-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Risk Rally Hits Pause, But No Reversal

HIGHLIGHTS:

- Risk rally hits pause, with equities, oil and core bond yields lower

- No real news drivers so far, progress of US stimulus bill a focus

- Bereft of data, but sizeable European issuance to pore over

US TSYS SUMMARY: Long End Yields Resume Fall From Monday's Highs

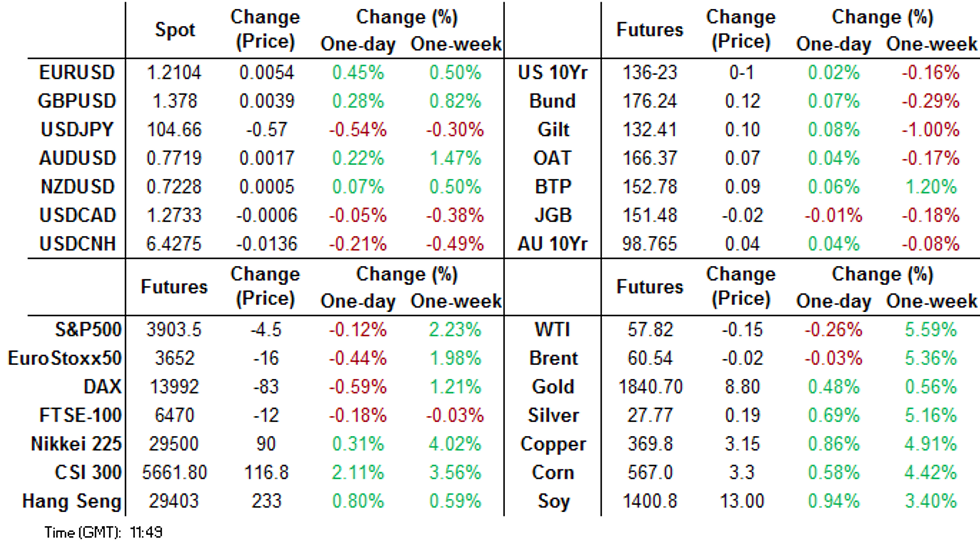

- Mar 10-Yr futures (TY) up 2/32 at 136-24 (L: 136-19.5 / H: 136-25)

- Curve bull flattening: The 2-Yr yield is unchanged at 0.1111%, 5-Yr is down 1bps at 0.4689%, 10-Yr is down 2.4bps at 1.1465%, and 30-Yr is down 2.6bps at 1.9268% (now 7+bps below Monday's highs).

- Notable weakness in USD (DXY -0.3%) with equities a little lower.

