-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI US MARKETS ANALYSIS - Tsys on Front Foot Ahead of Fed, CPI

Highlights:

- Treasuries edge higher ahead of key Fed, inflation releases

- Euro swap spreads continue to compress post-TLTRO

- Single currency creeps higher, but downside risks pervade

Key Links: ECB Preview / Fed Preview / Tame China CPI Justifies Stimulus

US TSYS: Risk-Off With Supply Set To Headline The Session Ahead Of US CPI, FOMC

- Cash Tsys trade richer amidst a risk-off environment, led by the long-end although with yields remaining higher than pre-US PPI levels across the curve (the 10Y a case in point having been sub-3.50% pre PPI). A very light docket today sees supply headline the session, including 3Y and 10Y notes – note the staggered times below - with focus on US CPI tomorrow and the FOMC decision Wed.

- 2YY -2.7bps at 4.317%, 5YY -5.4bps at 3.715%, 10YY -5.9bps at 3.520%, 30YY -6.0bps at 3.499%. 2s10s at -79.5bp sit 3-4bps off last week’s fresh multi-decade lows.

- TYH3 trades 9+ ticks higher at session highs of 114-12+, back in the middle of Friday’s range. Resistance remains the bull trigger at 115-06+ (Dec 7 high) whilst support is seen at 113-21+ (Dec 2 low).

- Data: Monthly budget statement for Nov (1400ET)

- Bond issuance: US Tsy $40B 3Y Note (91282CGA3) at 1130ET, US Tsy $32B 10Y Note re-open (912796X53) at 1300ET

- Bill issuance: US Tsy $45B 26W bills at 1130ET, $45B 13W bills at 1300ET

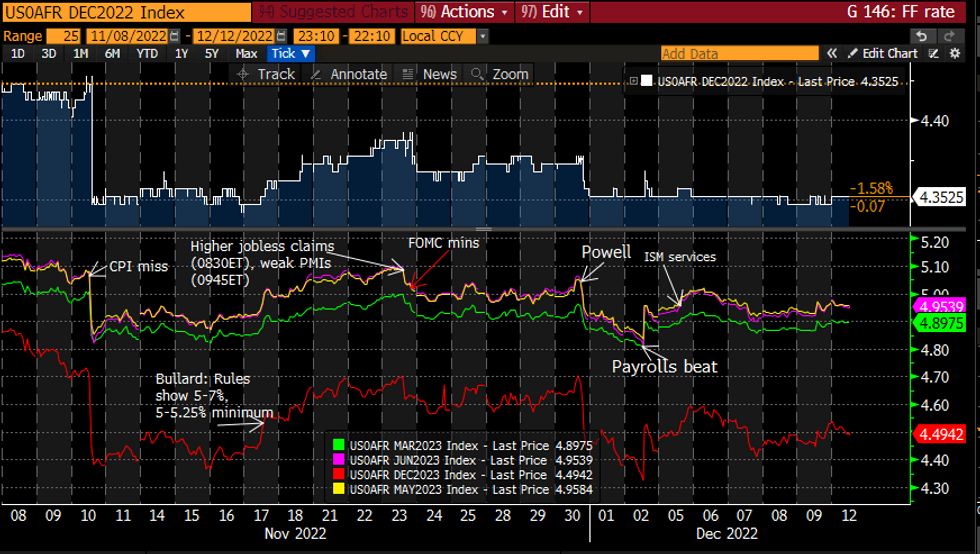

STIR FUTURES: Fed Rate Path Awaits Tomorrow’s CPI

- Fed Funds implied hikes for the most part hold the higher end of Friday’s range after a boost from US PPI beating.

- 52.5bp for Wed (+0.5bp), cumulative 90bp to 4.73% for Feb (+0.5bp), terminal 4.96% May’23 (-0.5bp) and 4.49% for Dec’23 (-4bp).

- The 47bps of cuts priced from the May peak to end-23 is towards the higher end of the range seen since the Nov 2 FOMC but typical of levels ever since Powell’s Brookings comments.

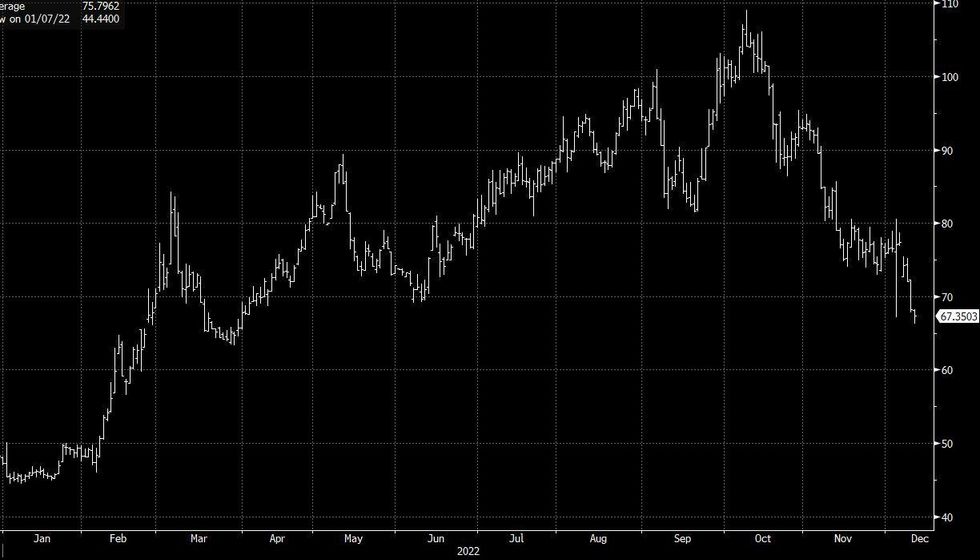

Source: Bloomberg

Source: Bloomberg

US 10YR FUTURES TECHS: (H3) Remains Above Support

- RES 4: 116-12 2.0% 10-dma envelope

- RES 3: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-14 50% Aug - Oct Downleg

