-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US MARKETS ANALYSIS - Greenback Touches Fresh Pullback Low

Highlights:

- EUR/USD ekes out new weekly high in Asia trade

- Early bank report revenues top street consensus

- Retail sales, Fedspeak and UMich sentiment round off the week

US TSYS: Modestly Richer Awaiting Retail Sales, Fedspeak and U.Mich

- Cash Tsys trade 1-2.5bps richer across most of the curve with only the 30Y lagging after yesterday’s re-open, with yields within yesterday’s ranges although at the very high end for the 30Y. A heavy data docket today with focus on retail sales and the preliminary U.Mich survey for April, with the former also landing at the same time as commentary from current year FOMC voters – see STIR bullet for now.

- 2YY -1.0bp at 3.958%, 5YY -2.3bp at 3.478%, 10YY -1.5bp at 3.430% and 30YY +0.1bp at 3.688%.

- TYM3 trades 6 ticks higher at 115-20+ on higher than most recent volumes but still tepid at 210k. A bullish outlook is seen with resistance at 116-08 (Apr 12 high) whilst support is seen at the 20-day EMA of 115-06.

- Data: Retail sales Mar (0830ET), International trade prices Mar (0830ET), IP and cap util Mar (0915ET), U.Mich Apr prelim (1000ET) and Business Inventories Feb (1000ET)

- Fedspeak: Goolsbee CNBC interview (0830ET), Gov Waller on economic outlook (0845ET)

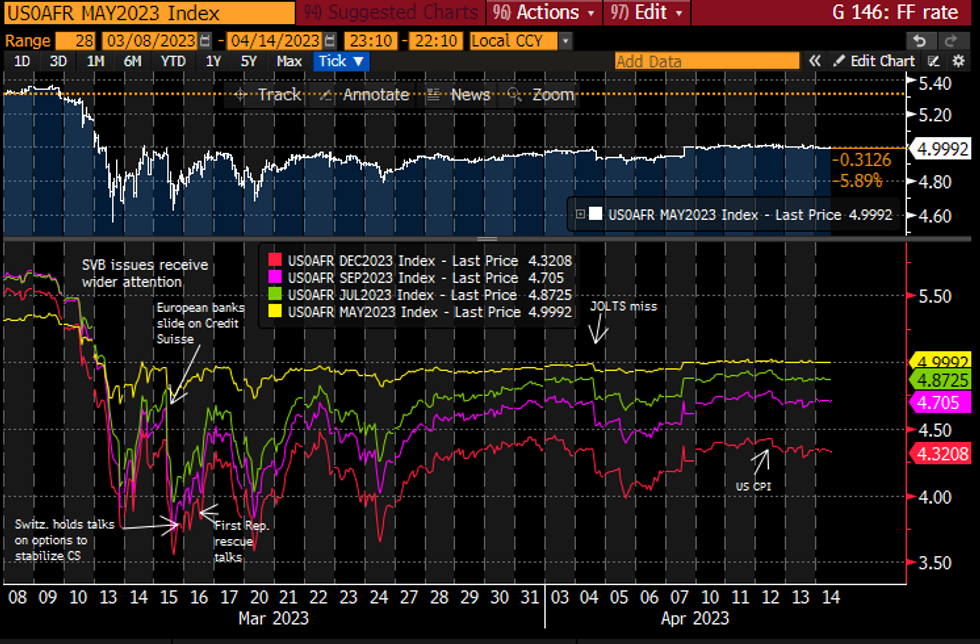

STIR FUTURES: Little Change In Rate Path, Current Voters Ahead

- Fed Funds implied rate path marginally lower overnight. 17bp hike for May 3, whilst the first cut from current levels is fully priced for Nov (-32bp) with 51bp of cuts to 4.32% at year-end.

- Latest Fedspeak from Bostic (’24 voter) doesn’t move the dial, in line with median dot (can “hit mark and hold” with one more hike).

- Goolsbee (’23 voter) speaks for the second time this week to CNBC as retail sales are released, closely followed by Gov Waller (voter) on the economic outlook with text + Q&A. Goolsbee called for patience and prudence in light of bank stress earlier this week, Waller said Apr 1 that the Fed should be able to bring inflation back to its 2% target without a sharp rise in the u/e rate whilst inflation expectations remain well anchored, but otherwise last spoke Mar 2.

Source: Bloomberg

Source: Bloomberg

USD: Options Markets Take Heed of Negative Technical Signals

- Options markets have taken heed of the negative technical signals emerging in USD markets - with major pairs taking out key upside levels (1.1033 in EUR/USD, 1.2525 in GBP/USD). Risk reversals markets flagged the upside risks to the USD across 2022, and have now fully reversed.

- Moving-average based trading strategies remain among the most profitable technical approaches to the USD Index over the past 12 months, with the simple, exponential and weighted moving average strategies all flipping to the current winning short USD trade in mid-March. Furthermore, the 30-day RSI is yet to flag the USD Index as technically oversold (the USD hasn't been oversold since Dec'20), opening 98.976, the 61.8% retracement for the 2021 - 2022 upleg.

