-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US MARKETS ANALYSIS - Focus Turns to Any December Signals

Highlights:

- 75bps Fed hike looks nailed on for November, with focus on December signaling

- USD Index oscillating either side of the 50-dma

- Treasury futures hold below first resistance

Key Links: MNI Fed Preview / MNI BoE Preview / MNI Norges Bank Preview / MNI RBA Review

US TSYS: Poised For a Pivot in Dec?

Tsy futures trading mildly higher, inside narrow overnight range on light volumes (TYZ<210k) as market awaits a likely 75bp rate hike from the FOMC at 1400ET today, Chairman Powell presser at 1430ET.- Main focus on forward guidance, many sidelined amid ongoing debate over a year end "pivot". Tuesday's JOLTS data (job openings rise unexpectedly to 10.717M vs. 9.75M est (above prior 10.053M) showed labor market remains tight - dampening speculation over step-down to 50bp hike at Dec FOMC.

- STIR pricing: Eurodollar futures trade steady to mixed in the short end: Dec'22 mildly lower (-0.005 at 94.875) while balance of 2023 futures gain +0.010-0.015. Cumulative pricing through December up slightly to 136.5bp from 135bp. Peak Fed funds climbs to 5.03% in May 2023.

- Limited data - markets are looking forward to ADP private employ read for October at 0815ET: +185k est vs. +208k prior, with main focus on Friday's NFP: +196k est vs. +263kl prior.

DENMARK: PM Adviser-Frederiksen To Seek Broad Centrist Gov't

Wires carrying comments from an adviser to head of the Social Democrats Mette Frederisken. Says that Frederiksen has offered her resignation to Queen Margrethe II (as is custom after an election) and will seek to form a 'broader centrist coalition gov't'.

- This comment adds credence to the scenario mooted in our earlier note on the election, that Frederiksen could seek to leave the far-left Red-Green Alliance out of a new governing coalition. Instead they could be replaced by the centrist Moderates of former PM Lars Lokke Rasmussen, a much closer ideological fit to Frederiksen's Social Democrats.

- A coalition of the Social Democrats, Moderates, Social Liberals, Green-Left, and the three left-leaning deputies from Greenland and the Faroe Islands would hold 91 seats in the Folketing, a majority of two. This would eliminate the need for the support of the Red-Green Alliance and even the leftist progressive Alternative Party, making for a much more moderate, centrist gov't.

- Potentially some unease on left with working with former PM Rasmussen's party. Rasmussen governed on two non-consecutive occasions as head of centre-right Venstre. Unclear what junior role he and his party would be willing to accept.

MNI POLITICAL RISK- Negotiations Key To Deciding Direction Of Denmark’s New Government.pdf

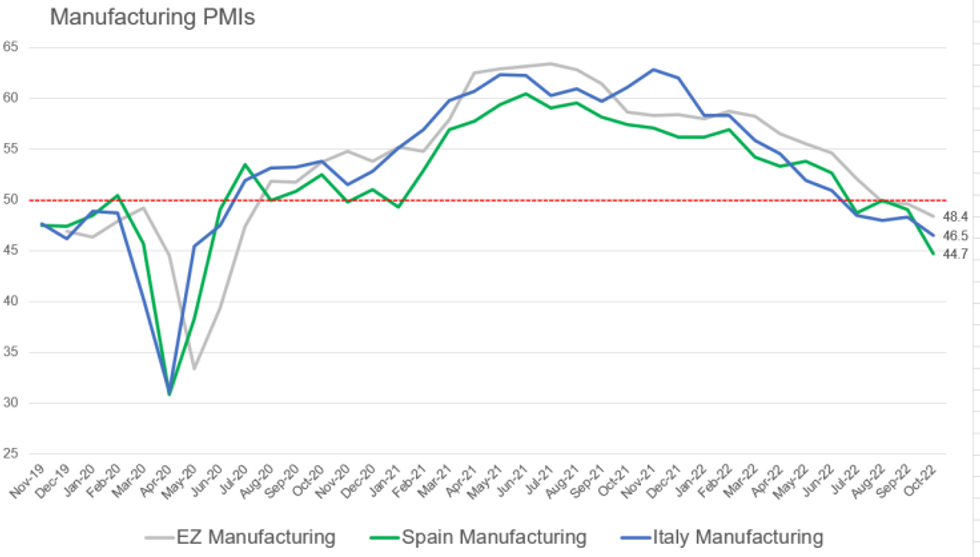

DATA: Spain, Italy Manufacturing PMIs at Lowest Since May '20

ITALY OCT MANUF. PMI 46.5 (FCST 46.9); SEP 48.3

SPAIN OCT MANUF. PMI 44.7 (FCST 47.5); SEP 49.0

Italian and Spanish October manufacturing PMIs indicated four consecutive months of contraction. The indexes were weaker than forecasts, falling to May 2020 lows.