- RES 1: 115-06+ High Dec 7 and the bull trigger

- PRICE: 114-10+ @ 10:51 GMT Dec 12

- SUP 1: 113-21+/113-00 Low Dec 2 / 50-day EMA

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures traded lower Friday but the contract is finding support today. Price remains below 115-06+, Dec 7 high and the next bull trigger. The outlook remains bullish following recent gains that have confirmed an extension of the trend sequence of higher highs and higher lows. A break higher would open 115-14, 50% of the Aug - Oct downleg on the continuation contract. Support to watch is at the 50-day EMA, at 113-00.

EUR: Absent Fresh Drivers, EUR at Risk of Dovish ECB

- The single currency trades moderately higher early Monday, with EUR/USD narrowing the gap with Friday's high and next key resistance at 1.0588.

- Few new drivers for the EUR so far this morning, although some optionality could be in play as expiries at $1.0550-51(E639mln) and $1.0610-20(E993mln) are within view.

- Focus understandably rests on Thursday's ECB decision, with markets split between seeing a 50bps and 75bps rate rise. A 50bps rate rise is fully priced, but the implied probability of a 75bps step has moderated considerably in recent weeks (implied pricing sits at ~55bps at pixel time).

- On the technical side, markets monitor a possible bearish daily candle pattern from Dec 5th - a shooting star - which could come into play if Lagarde proves dovish, leaving nearby support of 1.0387 (20-day EMA) at risk.

FIXED INCOME: Swap Spreads Continue To Compress On TLTROs, German Issuance

Swap spread narrowing stands out in an otherwise quiet start to the week so far for EGBs.

- Schatz spreads are down 2.1bp to 72.4bp this morning, the lowest since July, down 12bp on the week and well below the 121bp peak close. Bund ASW is down marginally but touched the narrowest level since March.

- Friday's higher-than-expected TLTRO repayments are one factor applying downside pressure on spreads.

- Another being cited is a Spiegel report at the end of last week adding further confirmation that the German 2023 fiscal deficit would be higher than previously planned (in line, as Commerzbank points out, with nat'l budget legislation) - suggesting more German debt and therefore more high-quality collateral coming into circulation.

Bund ASW, bpSource: BBG

Bund ASW, bpSource: BBG

FOREX: Currencies Trade Defensively Ahead of Critical Week

- Markets trade defensively and within recent ranges to mark a muted Monday session so far. JPY is modestly weaker on an intraday basis, while the single currency makes furtive gains.

- UK growth data came in moderately ahead of expectations, with manufacturing production contracting at a slower pace than forecast, playing in favour of the bullish trend conditions that remain present in GBP/USD. The pair has cleared the 200-dma and maintains a bullish sequence of higher highs and higher lows. Note that moving average studies remain in a bull-mode position, highlighting positive market sentiment. A resumption of gains would open 1.2406, the Jun 16 high.

- Lastly, commodity-tied currencies have failed to take advantaqe of a minor bounce in equity futures, with the e-mini S&P still within range of the overnight and Friday lows of 3956.00 and 3959.75.

- The data and speakers slate starts with a lull on Monday, with no key data releases or central bank events ahead of this week's deluge of meetings. As such, the focus for the session ahead will likely be pre-positioning and interpretation of Tuesday's critical US CPI release.

BONDS: Cautiously Higher As Big Week Gets Underway

Core FI is trading slightly stronger though largely within Friday's ranges early Monday, reflecting caution ahead of a week dominated with event risk.

- Gilts are outperforming amid UK curve bull flattening; the German curve has twist flattened slightly.

- The US curve is 4-5bp richer beyond 2Y which has seen just a 2bp drop in yields. 3Y and 10Y supply are the highlights of today's US schedule.

- Periphery EGB spreads are marginally tighter, as are German swap spreads - following on from Friday's above-expected TLTRO repayments.

- Multiple central bank decisions this week (with 50bp the most likely scenario for the big 3): MNI's Fed preview here; ECB preview here.

- UK Oct GDP out earlier was the session's data highlight - while coming in above expectations, it probably won't impact Thursday's BoE decision much.

- No US data of note ahead of Tuesday's Nov CPI report.

Latest levels:

- Mar TY future up 6/32 at 114-09, range of 113-29 to 114-10

- Mar Bund futures (RX) up 13 ticks at 140.65 (L: 140.26 / H: 140.74)

- Mar Gilt futures (G) up 34 ticks at 105.77 (L: 105.31 / H: 105.88)

- Italy / German 10-Yr spread 1.4bps tighter at 189.2bps

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/12/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 12/12/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 12/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 12/12/2022 | 1630/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/12/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/12/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 12/12/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 12/12/2022 | 2025/1525 |  | CA | Governor Macklem speech in Vancouver | |

| 12/12/2022 | 2200/1700 |  | CA | BOC Governor Macklem press conference | |

| 13/12/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 13/12/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 13/12/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 13/12/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 13/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/12/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/12/2022 | 1330/0830 | *** |  | US | CPI |

| 13/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/12/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/12/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.