-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Mixed, Focus on BoE

HIGHLIGHTS:

- Markets mixed, focus on BoE policy report

- Treasuries, core EGBs mildly stronger

- EUR/USD trading well, USD Index heading toward week's lows

US TSYS SUMMARY: Edging Higher Pre-Bank of England, Jobless Claims

Treasuries have traded a little stronger overnight, with front TYs nearing Tuesday's highs before easing off slightly.

- The 2-Yr yield is up 0.2bps at 0.1527%, 5-Yr is down 0.3bps at 0.7901%, 10-Yr is up 0.4bps at 1.5696%, and 30-Yr is up 0.5bps at 2.2471%. Jun 10-Yr futures (TY) up 3.5/32 at 132-21 (L: 132-17 / H: 132-23), on unremarkable volumes (~240k).

- Asia-Pac were sellers of cash Tsys at the re-open (the first round of cash trade during Asia-Pac hours for the week owing to holidays), but steepening largely reversed in European trade.

- Immediate global focus is on the Bank of England decision at 0700ET (possible asset purchase taper). US Equity futures are flat but have traded in a fairly wide range; w USD weaker (DXY -0.3%).

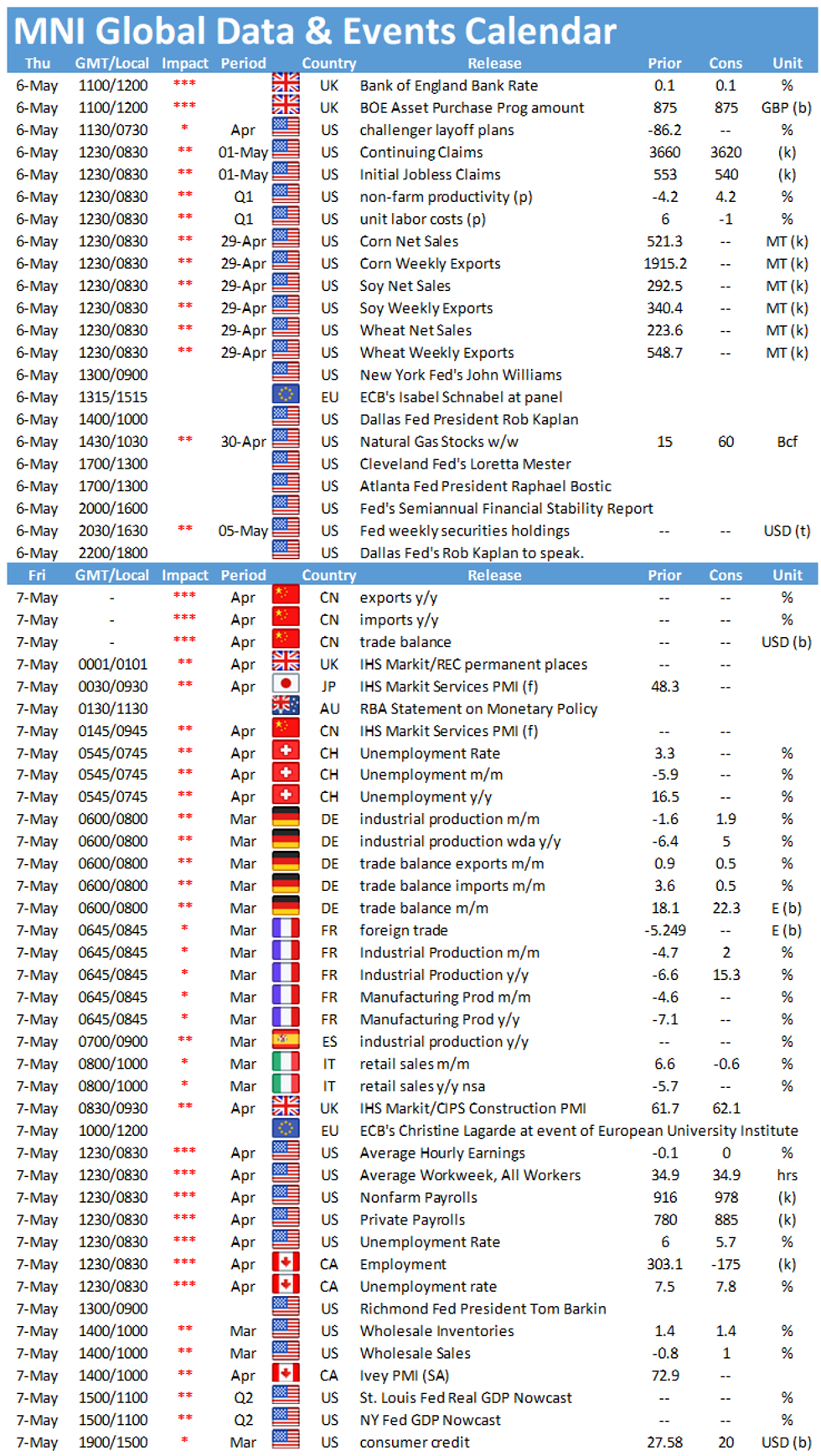

- A jobs data-focused couple of sessions begins w Apr Challenger job cuts at 0730ET, followed by weekly jobless claims at 0830ET, ahead of Friday's nonfarms.

- The parade of Fed speakers continues: NY Fed's Williams at 0900ET, Dallas' Kaplan at 1000ET, and Cleveland's Mester at 1300ET. We've heard from all of them - and in some depth - this week already though. Fed Fin Stab report out at 1600ET.

- In supply, $80B of 4-/8-week bills auctioned at 1130ET. NY Fed buys $1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY: Gilts/Core EGBs Bid Ahead of BoE

Gilts and core EGBs have traded firmer heading into today's BoE meeting, alongside uneven trading in equities and broad G10 FX gains against the USD.

- Gilts yields are 1-2bp lower with the curve 1bp flatter.

- The bund curve has similarly bull flattened with the 2s30s spread 1bp narrower.

- OAT yields have edged down 1-2bp.

