-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Gyrations in Short-End Continue

HIGHLIGHTS:

- Short-end yields surge further globally

- Focus turns to ECB's interpretation of inflation spike

- JPY benefits from broad risk-aversion

US TSYS SUMMARY: Short End Yields Surge Amid Global Rate Sell-Off

Global short-end rates sold off sharply overnight Thursday, with the Treasury curve bear flatter.

- The reaction from the Bank of Canada's unexpectedly hawkish turn Wednesday was exacerbated by the RBA's non-intervention on surging 2-yr bond yields overnight. These developments come ahead of today's ECB decision, and next week's Fed and BoE meetings.

- 2Y yields hit a fresh post-March 2020 high (0.5621%) as Eurodollar futures sold off (Reds last off 8 ticks). Conversely 10s and 30s yields were actually lower on the session by mid-morning Europe trade.

- 2-Yr yield last up 4.7bps at 0.5503%, 5-Yr is up 4.4bps at 1.1944%, 10-Yr is up 0.9bps at 1.5501%, and 30-Yr is down 0.3bps at 1.9479%. Dec 10-Yr futures (TY) down 10/32 at 130-27.5 (L: 130-25 / H: 131-02.5) on elevated volumes (~465k traded).

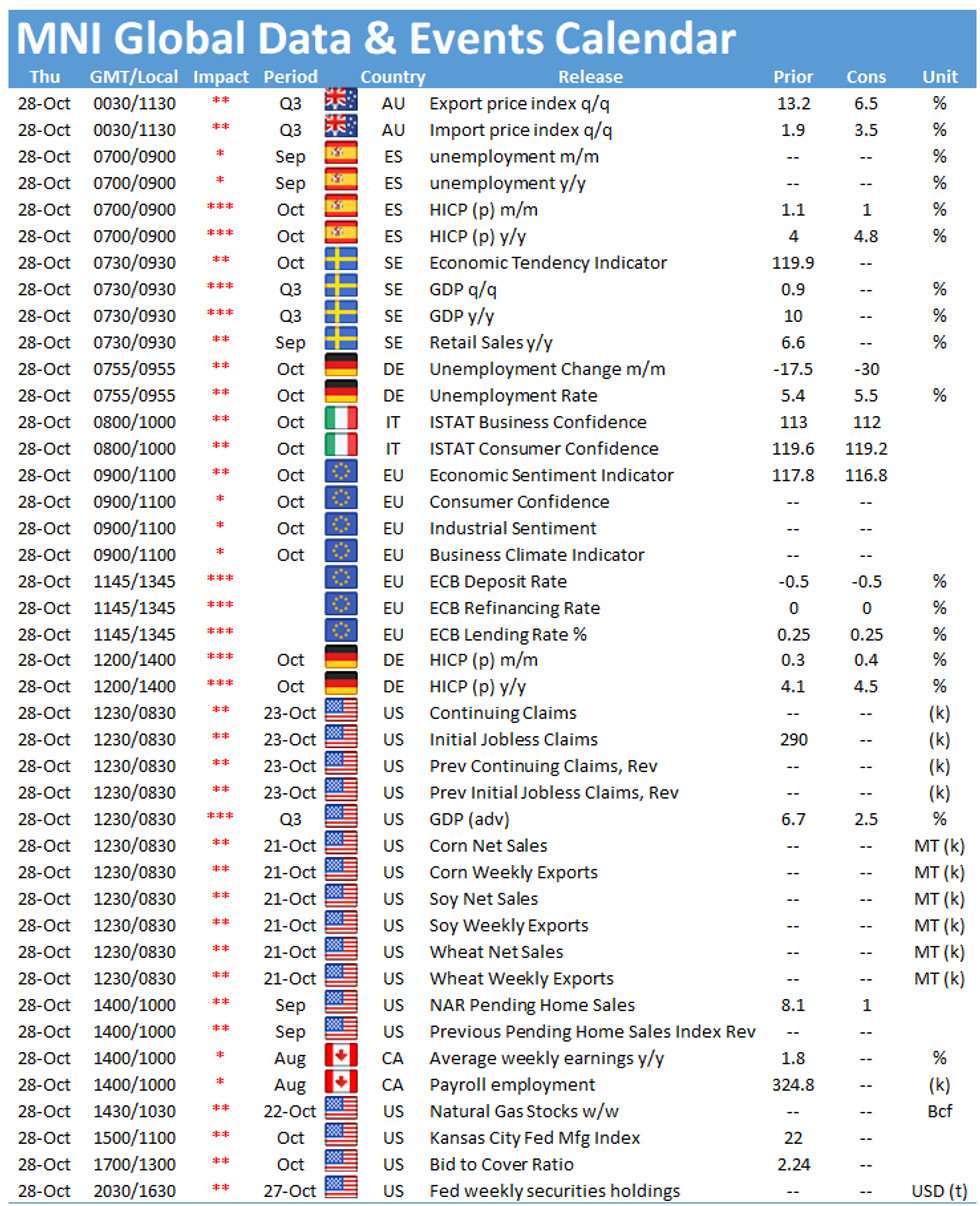

- In data, 0830ET sees jobless claims and advance Q3 GDP, while we get pending home sales at 1000ET and KC Fed manufacturing at 1100ET.

- Supply continues in earnest with $62B 7Y Note auction at 1300ET (also $85B combined in 4-/8-week bills at 1130ET). NY Fed buys ~$12.425B of 0-2.25Y Tsys.

EGB/GILT SUMMARY: ECBs Interpretation of Inflation Spike In Focus

EGBs have traded weaker ahead of today's ECB meeting, while equities and FX have been mixed.

- No new policy decisions are expected at the GC meeting, but President Lagarde is expected to reassert the forward guidance given the prior hawkish shift in market rate expectations.

- Markets will also be watching closely for any signs of the ECB becoming more concerned about the risk of second-round inflation effects given that the official position to date has been that the inflation spike is largely transitory.

- Bunds have traded weaker with cash yields broadly 2bp higher on the day.

- OATs have marginally underperformed bunds, particularly in the belly of the curve.

