-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Soft NFP Report Should Cement December Cut

MNI China Daily Summary: Friday, December 6

MNI US MARKETS ANALYSIS - Focus Turns to ECB's Strategy Switch

HIGHLIGHTS:

- Focus turns to ECB's presentation on strategy switch

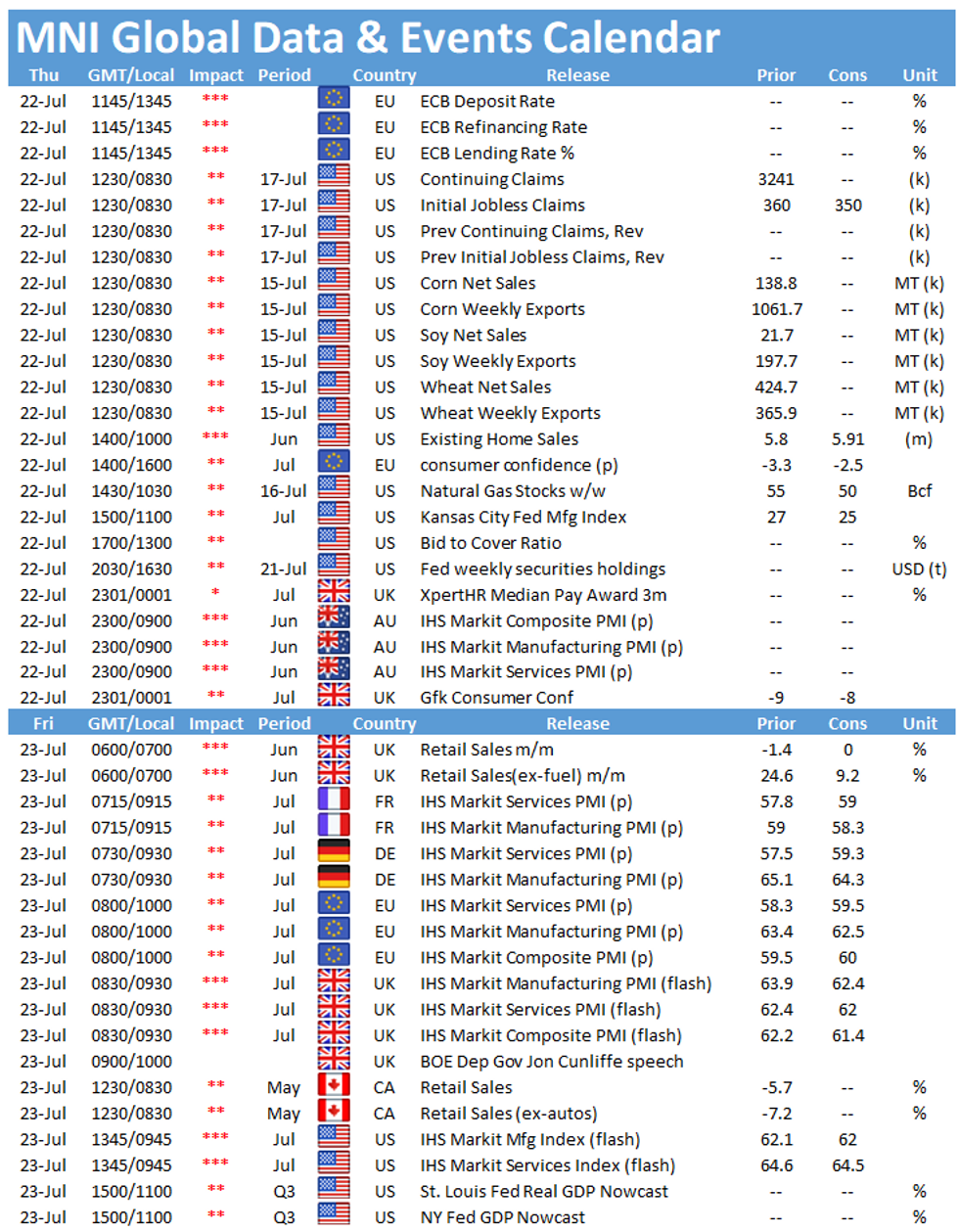

- Initial jobless claims, existing home sales data make up first real US data of the week

- Stocks higher again, financials driving gains

US TSYS SUMMARY: Edging Lower Ahead Of ECB, Claims Data

Treasuries have edged marginally lower in European trade, after a quiet Asia-Pac session (cash closed due to Japanese holidays).

- The 2-Yr yield is up 0.8bps at 0.216%, 5-Yr is up 0.8bps at 0.7442%, 10-Yr is up 0.3bps at 1.2916%, and 30-Yr is unch at 1.9386%. Sep 10-Yr futures (TY) down 4/32 at 133-31.5 (L: 133-30 / H: 134-08).

- Stock futures have edged higher, touching the week's best levels.

- Immediate attention is on the European Central Bank decision at 0745ET, presser at 0830ET.

- Data picks up a bit with weekly jobless claims alongside Chicago Fed Nat'l Activity Index at 0830ET. Existing home sales at 1000ET, and KC Fed manufacturing at 1100ET.

