-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Weakness Brings USD/JPY Bull Trigger Into Play

Highlights:

- Equities hold bulk of the bounce, keeping USD recovery underway

- JPY weakness brings USD/JPY bull trigger into range

- Treasuries sit modestly weaker ahead of light data, speaker session

US TSYS: Tsys Hug Lows, Policy Makers Wary of Cutting Too Soon

- Cash Tsys are holding moderately weaker, taking cues from core/semi-core EGBs again overnight as officials maintain hawkish vigil over inflation. ECB Lagarde data dependent and will wait for sustainable disinflation, Schnabel noted the "last mile" of disinflation may be the hardest.

- Mar'24 10Y futures tested Thursday lows overnight on heavier volumes (TYH4>500k) tied to the roll to Jun'24 contract. TYH4 currently -3 at 109-13 vs 109-09 low, next technical support level at 109-05.5 (Low Nov 28). Curves flatter: 2s10s near early January level at -39.600 (-0.281), 10Y yield at 4.3367% (+.0160) - early Dec'23 level.

- Projected rate cuts continue to consolidate vs. early Thursday levels: March 2024 chance of 25bp rate cut currently -2.0% vs. -6.8% early Thursday w/ cumulative of -0.5bp at 5.324%; May 2024 at -21.2% vs. -27.7% earl Thu w/ cumulative -5.8bp at 5.271%; June 2024 -55.4% vs. -61.5% early Thu w/ cumulative cut -19.7bp at 5.132%. Fed terminal at 5.33% in Feb'24.

- Today's data is limited to Bloomberg's US Economic Survey for February at 0900ET.

- No scheduled Fed speakers, nor US Treasury auctions. Auctions pick up in earnest on Monday due to the short month: $63B 2Y note and $70B 26W bills at 1130ET, followed by $79B 13W bills and $64B 5Y Note auctions.

STIR: Waller Comments Help Maintain Removal Of Rate Cut Premium

FOMC-dated OIS is little changed to ~2bp firmer across ’24 contracts, painting a similar picture to yesterday’s closing levels after a fresh unwind of some rate cut premium.

- Pushback from the Fed re: the need for imminent cuts, most recently via Governor Waller during Asia-Pac hours, continues to dominate headline flow, factoring into market pricing.

- Goldman Sachs have subsequently delayed their call for the first Fed cut to June from May, with their terminal rate call unchanged, sitting in the 3.25-3.50% target range.

- FOMC-dated OIS currently shows ~19.5bp of cuts through the June ’24 FOMC meeting, leaning towards, but not fully pricing, a 25bp cut.

- Further out, the first 25bp cut is more than fully discounted come the end of the July ’24 FOMC, with ~78bp of cuts priced over ’24.

- That leaves Goldman’s ’24 cutting view as a little more aggressive than market pricing.

- The median dot in the Fed’s Dec SEP showed 3 cuts in ’24 and participants have been unwilling to test that marker as of yet.

- The U.S. docket is slim to finish the week.

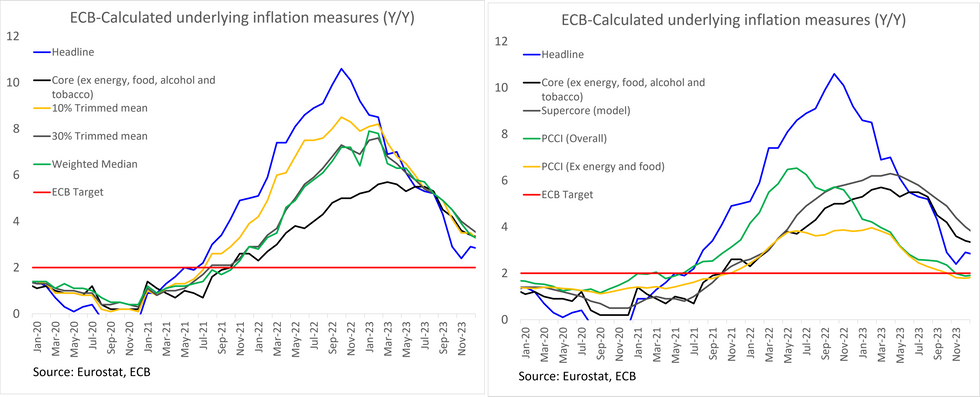

EUROZONE: Underlying Metrics Indicate Steady Disinflation Progress In Jan

The ECB's underlying inflation metrics for January are likely to be interpreted by policymakers as showing further progress toward the 2% target as they consider when to make the first rate cut.

- While core and headline PCCI (persistent/common component) inflation rose a touch in January, they each remained below 2% for the third consecutive month. Core PCCI was 1.85% Y/Y (vs 1.79% prior) while the headline reading was 1.93% Y/Y (vs 1.88% prior).

- The other underlying metrics (supercore, 10/30% trimmed mean and weighted median) also continued to moderate, with supercore (at 3.7% Y/Y) printing below 4% for the first time since May 2022.

- While certainly still of importance to the ECB, we would note that in a recent speech, ECB Chief Economist Lane caveated the reliability of the signals sent by underlying inflation measures, due to "the relative price shocks that have been triggered by the scale and breadth of the energy shock and the pandemic- and war-related shocks".

