-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - More Muted Trade After Last Week's Volatility

HIGHLIGHTS:

- Treasury curve trades bear flatter ahead of 3-year supply

- Tesla pullback restrains headline equity indices

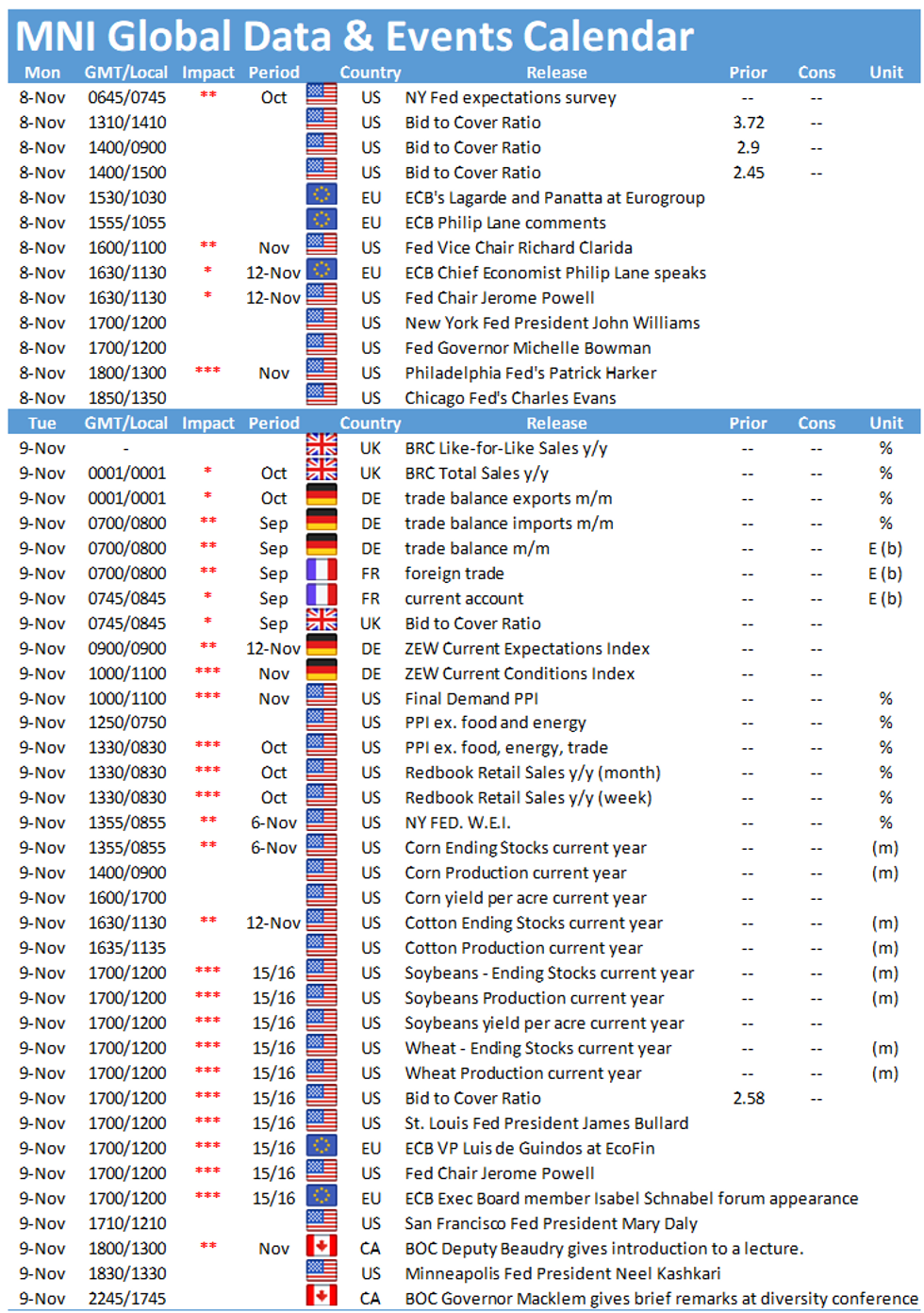

- Data calendar light, CB speaker slate busy

US TSYS: Bear Flattening Ahead Of 3Y Supply

Treasuries have edged lower from Friday's highs, with some bear flattening in the curve to start the week.

- The 2-Yr yield is up 3.2bps at 0.4327%, 5-Yr is up 3.4bps at 1.0894%, 10-Yr is up 3bps at 1.481%, and 30-Yr is up 2bps at 1.9068%. Dec 10-Yr futures (TY) down 9.5/32 at 131-17 (L: 131-15 / H: 131-25.5).

- While there's no major data out Monday (this week's focus is CPI Weds), we hear for the first time from several FOMC participants since last week's meeting.

- VC Clarida speaks at 0900ET (on monetary policy); Powell at 1030ET (at a Fed diversity conference); Philly's Harker (at Econ Club of NY) and Gov Bowman (on the housing market) at 1200ET ; and Chicago's Evans at 1350ET (on econ outlook and mon pol).

- The other highlight comes in supply, with $56B 3Y Note auction at 1300ET. There's also $93B combined of 13-/26-week bills at 1130ET.

- NY Fed buys $2.025B of 22.5-30Y Tsys.

EGB/GILT SUMMARY: More Muted Start, CB Speakers Eyed

- Following the acute volatility across bond markets last week, Monday has been somewhat calmer with equity markets mixed and moves in core fixed income more muted.

