-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - On Watch For Further European Lockdowns

HIGHLIGHTS:

- AUD, equities recover off last week's lows

- EUR on watch for further lockdown news as Merkel warns tighter curbs needed

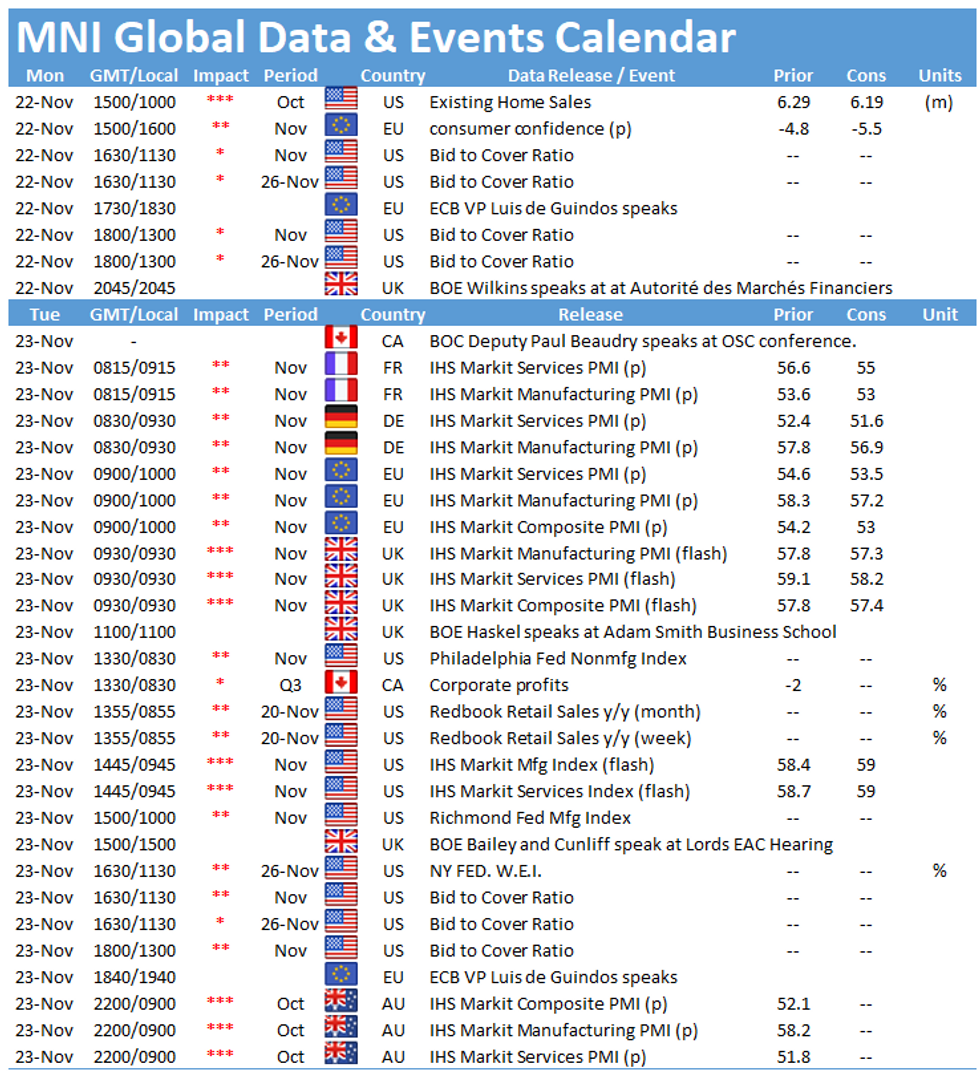

- Light data slate Monday, with existing home sales, EZ consumer confidence next up

US TSYS SUMMARY: Early Week Focus On Supply

Tsy futures have now fully reversed Friday's gains, though are still within ranges as Thanksgiving week gets underway. 2Y and 5Y supply are the session's highlights.

- Despite short-end/belly supply, the curve is bear steepening: 2-Yr yield is up 2.7bps at 0.5334%, 5-Yr is up 3bps at 1.251%, 10-Yr is up 3.8bps at 1.584%, and 30-Yr is up 3.8bps at 1.9475%.

- Dec 10-Yr futures (TY) down 13.5/32 at 130-14.5 (L: 130-14 / H: 130-24), on solid volumes (~410k). Note Friday's low was 130-13+.

- The supply schedule is busy, with a truncated holiday week ahead: 1130ET sees $51B of 26-week bills and $58B 2Y Note auction; at 1300ET is $57B 13-week bills and $59B 5Y Note auction. (And Tuesday we get $59B 7Y and $24B 2Y FRN).

- Data includes Oct Chicago Fed Nat'l Activity Index (0830ET) and Oct existing home sales (1000ET).

- Attention on the White House this week: Pres Biden due to speak Tuesday on the economy/inflation, with Fed Chair nomination expected before Thanksgiving.

- NY Fed buys ~$1.425B of 10-22.5Y Tsys.

EGB/GILT SUMMARY: EGB Curves Bear Steepen

Following a volatile start, European sovereign bonds have uniformly traded weaker through the morning with EGB curves bear steepening alongside modest gains for equities.

- Gilt yields are now uniformly 3bp higher across the curve.

- Bund yields are 1-3bp higher with the longer end of the curve underperforming.

- OATs have slightly underperformed bunds with long-end yields pushing up 4bp.

- BTPs trade in line with core EGBs. The curve is 2bp steeper.

- Protests in response to fresh Covid-related social restrictions in Europe continued over the weekend with the Netherlands, Belgium and Austria seeing the most disruption.

