-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US MARKETS ANALYSIS - UK CPI Triggers Sharper BoE Rate Cut Picture

Highlights:

- UK CPI softer than expected, triggering pricing for over 5 x 25bps cuts in '24

- Milder UK inflation picture contributes to bidtone in Treasuries

- Home sales, consumer confidence data round off US calendar

US TSYS: Holding Close To Best Levels Driven By Soft UK CPI

- Cash Tsys trade 3-6bp richer, led by 2s for a bull steepening with 2s10s at -49bps (+1.5bps). There was a general bid through Asia trading which then accelerated sharply on notably softer than expected UK CPI.

- TYH4 trades close to session and week-to-date highs of 112-23+. Technical trends point to a bullish signal that highlights resistance at 112-28+ and 113-12+ (Fibo projection points).

- Today’s docket likely sees focus on existing home sales data after a heavy decline in October and the Conference Board consumer survey, before some attention on 20Y supply. Harker could also see some headlines although impact is likely mitigated by moving to a non-voter ahead.

- Data: Weekly MBA mortgage data (0700ET), Current account Q3 (0830ET), Existing home sales Nov (1000ET), Conf Board consumer confidence Dec (1000ET).

- Fedspeak: Goolsbee (’25) WSJ podcast (1200ET), Harker (non-voter) on local radio (1215ET)

- Note/bond issuance: Tsy $13B 20Y re-open (912810TW8) – 1300ET

- Bill issuance: Tsy $56B 17w bills (1130ET)

STIR: Fed Rates Getting Close To Fully Pricing March Cut After UK CPI Spillover

- Fed Funds implied rates have been biased lower overnight by notably softer than expected UK CPI inflation.

- January pricing is relatively little changed (3bp of cuts) but cumulative cuts have lifted to now 22.5bp for March, 48bp for May, 73bp for June (from 68bp yesterday) and 151bp for end-2024 (from 143bp).

- It leaves the end-2024 implied rate below closes seen in the two days after last week’s FOMC decision.

- Today’s Fedspeak sees media appearances from Goolsbee (’25) and Harker (who after voting in 2023 will hold a non-voting position until retirement due by Jun’25). Goolsbee has spoken regularly, latest saying late yesterday the market got a little ahead of itself on cuts and that the Fed should not be bullied by what the market wants. It will be Harker’s first remarks since early Nov.

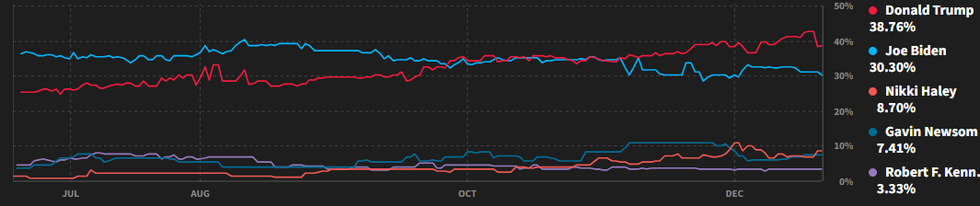

Colorado Supreme Court Ruling Sees Trump Odds Drop In Betting Market

The Colorado Supreme Court'sruling that disqualifies former President Donald Trump from appearing on the ballot in the state's presidential primary has seen a small decline in the Republican frontrunner's implied probability of winning the 2024 presidential election. The court ruled that Trump's alleged role in the 6 Jan 2021 riots at the Capitol amounted to an 'insurrection', and that under an 1868 provision to the US Constitution insurrectionists can be barred from running for office.

- Data from Smarkets shows Trump's implied probability of winning the presidency falling from 42.7% before the ruling to 38.8% presently. The primary beneficiary has not been incumbent President Joe Biden, but Trump's GOP primary opponent, former South Carolina Governor Nikki Haley. Her implied probability of winning the presidency has risen from 6.9% prior to the ruling to 8.7% currently.

- Courts in a number of other states are considering similar cases, and as is often the case in political rulings it could come down to the conservative/liberal split on various courts. All seven of Colorado's Supreme Court justices were appointed by Democratic governors, and even then the decision came to a 4-3 split in favour of barring Trump.

- Trump's legal team has stated that it will challenge the ruling, likely setting up a US Supreme Court showdown. Given that SCOTUS would prove the final arbiter of what constitutes an insurrection, the 6-3 split there in favour of conservatives could bolster Trump's chances of avoiding banishment from the ballot.

Source: Smarkets

Source: Smarkets

140bp of cuts priced; in line with our preview expectations for a downside miss

- We noted in the CPI preview that we thought around 140bp of cuts priced for 2024 was around the limit we thought the market could take here.

- Even with today's data we still don't think a cut before May looks likely. The MNI Markets team thinks that the MPC will want to see a softening in Q1 wage growth and we won't get enough clarity on that until after the March meeting.

- If that's the case we would only have six meetings left for the year (so 25*6=150bp).

- So markets may overshoot over the next few days but when we do settle we still wouldn't look for this to be at a level above 140bp.

- Pricing now is at about -140bp for the year, down around 21bp since yesterday's close.

Fiscal Rule Deal Comes Into View As France/Germany Agree; ECOFIN @ 1600CET

Following the announcement of an agreement between French Finance Minister Bruno Le Maire and his German counterpart Christian Lindner regarding EU fiscal rule reform on the evening of 19 Dec, the prospect of EU finance ministers signing off on the deal at today's informal ECOFIN meeting has risen. The meeting gets underway virtually at 1600CET (1000ET, 1500GMT).

