-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - National Insurance Cut Expected at Core of UK Budget

Highlights:

- National insurance cut expected to take centre stage of UK budget

- JPY vols notched higher BoJ NIRP exit chatter picks up

- Powell testimony, Bank of Canada decision in spotlight Wednesday

US TSYS: Yields Lift Slightly With Markets Primed For Powell (and Less So JOLTS)

- Cash Tsy yields are 0.5-1.5bp higher today, pulling further off the decline seen after the US ISM services miss but still well within yesterday’s range. UK fiscal speculation and Chinese easing expectations have helped set the early narrative.

- Attention now shifts to Powell’s semi-annual testimony, with data interest from JOLTS plus some spillover potential from the BoC decision.

- TYM4 holds near the bottom of narrow ranges at 111-04 (- 05+) with cumulative volumes slightly below recent starts of sessions at 280k. Yesterday’s high of 111-15 cleared resistance at the 50-day EMA of 111-06, which if it holds would highlight a bullish reversal that could open 111-27 initially (50% retrace of Feb 1-23 bear leg).

- Data: Weekly MBA mortgage data (0700ET), ADP employment Feb (0815ET), JOLTS report Jan (1000ET, Wholesale sales/inventories Jan/Jan final (1000ET).

- Fedspeak: Powell’s testimony to the House (1000ET), Daly keynote address (1200ET), Fed’s Beige Book (1400ET) and Kashkari (1615ET).

- Bill issuance: US Tsy $60B 17W bill auction (1130ET)

FED: Powell In The Spotlight – Reinforcing Patience, Watching Potential QT Clues

- The text for Chair Powell’s testimony is to be released at an unknown time ahead of his 1000ET appearance in front of the House, although as we noted yesterday, prior House appearances have recently seen a 0830ET text publication.

- Powell used the Jan 31 FOMC press conference to set a high bar for a March cut. See a recap here: https://roar-assets-auto.rbl.ms/files/59780/FedReviewJan2024.pdf

- Payrolls and CPI have since come in notably stronger than expected, albeit for January with seasonality likely at least partly distorting the underlying trend.

- Subsequent Fedspeak has for the most part called for patience before starting rate cuts in a careful manner, whilst some including NY Fed’s Williams have looked to maintain flexibility by rejecting the need to move at end-quarter meetings with the SEP.

- This patience was emphasized in last week’s Monetary Policy Report “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

- With Powell expected to echo this sentiment, greater attention could be on any insights ahead of the upcoming QT discussion. Powell at the Jan presser on QT tapering: "we had some discussion of the balance sheet" at this meeting - as expected - though Powell cast doubt on a QT taper announcement as soon as March and/or initiation soon thereafter ("We are planning to begin in-depth discussions of balance sheet issues at our next meeting in March.")

- Dallas Fed’s Logan, viewed in high regard on QT discussions, last week reiterated her desire for slowing the pace of QT as ON RRP balances declined near zero in order to ensure that ample reserves remained in the system to effectively and efficiently manage the policy rate under the floor system. As Deutsche Bank write, this is “an operating regime that some in Congress routinely voice their criticisms at the semi-annual monetary policy testimonies.”

STIR: Almost 90bp Of Fed Cuts For 2024 With Powell's Testimony Eyed

- Fed Funds implied rates hold yesterday’s decline for back closer to where they started the US session on Monday, eyeing Chair Powell’s semi-annual testimony to the House.

- Cumulative cuts: 0.5bp Mar, 6bp May, 21.5bp Jun, 36bp Jul and 88bp Dec.

- His appearance gets underway at 1000ET but text is published at an unknown time (although historical precedent sees us lean to a 0830ET release and failing that 1000ET) -- we will write more on Powell shortly.

- The actual appearance will also land with the JOLTS report for January, watched to see if the strength in the bumper payrolls report for the month is evident here as well.

- Daly (’24) follows with a keynote address at 1200ET (incl text) before the Fed’s Beige Book at 1400ET and Kashkari (non-voter) at a WSJ event at 1615ET. Daly said Feb 29 that she wants to avoid holding rates all the way to 2% inflation but inflation can get stuck if we cut too quickly.

US TSYS: OI Points To Mix Of Long Setting & Short Cover On Tuesday

The combination of yesterday's rally in Tsy futures and preliminary OI data points to a mix of net long setting and short cover across the curve on Tuesday.

- Net long setting seemed to be seen in TY, US & WN futures, while net short cover was seemingly seen in TU, FV & UXY futures.

- Net long setting was the dominant factor in broader net curve terms.

