-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - The Powell Rally

Highlights:

- Bonds and equities maintain sharp rally following yesterday's comments by Fed Chair Powell

- US dollar remains on back foot, with USDJPY at post-August lows

- Attention turns to US data including PCE, jobless claims, and ISM manufacturing (see note below)

US TSYS: Treasuries Rally As Breakevens Slide

- The sharp reversal in Tsys has come after the 2Y yield cleared new highs above 2.45% on the initial move in response to more positive headlines between Russia-Ukraine talks.

- The belly had led yields higher on the way up and does the same on the way down, along with the 10Y with both now down -5bps on the day.

- Potentially in response to lower inflationary pressure from a pulling back in the conflict, evidenced by lower oil, nominal yields are dragged lower by a slide in inflation expectations.

- The 5Y breakeven has dropped 13bps to 3.52%, the lowest since Mar 17 (and more than 20bps down from yesterday's highs), whilst the 10Y breakeven is 9bp lower at 2.87% and equally relatively low.

5Y nominal yield (white), breakeven (yellow) and real yield (green)Source: Bloomberg

5Y nominal yield (white), breakeven (yellow) and real yield (green)Source: Bloomberg

STIR FUTURES: Fed Terminal Holds Near Post US CPI Levels

- Fed Funds implied hikes have broadly held the post-Powell slide that continued late into US hours yesterday, aside from late 2023 rates rising off lows.

- 51bp for Dec (-2bp from Tue close), 87bp to 4.71% Feb’23 (-5bp), terminal 4.91% May’23 (-10bp) and 4.47% Dec’23 (-17bp despite +4.5bp on the day).

- The terminal of 4.91% compares with a low of 4.82% and close of 4.89% after the US CPI miss on Nov 10.

- Potentially sole mon pol Fedspeak from Gov. Bowman at 0930ET (no text). Logan (’23, 0920) is not set to talk on mon pol plus regulatory focus from NY Fed’s supervision head Dobbeck (0915ET) and Fed VC Supervision Barr (1700ET)

FOMC-dated Fed Funds implied rateSource: Bloomberg

FOMC-dated Fed Funds implied rateSource: Bloomberg

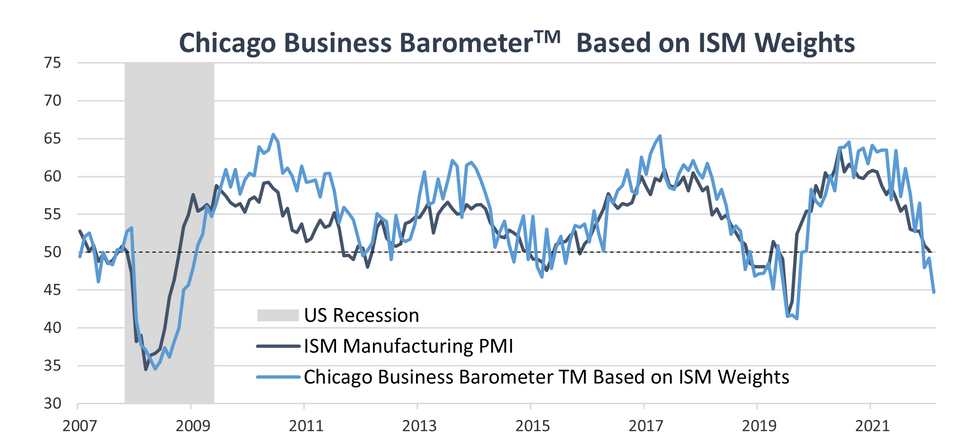

MNI Chicago Business Barometer Suggests Weaker ISM Manufacturing PMI

The Chicago Business Barometer plunged a further eight points to 37.2 in November, deepening the downturn in the third consecutive month of contractive business activity. The ISM manufacturing PMI weakened by 0.7 points to 50.2 in October.

- Both indexes are around Q3 2020 pandemic-shock lows, remaining substantially below pre-Ukraine-Russia war levels and the snowball effect of the associated global energy crisis and inflation surge.

- Reweighting the Chicago PMI to the ISM Manufacturing PMI weights exemplifies the strong correlation between the two indicators. Ahead of the ISM release, the Chicago PMI foreshadows a continued downward trend in the US manufacturing industry.

