-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - FX Vols See Muted Moves Post-Fed, ECB

Highlights:

- Spanish CPI tops forecast, putting markets on edge for French, German and Dutch releases this week

- FX implied vols see muted market moves post-Fed, ECB meetings

- USD/JPY dips as industry group recommends BoJ/Government commitment on inflation

US TSYS: European Inflation Drives Early Trade Before A Stacked Week

- Cash Tsy yields sit 3.5-4bps higher across the curve with the cheapening impetus coming from materially higher than expected Spanish CPI/HICP inflation even if it was partly down to methodological changes.

- The move sees the front end continue a cheapening trend from the second half of last week although the long end remains within Friday’s range. It's ahead of today's light docket before the week picks up with Fed, ECB and BoE meetings plus data including payrolls and ISM services on Friday.

- 2YY +3.3bp at 4.232%, 5YY +4.1bp at 3.652%, 10YY +4.2bp at 3.546% and 30YY +4.1bp at 3.660%

- TYH3 trades 7+ ticks lower at 114-12 just half a tick off recent session lows and close to key support at 114-09+ (Jan 17 low). Volumes are solidly above average of >300k with a ramping up after the Spanish inflation data.

- Data: Dallas Fed mfg (1030ET)

- Bill issuance: US Tsy $60B 13W, $48B 26W bill auctions (1130ET)

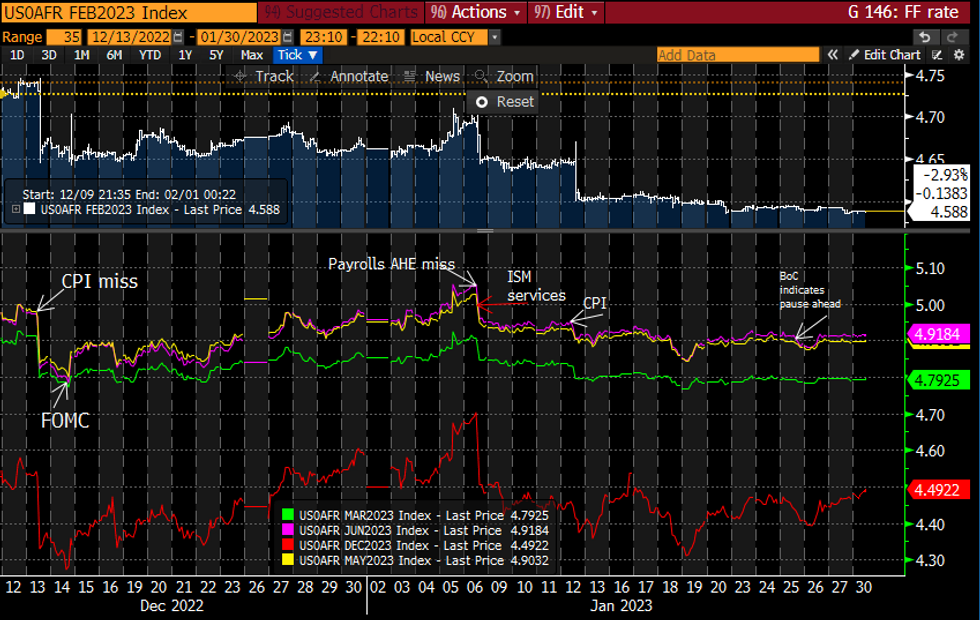

STIR FUTURES: A Further Minor Trimming Of 2H23 Fed Rate Cuts

- Fed Funds implied hikes for near-term meetings are little changed from last week’s tight range but continue to trim 2H23 cuts to now 42bps from the peak to end-2023 vs the 45-50bp of recent days.

- 25.5bp for Wed’s decision (unch), cumulative 47bp for Mar (+0.5bp), 59bp to 4.92% terminal in Jun (+0.5bp) before 4.49% Dec (+2.5bp).

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

FX OPTIONS: Sizeable Thursday Expiries Could Help Define EUR/USD Range

- Front-end implied vols across G10 FX are at the upper-end of the recent range ahead of the Fed, ECB and BoE this week. EUR/USD 1w vols added close to 3 points late last week as contract captured the fallout from the Fed and ECB.

- The vol premium added this week is relatively muted compared to the moves ahead of December's Fed/ECB - (ahead of which EURUSD 1w vols crossed as high as 15 points) signalling markets expect more muted prices moves at the end of this week - reflected in the solid pricing of 25bps and 50bps hikes from the Fed and ECB respectively.

- The first post-ECB NY cut shows sizeable expiries layered between 1.0750-1.08 ($1.5bln) and decent interest at 1.1150 ($744mln) that could help define the range across this week's CB schedule.

FOREX: EUR Rallies on Spanish Inflation Beat

- USD/JPY slipped sharply through mid-Asia hours on the back of a publication from the Japan Productivity Centre - notably headed by Yuri Okina, a leading candidate for a senior position at the BoJ in the upcoming reshuffle - who wrote that the BoJ and government should commit to longer-term policy objectives around inflation. The pair shed around 80 pips on the report's release, bottoming out at 129.21 before bouncing into the European open.