- BTPs have sold off sharply and the curve has bear flattened. Yields at the short-end/belly are up 6-7bp.

- The gilt curve has seen a hefty narrowing on the back of the short end selling off and the longer end rallying. The 2s30s spread is 12bp narrower and underpinned by the previous announcement by the DMO that planned debt sales will be cut by GBP60bn for this fiscal year.

- Supply this morning came from Italy (BTP/CCTeu, EUR7bn).

EUROPE ISSUANCE UPDATE

Italy sells:- E2bln 0% Aug-26 BTP, Avg yield 0.28% (Prev. 0.11%), Bid-to-cover 1.53x (Prev. 1.84x)

- E3.75bln 0.95% Jun-32 BTP, Avg yield 1.05%, Bid-to-cover 1.35x

- E1.25bln 0.65% Apr-29 CCTeu, Avg yield -0.01% (Prev. 0.03%), Bid-to-cover 1.73x (Prev. 1.46x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXZ1 168.5/167ps, 1x2, bought for 9 in 2.25k

UK:

L Z1 99.50/37/75/87c condor, bought was bought for 4 and 4.5 in 7k

SFIH2 99.35/99.55/99.75c fly 1x3x2, bought for 1 in 5k

SFIZ1 99.55/99.65/99.75/99.85c condor, bought for 2.75 in 8.5k

FOREX: JPY On Top Following Equity Dip Late Wednesday

- The JPY trades solidly across the board early Thursday, following downside pressure in USD/JPY ahead of the Wednesday close, that resulted in a showing back below previous resistance-turned-support at 113.41. This level remains a focus headed into NY hours as the USD Index trades in negative territory and just above key support at the 93.3495 50-dma.

- The single currency trades poorly ahead of the ECB decision, with markets continuing to reflect on the policy divergence between the ECB and other major global central banks. Short-term rates markets across the UK and US continue to accelerate pricing for earlier, sharper interest rate hikes, while the Eurozone equivalent lags considerably, translating to the EUR being one of the poorest performers so far in G10.

- Focus turns to the ECB rate decision, at which the bank are expected to double down on their view that the current surge in inflationary pressures is transitory, and their current policy mix remains relevant. Today's meeting is seen as a final hurdle ahead of the December decision, at which the bank will have full access to fresh economic projections and may tweak their asset purchase programme.

