-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - FX Vols Running Higher Pre-CPI

Highlights:

- JPY on top as local report spurs speculation of BoJ policy tweaks

- US CPI in focus, with FX vols running higher in anticipation of volatility

- Markets remain split between a 25 and 50bps move from the Fed in February

TSYS: Treasuries See Modest Further Flattening With CPI Eyed

- Cash Tsys see a limited twist flattening, with the 2Y slightly cheaper but holding on for a mild rally beyond that having only partially retraced an overnight bid that some pointed to softer than expected China PPI data even if the nature of the move didn't back that idea up, in our view.

- 2YY +0.6bp at 4.224%, 5YY -0.7bps at 3.651%, 10YY -1.5bps at 3.524% and 30YY -3.1bps at 3.641%. 2s10s of -70bps is down from most recent late Dec highs of almost -45bps but still off lows nearing -85bps.

- TYH3 trades 4 ticks higher at 114-18 on modestly above average volumes for the day. It remains at the high end of the week’s range, off highs of 114-23+ that form initial resistance, with a downside surprise in CPI potentially seeing more attention on the bull trigger at 115-11+ (Dec 13 high).

- Data: CPI at 0830ET dominates – preview here – plus also see weekly jobless claims plus monthly fiscal data for Dec (1400ET).

- Fedspeak: Harker (’23 voter) 0845ET, Bullard (non-voter) at 1130ET and Barkin (’24) at 1240ET.

- Bond issuance: US Tsy $18B 30Y Bond R/O (912810TL2) – 1300ET

- Heavy bill issuance: US Tsy $60B 4W, $55B 8W bill auction at 1130ET, $60B 35D bill at 1300ET

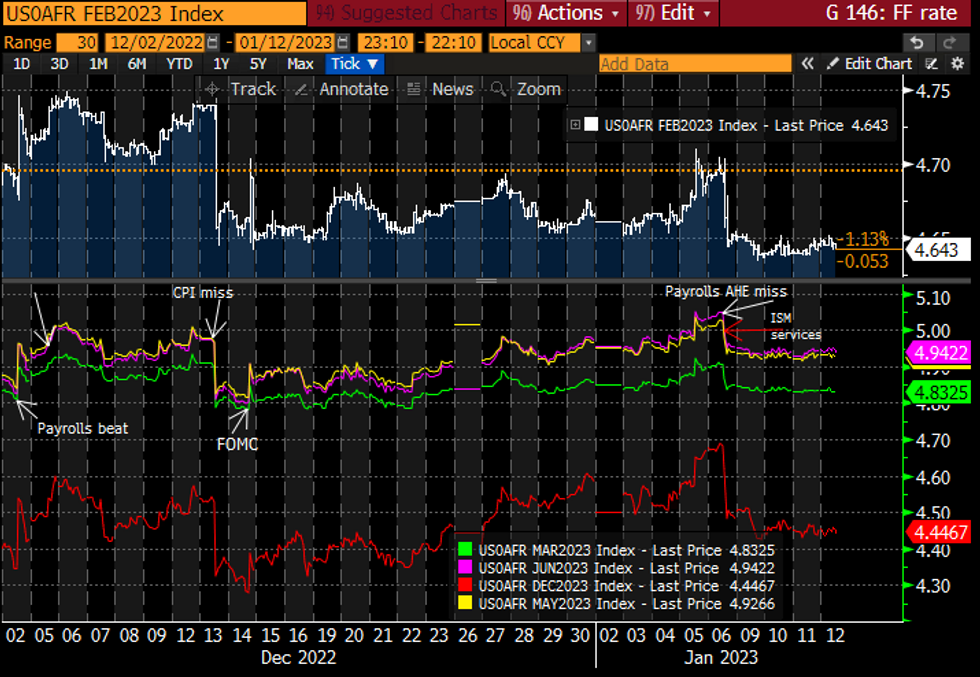

STIR FUTURES: Fed Rate Expectations Maintain Pause For Breath Pre CPI

- Fed Funds implied hikes maintain a broad pause seen through the week, consolidating the slide on payrolls/ISM.

- Hikes: 31bp for Feb 1 (unch), cumulative 50bp Mar (-0.5bp), peak 61bp to 4.94% Jun (unch). Cuts: 50bps from peak to 4.45% year-end (-0.5bp), below current effective by Jan’24.

