-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Gilts Sink as BoE Deny Delay to Active Sales Plan

Highlights:

- Gilts erase opening gains as BoE deny report on delay to active Gilt sales

- NZD outpaces all others as hot CPI raises risk of further 75bps hike

- Ample ECB / Fedspeak takes focus Tuesday

Key Links: RBA Can Move As Fast As Other Banks / China Press Digest / BoE to Examine Gilt Sales Plan / MNI Europe Positioning Indicator

US TSYS: Treasuries Reverse Overnight Bid For Little Change

- Cash Tsys have reversed an overnight bid following a FT source suggesting the BoE is likely to delay active gilt sales, subsequently cheapening with EU FI post-open. It leaves cash Tsys nearly unchanged across the curve, with 2s10s holding in the middle of last week’s wide ranges at -44bp vs a post-CPI low of -55bp and recent pre-CPI high of -33bp.

- Firmly in earnings season: GS still to come today whilst J&J warned on FX headwinds cutting FY sales and adjusted EPS outlooks.

- 2YY +0.9bps at 4.452%, 5YY +0.9bps at 4.238%, 10YY +0.2bps at 4.013%, and 30YY +0.5bps at 4.026%.

- TYZ2 trades just half a tick higher at 110-22+, remaining towards the low end of yesterday’s range on modestly above average volumes. Bearish trend conditions are seen in place, with support at the psychological 110-00 and then 109-23+ (Nov 30, 2007 low cont.)

- Data: Industrial production and cap util for Sept (0915ET), NAHB housing index for Oct (1000ET), TIC flows for Aug (1600ET)

- Fedspeak: Bostic (1400ET), Kashkari (1730ET)

- No issuance

STIR FUTURES: Fed Rate Path Holds Close To Cycle Highs

- Fed Funds implied hikes still close to cycle highs: 78.5bp for Nov, 142bp to 4.50% Dec, 4.94% terminal in Mar/May’23 and 4.56% for Dec’23.

- Scotia now also see terminal 5% by early 2023 from 3.5% prior. Likely to be a reasonably mild recession given balance sheets remain strong with the u/e rate rising from current 3.5% to 4.7% end-23.

- Fedspeak late in the session, neither with text: Bostic (’24, 1400ET) in a panel discussion after trading violations were reported Fri and Kashkari (’23, 1730ET).

FOMC-dated Fed Funds implies ratesSource: Bloomberg

FOMC-dated Fed Funds implies ratesSource: Bloomberg

FOREX: Price Action Highlights Remaining Two-Way Risk in USD/JPY

- Volatile price action in the JPY followed a gradual grind higher in USD/JPY to new highs of Y149.29 - with a quick correction lower prompting speculation of intervention from the Japanese authorities - with a headline detailing a planned meeting between the BoJ and the FSA potentially triggering the price action. The pair dropped over 100 pips in a sharp move lower, touching 148.19 before recouping almost all the losses.

- The price action continues to point to a fragile market, with the trend higher in USD/JPY still subject to acute moves lower.

- NZD and SEK are the outperformers for the session so far, with New Zealand's Q3 CPI coming in well ahead of expectations (2.2% Q/Q vs. Exp, 1.5%) and fuelling potential for a further 75bps move at the November 23rd RBNZ decision.

- Early strength in GBP faded through the NY crossover, with GBP/USD slightly lower on the day as the Bank of England released a statement claiming that a likely delay to their active Gilt sales plan is 'inaccurate'. This put GBP from the top to the bottom of the G10 pile, with EUR/GBP now within range of the Monday high at 0.8722.

- Tier one data releases are few and far between Tuesday, although some attention may be paid to industrial production data for September and the October NAHB housing market index. The central bank speakers slate is busier, with ECB's Herodotou, Makhlouf, Schnabel and Nagel on the docket as well as Fed's Bostic and Kashkari.

BOE denies active sales plan is postponed, destroying calm in gilt market

- We had been seeing (by recent standards at least) a relatively benign session for core FI. However, just before 10:00BST the BOE officially denied the FT story this morning. This caused gilt futures to fall almost 100 ticks from 96.96 to a low of 95.97. Over half of this move has since been retraced but this still leaves 10-year gilt yields 6bp higher on the day.

- Bund and Treasury futures had been slowly trending lower through the European morning session with both below their lows of yesterday (but still above Friday's lows). The moves in Treasuries simply retraced the moves higher in Asian trading.

- Looking ahead we have US industrial production data at 14:15BST / 9:15ET.

- We also have speeches from ECB's Makhlouf, Schnabel and Nagel as well as Fed's Bostic.

- TY1 futures are down -0-3 today at 110-19+ with 10y UST yields up 0.9bp at 4.021% and 2y yields up 0.8bp at 4.453%.

- Bund futures are down -0.54 today at 136.34 with 10y Bund yields up 5.8bp at 2.323% and Schatz yields up 3.9bp at 1.981%.

- Gilt futures are down -0.64 today at 965.59 with 10y yields up 6.2bp at 4.029% and 2y yields up 5.5bp at 3.594%.

PM Truss' Net Favourability Falls To -70%

Latest YouGov polling shows the net approval rating for PM Liz Truss falling to -70%. This is lower than her predecessor Boris Johnson at the height of the 'partygate' scandal (-51, Jan 2022), and worse than notably divisive former Labour leader Jeremy Corbyn's lowest ever score (-60, Oct 2019).

