connect Event on BoE projections | |

| 21/02/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/02/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 21/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 21/02/2024 | 1800/1300 |  | US | Fed Governor Michelle Bowman | |

| 21/02/2024 | 1900/1400 | *** |  | US | FOMC Rate Decision |

| 22/02/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.