-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Weakness Slows as Kanda Outlines Options

Highlights:

- Treasury curve flatter as debt ceiling lobbying begins

- JPY weakness stemmed on first FSA/BoJ/MoF meeting under Ueda

- Largest Italian auction of 2023 so far well digested thanks to strong demand

US TSYS: Bull Flatter With Corrective TY Bounce Amidst Low Volumes

- Cash Tsys have bull flattened after yesterday’s Memorial Day closure, although it’s an increasingly level flattening as the front end catches up. The general bid has been spurred by softer than expected Spanish inflation rather than any particular catch-up of the sizeable EU FI rally seen yesterday. Today sees notably heavy bill issuance.

- 2YY -5.6bp at 4.506%, 5YY -7.3bp at 3.854%, 10YY -7.7bp at 3.721%, 30YY -6.7bp at 3.894%.

- 2s10s trade at -78bps off an overnight low of -82.96bps that had touched the lowest since Mar 10 early on in SVB-spillover.

- TYM3 trades 18 ticks higher at 112-31 close to earlier highs of 113-00+ but which still haven’t troubled resistance at 113-12+ (May 25 high). The move higher is deemed a corrective bounce with still some focus on 111-31 (76.4% retrace of Mar 2-24 rally). Cumulative volumes of 125k track about half of recent averages.

- Data: FHFA and S&P CoreLogic house prices for Mar (0900ET), Conf Board consumer survey May (1000ET), Dallas Fed mfg index May (1030ET).

- Fedspeak: Barkin (’24 voter) at NABE webinar at 1300ET

- Bill issuance: US Tsy $63B 13W, $56B 26W bill auctions (1130ET), US Tsy $50B 161D CMB auction (1300ET)

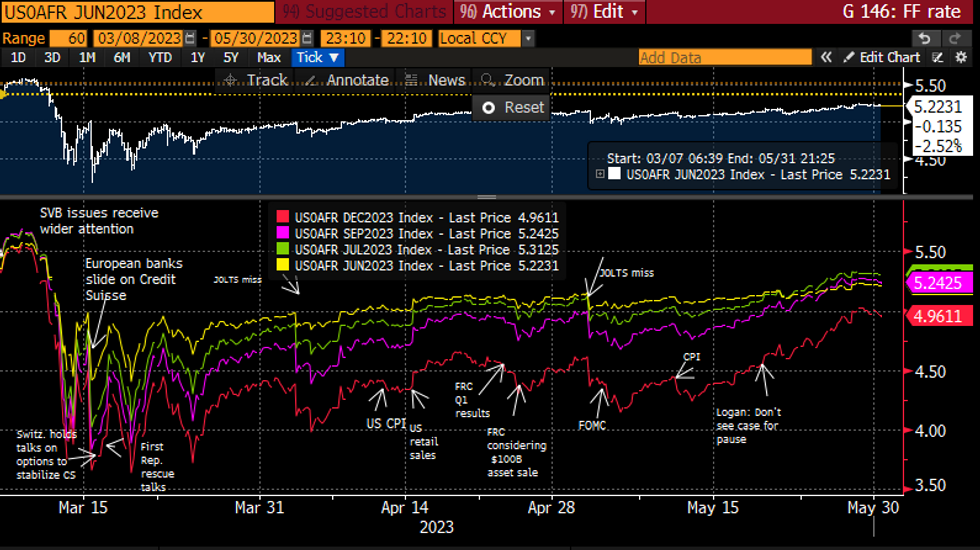

STIR FUTURES: Fed Rates Cool After Memorial Day, Not Quite Fully Pricing July Hike

- Fed Funds implied rates have nudged lower after on balance treading water in yesterday’s holiday-thinned trade, with a miss for Spanish inflation seeing some spillover.

- Pertinent points are a July hike not quite fully priced, whilst the 35bp of cuts from the 5.31% peak leaves only half a cut priced from current levels to year-end.

- Cumulative changes from 5.08% effective: +13.5bp Jun (-2.5bp from Fri close), +22.5bp Jul (-2bp), +15.5bp Sep (-3.5bp), +2.5bp Nov (-3.5bp), -12.5bp Dec (-4.5bp) and -29bp Jan (-6bp).

- Latest Fedspeak from Goolsbee (’23 voter) on Sunday echoed data dependence, which could limit the impact on Barkin (’24) speaking at 1300ET having already spoken on Thu. Barkin noted that the labor market is quite strong with labor demand for skilled trades still “crazy hot”, but that whilst demand isn’t cold it is cooling, helped in part by some marginal credit tightening.