- A reminder that continued weakness in Apple shares and a relatively soft ISM services survey were seen as the major drivers of yesterday's rally.

| 05-Mar-24 | 04-Mar-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,605,741 | 3,616,619 | -10,878 | -425,885 |

| FV | 5,804,285 | 5,814,427 | -10,142 | -438,067 |

| TY | 4,277,161 | 4,262,002 | +15,159 | +1,006,123 |

| UXY | 2,046,385 | 2,049,191 | -2,806 | -251,723 |

| US | 1,457,388 | 1,443,855 | +13,533 | +1,810,997 |

| WN | 1,588,231 | 1,586,455 | +1,776 | +376,564 |

| Total | +6,642 | +2,078,010 |

STIR: OI Points to Net Long Setting & Short Cover In SOFR Futures On Tuesday

The combination of yesterday's rally in SOFR futures and preliminary OI data points to net long setting in the whites and blues and net short cover in the reds and greens.

- Some exceptions were seen when inspecting on a contract-by-contract level, but those were the broader trends.

- Net long setting in SFRH4 & SFRZ6, along with the net short cover in SFRH6, caught the eye.

- A reminder that continued weakness in Apple shares and a relatively soft ISM services survey were seen as the major drivers of yesterday's rally.

| 05-Mar-24 | 04-Mar-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,227,640 | 1,227,438 | +202 | Whites | +29,830 |

| SFRH4 | 1,090,370 | 1,072,710 | +17,660 | Reds | -2,268 |

| SFRM4 | 1,089,728 | 1,082,842 | +6,886 | Greens | -12,197 |

| SFRU4 | 876,833 | 871,751 | +5,082 | Blues | +14,534 |

| SFRZ4 | 1,099,675 | 1,101,467 | -1,792 | ||

| SFRH5 | 674,921 | 673,720 | +1,201 | ||

| SFRM5 | 717,576 | 716,976 | +600 | ||

| SFRU5 | 657,716 | 659,993 | -2,277 | ||

| SFRZ5 | 702,869 | 703,403 | -534 | ||

| SFRH6 | 473,751 | 484,924 | -11,173 | ||

| SFRM6 | 477,969 | 481,833 | -3,864 | ||

| SFRU6 | 336,252 | 332,878 | +3,374 | ||

| SFRZ6 | 328,480 | 313,212 | +15,268 | ||

| SFRH7 | 190,122 | 191,996 | -1,874 | ||

| SFRM7 | 182,910 | 180,910 | +2,000 | ||

| SFRU7 | 148,495 | 149,355 | -860 |

FED: Powell Text for House Appearance Perhaps at 0830ET

There is no publicly known time for the publication of Chair Powell’s prepared remarks for his testimony before the House at 1000ET. Of the past eight, four have been released at the same time as the scheduled start, one has been 1 hour prior, two 1.5 hours prior and one 3.5 hours prior. However, there does however appear to be a pattern of a text release at 0830ET when it comes to speaking to the House first before the Senate on Thu, as is the case for this Congressional round.