- BTPs started on a strong footing before giving up early gains with the short-end/belly of the curve trading close to unch on the day.

- The BoE decision is announced at 1200GMT. No change in the main policy instruments are expected. The market will be focused on any communication around the pace of weekly asset purchases.

- Bilateral relations between the UK and France continue to deteriorate with the former sending patrol vessels to the coast of Jersey following a dispute over access to fishing waters for French fisherman.

- Supply this morning came from France (OATs, EUR10.36bn) and Spain (Bono/Oblis/ObliEi, EUR5.443bn).

EUROPE ISSUANCE UPDATE

France Sells E10.355bn of OATs

- E6.810bn of the 0% Nov-31 OAT: average yield 0.13% (Prev. 0.00%%), bid-to-cover 1.73x (Prev. 1.65x)

- E1.800bn of the 0.50% May-40 OAT: average yield 0.62% (Prev. 0.43%), bid-to-cover 2.51x (Prev. 2.30x)

- E1.745bn of the 0.75% May-52 OAT: average yield 0.93% (Prev. 0.78%), bid-to-cover 2.25x (Prev. 2.30x)

Spain Sells Combined E5.443bn of Bono/Oblis/ObliEi

- E1.330bn of the 0% Jan-26 Bono: Average yield -0.240% (Prev. -0.29%), bid-to-cover 2.08x (Prev. 1.64x)

- E1.942bn of the 0.10% Apr-31 Obli Average yield 0.433% (Prev. 0.37%), bid-to-cover 1.62x (Prev. 1.92x)

- E1.662bn of the 1.00% Oct-50 Obli: Average yield 1.045% (Prev. 1.30%), bid-to-cover 1.25x (Prev. 1.55x)

- E509mn of the 0.70% Nov-33 ObliEi: Average yield -0.802% (Prev. -0.91%), bid-to-cover 1.58x (Prev. 1.61x)

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

3RZ1 100.37/99.50 RR, bought the put for half in 20k (ref 100.125)

3RZ1 99.87/75/62/32 broken put condor, bought for 0.5 in 2.5k

RXM1C 172C trade for 17 in 5k (Some suggest sold)

FOREX: Markets Mixed, EUR/USD The Standout

- Currency markets are mixed early Thursday, with EUR/USD strength the most notable move so far. The pair is narrowing the gap with the 100-dma resistance at 1.2049. A break and close above here opens gains towards the week's highs of 1.2076 and the 1.2087 Fib retracement.

