-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Sell-Off in European Banks Sets Up Lower US Open

Highlights:

- Slide in European banks raises further concerns over financial stability

- Risk proxy currencies return lower, putting NOK, AUD and EUR lower

- STIR futures wipe out prospect of BoE, ECB rate hikes

US TSYS: Treasuries Surge On European Banking Fears

- Cash Tsys surge, led by the front end for a sizeable bull steepening, on spillover from European banks coming under increasing pressure since the open. It sees this week’s decision to hike 25bp to 4.75-5% increasingly viewed as the peak for the cycle with cut expectations mounting. Upcoming data likely take a second seat with market reaction skewed more keenly to downside surprises.

- Off extremes but still see 2YY -22.1bp at 3.612%, 5YY -17.1bp at 3.268%, 10YY -13.0bp at 3.295% and 30YY -9.1bp at 3.607%. 2s10s sit at -30bps having briefly marked their steepest levels since Oct’22 with -28.5bps.

- TYM3 trades 27+ ticks higher at 116-27 off a high of 117-01+. It opens 117-14+ (high Aug 29/30, 2022) having cleared key resistance at 116-28+ (Jan 19 high) and briefly 117-00 (61.8% retrace of Aug-Oct 22 bear leg (cont)). Cumulative volumes have accelerated to 515k for the day in a sizeable uptick since the European open after a subdued Asian session.

- Fedspeak: Bullard (non-voter) set to give the first post-FOMC remarks at 0930ET

- Data: Focus on Durable goods Feb prelim (0830ET) and S&P Mfg & Service PMI Mar prelim (0945ET), but also see wholesale inventories revisions plus the KC Fed service activity index.

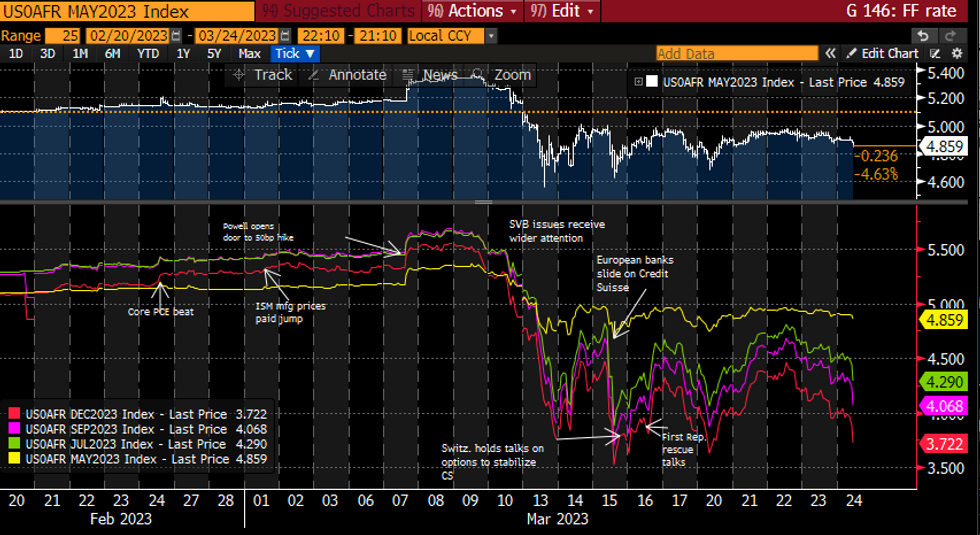

STIR FUTURES: Fed Rate Path Slides With Circa 50bp Cuts By July, 100bp By Year-End

- Fed Funds implied rates have slumped in recent trading in an intensification of a move that started with the European opens as banks slide.

- There is now just a 7bp hike priced for the May FOMC (-3bp) with two cuts priced for July from current levels (-49bps for -20bp on the day) and 106bp of cuts from current levels to 3.73% by year-end (-27bps).

Source: Bloomberg

Source: Bloomberg

25bp hikes no longer fully priced for BOE and ECB

- SONIA futures up to 32 ticks higher (Dec23 and Mar24), with the Mar24 contract marking a 60 tick move higher since Wednesday's close.

- In terms of BOE pricing there is now less than 7bp priced for May (down from 17bp at yesterday's close) and a terminal 17bp priced by August (down from 29bp at yesterday's close). A cut from the peak is now fully priced this year for the BOE (-22bp cumulative from current levels).

- Euribor futures up to 28 ticks higher on the day with Dec23 through Sep24 futures all up more than 40 ticks since the Wednesday close.

- Markets now pricing 17bp for the ECB May meeting with a peak of just below 25bp by July. that rate cut is almost fully reversed by the February 2024 meeting.

BANKS: European Bank Weakness Spills into US Pre-Market Trade

- European banking weakness spilling well over into US pre-market trade, putting the likes of JPM (-1%), Wells Fargo (-1.4%), Citi (-1.3%) and Morgan Stanley (-1.1%) all lower pre-market.

- Moves stemming from persistent weakness across European banks, with German names among the sharpest decliners (Deutsche Bank down 12%, Commerzbank down 9%) and at fresh daily lows at typing.

- CDS spreads remain a particular focus, with Deutsche Bank 5y CDS topping the highest levels of 2022 earlier today as another indicator of underlying banking stresses.

- While not the core driver, a DoJ announcement that Credit Suisse & UBS were being investigated for any evidence of helping clients skirt Russian sanctions added further weight given the fragility of the sector at present.

GILT ISSUANCE UPDATE:

GILTS: FQ1: Short / medium auctions

6 short auctions

- 3.50% Oct-25 gilt: 2 auctions on 3 May and 7 June (MNI had pencilled in one).