- The EUR is the strongest currency across G10, bouncing on the release of a much higher-than-expected Spanish CPI print. Y/Y CPI hit 5.8%, a 1 percentage point beat on expectations, prompting EUR/USD to trade north of the 1.09 handle at the NY crossover.

- The inflation release will raise concerns about other regional CPIs this week, with Germany, France, Netherlands and the Eurozone-wide figure on the docket ahead of Thursday's ECB decision. 50bps remains well-priced from the ECB, with the peak rate the point of focus for the press conference. Rates markets briefly priced a peak of 3.5% following the Spanish inflation release.

- Datapoints are few and far between Monday, with focus resting on the busy second half of the week, from the Fed, ECB and BoE decisions as well as a frantic earnings calendar and the US jobs report release on Friday. ECB's Villeroy is scheduled to speak, but is unlikely to address policy directly.

FX OPTIONS: Expiries for Jan30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E581mln), $1.0950(E783mln), $1.1315(E529mln)

- USD/JPY: Y130.00($785mln), Y131.40($1.3bln), Y133.50($801mln)

- USD/CAD: C$1.3400($841mln)

BONDS: EGBs Lead Core FI Lower Following Spanish Inflation Beat

- EGBs have led core fixed income lower this morning following a higher-than-expected Spain HICP print. There were some methodological changes behind some of the increase but the overall result was that Y/Y HICP was a whole percentage point higher than expected at 5.8%Y/Y, an increase on December's 5.5%Y/Y print.

- At the time of writing Schatz yields are over 6bp higher on the day with a very mild flattening of the German curve. USTs and gilts yields are 2-3bp higher on the day.

- Markets will already likely have one eye on further Eurozone inflation prints tomorrow with the FOMC, BOE and ECB decisions all due ahead of the US employment report on Friday. It is certainly a busy week!

- TY1 futures are down -0-4 today at 114-15+ with 10y UST yields up 3.0bp at 3.535% and 2y yields up 2.1bp at 4.223%.

- Bund futures are down -0.70 today at 136.74 with 10y Bund yields up 5.8bp at 2.295% and Schatz yields up 6.2bp at 2.633%.

- Gilt futures are down -0.25 today at 104.39 with 10y yields up 2.8bp at 3.349% and 2y yields up 3.2bp at 3.474%.

EQUITIES: Equity Futures Begin Week on Soft Footing

- EUROSTOXX 50 futures remain above support at 4097.00, Jan 19 low and the contract is trading just ahead of key short-term resistance at 4206.00, Jan 18 high. A break of this level would confirm a resumption of the uptrend and pave the way for a climb towards 4215.00, a Fibonacci projection. Note that the trend remains overbought. A pullback, if seen, would represent a healthy bull trend correction. Support to watch is 4094.60, the 20-day EMA.

- S&P E-Minis traded higher last week to confirm a resumption of the current uptrend. The breach of resistance has resulted in a print above the 4100.00 handle and an extension higher would open 4180.00, the Dec 13 high and a bull trigger. Initial firm support has been defined at 3954.84, the 50-day EMA. A move below the average would be seen as a bearish development and signal a short-term reversal.

COMMODITIES: WTI Futures Target $78.45 Jan 19 Low, Signaling Potential Reversal

- WTI futures remain below $82.64, the Jan 23 high. Key short-term resistance is located at $82.66, the Jan 18 high. Clearance of this hurdle would reinstate the recent bullish theme and expose $83.14, the Dec 1 high and $85.33, a Fibonacci retracement. On the downside, the support to watch lies at $78.45, the Jan 19 low. A break of this level would signal a potential reversal and allow for a deeper pullback.

- Trend conditions in Gold remain bullish and the yellow metal is holding on to the bulk of its latest gains. Recent cycle highs confirm an extension of the uptrend and maintain the price sequence of higher highs and higher lows. Moving average studies remain in a bull mode position - reflecting the uptrend. The focus is on $1963.0 next, a Fibonacci retracement. Initial firm support to watch lies at $1897.00, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2023 | 1000/1100 | ** |  | IT | PPI |

| 30/01/2023 | 1000/1100 |  | EU | Consumer / Economic Confidence Indicators | |

| 30/01/2023 | 1500/1000 |  | US | Treasury Quarterly Financing Estimates | |

| 30/01/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2023 | 2350/0850 | ** |  | JP | Industrial production |

| 31/01/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 31/01/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/01/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/01/2023 | 0630/0730 | ** |  | FR | Consumer Spending |

| 31/01/2023 | 0630/0730 | *** |  | FR | GDP (p) |

| 31/01/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/01/2023 | 0730/0830 | ** |  | CH | retail sales |

| 31/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 31/01/2023 | 0745/0845 | ** |  | FR | PPI |

| 31/01/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/01/2023 | 1000/1100 | *** |  | IT | GDP (p) |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/01/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/01/2023 | 1330/0830 | ** |  | US | Employment Cost Index |

| 31/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/01/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 31/01/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 31/01/2023 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 31/01/2023 | 1500/1000 | ** |  | US | housing vacancies |

| 31/01/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 01/02/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.