-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - Oil Price Spike Weighs On Treasuries

Highlights:

- A surprise OPEC+ output cut has driven overnight moves, with oil prices 5% higher

- In response to this inflationary development, yield curves have bear flattened

- The dollar has erased overnight gains, with the ISM report the highlight of the US docket

US TSYS: Post OPEC+ Bear Flattening, ISM Mfg Headlines Docket

- Cash Tsys are off lows but have nevertheless seen a solid bear flattening after a significant rally into Friday’s close with month/quarter end. The net cheapening pressure came from the overnight surprise OPEC+ cut announcement with Fed rate expectations continuing to increase and drag the yield curve higher.

- 2YY +6.4bp at 4.090%, 5YY +5.5bp at 3.628%, 10YY +4.3bp at 3.511% and 30YY +4.5bp at 3.695%.

- TYM3 trades 5+ ticks lower at 114-24 on more typical volumes a little under 300k. It remains within resistance at 115-07+ (Mar 28 high) and support at the 20-day EMA of 114-09+.

- Data: S&P Global US mfg PMI Mar final (0945ET), ISM mfg Mar (1000ET), Construction spending Feb (1000ET). ISM headlines after mixed indicators, with the MNI Chicago PMI pointing to a broadly similar print, S&P PMI showing upside and regional Fed surveys downside.

- Fedspeak: Gov Cook on mon pol (1615ET, moderated Q&A no text)

- Bill issuance: US Tsy $57B 13W, $48B 26W Bill auctions (1130ET)

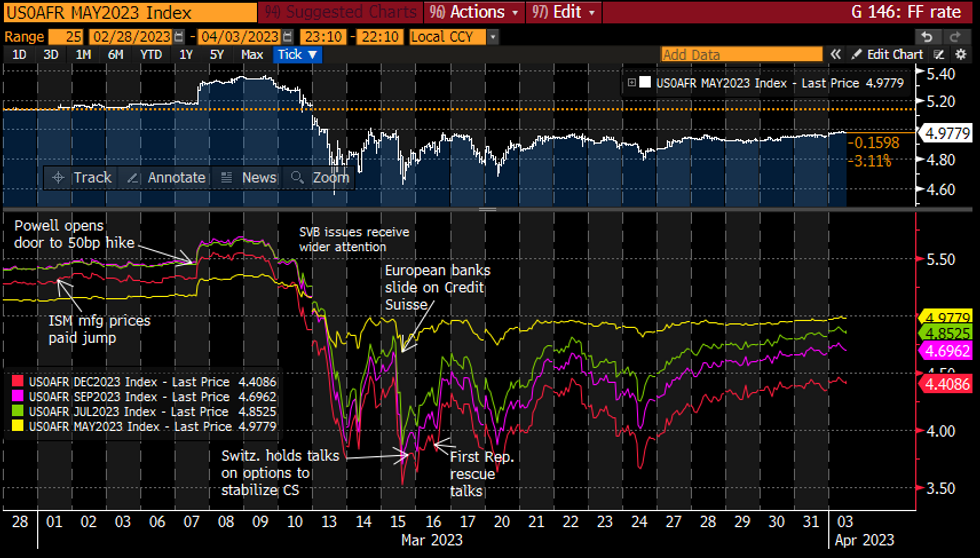

STIR: Fed Rate Path Continues Trend Move Higher

- Fed Funds implied rates have held onto a move higher at the open and despite some retracement from earlier highs are still at Friday’s high pre core PCE miss with a 15bp hike priced for May (+2bp) from the current effective 4.83%.

- The first cut from current levels is seen in Sep with -12.5bp at 4.71% (+3.5bp) and 42bp of cuts to 4.41% in Dec (+6.5bp).

- Gov. Cook speaks late at 1615ET in a moderated discussion on mon pol. She last spoke Fri – weighing stronger momentum against potential headwinds, with banking turmoil having potential to tighten credit [and lower the rate path].

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

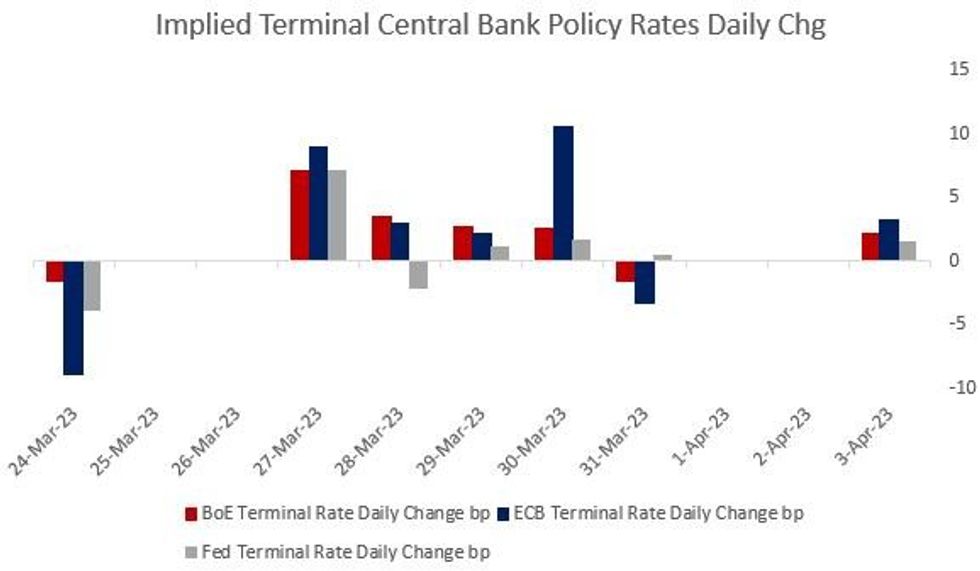

GLOBAL STIR: ECB / BoE Terminal Pricing Higher Is Notable Vs Limited Fed Increase

The surge in oil prices on the OPEC+ production cut has bear flattened yield curves early Monday but the bigger picture is it hasn't been hugely impactful on terminal central bank rate hike pricing on either side of the Atlantic.