- In supply: $75B combined of 4-/8-week bill auction at 1130ET, with $16B 10Y TIPS selling at 1300ET. NY Fed buys ~$2.025B of 22.5-30Y Tsys.

- Pres Biden set to meet with business and labor leaders at 1600ET on the bipartisan infrastructure framework (Congressional negotiations continue).

EGB/GILT SUMMARY: ECB Meeting Could Throw Up Some Surprises

European sovereign bonds have traded mixed this morning ahead of today's ECB meeting, while equities continue to build on yesterday's gains.

- The July ECB meeting has taken on significant prominence following the earlier than expected publication of the strategy review this month. Changes to the wording of the monetary policy decision/opening statement are to be expected to reflect both the new formulation of the inflation target (now, officially, symmetric) and the new streamlined and simpler format.

- The shift in communication - both in terms of style and in articulating the new policy formulation - could trigger some volatility. The ECB could also decide to press the issue of 'persistency' in some way, which would present a dovish risk.

- Beyond the UK CBI trends data (mixed), there were no data releases of note and no Gilt/EGB supply.

- Gilts have weakened with cash yields 1-2bp higher and the long end of the curve slightly underperforming.

- Bunds started on a strong footing, before weakening towards closing levels.

- The OAT curve has marginally flattened on the back of the short-end weakening a touch and the longer end firming.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 174.50/173.50ps 1x1.5, bought for 11 in 2k

RXU1 166.5p bought for 1 in 1.7k

RXV1 171.50/170.00/169.00/166.50 broken put condor vs 175.00/176.50cs, bought the condor for 1 in 4.7k.

DUU1 112.20/112.10/112.00p fly, bought for 1 and 1.5 in 3k

DUU1 112.20/112.10ps 1x2, bought for 1 in 1k

3RU1 100.25/100.12ps 1x2, bought the 1 for 0.75 in 10k

3RH2 100.25/100.12/100p fly, bought for 1.75 in 1k

3RU1 100.25/100.12ps 1x2, bought the 1 for 1 now in 4k - Bought 10k for 0.75 earlier

UK:

2LZ1 99.12/99.00ps (ref 99.33) vs 0LZ1 99.25/99.12ps, bought the 2yr for 1.25 in 5k

FOREX: GBP Edges Off Early Gains

- GBP was bid from the European open, with GBP/USD benefiting on the way up to 1.3758 as markets eyed recent signs that UK COVID case growth could have topped out, and awaited comments from BoE's Broadbent. The MPC member flagged near-term upside risks to the inflation outlook, but posited that this would subside in time. GBP is off the best levels of the session but remains one of the firmest currencies in G10.

- NZD, USD and CAD are among the poorest performers so far Thursday, slightly reversing the price action over the past few sessions.

- The ECB rate decision takes focus going forward, with no changes in policy expected today, but markets are likely to laser in on the explanation and justification behind the ECB's strategy review that resulted in a symmetric inflation target. The decision is due at 1245BST/0745ET with the press conference following 45 minutes later.

- In the first real data releases of the week, US weekly jobless claims, existing home sales and the Chicago National Activity Index all cross later today. Eurozone consumer confidence is also due.

FX OPTIONS: Expiries for Jul22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650-60(E562mln), $1.1710(E1.1bln), $1.1800-15(E1.1bln), $1.1900(E589mln), $1.1935(E1.1bln)

- EUR/GBP: 0.8650(E815mln)

- AUD/USD: $0.7375(A$1.1bln)

- USD/CAD: $1.2750($1.4bln)

- USD/CNY: Cny6.4300($1.6bln), Cny6.4400($645mln), Cny6.4370($520mln), Cny6.4900-10($666mln)

EQUITIES: Stocks Make Further Progress, EuroStoxx50 Testing 50-dma

- Equity markets globally are higher for a third session, with European indices making decent progress on the back of gains in Asia. Hong Kong's Hang Seng closed with gains of just shy of 2% giving sentiment a leg higher from the off.

- The positivity puts EuroStoxx50 on track to test the 50-dma at 4067.5. A break above here would put June's highs of 4165.6 within range.

- Across the continent, again financials are leading gains, prompting the EuroStoxx Bank Index to rally 7.5% off the week's lows. Financials are benefiting from a re-steepening of global government bond yield curves and fading concerns over the spread of the Delta COVID-19 variant across Western Europe and the US.

- Focus in the US again turns to earnings, with Biogen, American Airlines, AT&T, Southwest Airlines, Intel and Twitter all due today.

COMMODITIES: WTI, Brent Remain Constructive

- After drifting lower across Asia-Pacific hours, oil benchmarks are modestly higher ahead of the NY open, with WTI crude futures testing the Monday high at $71.67. Solid equity performance remains the driver, with continued strength in global stock futures buoying sentiment. The bullish candle formation printed Tuesday may also be continuing to exert influence.

- Focus turns to the EIA natgas storage change data crossing at 1530BST/1030ET. Markets expect a build of 42BCF.

- Gold and silver are both modestly lower, dented by positive risk sentiment as the yellow metal prints a lower low for the third consecutive session. A close below the 100-dma at $1795.4 would be bearish, opening $1792.4, the 50% retracement of the recent rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.