- New orders/production declined at the fastest rates since the Spring 2020 pandemic onset as demand plunged. A resurgence in material shortages was noted.

- Price growth slowed in both Spain and Italy, yet remained elevated due to high energy and raw material costs alongside euro weakness.

- Employment levels declined for the fourth consecutive month in Spain as firms looked to cut costs due to low production capacity and pessimistic growth outlooks. Italy saw hiring easing, yet labour plans remain optimistic and anticipate a demand revival.

- Confidence weakened to pandemic onset lows in Spain, against the backdrop of severe economic uncertainty. Italy noted a modest improvement as the manufacturing sector hopes for a demand rebound and easing inflation.

- These PMIs add to a slew of contractionary eurozone PMIs kicking off Q4 and adding to downside growth risks for the bloc.

Source: MNI / BBG / S&P Global

FOREX: USD Index Oscillating Either Side of 50-dma

- The greenback is modestly softer, but well within recent ranges, ahead of the Wednesday Fed decision, with markets looking beyond a likely 75bps rate hike today for any guidance on whether a pivot for policy could come as soon as December. Markets are partially pricing such an eventuality, with a roughly 50/50 split in pricing for a 50bps vs. 75bps hike at the final meeting of the year. The USD Index continues to oscillate on either side of the 50-dma at 111.0479, a key support Wednesday.

- At the top of the G10 table, JPY is outperforming all others, with USD/JPY testing the Tuesday low of 146.99 ahead of the Fed rate decision later today. The move lower for the pair during Asia-Pac hours is notable ahead of the market holiday for Japan on Thursday, with traders possibly positioning for the risk of a hawkish Fed prompting another wave of direct intervention from the Japanese authorities a strong background possibility.

- The EUR is middle-of-the-pack, with PMI data out across the morning confirming a marked slowdown in manufacturing across the Eurozone in October. The EZ release slowed to 46.4 for the final reading, just below expectations of 46.6. EURUSD trend conditions remain bullish and the recent pullback is still considered corrective. Last week's key technical development was the break of the top of a bear channel drawn from the Feb 10 high and highlights a stronger bull reversal. The focus is on 1.0198 next, the Sep 12 high.

- Ahead of the much-watched Fed decision, markets will also digest ADP employment change for October ahead of this Friday's NFP release. A number of ECB speakers are due, with Makhlouf, Villeroy and Nagel on the docket.

FX OPTIONS: Expiries for Nov02 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.1bln), $0.9725(E702mln), $0.9800(E1.3bln), $0.9820-25(E702mln), $0.9850-70(E1.1bln), $0.9900(E862mln), $1.0000(E2.4bln)

- USD/JPY: Y150.00($1.0bln)

- GBP/USD: $1.2000-22(Gbp1.3bln)

- EUR/JPY: Y141.10(E738mln)

- AUD/USD: $0.6720(A$1.2bln)

- NZD/USD: $0.6175(N$713mln)

- USD/CNY: Cny7.2500($715mln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/11/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/11/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/11/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 02/11/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/11/2022 | 1515/1115 |  | CA | BOC director Ron Morrow speaks on payments supervision | |

| 02/11/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 03/11/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 03/11/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/11/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/11/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2022 | 0730/0830 | *** |  | CH | CPI |

| 03/11/2022 | 0805/0905 |  | EU | ECB Lagarde Panels Latvijas Banka Conference | |

| 03/11/2022 | 0810/0910 |  | EU | ECB Panetta Speech at ECB Money Market Conference | |

| 03/11/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 03/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/11/2022 | 0950/1050 |  | EU | ECB Elderson Panels Latvijas Banka Conference | |

| 03/11/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 03/11/2022 | 1230/0830 | * |  | CA | Building Permits |

| 03/11/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 03/11/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 03/11/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/11/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/11/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/11/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 03/11/2022 | 1730/1330 |  | CA | BOC Deputy Beaudry gives opening remarks before academic lecture | |

| 03/11/2022 | 2000/1600 |  | CA | Canada FM Freeland presents fiscal update | |

| 03/11/2022 | 2030/2030 |  | UK | BOE Mann Panels American Enterprise Institute |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.