- Jun 23 – House then Senate. Appearance 1000ET. Text 0830ET -- 1.5hrs early

- Mar 23 – Senate then House. Appearance 1000ET. Text 1000ET -- same time

- Jun 22 – Senate then House. Appearance 0930ET. Text 0930ET -- same time

- Mar 22 – House then Senate. Appearance 1000ET. Text 0830ET -- 1.5hrs early

- Jul 21 – House then Senate. Appearance 1200ET. Text 0830ET -- 3.5hrs early

- Feb 21 – Senate then House. Appearance 1000ET. Text 1000ET -- same time

- Jun 20 – Senate then House. Appearance 1000ET. Text 1000ET -- same time

- Feb 20 – House then Senate. Appearance 0930ET. Text 0830ET – 1hr early

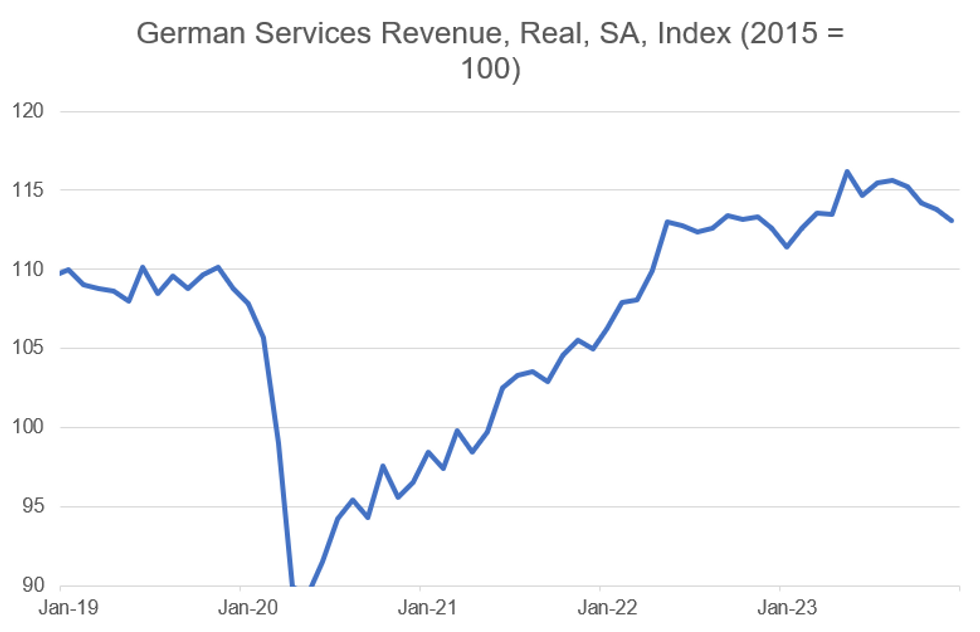

GERMANY: Services Sector Weakness Becoming More Apparent

Turnover in German services sectors (excl. finance and insurance) weakened further in December, coming in at -0.6% M/M (vs -0.4% prior). On a yearly comparison, turnover is still up, however, at +0.4% Y/Y (vs +0.4% prior).

- Those figures, which are reported by Destatis in real (inflation adjusted) and seasonally adjusted terms, represent the fourth monthly decline in a row. The 3M/3M measure came in at -1.5% (vs -0.8% prior), the third decline after 6 consecutive positive prints.

- Furthermore, looking at the index level, a downtrend appears to be forming (see the chart below).

- In spite of this weakness through the end of 2023, as a whole, the year printed an all-time high and +2.0% Y/Y (real, but not seasonally- and calendar-adjusted).

- Services had been relatively resilient compared to the manufacturing sector in Germany, but the weakness which started to emerge at the beginning of autumn last year seems to continue with survey data showing little enouragement.

- Activity implied by the German Services PMI has remained in contractionary territory since December, coming in at 48.3 in February (47.7 Jan, 49.3 Dec). The latest release cited "tight financial conditions, client uncertainty and associated weakness in the wider economy (particularly the manufacturing and construction sectors)", with the new business category printing a contraction for the eighth consecutive month. The IFO services subbalance also printed in contractionary territory since mid-2023 (-4.1 Feb, -4.8 Jan).

- Note that services ex financial and insurance accounts for roughly 2/3 of German GVA.

MNI, Destatis

MNI, Destatis

FOREX: JPY Bumped Higher as Reports See BoJ NIRP in the Balance at March Meeting

- JPY price action has been front-and-centre for markets across Wednesday morning, with a series of exclusive reports from MNI and Jiji further raising speculation of an exit from negative interest rate policy as soon as the March meeting. The headlines were met with JPY strength, which pressed USD/JPY to new pullback lows at 149.33 before stabilising.

- Two-week JPY vols, now capturing the outcome of the March 19th BoJ decision, are further bid, adding to yesterday's rally to touch 9.3 points and the highest level since early February. This tips 2w vols above the YTD average, but still just shy of the 12m rolling 2w vol. OIS markets now price a ~50% chance of a 10bp March hike (vs. 30% yesterday), with a BoJ exit from NIRP now fully priced through the end of the June meeting (vs. 90% prior).

- GBP sits mid-table in G10 ahead of the Spring Budget from the UK Chancellor later today. The Chancellor faces the task of rejuvenating an economy with limited fiscal headroom - a cut to National Insurance rates is expected to headline, with space seen too tight for any steps on income tax. GBP/USD is on the front-foot thanks to broad USD weakness headed into the crossover, however the pair has failed to make headway through the 1.2735 weekly high.

- Focus for the remainder of the Wednesday session turns to the ADP employment change release and JOLTS Job Openings data for January - ahead of the Bank of Canada rate decision - at which no change in headline policy is expected.

CAD, EUR Vol Premiums Build Into Respective Rate Decisions

- Ahead of the busier second half of the week, front-end USD vols are higher - with CAD and EUR vols adding the most notable premium ahead of the BoC and ECB rate decisions. Overnight CAD vols have cleared 8 points (close to double the YTD average), meaning an overnight ATM straddle implies a ~45 pip swing in USD/CAD across the BoC decision – while Powell’s semi-annual testimony could be adding to underlying vols.

- Markets may be wary of heavy expiry slate for EUR/USD in particular today - very clustered between 1.0840-75 today - ~€6.7bln set to roll-off between those strikes and could help define spot range across Powell, ADP Employment change later today.

- In terms of DTCC-tracked options trade, it's generally quiet outside of JPY markets although a little more interest in usually quieter HKD and NZD trade so far Wednesday.