- Supply this morning came from Germany (Bubills, EUR 2.792bn allotted) and Belgium (OLOs, EUR3.2bn). This afternoon France will come to market to offer EUR4.4-5.6bn of BTFs.

- Today's roster of ECB speakers includes Holzmann, Kazaks, Kazimir, de Cos and Guindos.

EUROPE OPTION FLOW SUMMARY

Eurozone:

Bund downside: RXF2 172.00/171.00 put spread bought for 15.5 in 2k

Bobl: OEZ1 135.50/135.75 call spread bought for 13.5/14 in 10k (hearing short cover)

Bobl downside: OEG2 133.50/133.00 put spread bought for 12 in 2k (d -10%)

Euribor downside: 2RU2 100.00/99.875 put spread vs 100.25/100.375 call spread, net paid flat in 3k (bought ps/ sold cs)

FOREX: AUD Joins Equities in Recovering Off Lows

- AUD trades most favourably early Monday, with AUD/USD inching higher to further erase the losses suffered on Friday. The pair still remains well short of the Friday highs at $0.7291.

- Price action elsewhere has been largely rangebound. EUR/CHF remains a focus, with the cross in a holding pattern below the 1.05 handle. Some attention was paid to the weekly SNB sight deposits data, with CHF running slightly higher as the data showed the central bank did not meaningfully intervene in the FX rate despite recent CHF strength.

- JPY trades at the bottom end of the G10 table, with USD/JPY back above the Y114.00 handle as equities improve off lows. Progress is needed through Friday's 114.54 to cement any improvement in the near-term outlook.

- GBP is similarly offered, further reinforcing the view that recent rallies have been corrective in nature. Moves also follow Friday's CFTC release showing the GBP net position had deteriorated to its largest short position in over 12 months.

- The data slate is typically light for a Monday, with US existing home sales and Eurozone consumer confidence data the sole releases. ECB's Holzmann, de Cos and de Guindos make up the speaker schedule.

FX OPTIONS: Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1350(E774mln), $1.1380-90(E677mln), $1.1450(E1.5bln), $1.1580(E1.3bln)

- GBP/USD: $1.3360-70(Gbp811mln)

- EUR/GBP: Gbp0.8360(E507mln)

- AUD/USD: $0.7400-15(A$604mln)

- USD/CAD: C$1.2485-95($1.0bln), C$1.2685($1.1bln)

Price Signal Summary - USD Trend Direction Remains Up

- In the equity space, S&P E-minis traded to another all-time high Friday of 4723.50. From a trend perspective, the outlook remains bullish and any short-term pullback is likely corrective in nature. Bulls eye, 4746.68 next, the 1.618 projection of Jul 19 - Aug 16 - Aug 19 price swing. The support to watch is 4625.25, the Nov 10 low. EUROSTOXX 50 futures uptrend remains intact however, the contract has recently faced selling pressure and remains below recent highs. Dips are considered corrective and the support to watch is 4311.70, the 20-day EMA. A resumption of gains would refocus attention on 4420.80, 1.382 projection of the Jul 19 - Sep 6 - Oct 6 price swing.

- In FX, EURUSD remains in a downtrend. The pair is trading at the base of its bear channel drawn from the Jun 1 high. The channel intersects at 1.1285 today. A clear break lower and continued bearish follow through would open 1.1222, 1.618 projection of the Jan 6 - Mar 31 - May 25 price swing. The recent break in GBPUSD of 1.3412, Sep 29 low, opens 1.3334 next, 1.00 projection of the Sep 14 - 29 - Oct 20 price swing. Recent gains are still considered corrective, initial resistance is at 1.3533, the 20-day EMA. USDJPY remains bullish following the recent breach of resistance at 114.70, Oct 20 high. The break higher confirms a resumption of the underlying uptrend and opens 115.51 next, the Mar 10, 2017 high. Price action on Nov 17 is a bearish engulfing candle and remains a concern for bulls. A deeper pullback would expose key support at 112.73, Sep 9 low. EURCHF is bearish. The cross has cleared 1.0505, May 14, 2020 low and the break exposes 1.0397 next, the Jul 15, 2015 low.

- On the commodity front, Gold remains bullish and dips are considered corrective. Attention is on $1877.7, Jun 14 high and $1903.8, Jun 8 high. Support is seen at $1822.4, Nov 10 low. WTI last week traded through key short-term support at $77.23, Nov 4 low. The break suggests scope for a deeper corrective pullback towards $74.25 next, 38.2% retracement of the Aug 23 - Oct 25 rally.

- In the FI space, Bund futures rallied sharply Friday, strengthening bullish conditions. The focus is on 172.95, 76.4% retracement of the Aug - Nov sell-off. Gilts maintain a firmer tone. The recent resumption of strength suggests potential for a climb towards 127.69 next, Sep 21 high. Initial support has been defined at 125.40, Nov 17 low.

EQUITIES: Steady Start Across European Stock Markets

- A steady enough start for European equities, which trade higher by 0.2-0.4% in early trade. Modest outperformance across Spain's IBEX-35, but Germany's DAX lags, sitting only just above unchanged. Similarly, US futures trade higher, bouncing off the negative close on Friday, with the e-mini S&P showing back above 4,700.

- Europe's communication services and energy names are leading the way higher, with real estate and tech at the bottom end of the table.

COMMODITIES: Oil Bouncing, Gold Ebbs Lower

- WTI Crude up $0.38 or +0.5% at $76.35

- Natural Gas down $0.18 or -3.46% at $4.884

- Gold spot up $0.29 or +0.02% at $1845.88

- Copper down $1.3 or -0.3% at $438.2

- Silver up $0.23 or +0.93% at $24.8372

- Platinum up $4.32 or +0.42% at $1038.78

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.