- After both Le Maire and Lindner placed the level of agreement in the low 90%'s after the ECOFIN meeting of 7-8 Dec, in a post on X, Le Maire stated that "We have this evening reached a 100% agreement with (Christian Lindner) on the new rules for the Stability and Growth Pact,"

- An agreement between the two largest EU economies on reform to fiscal rules does not guarantee a deal at today's meeting, with Italy - which alongside France runs a deficit above the 3% of GDP limited by the SGP - concerned about being placed under the Excessive Deficit Procedure in 2024.

- If a deal is signed off at the ECOFIN meeting, it will have to get through the European Parliament early in 2024 before MEP's focus turns to the June 2024 European Parliament elections.

FOREX: Sterling Sinks on Soft CPI, But Underlying Bull Theme Intact for Now

- GBP/USD holds the vast majority of the post-CPI losses, after inflation slowed markedly faster than forecast in November. Core CPI posted a 0.6ppts drop to hit a new post-COVID low of 5.1%. Monday's lows of 1.2629 the next notable downside level in the pair, keeping GBP as the poorest performing currency across G10, reflecting the retracement in yields across both STIR and Gilt markets.

- Much of the weakness stemming from the adjustment in '24 rate expectations, with the biggest moves in STIR seen across the Sep24 / Dec24 contracts - culminating in over 5 x 25bps rate cuts being priced for the next calendar year.

- Today's weakness refutes the previously bullish theme in GBPUSD, after key resistance and the bull trigger at 1.2733, the Nov 29 high, had been cleared. Notable support undercuts at 1.2600, the 20-day EMA. The pullback from last Friday’s high is considered corrective, but further weakness could reinforce a pullback.

- JPY is the firmest currency in G10, reversing a small part of yesterday's post-BoJ weakness. EUR/JPY failed to materially top key resistance at the 158.76 100-dma on Tuesday, prompting small selling into today's NY crossover. US yields will likely lead prices through year-end, with the 10y yield today hitting fresh multi-month pullback lows below 3.89%.

- Focus for the rest of the Wednesday session lies on US existing home sales and the December consumer confidence. Bank of Canada minutes are set for release, while appearances from ECB's Lane, Fed's Goolsbee and Harker could draw attention.

FX OPTIONS: Expiries for Dec20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0890-00(E1.3bln), $1.0950-60(E598mln), $1.0975(E547mln), $1.0990-00(E1.2bln)

- USD/JPY: Y143.45-50($854mln), Y144.00($1.1bln), Y145.00($1.8bln)

- AUD/USD: $0.6790-00(A$1.5bln)

- NZD/USD: $0.6200(N$547mln)

- USD/CAD: C$1.3390-00($1.0bln)

- USD/CNY: Cny7.1000($1.7bln)

EQUITIES: Bullish Theme in Eurostoxx 50 Futures Intact Despite Latest Pullback

- A bullish theme in Eurostoxx 50 futures remains intact and the latest pullback is considered corrective. Last week’s gains confirm, once again, a resumption of the uptrend and maintain a bullish price sequence of higher highs and higher lows. Moving average studies are in a bull-mode position too, signalling a rising cycle. The focus is on 4636.70, a long-term Fibonacci retracement. Support to watch is at 4496.50, the 20-day EMA.

- A bullish theme in S&P e-minis remains intact and the contract has traded higher this week, confirming once again a resumption of the uptrend that started Oct 27. Note too that the contract has recently cleared resistance at 4738.50, the Jul 27 high, reinforcing current positive trend conditions. This signals scope for a climb towards 4854.75 next, a Fibonacci projection. On the downside, initial firm support lies at 4674.59, the 20-day EMA.

COMMODITIES: Gold Moving Average Studies Remain in a Bull-Mode Position

- Bearish conditions in WTI futures remain intact and recent gains appear to be a correction. Resistance to watch is $76.14, the 50-day EMA. Last week’s fresh trend low reinforces a bearish theme and the break of $69.08, Dec 7 low, confirms a resumption of the trend. This maintains the price sequence of lower lows and lower highs and note that MA studies are in a bear-mode position. A resumption of weakness would open $67.07, the Jun 23 low.

- Gold traded sharply higher Dec 13. This signals a short-term reversal and the end of the recent Dec 4 - 13 corrective pullback. Moving average studies remain in a bull-mode position, highlighting an uptrend. A continuation higher would signal scope for a climb toward key resistance and the Dec 4 all-time high of $2135.4. A break of this level would confirm a resumption of the primary bull trend. Initial firm support lies at $1973.2, the Dec 13 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/12/2023 | 1330/0830 | * |  | US | Current Account Balance |

| 20/12/2023 | 1400/1500 |  | EU | ECB Lane Speech On Euro Area Outlook | |

| 20/12/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/12/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 20/12/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 20/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/12/2023 | 1830/1330 |  | CA | BOC minutes from last rate meeting | |

| 21/12/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/12/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2023 | 0900/1000 | ** |  | IT | PPI |

| 21/12/2023 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 21/12/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 21/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/12/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 21/12/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2023 | 1330/0830 | *** |  | US | GDP |

| 21/12/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 21/12/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 21/12/2023 | 1600/1700 |  | EU | ECB Lane Participates In Workshop Panel | |

| 21/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 22/12/2023 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.