- Across the Eurozone inflation breakevens have picked up as energy prices rise once more (with renewed concerns about Russian supply). Despite more negligible increases in breakevens in the US and UK, Bunds continue to outperform in core income space on the day.

- Having said that, there are some interesting curve dynamics at play with the German and UK curves steepening a little, but the UST curve flattening.

- The Monday data slate is bereft of any tier one releases, keeping focus on the busier speaker slate which includes Fed's Powell, Clarida, Harker, Bowman and Evans as well as BoE's Bailey and ECB's Lane.

EGB OPTION FLOW SUMMARY

Eurozone:

RXZ1 169/168ps, bought for 9 in 3kRXZ1 168.5p, bought for 10 in 1k

2RZ1 100/99.75ps vs 100.25c, bought the ps for half in 1.5k

2RH2 99.75/99.62ps vs 100.37c, bought the ps for -0.5 (receive), in 2k

ERZ2 100.25/100.15ps, sold at 2.5 in 10k3RZ1 99.75p, bought for 2 in 1.25k

UK:

0LZ1 98.25p, bought for half in 4.1k

US:

TYZ1 130.75/130.25/129.75p fly, bought for 1 in 1k

FOREX: GBP Vols Remain Perky After Last Week's Downtick in Spot

- Sterling remains soft following last week's BoE bait-and-switch, with GBP among the poorest performers so far in G10. GBP/USD remains above last Friday's lows of 1.3424 which forms first support along which the late September print of 1.3412. GBP vols remain perky, with the 1m implied contract inching higher again early Monday to clear 7 points.

- At the other end of the table, NZD and NOK make up Monday's modest outperformers, with strength across commodities markets assisting high beta and growth proxy currencies higher.

- US equity futures trade higher ahead of the Monday bell, with the exception of the tech-led NASDAQ future, which trades softer as Tesla shares dip over 5% pre-market on Musk's tweet warning he could sell 10% of his stake in the company driving prices lower.

- The Monday data slate is bereft of any tier one releases, keeping focus on the busier speaker slate which includes Fed's Powell, Clarida, Harker, Bowman and Evans as well as BoE's Bailey and ECB's Lane.

Price Signal Summary - Equity Space Sentiment Remains Bullish

- In the equity space, the uptrend in the S&P E-minis remains intact and underlying sentiment is still clearly bullish. The focus is on 4717.00 next, 1.50 projection of the Jul 19 - Aug 16 - Aug 19 price swing. The EUROSTOXX 50 futures trend needle continues to point north. The focus is on 4371.00, 1.236 projection of Jul 19-Sep 6-Oct 6 2020 swing (cont)

- In FX, EURUSD traded below support at 1.1524 Friday, the Oct 12 low. This reinforces the current bearish theme and signals a resumption of the downtrend within its bear channel drawn from the Jun 1 high. The focus is on1.1493, 50.0% retracement of the Mar '20 - Jan '21 bull phase. GBPUSD remains vulnerable following last week's bearish pressure. The pullback has exposed the next key support at 1.3412, Sep 29 low. Thursday's strong rally in EURGBP and Friday's gains have exposed 0.8598, 76.4% retracement of the Sep 29 - Oct 26 sell-off and 0.8658 further out, Sep 29 high. USDJPY remains below recent highs but above support at 113.00, the Oct 12 low. A break of the support would signal scope for a deeper pullback. The trend for now remains up and the bull trigger is at 114.70, Oct 20 high.

- On the commodity front, Gold reversed course Thursday and ended last week on a firm note. The turnaround reinstates a bullish theme and opens $1834.0, Sep 3 high. Last week's sell-off in WTI resulted in a breach of $80.58, Oct 28 low and the contract cleared the 20-day EMA. Despite the most recent recovery, the 50-day EMA at $77.33 remains exposed. Key resistance has been defined at $85.41, Oct 25 high. The initial resistance to watch is $83.42, high Nov 4.

- In the FI space, short-term gains in Bund futures traded higher last week and breached former resistance at 169.83, Oct 27 high. Note too that futures have also cleared the 50-day EMA. This opens 171.95, 61.8% of the Aug - Nov sell-off. Gilts maintain a firmer tone and the recent double bottom reversal continues to play out. The focus is on 127.69 next, Sep 21 high.

EQUITIES: Tesla Drop Weighs On US Futures

- Asian markets closed mixed, with Japan's NIKKEI down 104.52 pts or -0.35% at 29507.05 and the TOPIX down 6.2 pts or -0.3% at 2035.22. China's SHANGHAI closed up 7.063 pts or +0.2% at 3498.631 and the HANG SENG ended 106.74 pts lower or -0.43% at 24763.77

- European equities are mixed as well, with the German Dax down 19.04 pts or -0.12% at 16035.49, FTSE 100 up 3.04 pts or +0.04% at 7306.17, CAC 40 up 11.9 pts or +0.17% at 7053.09 and Euro Stoxx 50 down 5.84 pts or -0.13% at 4356.97.

- U.S. futures are flat, with the Dow Jones mini up 66 pts or +0.18% at 36281, S&P 500 mini up 1.25 pts or +0.03% at 4691.5, NASDAQ mini down 17 pts or -0.1% at 16334.75.

COMMODITIES: Energy Prices Lead The Way Higher

- WTI Crude up $1.29 or +1.59% at $82.58

- Natural Gas up $0.09 or +1.7% at $5.604

- Gold spot down $1.52 or -0.08% at $1815.88

- Copper up $0.85 or +0.2% at $435.05

- Silver up $0.03 or +0.11% at $24.1718

- Platinum up $4.52 or +0.44% at $1040.25

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.