-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Trend Extends, Yields Fall Further

HIGHLIGHTS:

- Stock sell-off stabilises, but recovery is tepid at best

- Treasury rally continues, belly outperforms

- Dollar firmer for a fourth session

US TSYS SUMMARY: Rally Continues

Treasuries have gained in late morning European trade Tuesday after flatlining in Asia-Pac hours.

- Sep 10-Yr futures (TY) near session highs up 5/32 at 134-27 (L: 134-14 / H: 134-28), with strong volumes (~540k), with gains posted in the last couple of hours.

- Again no particular headline drivers, and equities fairly steady - but the narrative continues to center around Delta COVID variant risks to global economic reopenings.

- The belly of the curve has outperformed: 2-Yr yield is down 1.2bps at 0.2036%, 5-Yr is down 3.1bps at 0.6738%, 10-Yr is down 1.5bps at 1.1738%, and 30-Yr is down 0.3bps at 1.8165%.

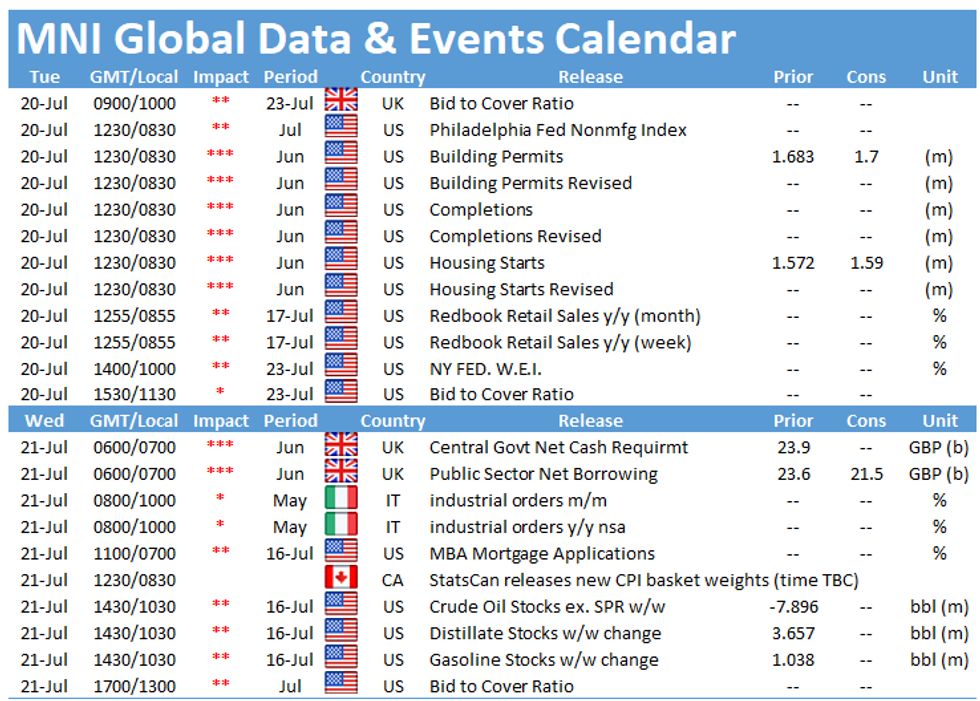

- A fairly quiet calendar lies ahead. All of today's data is out at 0830ET: Jun Housing Starts and Building Permits.

- Only supply is 42-Day bills ($35B) at 1130ET. NY Fed buys ~$1.225B of 7.5Y-30Y TIPS.

EGB/GILT SUMMARY: Equities Stabilise, Sovereign Bonds Still Bid

European equities have stabilized this morning following yesterday's heavy selling, while government bonds continue to make gains. Given that the potential impact of the Delta variant on economic activity remains unclear, today's respite for equities may prove fleeting.

- Gilts remain bid and the curve continues to bull flatten. Cash yields are now 3-4bp lower on the day.

- Bunds have marginally outperformed gilts at the longer end with the 30-year benchmark yield down 5bp on the day.

- OATs have firmed with the 2s30s spread narrowing 2bp.

- Having initially sat on the sidelines yesterday morning amid the rally in core EGBs, BTPs are now catching up. Yields are now broadly 1-3bp lower across the curve.

- Supply this morning came from the UK (Gilt, GBP1.25bn), Germany (Bund, EUR3.349bn allotted) and the ESM (Bills, EUR1.492bn).

- There were not tier one data releases this morning.

EUROPE ISSUANCE UPDATE

Germany allots E3.349bln 0% Nov-28 Bund, Avg yield -0.58% (Prev. -0.37%), Bid-to-cover 1.32x (Prev. 1.01x), Buba cover 1.57x (Prev. 1.24x)

UK DMO sells GBP1.25bln 1.625% Oct-71 Gilt, Avg yield 0.861% (Prev. 1.153%), Bid-to-cover 2.51x (Prev. 2.26x), Tail 0.2bps (Prev. 0.3bps)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 166.5p, bought for 1 in 13.5k

DUU1 112.20/112.10/112.00p fly, bought for 2 in 1.25k

3RU1/3RZ1 100.25/37cs spread, bought the Sep for 0.25 in 3k

UK:

0LU1 99.62c vs 2LU1 99.50c, bought the 1yr for -0.5 (receive) in 5k

0LV1 99.62/50/25 broken put fly bought for 1.5 in 2k

FOREX: Market Still Favours USD as Stock Selloff Abates

- The dollar is firmer for a fourth session, with the greenback rising against most others in G10. Greenback strength comes despite the easing of selling pressure in equity markets, with stocks across Europe and in US futures space both staging a modest bounce.