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE

Italy auction results

A strong auction, despite being the largest of 2023 at a combined E11.0bln. The bid-to-covers were all healthy while all issues on offer today have moved higher post-auction with the three BTPs sold trading at a price in excess of that achieved at auction.

- E5bln of the 3.80% Aug-28 BTP. Avg yield 3.79% (bid-to-cover 1.4x).

- E2bln of the 4.4% May-33 BTP. Avg yield 4.24% (bid-to-cover 1.53x).

- E2.5bln of the 4.35% Nov-33 BTP. Avg yield 4.32% (bid-to-cover 1.43x).

- E1.5bln of the 0.80% Oct-28 CCTeu. Avg yield 4.38% (bid-to-cover 1.82x).

FOREX: USD/JPY Retreats From Cycle High as Kanda Warns Speculators

- USD/JPY printed a new cycle high of 140.93 in early European trade, but the pair backtracked following an unscheduled tri-party meeting held between the Japanese FSA, the Ministry of Finance and the Bank of Japan. Following the meeting, Japan's currency diplomat Kanda warned that the Ministry would take appropriate steps on currency markets if required, and outlined their intention to consider various options.

- Following recent weakness, GBP has turned higher in G10, rising against all others in G10 and putting GBP/USD within range of 1.2400 and the 50-dma at 1.2440. The pair saw support on the back of a slowdown in the BRC shop price index, which provided tentative signs of a peak in food prices - a particularly strong contributor to current UK inflation issues.

- The USD is fading into the NY crossover, coming off the better levels of the session as markets got a risk-on boost from China trade headlines. The Chinese trade ministry releaased a statement confirming the extension of tariff waivers on some US goods until the end of December, helping provide headline equity indices with some support ahead of the open.

- US consumer confidence and the Dallas Fed Manufacturing Activity Index makes up the data releases for the day, while ECB's Holzmann, Centeno and Villeroy are set to speak ahead of Fed's Barkin.

FX OPTIONS: Expiries for May30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0690-00(E1.7bln), $1.0770-85(E2.0bln)

- USD/JPY: Y135.85-00($966mln), Y136.50($628mln), Y138.00($725mln), Y138.50($541mln)

- GBP/USD: $1.2295-00(Gbp507mln)

- AUD/USD: $0.6550(A$507mln)

- NZD/USD: $0.6150(N$647mln)

- USD/CNY: Cny7.0400($500mln)

EQUITIES: Trend Condition in E-mini S&P Remains Bullish

- S&P E-minis trend conditions remain bullish. Last week’s bounce from 4114.00, May 24 low, means that support around the 50-day EMA remains intact. The average intersects at 4129.2 and a clear break of it is required to signal a reversal.

- Eurostoxx 50 futures managed to find support last week at 4252.00, the May 25 low. This means that for now, support around the 50-day EMA, which intersects at 4271.40, remains intact for now. A clear break of the average would expose 4233.00, May 4 low and a key short-term support.

COMMODITIES: WTI Falters at Resistance

- The latest pullback in WTI futures means that - for now - the contract has failed to overcome resistance at the 50-day EMA, which intersects at $74.24. Recent short-term gains are considered corrective, however, a clear breach of the 50-day EMA would highlight a stronger bullish theme.

- The bear cycle in Gold remains intact and the yellow metal is trading lower today. Price is through a key level at $1938.0, trendline support drawn from Nov 3 2022.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/05/2023 | 1230/0830 | * |  | CA | Current account |

| 30/05/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 30/05/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/05/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/05/2023 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 30/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 31/05/2023 | 2350/0850 | ** |  | JP | Industrial production |

| 31/05/2023 | 2350/0850 | * |  | JP | Retail sales (p) |

| 31/05/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 31/05/2023 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 31/05/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 31/05/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 31/05/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2023 | 0630/0730 |  | UK | DMO to Publish Gilt Op Calendar for Jul-Sep | |

| 31/05/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2023 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/05/2023 | 0800/1000 | *** |  | IT | GDP (f) |

| 31/05/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 31/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/05/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 31/05/2023 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2023 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2023 | 1230/1430 |  | EU | ECB Lagarde Q&A at Generation Euro Students' Awards | |

| 31/05/2023 | 1250/0850 |  | US | Boston Fed's Susan Collins | |

| 31/05/2023 | 1250/0850 |  | US | Fed Governor Miki Bowman | |

| 31/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/05/2023 | 1315/1415 |  | UK | BOE Mann Panellist at Pictet Family Forum | |

| 31/05/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 31/05/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 31/05/2023 | 1730/1330 |  | US | Philadelphia Fed's Pat Harker | |

| 31/05/2023 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 31/05/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 01/06/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.