- ECB/BoE peak pricing is a couple of bps off early session highs but have still gained more than Fed peak pricing this morning (which is still focused on May being the last hike, at only about 60%/40% prob of 25bp vs pause, and 55bp of cuts by year-end). We'll see if that changes as US desks come in.

- The wider terminal differential has probably helped contribute to keeping a lid on the dollar (as noted), with the broad index back to flat vs earlier gains of +0.4% on the OPEC surprise (which defied the usual inverse relationship between oil prices and USD).

- ECB terminal Depo rate pricing +4.1bp to 3.60%

- BoE terminal Bank Rate pricing +3.7bp to 4.70%

- Fed terminal Funds rate (upper limit) pricing +1.5bp to 5.16%

MNI RBA Preview - April 2023: April Pause, Q1 CPI To Determine May Outcome

- The April 4 RBA meeting is going to be particularly close but it is likely rates will be kept at 3.6% as the Board watches and waits for more information on domestic and global developments. But economists are split and many expect another 25bp hike. However, given that rates are now in restrictive territory, the Board has the luxury to pause in April and reassess at the May meeting.

- Click to view the full preview: MNI RBA Preview - April 2023

FOREX: USD is paring overnight gains

- The Dollar has pared its overnight gains during the early European session.

- The Greenback was in the Green overnight, following the OPEC news that they would cut output.

- The USD is now more mixed against G10, down 0.66% vs the NOK, given the Oil bid.

- The Yen sits at the other end of the spectrum, and is down 0.43% at the time of typing.

- European mfg PMIs were mostly close to inline and had no impact in FX.

- The EUR found a bid against the USD, GBP, CNH, CHF, but is overall mixed.

- Next resistance in EURGBP is at 0.8829 High Mar 30.

- Looking ahead, sees US Final mfg PMIs, so more focus on the US ISM mfg this afternoon.

- Speakers, include, ECB Simkus, Vujcic, and Fed Cook.

FX OPTIONS: NOTABLE EXPIRIES

Of note:

EURUSD 1.21bn at 1.0900.

GBPUSD 1.07bn at 1.2250 (tue).

USDCAD 1.77bn at 1.3600 (tue).

USDCNY 1.37bn at 6.9000 (tue).

EURUSD 3.82bn at 1.0900 (wed).

USDJPY 1.27bn at 133.00 (wed).

USDCAD 1.37bn at 1.3600 (wed).

USDCAD 1.05bn at 1.3600 (thu).- EURUSD: 1.0800 (221mln), 1.0825 (345mln), 1.0850 (599mln), 1.0900 (1.21bn).

- GBPUSD: 1.2400 (581mln).

- AUDUSD: 0.6650 (470mln), 0.6715 (283mln).

EQUITIES: S&P E-Minis Bull Cycle Still In Play

- In the equity space, S&P E-Minis ended last week on a bullish note. Price has breached 4119.50, reinforcing the bullish conditions. The move higher exposes 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. Clearance of this level would signal scope for an extension towards 4205.50, Feb 16 high ahead of 4244.00, Feb 2 high and a key medium-term resistance. Firm support is at 4027.87, the 50-day EMA.

- EUROSTOXX 50 futures traded higher last week and the contract remains bullish. Price has pierced resistance at 4268.00, the Mar 6 high and a key resistance. A clear break of this hurdle would strengthen bullish conditions and open 4300.00 next. Moving average studies are in a bull-mode set-up and this highlights a broader uptrend. Initial firm support lies at 4146.30, the 20-day EMA.

COMMODITIES: WTI Trend Outlook Remains Bullish

- On the commodity front, trend conditions in Gold remain bullish and the recent short-term pullback is considered corrective. Note that price action since Mar 20 appears to be a pennant - a continuation pattern. This reinforces bullish conditions and signals scope for an extension higher near-term. The recent test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 marks a firm support, the Mar 17 low - a break would signal scope for a deeper pullback.

- In the Oil space, WTI futures remain in a bull cycle and today’s gap higher at the open, strengthens this current condition. The contract has touched a high of $81.69, just above resistance at $81.04, the Mar 7 high. A clear break of $81.04 would signal scope for a continuation higher and open $83.04, the Jan 23 high. Key support is seen at $75.72, the Mar 31 high and the gap low on the daily chart. Initial support lies at $77.60, 23.6% retracement of the Mar 20 - Apr 3 rally.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/04/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/04/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/04/2023 | 1400/1000 | * |  | US | Construction Spending |

| 03/04/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/04/2023 | 2015/1615 |  | US | Fed Governor Lisa Cook | |

| 04/04/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 04/04/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 04/04/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Keynote Speech at RES Conference | |

| 04/04/2023 | 1230/0830 | * |  | CA | Building Permits |

| 04/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/04/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 04/04/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/04/2023 | 1630/1730 |  | UK | BOE Pill Speech at ICMB | |

| 04/04/2023 | 1730/1330 |  | US | Fed Governor Lisa Cook | |

| 04/04/2023 | 2245/1845 |  | US | Cleveland Fed's Loretta Mester | |

| 05/04/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/04/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.