- Norway opted to keep policy unchanged this morning, alongside expectations. The accompanying statement continued to nudge markets toward the likelihood of a rate hike in the second half of 2021. EUR/NOK was unmoved, with prices holding just below the week's highs of 10.0455.

- Focus turns to the Bank of England rate decision and Monetary Policy Report, at which markets will be watching for any clues over the future trajectory of the BoE's asset purchase programme.

- The Turkish central bank rate decision is also due, with the Bank seen keeping rates unchanged. Weekly jobless claims numbers are the data highlight.

FX OPTIONS: Expiries for May06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-15(E525mln), $1.1850-65(E703mln), $1.1875-85(E573mln), $1.1900-05(E511mln), $1.2000-20(E1.8bln), $1.2025-35(E630mln), $1.2050-55(E737mln), $1.2100-20(E1.3bln)

- USD/JPY: Y107.00-15($1.2bln), Y107.80-00($676mln), Y108.80-00($1.0bln), Y109.60-80($1.2bln)

- GBP/USD: $1.4000(Gbp711mln)

- AUD/USD: $0.7700-20(A$705mln), $0.8000(A$1.0bln-AUD puts)

- NZD/USD: $0.7000(N$577mln)

- USD/CAD: Cny6.45($1.4bln-USD puts)

Price Signal Summary - E-mini S&P Holding Above Support

- In the equity space, S&P E-minis have pulled back from recent highs. Support levels to watch are; 4110.50, Apr 20 low and trendline support that intersects at 4108.75, drawn off the Mar 4 low. This support zone will likely determine the outcome of this correction - will it be a shallow one if support holds or develop into a deeper pullback on a break?

- In FX, EURUSD is firmer today however a near-term bearish risk remains present. Last week the pair failed to confirm a clear break of the bear channel resistance drawn off the Jan 6 high. The subsequent sell-off is bearish. Watch support at, 1.2013/1989, the 20- and 50-day EMAs. This support zone has been probed, a clear break would open 1.1943, Apr 19 low. GBPUSD is consolidating. The pair remains below 1.4009, Apr 20 high. The break on Apr 30 of support at 1.3824, Apr 22 low highlights a bearish risk. The focus is on 1.3717, Apr 16 low. USDJPY maintains a bullish tone following last week's gains. Attention is on 109.96 next, Apr 9 high.

- On the commodity front, the Gold outlook is bullish and the focus is on $1805.7, Feb 25 high. Watch key short-term support at $1756.2, Apr 29 low. The Brent (N1) uptrend remains intact. The focus is on the psychological $70.00 level and $71.75, Jan 8 2020 high (cont). WTI bulls are eyeing the key resistance at $67.29, Mar 8 high.

- In the FI space, Bunds (M1) have recently breached 170.05, 76.4% of the Feb 25 - Mar 25 rally. This opens 169.24, Feb 25 low. Short-term gains are considered corrective. Short-term risk in Gilts is skewed to the downside. The next support and intraday bear trigger is at 127.32, Apr 1 low.

EQUITIES: Muted Open, S&P Futures Parameters Unchanged

- Equity markets across Europe and the US are broadly unchanged, with most indices just either side of the Wednesday close.

- The consumer staples sector is modestly outperforming, with utilities and materials also (just) in positive territory. Gains are being moderated by weakness in tech and consumer discretionary names.

- Directional parameters for the e-mini S&P remain unchanged at 4211.00, the Apr 29 high and the 20-day EMA support at 4135.03.

COMMODITIES: Oil Moderating, Futures Curve Still Strong

- The oil rally is moderating ahead of the Thursday open, with both WTI and Brent crude futures in negative territory. The move lower in oil comes despite the downside in the greenback this morning, which is unwinding some of the strength seen earlier in the week.

- Gold's recovery off the $1770.51 Wednesday low is intact, with prices topping $1790 to target the week's best levels of $1799. A break and close above here as well as the 100-dma would improve the outlook and resume the April uptrend.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.