-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Vols Surge Ahead of Kuroda's Final BoJ

Highlights:

- JPY vols surge as markets narrow in on Kuroda's final BoJ meeting

- Fed terminal pricing still sits north of 5%

- Weekly jobless claims provide last look at labour market ahead of Friday NFP

US TSYS: 2Y Yields Trimmed With Fed Terminal But Still North of 5%

- Cash Tsys twist steepen as the front-end and belly see a 3-4bp rally, only gathering momentum in European hours having faded weaker-than-expected China PPI and CPI inflation at the time. It follows Fed terminal rate expectations being pared back slightly after pushing to fresh cycle highs late yesterday, as markets turn attention away from Powell to tomorrow’s payrolls report. The long-end underperforms ahead of 30Y supply later today.

- 2YY -4.2bp at 5.028%, 5YY -2.7bp at 4.322%, 10YY -0.6bp at 3.985% and 30YY +0.6bp at 3.901%. 2s10s at -104bp having breached -110bps yesterday.

- TYM3 trades unchanged at 110-29+ in a tight range of 110-23+-110-31+ with notably below average volumes. The trend needle still points south, sitting close to support at the bear trigger of 110-12+ (Mar 2 low).

- Data: Challenger Job Cuts Feb (0730ET), Weekly jobless claims (0830ET), Household chg in net worth Q4 (1200ET).

- Fedspeak: Limited to VC Supervision Barr on crypto (1000ET)

- Note/bond issuance: US Tsy $18B 30Y Bond auction re-open (912810TZN8) – 1300ET

- Bill issuance: US Tsy $65B 4W, $55B 8W bill auctions – 1130ET

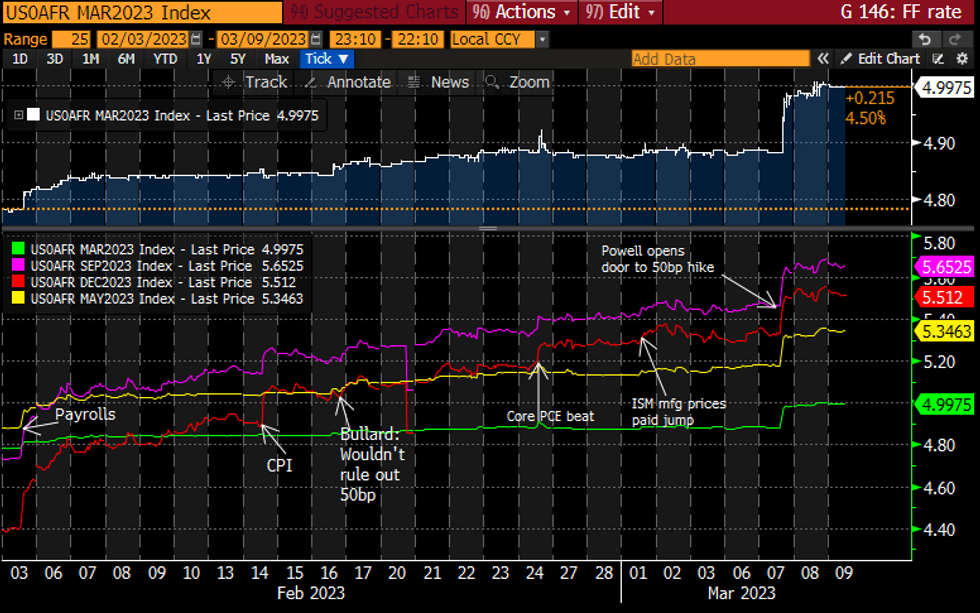

STIR FUTURES: Fed Terminal Pulls Back From Fresh Highs Late Yesterday

- Fed Funds implied hikes have pulled back from fresh cycle highs late yesterday as attention turns away from Powell to payrolls tomorrow.

- 42bp for Mar (-0.5bp), cumulative 77bp for May (-1bp), 108bp to 5.65% terminal in Sep (-4bp) before 14bp of cuts to 5.51% year-end (-4.5bp).

- Fedspeak: Calendar still devoid of scheduled speakers, with only VC Supervision Barr on crypto today before the media blackout starts Fri midnight (after payrolls).

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

MNI BoC Review, Mar'23: Will The Pause Still Be Lengthy?

- The BoC held rates at 4.5% for the first time since starting its 425bp hiking cycle last March.

- The single page statement struck a mixed tone with some conflicting changes. Analysts look to Senior Dep Gov Rogers’ remarks at 1340ET for any further clarity before Friday’s jobs report.

- Most analysts haven’t outwardly changed their prior rate calls of on hold in the near-term except for Citi who now see at least one more 25bp hike in April, potentially tied to their new 50bp hike call for the March FOMC.

- Full report found here: https://marketnews.com/mni-boc-review-mar-23-will-the-pause-still-be-lengthy

JPY: O/N Vols Surge as Market Gears for BoJ in Similar Fashion to Jan Meeting

- With overnight FX vol contracts now capturing both Kuroda's last rate decision at the BoJ as well as the Nonfarm Payrolls release Friday, prices are well bid - and most notably in USD/JPY, with O/N implied vols showing above 41 points for the first time since the January BoJ decision and just the second time since 2016.