- Fedspeak: Harker (’23 voter) at 0845ET shortly after CPI with text and Q&A means first CPI reaction more likely from Bullard (non-voter) at 1130ET before Barkin (’24) at 1240ET. Harker still of note though, with first updates since mid-Nov.

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

MNI CPI Preview: Core Services Ex Shelter Keenly Watched

- Core CPI inflation is seen nudging up to 0.3% M/M in December after surprising lower with 0.20% in November when the three main areas of core - shelter, services ex shelter and goods - all moderated.

- OER and tenants’ rents could see a modest dip but barring no surprises there, attention is likely most firmly on core services excluding shelter with its continued FOMC focus, and then any further goods deflation.

- We see high sensitivity to surprises in either direction, especially if in stickier, less idiosyncratic categories.

- The historically low u/e rate gives hawks something to build upon if an upside surprise, but might need to be followed by strong composition-adjusted wage growth in measures released later this month to lock in another 50bp hike, whilst a downside surprise could further cement a 25bp hike with a resulting relief rally.

FX OPTIONS: Options Markets See Scandi & EM Currencies as Most Vulnerable Over CPI

- Overnight USD implied vols are broadly higher across a panel of both G10 and EM currencies, with today's US CPI release spurring hedging activity in anticipation of acute volatility.

- USD/JPY vols now clear 32 points, the highest level since the September Fed rate decision (where they hiked 75bps) and the third highest read since the onset of the COVID pandemic in 2020. An ATM overnight USD/JPY straddle breaks even on a circa 180 pip move in the pair today - the widest breakeven since Q3 last year.

- In terms of vol premium added, EM currencies and Scandi FX are seeing front-end vols rise most materially, suggesting high beta markets are at risk of the most out-sized moves. In G10, overnight SEK and NOK vols have added near 5 points in the run-up to CPI, while ZAR vols have added just over 7 points.

EUROPE ISSUANCE UPDATE

Spain auction results - Towards the top end of the target range sold of nominals (E6.428bln)That's the largest Spanish auction in nominal terms since June 2020. Decent bid-to-covers seen, too, with the low price in excess of the pre-auction mid-price for all issues.

- E2.864bln of the 2.80% May-26 Bono. Avg yield 2.805% (bid-to-cover 1.8x)

- E2.088bln of the 0.80% Jul-29 Obli. Avg yield 2.889% (bid-to-cover 2.18x)

- E1.475bln of the 2.90% Oct-46 Obli. Avg yield 3.426% (bid-to-cover 1.58x)

- E507mln of the 0.70% Nov-33 Obli-Ei. Avg yield 1.018% (bid-to-cover 2.1x)

The bid-to-cover fell on the 3-year BTP, but that was more than explained by the auction size increasing from E2.0bln in December to E3.5bln today. Both 3/7-year issues coming in slightly above the pre-auction mid price. 7-year auction very marginally better than December's.

- E3.5bln of the 3.50% Jan-26 BTP. Avg yield 3.26% (bid-to-cover 1.52x)

- E3.5bln of the 3.85% Dec-29 BTP. Avg yield 3.77% (bid-to-cover 1.41x)

The BOE has announced that it has completed the sales of it Financial Stability Portfolio this morning (following on from the small holdings left after yesterday's operation).

FOREX: JPY On Top as Local Report Stirs Policy Speculation

- JPY sits firmer against all others in G10 following an overnight report in Yomiuri, which suggested the Bank of Japan would take a closer look at the side-effects of their monetary policy and yield curve control programme. The report has stirred speculation that the Bank could change tack on policy sooner-than-expected, and has raised the focus on the January 18th policy meeting. USD/JPY has drifted lower throughout European trade, with the downside accelerating on the break below the Monday low at 131.31.

- Elsewhere, price action is more muted as markets sit on the sidelines ahead of the inflation release. EUR/USD remains either side of the 1.0750 level, while AUD/USD sits just above the $0.69 after yesterday's inflation-inspired strength.

- EUR/CHF's break above parity has held for a second session and could mark a material technical break higher. The solid close above the 200-dma opens progress toward 1.0092 - the 61.8% retracement for the June - September downleg.