- EUR/USD: $1.0760(E1.2bln), $1.0800(E1.8bln), $1.0840-50(E2.6bln), $1.0865-75(E4.1bln), $1.0950(E1.8bln)

- USD/JPY: Y149.50($524mln), Y149.80($907mln), Y150.00($684mln), Y150.20-25($800mln), Y151.10($1.1bln)

- AUD/USD: $0.6500-05(A$687mln)

Demand for JPY Hedges Picks Up Alongside BoJ Tightening Talk

- After a quiet first two sessions of the week, FX options markets are busier early Wednesday, with BoJ-centric stories from MNI and Jiji helping stimulate activity. Total USD/JPY options notional traded is ~20% ahead of average for this time of day, and conversely to spot moves today, upside protection is in demand - evident in decent interest across 140.65, 144.50 and 146.25 ITM call strikes, tipping the put/call ratio to 0.71 for DTCC-tracked trades today.

- Two-week vols, now capturing the outcome of the March 19th BoJ decision, are further bid, adding to yesterday's rally to touch 9.3 points and the highest level since early February. This tips 2w vols above the YTD average, but still just shy of the 12m rolling 2w vol.

- The bid in the front-end of the JPY vol curve has added to the recent vol skew, as 3m vols fail to keep pace and remain subdued: 3m implied holds at 8 points, close to 2 points below the rolling 12m average, despite capturing both the March and April BoJ decisions. OIS markets now price a ~50% chance of a 10bp March hike (vs. 30% yesterday), with a BoJ exit from NIRP now fully priced through the end of the June meeting (vs. 90% prior).

EQUITIES: E-Mini S&P Trend Conditions Bullish With Corrections Lower Shallow

- The trend condition in S&P E-Minis remains bullish and the latest move lower appears to be a correction. Price action continues to highlight the fact that corrections are shallow - this is a bullish signal that highlights positive market sentiment. Support to watch is 5049.64, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4935.76, the 50-day EMA. Sights are on 5170.86, a Fibonacci projection.

- A bullish theme in Eurostoxx 50 futures remains intact and Monday’s fresh cycle high reinforces this theme. Moving average studies remain in a bull-mode position and this set-up highlights positive market sentiment. Sights are on 4939.30 next, a Fibonacci projection. Further out, scope is seen for a climb towards a bull channel top at 5008.70. The channel is drawn from the Oct 27 low. Initial firm support lies at 4816.80, the 20-day EMA.

COMMODITIES: Fresh Record Highs in Gold Reinforce Strong Bullish Conditions

- The WTI futures trend condition remains bullish and last week’s break of key resistance at $79.09, the Jan 29 high, reinforces this theme. The clear breach of this hurdle highlights potential for a continuation towards $81.70, a Fibonacci retracement. On the downside, support to watch is $76.24, the 50-day EMA. A break would instead signal a possible top. The latest pullback is considered corrective.

- Gold remains firm on the back of the latest rally. The yellow metal yesterday traded above resistance at $2135.4, the Dec 4 high to deliver a fresh all-time cycle high. The break reinforces bullish conditions and signals scope for a climb towards $2177.6 next, a Fibonacci projection. Short-term conditions are overbought, however, this does not appear to be a concern for bulls - for now. Initial support lies at $2088.5, the Dec 28 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/03/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/03/2024 | 1230/1230 |  | UK | Budget Statement | |

| 06/03/2024 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/03/2024 | 1445/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 06/03/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 06/03/2024 | 1500/1000 |  | US | Fed Chair Jay Powell | |

| 06/03/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/03/2024 | 1530/1030 |  | CA | BOC Press Conference | |

| 06/03/2024 | 1700/1200 |  | US | San Francisco Fed's Mary Daly | |

| 06/03/2024 | 1900/1400 |  | US | Fed Beige Book | |

| 06/03/2024 | 2115/1615 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/03/2024 | 0030/1130 | ** |  | AU | Trade Balance |

| 07/03/2024 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 07/03/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 07/03/2024 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 07/03/2024 | 0930/0930 |  | UK | BOE's Monthly Decision Maker Panel Data | |

| 07/03/2024 | - | *** |  | CN | Trade |

| 07/03/2024 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 07/03/2024 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 07/03/2024 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 07/03/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 07/03/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/03/2024 | 1330/0830 | * |  | CA | Building Permits |

| 07/03/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 07/03/2024 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 07/03/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/03/2024 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 07/03/2024 | 1500/1000 |  | US | Fed Chair Jay Powell | |

| 07/03/2024 | 1500/1600 |  | EU | ECB Podcast - Lagarde presents latest monpol | |

| 07/03/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 07/03/2024 | 1630/1130 |  | US | Cleveland Fed's Loretta Mester | |

| 07/03/2024 | 2000/1500 | * |  | US | Consumer Credit |

| 08/03/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.