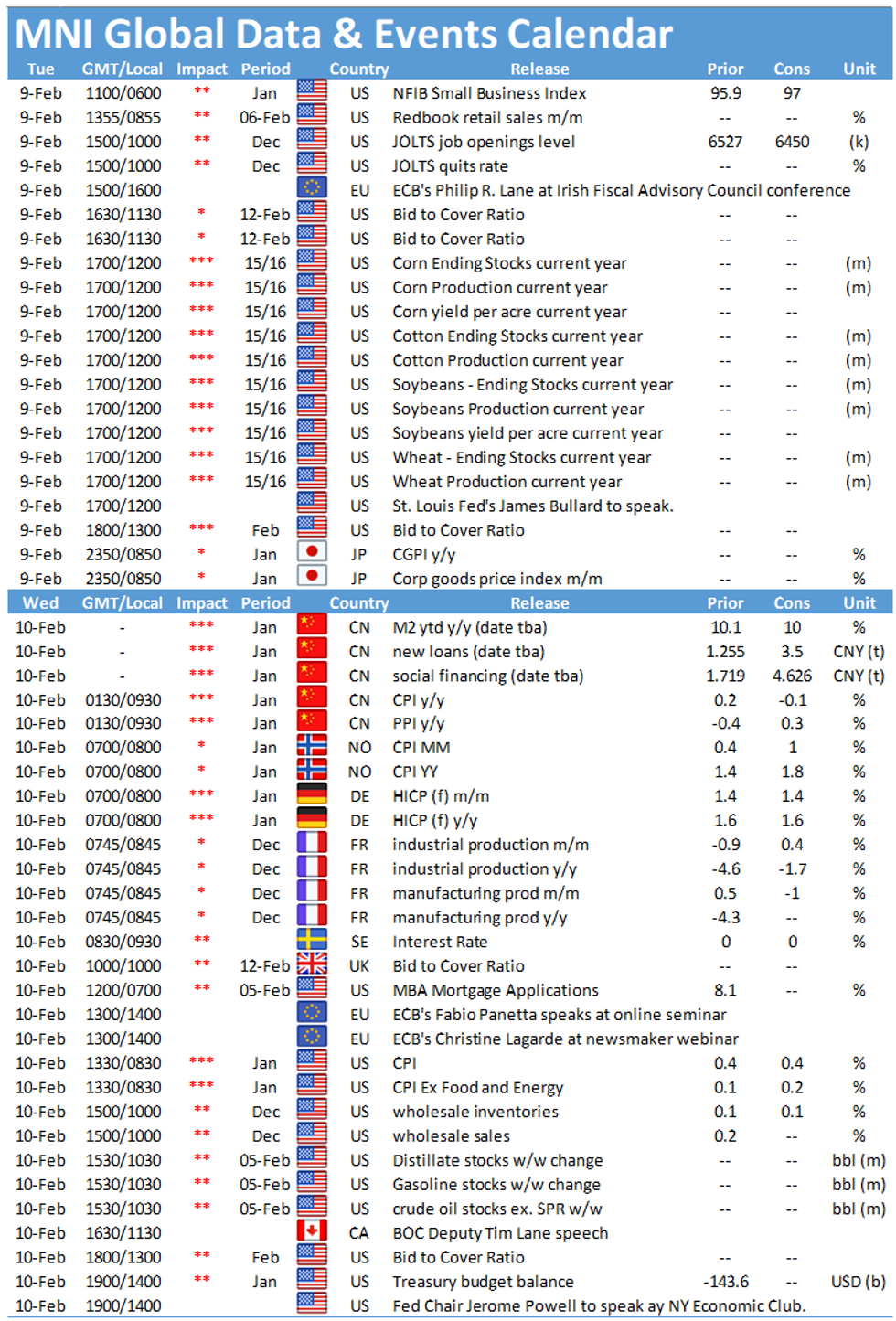

- In data, NFIB small business optimism came in slightly below expectations in Jan (at 95.0 vs 97.0 expected, 95.0 prior); JOLTS at 1000ET.

- StL Fed's Bullard speaks at 1200ET.

- Trump impeachment trial gets underway in the Senate this afternoon (~1300ET), but market-wise likely a sideshow for markets compared to fiscal matters, with House Ways and Means Committee beginning the markup of legislative proposals for COVID relief Wednesday.

- Supply sees $60B in 42-/119-day bills at 1130ET, and $58B 3-Yr Note auction at 1300ET. NY Fed buys ~$2.425B of 1Y-7.5Y TIPS.

EGB/GILT SUMMARY: Core EGBs Recover Early Losses

Core European govies started the session on a weak footing, but recovered early losses, and partially unwinding yesterday's sell off. European stocks and global energy have inched lower while the US dollar is on the back foot against G10 FX.

- Gilts have traded firmer through the morning and are now in line with yesterday's closing levels. The curve is 1bp flatter on the day.

- It is a similar story for bunds. Last yields: 2-year -0.7154%, 5-year -0.6912%, 10-year -0.4493%, 30-year 0.0164.

- The OAT curve is marginally steeper with the 2s30s spread 1bp wider.

- BTPs are now close to unch on the day with the curve flat overall.

- Supply this morning came from Germany (linker, EUR1.111bn allotted), Spain (letras, EUR6.67bn), Belgium (TCs, EUR 2.022bn) and Finland (bills, EUR2bn).

- The European data calendar was relatively light again this morning. German export data for December came in better than expected (0.1% M/M vs -0.6% survey), while Italian industrial production for the same period missed (-0.2% M/M vs 0.3% expected).

EUROZONE ISSUANCE: Syndications from UK, Netherlands, Spain, issuance from Germany

Dutch DDA: 0% Jul-31 Final Spread Guidance

- FINAL SPREAD GUIDANCE: +12.5 TO +13.5 BPS OVER 0% Feb-31 Bund

- AMOUNT: E4 - 6bln

- COUPON: 0%

- BOOKS: > E25bln

- Size set at E5bln in line with our expectation of E4-8bln

- Spread set earlier at 3.45% Jul-66 Obli +13bps (guidance had been + 15 bpsarea+/-2bps WPIR)

- Books closed in excess of E65bln (inc E4.575bln JLM)

- Deal size set at GBP2.25bln nominal (in line with our GBP2-4bln estimate)

- Final orderbook in excess of GBP20.75bln (including JLM trading interest ofGBP2.8bln)

- Spread previously set at 0.50% Mar-50 UKTI +2.75bps

- Books closed

German Auction Results: Germany Allots E1.111bln of the new 0.10% Apr-33 linker

- Average yield -1.51%

- Buba cover 1.45x

- Bid-to-cover 1.08x

- Price: 121.68

- Issuance volume E1.5bln

EUROPE OPTIONS SUMMARY

Eurozone:

RXH1 176.5/177.5cs 1x2, bought for 16 in 1k

RXJ1 173/172/171/170p condor, bought for 24 in 5k vs RXH1 177p sold at 103.5 in 1k

RXJ1 171.5/170ps, bought for 22.5 in 2k

UK:

LU1 100/100.12/100.25c fly, bought for 1.25 in 9.5k

FOREX: Greenback Offered as Risk Rally Hits Pause

The Greenback is softer, slipping against all others in G10, with haven currencies outperforming as the recent risk rally flatlines. There's been no material drawback in equities, but the e-mini S&P is off by around 4 points or so, while core government bonds are firmer.