- The poll shows 80% of respondents view the PM unfavourably, with 62% in total viewing her 'very unfavourably'. Just 10% of respondents view the PM favourably (8% somewhat favourably, 2% very favourably).

- Data from Smarkets shows an implied probability of 62.5% that Truss leaves office in 2022, down from a peak of 78% yesterday evening. Bettors assign a 32.3% chance that Truss is removed in 2023.

- Net favourability ratings (14-16 Oct): Labour leader Keir Starmer: -5 (down 7 from 11-12 Oct), former Chancellor Rishi Sunak: -21 (up 14 from 24-25 Aug), former PM Boris Johnson: -36 (up 4 from 8-9 Aug), Chancellor Jeremy Hunt: -41 (up 7 from 13-14 Jul), PM Liz Truss: -70 (down 14 from 11-13 Oct)

Source: YouGov. Latest data point 14-16 Oct

Source: YouGov. Latest data point 14-16 Oct

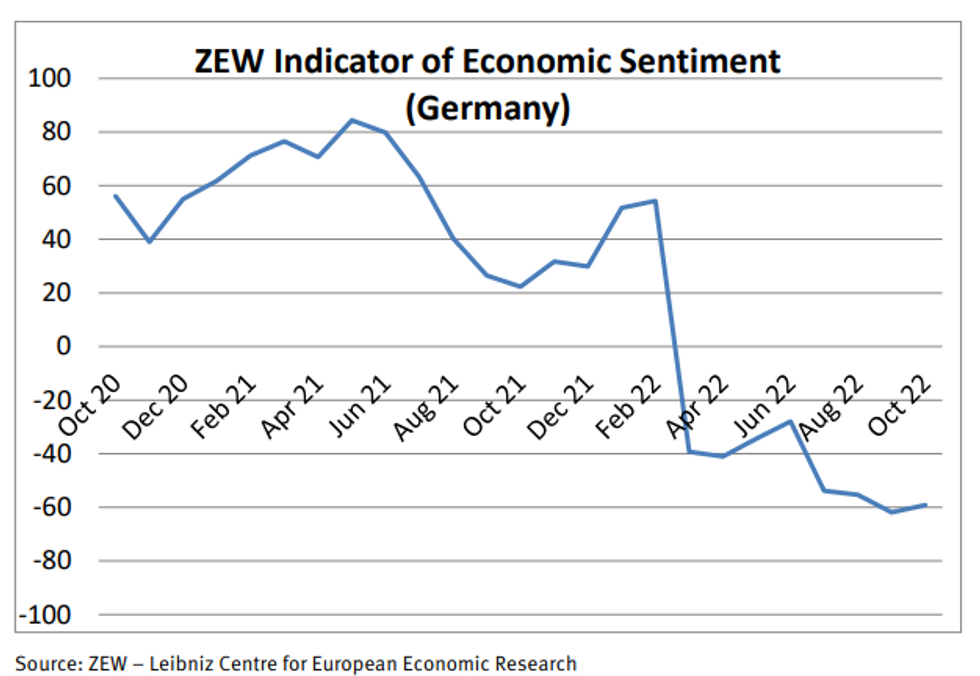

GERMANY: ZEW Survey Expectations Improve, But From Very Low Base

GERMANY OCT ZEW CURRENT CONDITIONS -72.2 (FCST -68.5); SEP -60.5

GERMANY OCT ZEW EXPECTATIONS -59.2 (FCST -66.5); SEP -61.9

- The ZEW survey recorded a modest 2.7-point improvement in the German economic expectations index for October, beating expectations after nearing historic 2008 lows last month.

- Current conditions plunged 11.7 points to -72.2, the lowest since 2003. Both indicators remain deeply pessimistic and imply a deterioration in assessments.

- Anticipated energy shortages ahead of winter remain a key downwards driver for German industry outlooks as energy-intensive production sees further cuts. Pessimistic outlooks regarding growth in China add to lower export demand.

- Despite CPI slowing in major eurozone economies Spain and France, the 2.1pp jump in headline CPI to 10.0% in September confirms that the German economy is yet to see relief as high prices continue to drag down demand.

- On Oct 28 flash GDP data will signal a contraction of the German economy, expected to kick off a Winter recession after almost stalling in Q2. This adds to a slew of worsened growth outlooks for the ECB, which looks set to tighten policy by a further 75bp next week.

- No notable market reaction was seen as focus remains on the UK.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/10/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/10/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 18/10/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/10/2022 | 1600/1800 |  | EU | ECB Schnabel Alumni Event at Uni Mannheim | |

| 18/10/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/10/2022 | 2000/1600 | ** |  | US | TICS |

| 18/10/2022 | 2130/1730 |  | US | Minneapolis Fed's Neel Kashkari | |

| 19/10/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/10/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/10/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/10/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/10/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/10/2022 | 1230/0830 | *** |  | CA | CPI |

| 19/10/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/10/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 19/10/2022 | 1500/1600 |  | UK | BOE Mann Panels Webinar on ERM Crisis | |

| 19/10/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 19/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/10/2022 | 1800/1400 |  | US | Fed Beige Book | |

| 19/10/2022 | 2230/1830 |  | US | St. Louis Fed's James Bullard | |

| 19/10/2022 | 2230/1830 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.