- Elsewhere, even though services inflation was sticky at 4% Y/Y in January (for the third month running), MNI's calculations indicate a softening of services momentum. Measured as a 3m/3m saar using ECB data, services momentum moderated to 2.25% (vs 2.54% prior).

- However, the ECB will still want to see moderations in NSA services inflation before progressing with its easing cycle, as it assesses the passthrough of wage pressures into end prices through this quarter.

FOREX: USD/JPY Streak of Higher Lows Brings Key Resistance Into Range

- The USD remains firmer off the Thursday lows, with the ability of US stock futures to hold the NVIDIA-triggered rally helping aid greenback sentiment. A Japanese market holiday kept Asia-Pac trade muted, but firmer front-end US yields upon the re-opening of trade has also proved USD-supportive.

- USD/JPY continues to print higher lows, with the new weekly high in spot at 150.77 well within range of key resistance and the bull trigger at 150.89. Any clearance here would put the pair at the best levels since late November, and could re-trigger concern in Japan over the weakness in the JPY, particularly as EUR/JPY's uptrend continues to bed in.

- NOK sits at the other end of the table, softer against broader G10 despite few domestic cues in Norway. Brent prices sit softer, which could be undermining the currency - however a decent gap remains between current levels and key resistance at 11.5004.

- Data releases are few and far between for the Friday session, with no Fed speakers on the docket. ECB's Schnabel is set to speak, but fresh policy messaging is unlikely at this stage.

FX OPTIONS: Expiries for Feb23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0815-30(E1.5bln)

- USD/JPY: Y146.90-00($944mln), Y149.10-15($625mln), Y150.00($752mln)

EGBS: Remain Under Pressure; Peripheries Mixed

Core/semi-core EGBs remain under pressure, as this morning's ECB speakers stuck close to their usual stances.

- ECB's Schnabel noted again that the "last mile" of disinflation may be the hardest, but did note that the peak tightening impact from past hikes may be over.

- Elsewhere, Nagel and Holzmann remained on the hawkish end, with the former stressing the importance of Q2 data for rate cut decisions (most of the Governing council have been focused on the Q1 figures thus far).

- The German IFO was pretty much in line, while the ECB's 1-year ahead expectations rose a touch to 3.3% (3-year ahead remained at 2.5%).

- Bunds are -43 ticks at 132.15, with the first support still at 131.73 (1.0% 10-dma envelope). OAT and BTP futures are also around 40 ticks lower.

- The German and French curves have bear flattened, while periphery spreads to Bunds are mixed. The 10-year BTP/Bund spread is +1.2bps wider at 148.7bps, roughly in the middle of this week's range.

- A second appearance from ECB's Schnabel at 1300GMT/1400CET highlights the remainder of today's regional docket.

EQUITIES: Trend Condition in E-Mini S&P Resolutely Bullish

- The bull cycle in Eurostoxx 50 futures extended sharply early Thursday, with psychological resistance at 4800 cleared in style, and first modest resistance at 4548.00 cracking in the process. The intraday high of 4864.00 looks extended having pierced the 2.0% Upper Bollinger Band, however the outlook is resolutely bullish the longer these levels hold. The upleg reinforces current conditions. Moving average studies are in a bull-mode position, highlighting positive market sentiment.

- The trend condition in S&P E-Minis is resolutely bullish, with the upside trigger at 5066.50 giving way to new highs at 5107.75. This erases the pullback off last week’s highs, confirming S/T weakness as corrective. Support to watch lies at 4967.25, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. The trigger for a resumption of gains is 5107.75, the Feb 22 high.

COMMODITIES: WTI Futures Struggle to Make Clear Break of Key Short-Term Resistance

- Gains in WTI Futures off the Feb 5 low still appear corrective at these levels. Key short-term resistance has been defined at $78.52, the Feb 16 high - a level briefly pierced by the recovery off this week’s low. Clearance of this level would be a bullish development. On the downside, support to watch lies at $71.49, the Feb 5 low. A break of this level would reinstate the recent bearish theme and pave the way for a move towards $69.79, the Jan 3 low.

- Gold traded lower into mid-month, but is building well off lows and has pierced the 50-dma of $2031.71. Clearance here and above the Feb 1 high of $2065.50 would reinstate a bullish theme, with the mid-month weakness proving corrective in nature. Any reversal and continuation lower would open $1973.2, the Dec 13 low and the next key support.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2024 | 1300/1400 |  | EU | ECB's Schnabel speech at Forum Analysis | |

| 23/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/02/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/02/2024 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 23/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 26/02/2024 | 0800/0900 | ** |  | ES | PPI |

| 26/02/2024 | 0900/0900 |  | UK | BOE's Breeden at BOE agenda for Research Conference | |

| 26/02/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 26/02/2024 | 1100/1100 |  | UK | BOE's Pill at BOE Agenda for Research conference | |

| 26/02/2024 | 1500/1000 | *** |  | US | New Home Sales |

| 26/02/2024 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/02/2024 | 1600/1700 |  | EU | ECB's Lagarde participates in debate on ECB 2022 Report | |

| 26/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/02/2024 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.