-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - Markets Poised for Disappointment?

HIGHLIGHTS:

- Focus turns to Aug payrolls, analysts expect 725k jobs added

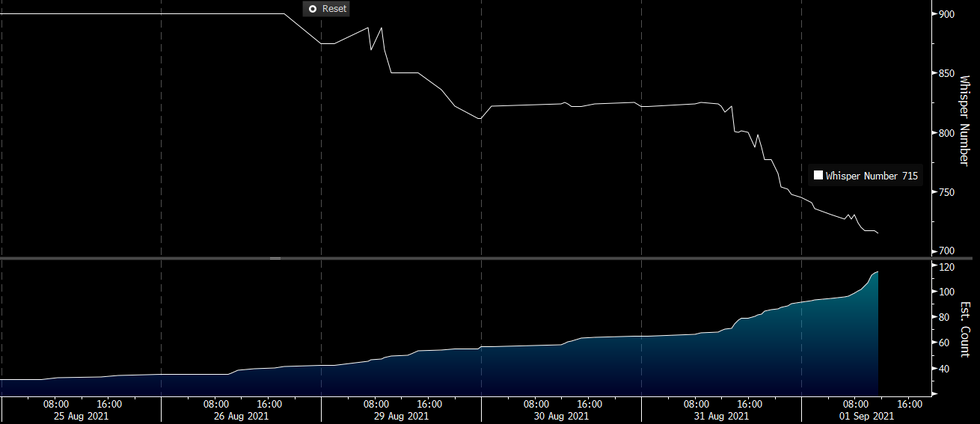

- Markets appear poised for a lower-than-expected reading, with whisper number drifting

- USD Index extends near-term weakness

US TSYS SUMMARY: Focus on August Employ Data

Tsys trading mildly weaker, low end narrow range with 30Y Bond leading move ahead eagerly awaited August employ report ahead extended holiday weekend:- August nonfarm payroll survey change median is +725k on a range of 400k to 1M, with average 707k and standard deviation 137k (suggesting a 570k to 844k figure would be roughly within expectations). Current "whisper" estimate from Bbg: +677k.

- According to JPM: "All U.S. payroll releases since 2007 that coincided with an early market close before the U.S. July 4th holiday the Treasury market is 1.5 times to 2 times more volatile than the average payrolls report day."

- Tsy yield curves modestly steeper (5s30s +.339 at 113.445), overnight trade volumes rather modest (TYZ<165k). EGBs little weaker as well, sov spds wider w/Bund/BTP +1.8 at 107.1/mid.

- Equities not far off new all-time highs overnight (ESU1 4545.75) Gold gaining (+3.65), US$ near steady (DXY 92.234).

- Two-way overnight flow say slightly better prop and fast$ selling intermediates during early London hours, some option trades in 5Y puts.

- The 2-Yr yield is up 0.2bps at 0.208%, 5-Yr is up 1.4bps at 0.7788%, 10-Yr is up 1.7bps at 1.3004%, and 30-Yr is up 1.7bps at 1.914%.

Nonfarm Payrolls: Expect Bear Flattening On A Beat

August nonfarm payroll survey change median is +725k on a range of 400k to 1mn, with average 707k and standard deviation 137k (suggesting a 570k to 844k figure would be roughly within expectations). Current whisper +677k.

- A decent beat (850k+) would probably be more surprising than a miss. We've already seen some downside in yields after disappointing ADP / ISM manuf employment this week, and the "whisper" number has declined by more than 100k to 718k since those releases.

- On an upside surprise we'd expect an outsized reaction in the belly of the curve as it's been the most sensitive area to Fed funds liftoff. And perception of liftoff timing has depended closely on a) taper timeline and b) the dot plot, the upcoming September edition of which could well be influenced in a hawkish direction by a strong NFP beat.

- CFTC COT data suggests that net positioning in 5Y futures has moved to close to its largest net longs in at least 12 months, with 2Y and 10Y Ultra longs being trimmed: a setup for a payrolls 'beat' to trigger bear flattening.