- US inflation data marks the focus for asset prices going forward, with consensus looking for a slowdown in CPI to 6.5% on the year and 5.7% core. The release is seen as one of the most important economic releases of recent weeks, and could prove pivotal for the February's FOMC decision, at which markets remain split between a 25 and 50bps rate hike.

FX OPTIONS: Expiries for Jan12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E1.2bln), $1.0670-90(E3.9bln), $1.0750(E2.4bln), $1.0770-75(E1.5bln)

- USD/JPY: Y140.00($1.3bln)

- AUD/USD: $0.6825($511mln)

- USD/CAD: C$1.2900($1.8bln), C$1.3650($1.4bln), C$1.4000($1.3bln)

BONDS: Cautious Optimism That CPI Report Won't Produce Hawkish Surprise

Global core FI is stronger with curves mostly flatter, and Gilts outperforming Treasuries and Bunds ahead of the highly anticipated US inflation report.

- Bonds are trading with cautious optimism that the much-anticipated US inflation release won't produce a hawkish surprise. This is corroborated by US dollar weakness and broad equity strength.

- While headline CPI is expected to have retreated in December (-0.1% M/M survey), core CPI is the focus of today’s US inflation report (0830ET/1330GMT), seen picking up to 0.3% M/M from 0.2% prior. Jobless claims data is out simultaneously but as usual won’t be a market mover.

- Periphery EGBs continue to rally following Wednesday’s dovish-leaning ECB news (including an MNI sources piece pointing to potential for slower rate hikes in the spring), with BTP/Bund 10Y spreads testing the 180bp mark.

- Fed speakers include Barkin, Bullard and Harker; BoE's Mann speaks as well.

- $18B 30Y Tsy re-open auction features later in the session.

EQUITIES: European Equity Futures Reach Fresh Cycle Highs Ahead of US CPI

EUROSTOXX 50 futures bullish conditions remain intact and the contract traded higher yesterday. Futures have cleared resistance at 4043.00, the Dec 13 high and a bull trigger. The clear break represents a key short-term positive development and paves the way for gains towards 4175.50 next, the Feb 16 high. Moving average studies are in a bull-mode condition, reinforcing the current positive trend condition. Initial support lies at 3944.00. S&P E-Minis traded higher Wednesday and the contract is holding on to this week’s gains. Price has cleared resistance at the 50-day EMA and this has strengthened the short-term bullish condition. Price is approaching the 4000.00 handle where a break would open 4043.00, the Dec 15 high. Key support and the bear trigger has been defined at 3788.50, the Dec 22 low. A reversal lower and a break of this level would resume bearish activity.

COMMODITIES: WTI Futures Traded Higher Wednesday Despite Broader Bearish Outlook

WTI futures traded higher Wednesday to extend the recent recovery. A continuation higher would signal scope for a test of resistance at $81.50, the Jan 3 high and a bull trigger. Clearance of this hurdle is required to strengthen a bullish theme. The broader trend outlook appears bearish. A reversal lower would expose the bear trigger that has been defined at $70.31, the Dec 9 low. Trend conditions in Gold remain bullish and the yellow metal continues to trade higher, extending the current uptrend. This week’s move higher maintains the positive price sequence of higher highs and higher lows and note that moving average studies are in a bull mode position - reflecting the current uptrend. The focus is on $1896.5, a Fibonacci retracement. On the downside, support to watch lies at $1825.2, Jan 5 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 12/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/01/2023 | 1330/0830 | *** |  | US | CPI |

| 12/01/2023 | 1345/0845 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 12/01/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 12/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2023 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2023 | 1700/1700 |  | UK | BOE Mann Lecture at University of Manchester | |

| 12/01/2023 | 1740/1240 |  | US | Richmond Fed President Tom Barkin | |

| 12/01/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/01/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 13/01/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 13/01/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 13/01/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 13/01/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 13/01/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 13/01/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 13/01/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 13/01/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 13/01/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 13/01/2023 | 0900/1000 |  | DE | GDP 2022 | |

| 13/01/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 13/01/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 13/01/2023 | - | *** |  | CN | Trade |

| 13/01/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 13/01/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 13/01/2023 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 13/01/2023 | 1520/1020 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.