FX OPTIONS: Expiries for Oct28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E1.5bln), $1.1620-30(E811mln), $1.1650-65(E695mln)

- USD/JPY: Y113.00($1.5bln), Y113.70-90($2.3bln)

- AUD/USD: $0.7475(A$975mln), $0.7505(A$502mln)

- USD/CAD: C$1.2360-80($1.8bln)

- USD/CNY: Cny6.3900($805mln)

Price Signal Summary - Sentiment In The Equity Space Remains Bullish

- In the equity space, S&P E-minis are still in a clear uptrend and yesterday's pullback is considered corrective. The next objective is 4591.25, the 1.00 projection of the Jul 19 - Aug 16 - Aug 19 price swing. Scope is also seen for a break of the 4600.00 handle. EUROSTOXX 50 futures are trading near recent highs. The focus is on key resistance at 4223.00, Sep 6 high and bull trigger. A break would confirm a resumption of the broader uptrend and open 4290.50, 1.00 projection of the Jul 19 - Sep 6 - Oct 6 price swing.

- In FX, EURUSD continues to consolidate with a slightly weaker tone still dominating for now. From a short-term perspective, scope exists for a move towards the 50-day EMA at 1.1684. A key resistance also resides at 1.1711, a bear channel top drawn off the Jun 1 high. Initial support lies at 1.1572, Oct 18 low. GBPUSD short-term bullish conditions remain intact and corrections so far have been shallow. The focus is on 1.3913, Sep 14 high and a key resistance. Support to watch is at 3710, yesterday's low. USDJPY remains below recent highs but maintains a bullish tone. Scope is seen for a climb towards 114.99, 1.50 projection of the Apr 23 - Jul 2 - Aug 4 price swing. Initial support is at 113.09, the 20-day EMA. A break would signal scope for a deeper corrective pullback.

- On the commodity front, Gold maintains a positive short-term tone. Scope is seen for a climb towards $1834.0, the Sep 3 high. Key near-term support is at $1760.4, Oct 18 low. WTI broader trend conditions are unchanged although futures faced some selling pressure yesterday. Support to watch is at $80.34, 20-day EMA.

- In the FI space, Bund futures sights are on 167.79, 2.50 projection of the Sep 9 - 17 - 21 price swing. Key resistance at 169.92, Oct 14 high, remains intact. Gilts breached and closed above resistance at 152.57 yesterday, Oct 14 high. This has confirmed a double bottom reversal on the daily chart and signals scope for a climb towards 126.39, 50.0% retracement of the Aug - Oct downleg. Initial support is at yesterday's low of 124.55.

EQUITIES: Nasdaq Gaining In Mixed Session So Far

- Asian stocks closed weaker, with Japan's NIKKEI down 278.15 pts or -0.96% at 28820.09 and the TOPIX down 14.15 pts or -0.7% at 1999.66. China's SHANGHAI closed down 43.888 pts or -1.23% at 3518.417 and the HANG SENG ended 73.01 pts lower or -0.28% at 25555.73.

- European shares are mixed, with the German Dax down 16.59 pts or -0.11% at 15654.16, FTSE 100 down 24.18 pts or -0.33% at 7234.85, CAC 40 up 8.77 pts or +0.13% at 6772.27 and Euro Stoxx 50 up 6.97 pts or +0.17% at 4213.17.

- U.S. futures are a little higher, led by Tech, with the Dow Jones mini up 43 pts or +0.12% at 35433, S&P 500 mini up 9.75 pts or +0.21% at 4554.5, NASDAQ mini up 71.25 pts or +0.46% at 15659.

COMMODITIES: Metals Outperforming Energy

- WTI Crude down $0.37 or -0.45% at $81.84

- Natural Gas down $0.04 or -0.56% at $6.162

- Gold spot up $4.86 or +0.27% at $1802.47

- Copper up $5.35 or +1.22% at $443.2

- Silver up $0.02 or +0.09% at $24.1432

- Platinum up $4.13 or +0.41% at $1020.92

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.