- A modest 'miss' (~550-600k) would merely be in line with most of August's disappointing data, and wouldn't change the taper timeline much, perhaps extending the start by another meeting or so (so announcement in December for January start, as opposed to November for December start). Especially after Powell dialed back expectations of a September taper announcement last week.

Bloomberg "Whisper" Survey For Aug Nonfarm Payroll ChgSource: BBG

Bloomberg "Whisper" Survey For Aug Nonfarm Payroll ChgSource: BBG

EGB/GILT SUMMARY: Inching Lower Ahead of NFP

European government bonds have traded weaker this morning with gilts underperforming and equities and FX mixed.

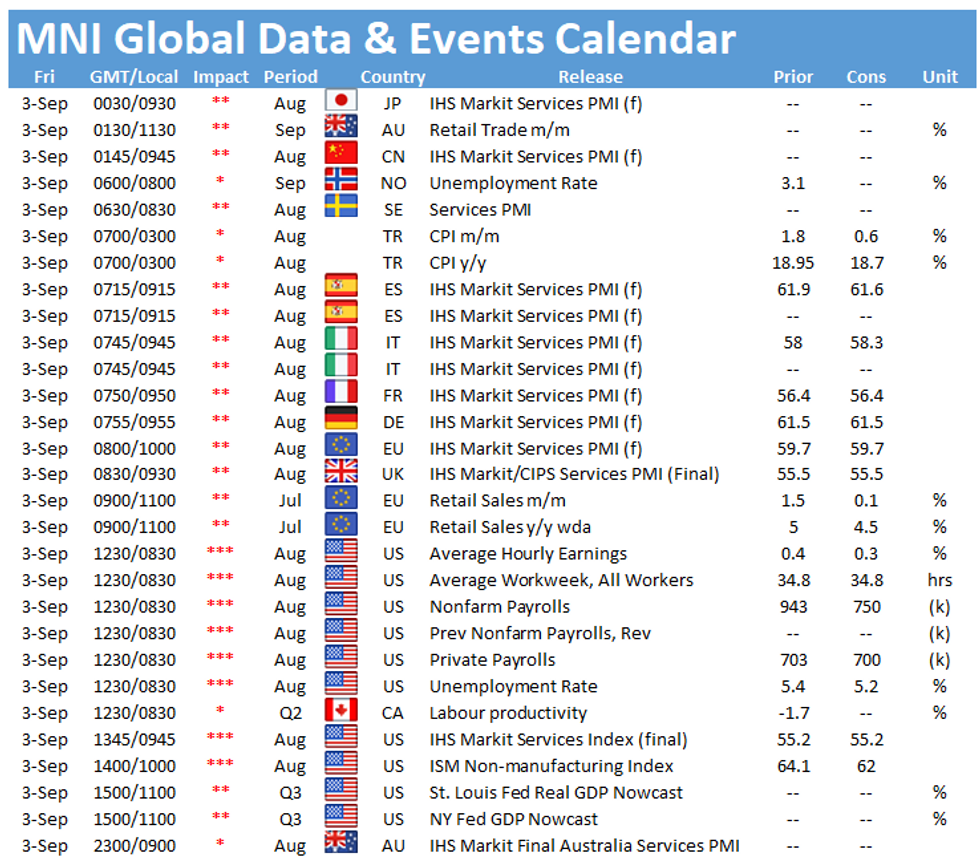

- Final European services PMI data were broadly in line with original estimates. Focus today will be on US NFP.

- Supply this morning came from the UK (Bills, GBP3bn).

- Gilts initially opened a firm footing but soon started to sell off, with the longer end of the curve underperforming. Cash yields are 1-2bp higher with the curve 1bp steeper.

- Bunds have similarly sold off following a strong start, with yields now hovering around yesterday's close.

- OATs are now unchanged on the day.

- BTPs have undperformed core EGBs with yields broadly 1-3bp higher on the day.

- The ECB will take centre stage next week. Indications from GC members on the possibility of a PEPP adjustment have been mixed, with the genuinely positive economic outlook competing with concerns over the Delta variant.