The beneficiaries so far Tuesday have been JPY and EUR, the former being supported on the break through the Y105.00 handle in USD/JPY, while EUR garners focus as Italian PM-designate Draghi gains more cross-party support for his technocratic government. EUR/USD sits at the highest since Feb1, with the pair now comfortably above the 1.21 handle.

Despite the softness in stocks this morning, AUD continues to outperform, prompting a new and clean break above the $0.77 mark.

US JOLTs data is the sole material release, but speeches are due from ECB's Visco & Lane and Fed's Bullard.

FX OPTIONS: Expiries for Feb09 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1850-55(E511mln), $1.2000(E853mln), $1.2050(E644mln), $1.2090-1.2100(E544mln), $1.2160-75(E591mln)

USD/JPY: Y105.00-10($699mln)

USD/CAD: C$1.2960($1.2bln)

AUD/CAD: C$0.9860(A$640mln-AUD puts)

USD/CNY: Cny6.4325-45($812mln), Cny6.45($781mln), Cny6.50($2.1bln), Cny6.55($1.2bln)

TECHS: Price Signal Summary - USD Facing Selling Pressure

- No change on the equity front with bullish conditions still dominating. E-mini S&P futures targets the psychological 4000.00 handle. The EUROSTOXX50 index is firmer too and has breached 3657.83, Jan 8 high to resume the underlying uptrend. Attention is on 3700.00 and 3798.19. The latter is the 0.764 projection of the Mar - Jul - Oct 2020 price swing

- In the FX space, the USD is facing selling pressure.

- EURUSD is extending the recovery off the Friday low of 1.1952. Yesterday we highlighted the possibility that Friday's activity in pattern terms, is a bullish engulfing candle. Today has seen the pair trade through the 20-and 50-day EMAs opening 1.2156 next, Jan 29 high.

- Last week we highlighted an inverted head and shoulders in the USD Index. Note this pattern's key support lies at 90.048, Jan 21 low and the right shoulder of the pattern. A break would negate the pattern and reinforce a USD bearish risk theme.

- USDJPY is off recent highs too. The next support lies at 104.47, the 20-day EMA.

- EURGBP remains bearish and targets 0.8711, May 11, 2020 low.

- On the commodity front, Gold is firmer too and has breached its 20-day EMA. This opens the 50-day EMA at $1857.5 next. Oil contracts remain firm. Brent (J1) targets $61.61 next - 1.500 projection of the Apr - Aug - Nov 2020 price swing. WTI (H1) bulls eye $59.06 next, 1.382 projection of Apr - Aug rally from the Nov 2 low.

- In the FI space, Bunds (H1) have found support at 175.61, 1.236 projection of Jan the 4 - 12 sell-off from the Jan 27 high. This is the bear trigger. Gilts (H1) outlook remains bearish with attention on 131.53, 2.236 projection of the Dec 11 - 24 sell-off from the Jan 4 high. BTPs (H1) continue to push higher with sights set on the 153.00 a round number.

EQUITIES: Stocks in (Very) Minor Negative Territory Pre-NY

European equity markets have taken minor move lower this morning, with mainland indices in the red by 0.1-0.4%. The most notably mover has been Spanish stocks, with the IBEX-35 off 1% as major industrial name Solaria Energia sags on disappointing earnings.

Across Europe, the utilities sector is leading losses, with communication services and tech firms not far behind. Energy is the sole sector in the green, with persistent strength in WTI and Brent crude prices underpinning the gains.

The e-mini S&P hit new all time highs in Asia-Pacific trade at 3913.25 but has stagnated slightly since. Earnings continue Tuesday, with reports due from Twitter and Cisco Systems among others.

COMMODITIES: Strong Oil Stands Out Amid Soft Risk Backdrop

WTI crude futures have touched higher highs for the 8th consecutive session Tuesday, with the high watermark of $58.62 printed this morning. The commodity complex on the whole is higher, benefiting from broad greenback weakness this morning, while global stock markets have softened slightly.

Gold and silver are again higher, with silver seeing some decent upside to touch $27.82 and extend the rally from last week's lows to over 7%. There still remains a decent gap with the retail-driven highs printed early last week at $30.10, however.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.