- Nonetheless, the recovery in stocks has been tepid at best, with the e-mini S&P still around 50 points shy of the week's best levels. As a result, growth proxies and high beta currencies are yet to have felt any benefit, with NZD and AUD among the session's poorest performers so far.

- GBP/USD's downtrend persists Tuesday, with the pair bottoming out a new multi-month low of 1.3627. The outlook is deteriorating with prices south of the 200-dma, opening losses toward the next key support at the February low of 1.3567.

- Today's session is a little busier, but there's still a relative lack of tier 1 data releases. US building permits/housing starts are due and there are no notable central bank speakers.

Expiries for Jul20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-70(E765mln), $1.1800-15(E1.6bln), $1.1850-60(E836mln), $1.1880-90(E1.2bln)

- USD/JPY: Y108.70-85($715mln), Y110.00-10($881mln), Y110.50-55($725mln)

- EUR/JPY: Y130.75(E880mln)

- USD/CAD: C$1.2200($832mln)

- USD/CNY: Cny6.4820($1.4bln), Cny6.50($565mln)

Price Signal Summary - Oil Confirms a Top, Shifts to Clear Bearish Cycle

- In the equity space, prices slipped further off highs Monday and are staging only a modest bounce. S&P E-minis contract has extended the pullback from 4384.50 Jul 14 high. Yesterday's sell-off resulted in a break of support at 4279.25, Jul 8 low. This highlights a short-term trend top and suggests scope for a deeper corrective pullback. EUROSTOXX 50 futures last week failed to challenge resistance at 4101.50, Jul 1 high and the subsequent sell-off has resulted in a resumption of the bear cycle that started Jun 17. Yesterday's break of 3951.50, Jul 8 low signals scope for weakness towards 3871.00, May 19 low.

- Yesterday's move in EURUSD resulted in a print below support at 1.1772, Jul 13, 14 low. A clear break would again confirm a resumption of the downtrend. GBPUSD took out key support at 1.3669, Apr 12 low as well as the 200-dma at 1.3700. A clear breach of 1.3669 would reinforce bearish conditions and pave the way for an extension of the bear cycle. USDJPY sold off sharply yesterday resulting in a break of support at 109.53, Jul 8 low. This confirms a resumption of the reversal that occurred early July and paves the way for an extension lower.

- On the commodity front, Gold maintains a bullish tone and the pullback is considered corrective. Price however needs to clear last week's high print to confirm a resumption of the recent upleg. Brent futures have confirmed a top with momentum in a clear bearish cycle as the current corrective pullback extends. Price yesterday also confirmed a clear break of the 50-day EMA paving the way for further downside. The focus is on $67.43, a Fibonacci retracement. WTI (Q1) focus is on $65.56, a Fibonacci retracement where a break would open $63.10, the May 24 low.

- Within FI, Bund futures remain firm, trading above the former resistance of 174.77, Jul 8 high. The clear break of this level strengthens a bullish case and highlights a bullish breakout of a rising channel drawn off the May 19 low. The move in Gilts resulted in a probe of key short-term resistance at 129.92, the Jul 8 high. A clear breach of this level would confirm a resumption of the uptrend that started mid-May and maintain a bullish price sequence of higher highs and higher lows.

EQUITIES: Asian Markets Close Weaker; US And Europe Clawing Back Losses

- Asian markets closed weaker, with Japan's NIKKEI down 264.58 pts or -0.96% at 27388.16 and the TOPIX down 18.24 pts or -0.96% at 1888.89. China's SHANGHAI closed down 2.332 pts or -0.07% at 3536.791 and the HANG SENG ended 230.53 pts lower or -0.84% at 27259.25.

- European stocks have bounced a bit, with the German Dax up 76.62 pts or +0.51% at 15211.01, FTSE 100 up 48.9 pts or +0.71% at 6893.38, CAC 40 up 58.47 pts or +0.93% at 6353.77 and Euro Stoxx 50 up 25.93 pts or +0.66% at 3954.34.

- U.S. futures are edging higher, with the Dow Jones mini up 214 pts or +0.63% at 34053, S&P 500 mini up 21.25 pts or +0.5% at 4272.5, NASDAQ mini up 67.75 pts or +0.47% at 14608.5.

COMMODITIES: Stable After Monday's Weakness, With Copper Outperforming

- WTI Crude up $0.08 or +0.12% at $66.5

- Natural Gas down $0.01 or -0.19% at $3.769

- Gold spot up $2.07 or +0.11% at $1814.75

- Copper up $3.2 or +0.76% at $423.55

- Silver down $0.04 or -0.17% at $25.1361

- Platinum up $2.25 or +0.21% at $1079.7

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.