FOREX: Final Jobs Report Ahead of Sep FOMC

- Nonfarm payrolls take focus going forward, with markets expecting a decent read of 725,000 jobs added. While this would be below last month's 943,000, the number remains highly elevated above pre-pandemic levels. The dispersion around the median estimate remains considerable, with a range of forecasts between 400k - 1mln, which could suggest a decent market response later today.

- Ahead of the figure, Scandi FX trades weaker, but well within the recent range and AUD continues its recent spell of outperformance. AUD/USD now trades higher on the week by close to 2%, with the pair topping out at a new multi-month high. AUD strength continues to defy broader commodity markets, with Dalian-listed iron ore still nursing losses of over 10% from Monday's high after the China authorities' pledge to pressure prices.

- Outside of the jobs release, the ISM Services Index also crosses. There are no central bank speakers of note.

FX OPTIONS: Expiries for Sep03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-65(E942mln), $1.1850-55(E770mln), $1.1865-85(E2.1bln)

- USD/JPY: Y108.90-00($708mln), Y109.65-85($1bln), Y110.00($1.3bln), Y110.20($510mln)

- AUD/USD: $0.7280(A$790mln), $0.7350-70(A$1.6bln)

- USD/CAD: C$1.2500($892mln), C$1.2550($1bln)

Price Signal Summary - S&P E-Minis Continue To Climb

- On the equity front, S&P E-minis are trading higher once again into uncharted territory. With bullish conditions firmly in place, the focus is on 4580.21, 1.382 projection of the Jun 21 - Jul 14 - 19 price swing. EUROSTOXX 50 remains firm following this week's break of 4238.50, Aug 13 high. This confirms a resumption of the uptrend and opens 4294.20, 1.236 projection of the May 13 - Jun 17 - Jul 19 price swing.

- In the FX space, EURUSD maintains a firmer tone and is holding above its 50-day EMA. An extension would set the scene for a climb towards 1.1909, Jul 30 high and a key short-term resistance. Firm support to watch is 1.1735, Aug 20 low. Initial support is at 1.1788, the 20-day EMA. GBPUSD rallied yesterday and has moved above its 50-day EMA, at 1.3824. The break signals potential for a stronger recovery towards 1.3888 next, Aug 11 high. Initial firm support is at 1.3680. AUDUSD has continued to rally this morning and has probed 0.7427, Aug 4 high. This opens 0.7449, 50.0% retracement of the May - Aug sell-off.

- On the commodity front, Gold is consolidating but the outlook remains bullish with the focus on $1834.1, Jul 15 high and the next bull trigger. WTI bullish conditions remain intact. The focus is on $70.74, 76.4% of the Jul 30 - Aug 23 sell-off. Support is seen at $67.12, Sep 1low.

- In FI, Bund key trendline support at 175.2 today remains exposed. The trendline is drawn from the May 19 low and a break would strengthen bearish conditions. Bulls will be looking for the trendline to hold. Gilt futures cleared support earlier this week at 128.33, Aug 12 low and 128.24, Aug 12 low. The break lower strengthens a bearish case and signals scope for 128.03, the Jul 6 low (cont).

EQUITIES: Mixed, But Rangebound Pre-Payrolls

- The Asia-Pac session finished mixed, with the Nikkei 225 finishing with gains of over 2%, while the Hang Seng and CSI 300 both finished lower. This fed through into a mixed European open, with indices remaining either side of unchanged at the NY crossover. The UK's FTSE-100 is just above water, while the French CAC-40 is off 0.4%.

- US futures are slightly bucking the trend, with all three major futures contracts in positive territory, with the E-mini S&P managing to touch a fresh alltime high in the process. The contract has printed alltime highs in eight of the past ten sessions.

COMMODITIES: WTI-Brent Spread Resumes Widening

- Having approached the widest spread of 2021 earlier in the week, markets had closed the gap between WTI and Brent over the past few sessions, but the trend has resumed ahead of the Friday NYMEX open.

- Brent is outperforming modestly, with prices touching their best levels since early August. This opens gains toward next resistance at the $74.84 Jul 30 high and the bull trigger beyond at $75.20.

- Precious metals markets are more muted, with gold and silver both in minor positive territory as the USD remains within the near-term downtrend. This keeps the first upside gold level at $1823.3, the Aug 30 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.