- Markets will be watching for signs of price pressures diminishing due to weaker demand and employment growth showing any weakness.

- The ISM index calculation involves equal weighting of Production, New Orders, Inventories, Employment and Supplier Deliveries. The ISM index has recently remained more elevated than the Chicago PMI largely due to the inclusion of the inventory sub-index, which has been hovering around historic highs due to supply chain crisis-induced over-stocking.

Source: MNI / ISM

FED: Transcript Of Powell's Nov 30 Q&A

We've put together a transcript of Chair Powell's Q&A at Brookings on Nov 30, sourced from the YouTube closed captioning but heavily edited for clarity.

- The discussion with Powell is worth reading in full, as in conjunction with his prepared speech, it touches on many of the major themes that we expect he and the FOMC will grapple with at the upcoming meeting in 2 weeks' time. See below:

FIXED INCOME: Core FI higher as markets saw Powell's speech as dovish

- Core fixed income is higher this morning with Bunds and gilts having caught up with some of the late UST moves yesterday seen following Fed Chair Powell's speech. Markets read the speech as a dovish pivot and the risk of a 75bp hike in December was all but eliminated. But Powell also put more focus on the labor market, signalling for example that the FOMC will continue to see it as imbalanced until we start to see payrolls more sustainably around or below 100k - something that with lags to the data could still mean that we get another 50bp in February (which is no longer fully priced by markets).

- The European morning session has also seen some mixed final manufacturing PMI prints and the BOE DMP survey which suggested that firms may be less concerned about inflationary pressures than previously, but inflation expectations and wage growth expectations are being very slow to recede - which will be a concern to the MPC.

- Looking ahead with have US personal income /spending, PCE and weekly claims data ahead of the ISM manufacturing print. This will be closely watched after the big fall in yesterday's MNI Chicago Business Barometer.

FOREX: Dovish Powell keeps the lid on USD

- Although off its best levels, the Yen has continued to extend gains. Lower US Yield and Risk on tone following a Dovish Powell yesterday, has kept the pressure on the USD, but off its worst levels.

- Equities and Govies faded off their overnight and opening highs.

- This was more of an unwind during the morning European session.

- Worth keeping an eye on the Pound and Cable, testing the 200SMA at 1.2155, printed a 1.2155 so far today.

- AUDNZD is also trading at its lowest level since March after breaking through the initial support at 1.0743, printed a 1.0728 low, ahead of next support area at 1.0694.

- Looking ahead, US final Manufacturing PMI, US PCE core deflator, and ISM Manufacturing are the notable releases for this afternoon.

- Speakers are, Fed Dobbeck, Logan, Bowman, Barr, and ECB Lane.

FX OPTION EXPIRY (updated)

Of note:

EURUSD ~1bn at 1.0420 (fri).

USDCNY 1.14bn at 7.00 (mon).- EURUSD: 1.0300 (1.2bn), 1.0310 (374mln), 1.0350 (393mln), 1.0385 (256mln), 1.0450 (212mln), 1.0500 (516mln). 1.0550 (261mln).

- AUDUSD: 0.6800 (299mln).

- USDCNY: 7.00 (390mln), 7.0375 (450mln) 7.15 (403mln).

Price Signal Summary - S&P E-Minis Uptrend Resumes

- In the equity space, S&P E-Minis remain in an uptrend and yesterday’s gains reinforce a bullish theme. The rally resulted in a break of initial resistance at 4050.75, the Nov 15 high. This confirms a resumption of the uptrend. Sights are on the 4100.00 level next. On the downside, key short-term support has been defined at 3912.50, the Nov 17 low.

- EUROSTOXX 50 futures trend conditions remain bullish and the contract has traded to a fresh cycle high. This maintains the uptrend that started in early October and confirms an extension of the price sequence of higher highs and higher lows. The 4000.00 handle has been pierced, this opens 4049.50 next, the Feb 23 high (cont). Initial firm support is at 3840, the Nov 17 low.