- An MNI-weighted 1m USD Risk Reversal spiked in mid-2022 and held the higher levels for the rest of the calendar year - helping presage the USD strength into the September high. This metric has fully reversed, with the metric now below the 2022 average, and suggesting the USD remains vulnerable to the downside.

Figure 1: Weighted USD 1m Risk Reversal flags USD vulnerability

FOREX: EUR/USD Ekes Out a Fresh Cycle High in Late Asia

- The single currency fares better early Friday, creeping higher against most others in G10 - although market moves are more muted relative to Thursday trade. EUR/USD has printed a fresh weekly high at 1.1076 in late Asia hours, which remains the high watermark headed through to the NY crossover.

- GBP/USD traded well before meeting selling pressure across early Europe. Moves were order flow driven rather than headline driven, with futures markets showing evidence of sizeable selling helping push prices back to handle support of 1.2500.

- AUD is at the bottom of the G10 pile, partially reversing the solid rally posted during the Thursday session. 0.6755 Fib retracement provides first weak support ahead of the 50-, 200-dmas of 0.6749 and 0.6744 respectively. Note that the DMAs are on the cusp of printing a death cross (50-dma < 200-dma) for the first time since May 2022 - a bearish technical signal.

- Data highlights Friday include import/export price indices for March, as well as the monthly retail sales report. Consensus looks for retail sales to have dropped 0.4% - a similar pace to February - with the ex-auto and gas component seen particularly weak.

- Prelim University of Michigan Sentiment rounds off the week, which is expected to show further stickiness in inflation expectations last month. Fed's Goolsbee and Waller are the highlights of the speaker slate.

FX OPTIONS: Expiries for Apr14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0890-00(E2.2bln), $1.0950(E1.1bln), $1.1000(E1.8bln), $1.1050(E630mln)

- USD/JPY: Y130.00($1.2bln), Y132.00($910mln), Y133.00($661mln), Y134.00($602mln)

- NZD/USD: $0.6400(N$1.1bln)

- USD/CAD: C$1.3440-45($1.7bln)

- USD/CNY: Cny6.8000($503mln), Cny6.9000($914mln), Cny6.9050($514mln)

RATINGS: Friday’s Rating Slate

Potential rating reviews of note slated for after hours on Friday include:

- Fitch on Croatia (current rating: BBB+; Outlook Stable) & Portugal (current rating: BBB+; Outlook Stable)

- Moody’s on the European Union (current rating: Aaa; Outlook Stable)

- S&P on the Czech Republic (current rating: AA-; Outlook Stable)

- DBRS Morningstar on Malta (current rating: A (high), Stable Trend)

EQUITIES: March Highs Ahead of Best Level in a Year for EuroStoxx

- Eurostoxx 50 futures remain firm and price is trading at this week’s highs. The continued appreciation strengthens the bullish significance of the recent break of 4268.00, the Mar 6 high and a key hurdle for bulls. Sights are on 4324.50, the Jan 13 2022 high (cont) and 4381.50, the Jan 5 2022 high (cont). Moving average studies are in a bull-mode set-up, highlighting a broader uptrend. Initial firm support lies at 4209.70, the 20-day EMA.

- The current trend condition in S&P E-minis remains bullish. Price has recently breached 4119.50, Mar 6 high, reinforcing a positive theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4061.00, the 50-day EMA.

COMMODITIES: Gold Eyes $2070.40 Resistance Ahead of $2075.50 All-Time High

- WTI futures remain in a bull cycle. This week’s gains resulted in a break of resistance at $81.81, the Apr 4 high. This confirms a resumption of the current uptrend and note that an important resistance at $83.04, the Jan 23 high, has also been breached. The focus is on $85.01, the Nov 14 high. On the downside, key short-term support is seen at $79.00, the Apr 3 low and the gap high on the daily chart.

- Trend conditions in Gold remain bullish and Thursday’s break of resistance at $2032.1, Apr 5 high, confirms a resumption of the current uptrend. The move higher maintains the positive price sequence of higher highs and higher lows and sights are set on the next key resistance at $2070.4, the Mar 8 2022 high. This is just ahead of the all-time high of $2075.5. Key short-term support has been defined at $1981.7, the Apr 10 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 14/04/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2023 | 1245/0845 |  | US | Fed Governor Christopher Waller | |

| 14/04/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/04/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 14/04/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2023 | 1530/1630 |  | UK | BOE Tenreyro Panellist at the IMF Meeting | |

| 17/04/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/04/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/04/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 17/04/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/04/2023 | 1300/1400 |  | UK | BOE Cunliffe Speech at Innovate Finance Global Summit | |

| 17/04/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/04/2023 | 1500/1700 |  | EU | ECB Lagarde Speech at Council on Foreign Relations | |

| 17/04/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 17/04/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.