- 4.125% Jan-27 gilt: 2 auctions on 19 April and 17 May (MNI had pencilled in one).

- New 7 June 2028 gilt: MNI had previously expected a launch in May but the DMO has confirmed a 20 June launch date.

- 0.50% Jan-29 gilt: The DMO had announced that this will be on offer on 5 April. This is the only auction in the quarter.

5 medium auctions

- 3.25% Jan-33 gilt: 3 auctions as expected by MNI: 13 April, 10 May, 13 June

- 0.875% Jul-33 Green gilt: One auction on 24 May (as expected)

- 3.75% Jan-38 gilt: One auction on 28 June (as expected)

Long / linker operations

3 long-dated auctions, 1 syndication

- 1.125% Jan-39 gilt: To be reopened on 4 April (as already confirmed).

- New Oct-63 gilt: An October 2063 gilt to be launched via syndication (as expected by MNI) in the W/C 15 May. To have an ISIN GB00BMF9LF76.

- 3.75% Oct-53 gilt: 2 auctions on 18 April and 6 June (we had looked for 1-2). 3 linker auctions, 1 syndication:

- New Nov-33 linker: To be launched via auction on 27 June (as expected). To have ISIN GB00BMF9LJ15.

- New 15-25 year linker: To be launched in the W/C 24 April as we expected. ISIN: GB00BMF9LH90

- 0125% Mar-39 linker: One auction on 12 April

- 0.125% Mar-51 linker: One auction on 23 May

RATINGS: Friday’s Rating Slate

Sovereign rating reviews of note slated for after hours on Friday include:

- Fitch on Malta (current rating: A+; Outlook Stable)

- Moody’s on Estonia (current rating: A1; Outlook Stable) & Poland (current rating: A2; Outlook Stable)

- S&P on Germany (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Finland (current rating: AA (high), Stable Trend) & France (current rating: AA (high), Stable Trend)

FOREX: Data Plays Second Fiddle to Ebb and Flow of Risk Sentiment

- Data releases and speakers have played second fiddle the ebb and flow of risk sentiment early Friday, with a sour open for European equities helping dictate proceedings. A gap lower at the cash equity open was triggered by weakness across the European banking sector, with the likes of Credit Suisse and UBS hit particularly hard after a report that the US Dept of Justice could be investigating the banks for evidence that they aided Russian oligarchs in skirting Western sanctions.

- As a result, concerns about the stability of one of Europe's largest banking sectors have worsened, leading to underperformance across risk proxies and high Beta FX.

- Souring risk sentiment has led to outperformance of the USD and JPY, helping put the USD index higher for a second session and within range of the 50-dma pivot of 103.4421.

- PMI data from across the Eurozone saw mixed results, with composite indices beating expectations thanks to a healthier services sector, although manufacturing continues to weigh on overall sentiment.

- Focus for Friday trade turns to prelim February durable goods data and the prelim March PMIs for the US. Markets also see the first post-FOMC decision Fed speakers, with Bullard due to speak from St. Louis. ECB's Centeno, Nagel and BoE's Mann also make appearances.

FX OPTIONS: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600-05(E1.7bln), $1.0675-80(E627mln), $1.0700-10(E1.4bln), $1.0800(E1.6bln), $1.0850(E539mln), $1.0875(E509mln), $1.0890-10(E656mln)

- USD/JPY: Y130.00($830mln), Y131.00($592mln), Y132.95-00($1.3bln), Y133.75($749mln)

- EUR/GBP: Gbp0.8900(E635mln)

- AUD/USD: $0.6700(A$669mln)

- USD/CAD: C$1.3600-05($606mln), C$1.3620-30($1.1bln)

- USD/CNY: Cny7.3635($1.4bln)

EQUITIES: European Banks Drive Dip in Equities at Cash Open

- Eurostoxx 50 futures are holding on to recent highs. The recovery from Monday’s 4057.00 low has resulted in a breach of both the 20- and 50-day EMAs. A continuation higher would signal scope for 4184.50, a Fibonacci retracement. Key resistance and the bull trigger is at 4268.00, the Mar 6 high. On the downside, a reversal lower and a breach of 3914.00 would resume the recent downtrend. Initial support lies at 4069.00, the Mar 21 low.

- S&P E-Minis reversed sharply lower Wednesday. It is too early to tell whether the pullback marks the start of a bearish cycle. However, the move lower means that price has - so far - failed to hold above pivot resistance around the 50-day EMA. The average intersects at 4021.50 and a clear break is required to strengthen bullish conditions. Watch support at 3966.25, Wednesday’s low - a break would be bearish. Key S/T resistance is 4073.75.

COMMODITIES: Recent Pullback in Gold Considered Corrective, Trend Conditions Still Bullish

- WTI futures remain in a downtrend and this week’s recovery appears to be a correction. Note that the latest move higher is allowing a recent oversold condition to unwind. Firm resistance is seen at $72.85 the 20-day EMA. Recent weakness confirmed a resumption of the broader downtrend and has paved the way for a move towards $62.43, the Dec 2 2021 low. The bear trigger is $64.36, the Mar 20 low.

- Trend conditions in Gold remain bullish and the recent short-term pullback is considered corrective. The breach on Mar 17 of former resistance at $1959.7, Feb 2 high, confirmed a resumption of the bull trend that started late September 2022. The test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 is seen as a firm support. It is the Mar 17 low and a break would signal scope for a deeper pullback.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/03/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/03/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/03/2023 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/03/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 24/03/2023 | 1500/1500 |  | UK | BOE Mann Panellist at Global Independence Center Conference Ukraine | |

| 24/03/2023 | 1630/1630 |  | UK | BOE Announces Q2 Active Gilt Sales Schedule |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.