Price Signal Summary - Fresh Cycle Low In USDJPY

- In FX, EURUSD traded higher Wednesday and is firmer again today. However, the pair remains below 1.0497, the Nov 28 high. Monday’s price action continues to warn of a possible top - a shooting star candle that day highlights a bearish threat. An extension lower would expose key support at 1.0223, Nov 21 low. Clearance of this level would confirm a short-term top. For bulls, a break of 1.0497, is required to resume recent bullish price action.

- GBPUSD trend conditions remain bullish and last week’s gains reinforced this, highlighting an extension of the bullish price sequence of higher highs and higher lows. The focus is on 1.2161, the 200-dma. A break of this level would strengthen bullish conditions and open 1.2276, the Aug 10 high. On the downside, key short-term support is seen at 1.1829, the 20-day EMA.

- The USDJPY trend condition remains bearish and today’s move lower has confirmed a resumption of the downtrend. The break lower maintains the bearish price sequence of lower lows and lower highs and sights are set on 135.49, 76.4% retracement of the Aug 2 - Oct 21 bull leg. Resistance to watch is 139.89, yesterday’s high.

Price Signal Summary - FI Futures Trend Signals Remain Bullish

- In the FI space, Bund futures remain in a short-term uptrend despite the latest pullback. Price has cleared the 50-day EMA, highlighting a stronger short-term reversal. The focus is on 142.87, the Oct 4 high. The 20-day EMA marks initial firm support - it intersects at 139.97.

- Trend conditions in Gilt futures remain bullish. Fresh cycle highs last week maintain the bullish price sequence of higher highs and higher lows and moving averages appear to be highlighting a bull mode set-up. If confirmed this would reinforce the uptrend. The bull trigger for a continuation of gains is 107.06, the Nov 24 high. Initial firm support lies at 104.78, the Nov 23 low.

SNAPSHOT: Equity, Commodity Gains Hold Overnight

Equities:

- Asia closes: Japan's NIKKEI closed up 257.09 pts or +0.92% at 28226.08 and the TOPIX ended 0.89 pts higher or +0.04% at 1986.46. China's SHANGHAI closed up 14.136 pts or +0.45% at 3165.471 and the HANG SENG ended 139.21 pts higher or +0.75% at 18736.44.

- Europe: German Dax up 109.63 pts or +0.76% at 14507.51, FTSE 100 up 8 pts or +0.11% at 7581.45, CAC 40 up 7.15 pts or +0.11% at 6745.67 and Euro Stoxx 50 up 24.73 pts or +0.62% at 3990.01.

- U.S. futures: Dow Jones mini down 38 pts or -0.11% at 34563, S&P 500 mini down 0 pts or 0% at 4081.5, NASDAQ mini down 8.75 pts or -0.07% at 12034.

Commodities:

- WTI Crude up $0.9 or +1.12% at $81.46

- Natural Gas up $0.11 or +1.62% at $7.043

- Gold spot up $12.64 or +0.71% at $1781.17

- Copper up $0.65 or +0.17% at $374.45

- Silver down $0.04 or -0.18% at $22.1559

- Platinum down $5.97 or -0.58% at $1031.26

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/12/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 01/12/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 01/12/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 01/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/12/2022 | 1425/0925 |  | US | Dallas Fed's Lorie Logan | |

| 01/12/2022 | 1430/0930 |  | US | Fed Governor Michelle Bowman | |

| 01/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/12/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/12/2022 | 1500/1000 | * |  | US | Construction Spending |

| 01/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/12/2022 | 1600/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 01/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/12/2022 | 1645/1745 |  | EU | ECB Lane at Banque de France / EUI conference | |

| 01/12/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Lustrum Symposium | |

| 01/12/2022 | 2000/1500 |  | US | Fed Vice Chair for Supervision Michael Barr | |

| 02/12/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 02/12/2022 | 0240/0340 |  | EU | ECB Lagarde Panels Bank of Thailand Conference | |

| 02/12/2022 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/12/2022 | 1000/1100 | ** |  | EU | PPI |

| 02/12/2022 | 1200/1300 |  | EU | ECB de Guindos Speech at OK Diario Event | |

| 02/12/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 02/12/2022 | 1330/0830 | * |  | CA | Production Estimate of Principal Field Crops |

| 02/12/2022 | 1330/0830 | *** |  | US | Employment Report |

| 02/12/2022 | 1415/0915 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.