-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Implied Fed Rate Path Recovers Off Recent Lows

Highlights:

- Greenback on steadier footing as Waller talks down CPI importance

- Implied Fed rate path recovers off recent lows

- ECB, Fedspeak in focus

US TSYS SUMMARY: Post Veteran's Day Cheapening, Brainard & Biden-Xi Eyed

- Cash Tsys re-opened after Veterans Day by pulling back off Thursday’s post-CPI highs with news of a notable round of support for China property space and Fed Gov. Waller pushing back on reading too much into a single inflation print, warning we have seen similar before. Limited docket aside from Brainard later but should also see post-meeting comments between Presidents Biden and Xi at an unspecified time.

- In yield space, 2YY +4.8bps at 4.38%, 5YY +6.5bps at 4.002%, 10YY +7.3bps at 3.886%, and 30YY +5.9bps at 4.074%.

- TYZ2 trades 9+ ticks lower at 112-01 on above average volumes. It pulls back below the 50-day EMA of 112-12+, a clear break of which would strengthen the case for short-term bulls and open key resistance 113-30 (Oct 4 high), whilst initial support lies at the 20-day EMA of 111-00.

- Fedspeak: VC Brainard (1130ET), NY Fed’s Williams (1630ET).

- Bill issuance: US Tsy $57B 13W, $45B 26W bill auctions – 1130ET

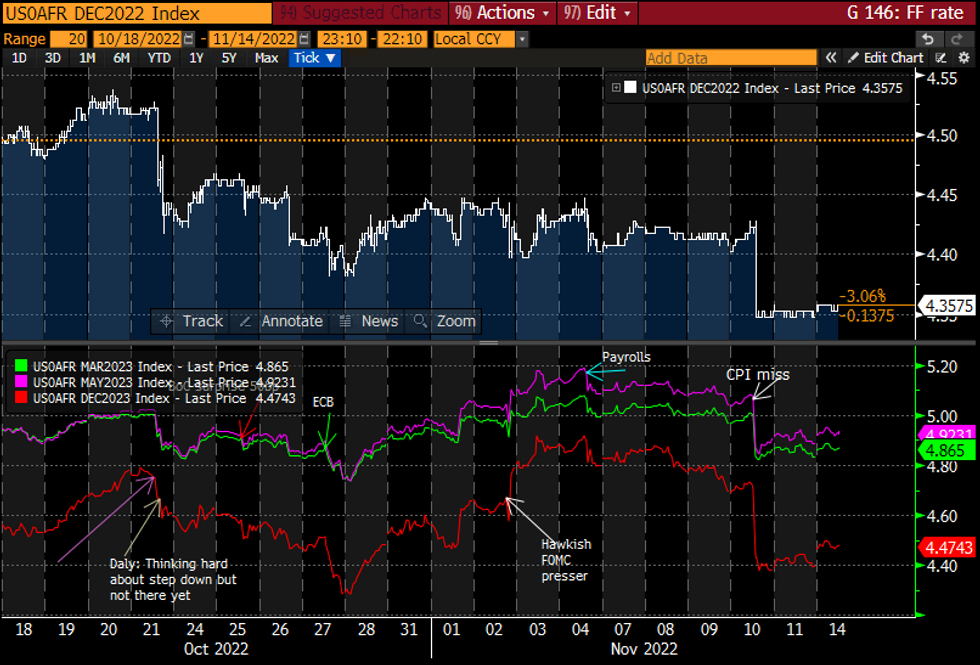

STIR FUTURES: Rate Path Pushes Higher After Weekend Waller, Brainard Ahead

- Fed Funds implied hikes firmed at open after what should have been unsurprising comments from Gov. Waller Sunday, noting the CPI miss was just one data point and “the market seems to have gotten way out in front of this”, looking at potentially hiking 50bps next meeting or after.

- Sitting with 51bp for Dec (+1bp), cumulative 86bp to 4.71% Feb'23 (+2bp), terminal 4.92% in May/Jun’23 (+4/5bp) and 4.47% Dec’23 (+7.5bp), with terminal and end-23 rates clawing back about a third of the CPI hit.

- VC Brainard in focus at 1130ET (no text). Last spoke Oct 10 with two CPI reports and the Nov FOMC since (it’ll take time for tighter policy to affect economy, 1970s taught risks of easing prematurely but at some points risks could become more two-sided). NY Fed’s Williams late at 1830ET.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

US-China: Biden-Xi Meet In Bali Ahead Of G20

US President Joe Biden and his Chinese counterpart Xi Jinping holding their first in-person meeting while in office (the two previously met in 2017 when Joe Biden was vice president) shortly. The meeting takes place in Bali, Indonesia ahead of the G20 leaders' summit.