- The BoJ vol premium is clear to see - EUR/USD vols are higher ahead of NFP, but by a considerably smaller margin - suggesting markets are hedging against JPY volatility despite the consensus looking for an unchanged rate decision.

- An ATM USD/JPY straddle breaks even on an approx. 230 pip swing in the pair (the equivalent break-even in January was ~275 pips), and the shift lower for short-end risk reversals suggests investors are cautious of a hawkish tweak to YCC - as was the case in December.

- MNI's policy team wrote on March 6th that BoJ officials are "working to understand the impact on U.S growth from additional Federal Reserve rate hikes ahead of possible changes" to YCC.

FOREX: JPY Favoured, But USD/JPY Dips Deemed Corrective

- JPY is the firmest performer so far Thursday, rising against all others in G10 to drag USD/JPY away from 200-dma resistance at 137.47 and into negative territory ahead of the NY crossover. The Tuesday low at 135.55 marks next support and slippage through here opens 135.39 and below. For now, pullbacks are deemed corrective in nature, with the over-arching bull trend still intact.

- The greenback is edging lower, however dips are minor at this stage given the 1.7% rally off the lows on Tuesday.

- Elsewhere, the NOK continues to hold almost the entirety of the post-Powell losses against the USD, with the currency among the weakest across G10. USD/NOK's print yesterday at 10.7223 was the highest since mid-October last year, and comes despite continued re-pricing for the Norges Bank rate hike expectation, evident in the upside pressure across NOK FRAs over the past fortnight.

- The weekly US jobless claims release is the data highlight Thursday, providing the last glimpse at the labour market ahead of Friday's Nonfarm Payrolls release. The speaker slate is busier, however few appearances are expected to directly address monetary policy. Fed's Barr appears to talk Crypto, while ECB's Vujcic is set to speak on Croation inflation.

FX OPTIONS: Expiries for Mar09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.1bln), $1.0530-50(E1.1bln), $1.0570-75(E1.1bln), $1.0585(E504mln), $1.0600(E1.7bln), $1.0635-50(E2.6bln)

- USD/JPY: Y136.50-55($1.0bln), Y137.00-10($1.5bln), Y138.00($810mln)

- GBP/USD: $1.1940-50(Gbp690mln)

- EUR/GBP: Gbp0.8915(E738mln), Gbp0.8950(E684mln)

- AUD/USD: $0.6755(A$570mln), $0.6785-00(A$1.3bln)

- USD/CAD: C$1.3500($1.1bln), C$1.3875($605mln)

- USD/CNY: Cny6.9000($1.3bln)

EQUITIES: E-Mini S&P Trading Within Range of Bear Trigger

- Eurostoxx 50 futures continue to trade above key support - the base of a bull channel drawn from the Oct 13 low. The line intersects at 4239.90. While this channel support holds, the broader uptrend remains intact. Monday’s gains resulted in a test of 4323.00, the Feb 16 high and bull trigger. A clear break would resume the uptrend. On the downside, a breach of the channel base alters the picture.

- The S&P E-Minis trend condition is bearish and Tuesday's move lower signals the end of the recent corrective bounce. An extension of weakness would pave the way for a move towards the next key support at 3925.00, Mar 2 low. This level is a bear trigger and a break would confirm a resumption of the bear leg that started Feb 2. For bulls, clearance of 4082.50, the Mar 6 high, is required to reinstate a bullish theme.

COMMODITIES: WTI Futures, Gold Remain Bearish Following Tuesday Sell Off

- A sharp sell-off in WTI futures Tuesday has defined a key near-term resistance at $80.94, Feb 7 high. A break above this hurdle is required to reinstate the recent bullish theme that would open $82.89, the Jan 23 high and a key resistance. On the downside, support to watch lies at $75.83, the Mar 3 low. A continuation lower and a breach of this level would strengthen a bearish case and open $73.80, the Feb 22 low.

- Trend conditions in Gold remain bearish and Tuesday’s strong sell-off reinforces this theme. The move lower signals the end of the recent corrective bounce and attention is on support and the bear trigger, at $1804.9. A break of this level would confirm a resumption of the downtrend and open $1787.3, a Fibonacci retracement. The yellow metal needs to breach $1858.3, the Mar 6 high, to signal scope for a stronger reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/03/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 09/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/03/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/03/2023 | 1840/1340 |  | CA | BOC's Rogers "Economic Progress Report" speech | |

| 10/03/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/03/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/03/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/03/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/03/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/03/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/03/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 10/03/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 10/03/2023 | 0900/1000 | ** |  | IT | PPI |

| 10/03/2023 | 0900/1000 |  | EU | ECB Panetta Presentation on Digital Euro | |

| 10/03/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/03/2023 | 1330/0830 | *** |  | US | Employment Report |

| 10/03/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.