- As the two leaders shake hands, WH press set Karine Jean-Pierre issues brief statement: "The Leaders will discuss efforts to maintain and deepen lines of communication between the United States and the PRC, responsibly manage competition, and work together where our interests align, especially on transnational challenges that affect the international community."

- Biden: "As leaders...We share a responsibility in my view to show that China and the US can manage our differences, prevent competition from becoming anything even near conflict, and to find ways to work together on urgent global issues that require our mutual cooperation."

- Xi: "We need to chart our course, find right direction for relationship and elevate it...I am ready to have a candid and in-depth exchange of views with you on issues of strategic importance."

- Issue of Taiwan likely to feature heavily in talks, with US concerns about potential Chinese aggression rising. Trade, IP, war in Ukraine/Chinese-Russia relations, Asia-Pacific security, North Korea all potential topics of discussion/debate between the two sides.

FOREX: Greenback on Steadier Footing After Waller Talks Down CPI Hopes

- The dollar is firmer for the first session in three, with the USD Index recovering back to the 107.00 handle as recent price action stabilises. Comments from Fed's Waller proved USD supportive, stating that the FOMC need to see more than just a single lower CPI print before being comfortable that inflation is in decline. Waller added that "The market seems to have gotten way out in front on this".

- Background USD strength is keeping EUR/USD support at the 1.03 handle under pressure, with a break below opening retracement toward 1.0217, the 23.6% Fib for the November upleg.

- The JPY is the poorest performer in G10 amid solid performance for Asia-Pac equity markets after Chinese authorities moved to support the local property market. Regulators rolled out a series of 16 policy measures including liquidity support to looser pre-payment conditions. USD/JPY remains in range of the 100-dma at 140.82, the first upside level of note.

- Datapoints are few and far between Monday, with focus instead on the speaker slate. ECB's Centeno, de Guindos, Brainard and Williams are due as well as Nagel speaking in a Bundesbank capacity.

FX OPTIONS: Expiries for Nov14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.2bln), $1.0025-30(E568mln)

- GBP/USD: $1.1715(Gbp557mln)

- AUD/USD: $0.6920-30(A$903mln)

- EUR/JPY: Y146.00(E1.4bln)

Price Signal Summary - Bund Trend Needle Points North

- In the FI space, Bund futures traded sharply higher Thursday. The short-term outlook remains bullish despite Friday’s move lower. Price has recently pierced the 50-day EMA at 139.99. A clear break of this average would threaten the recent bearish theme and highlight a stronger short-term reversal. This would open 140.92, the Oct 28 high and 142.87, the Oct 4 high. The 20-day EMA marks initial support, at 138.15 today.

- Gilt futures remain in a short-term uptrend and last week’s gains reinforce bullish conditions. The contract has cleared 104.39, Oct 27 high and confirmed a resumption of the uptrend. This has also confirmed a recent bull flag pattern on the daily chart. A continuation higher would open 106.25, Sep 12 high. Key support is at 99.92, the Nov 8 low. Initial support is at 102.26, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/11/2022 | - |  | UK | House of Commons Returns | |

| 14/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 14/11/2022 | 1345/0845 |  | CA | BOC's Macklem opening remarks at diversity conference | |

| 14/11/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 14/11/2022 | 1615/1715 |  | EU | ECB de Guindos Speech at Euro Finance Week | |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/11/2022 | 1630/1130 |  | US | Fed Vice Chair Lael Brainard | |

| 14/11/2022 | 2330/1830 |  | US | New York Fed's John Williams | |

| 15/11/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/11/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/11/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/11/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/11/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 15/11/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 15/11/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/11/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/11/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 15/11/2022 | 1000/1100 | * |  | EU | Employment |

| 15/11/2022 | 1000/1100 | *** |  | EU | GDP First Estimates |

| 15/11/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 15/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 15/11/2022 | 1330/0830 | *** |  | US | PPI |

| 15/11/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/11/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 15/11/2022 | 1400/0900 |  | CA | BOC Deputy Kozicki moderates panel on diversity | |

| 15/11/2022 | 1400/0900 |  | US | Fed Governor Lisa Cook | |

| 15/11/2022 | 1500/1000 |  | US | Fed Vice Chair for Supervision Michael Barr | |

| 15/11/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Euro Finance Week |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.