-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US MARKETS ANALYSIS - US Yields Higher For Fourth Session

HIGHLIGHTS:

- Treasury curve bear steepening ahead of 7yr supply, Fed speakers

- Gilts, GBP underperform, GBP/USD back below 1.36

- Weak tech sector leads Europe, US futures lower

US TSYS SUMMARY: Bear Steepening With 7Y Supply And Fed Speakers Ahead

Treasuries continued to sell off overnight, but have picked up a bit of a bid in the last couple of hours of European trade. Some data ahead but the main focus again is on Fed speakers, and 7Y Supply.

- 10Y Tsy yields hit fresh post-Jun highs (1.5496%) a little after 0400ET but have retraced as equities have drifted to session lows and DXY dollar index to session highs.

- Similarly, 30Y seeing highest yld level since early July (2.0718%) in bear steepening move: 2-Yr yield is up 3.7bps at 0.3147%, 5-Yr is up 3.5bps at 1.0196%, 10-Yr is up 3.5bps at 1.5218%, and 30-Yr is up 5bps at 2.0441%. Dec 10-Yr futures (TY) down 10/32 at 131-15.5 (L: 131-09/ H: 131-27).

- European energy price surge helping set the tone.

- Plenty more FOMC speakers today, in the wake of announced departures of Dallas' Kaplan and Boston's Rosengren: Chicago's Evans at 0900ET; Chair Powell (alongside Tsy Sec Yellen) at 1000ET; Gov Bowman at 1340ET; Atlanta's Bostic at 1500ET.

- $62B in 7-Year supply at 1300ET. NY Fed buys ~$8.425B of 2.25-4.5Y Tsys.

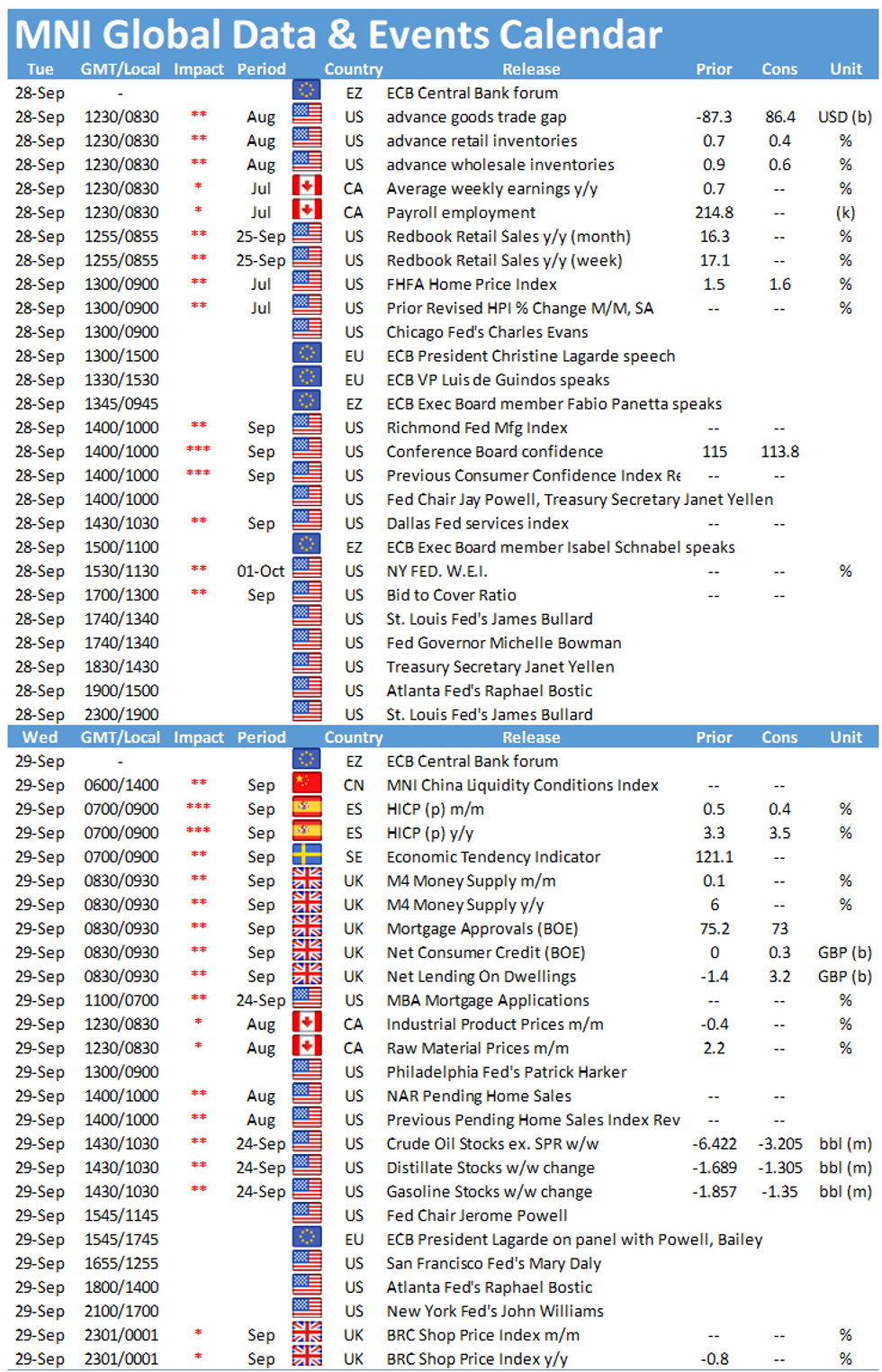

- Data today consists of Wholesale/retail inventories and Advance goods trade balance at 0830ET; house price data at 0900ET; and at 1000ET, Conference Board Consumer Confidence and Richmond Fed Mfg.

EGB/GILT SUMMARY: Gilts Underperform

European sovereign bonds have sold off this morning with gilts leading the charge. Equities have also edged lower, while the US dollar has made broad gains against global FX.,

- The shift in monetary policy expectations has further fueled the sell-off in gilts. Cash yields are 3-6bp higher on the day with the 10-year yield at one point touching 1% for the first time since March 2020.

- The bund curve has bear steepened with the 2s30s spread 2bp wider.

- The OAT curve has similarly steepened 2bp.

- BTPs have underperformed core EGBs, particularly in the belly of the curve where yields have pushed up 4-5bp.

- Supply this morning came from the UK (Gilt, GBP4.0bn), Italy (BOTs, EUR5.5bn), Netherlands (DSL, EUR4.915bn).

- The European data calendar was relatively light this morning, with no tier one releases for the UK or Eurozone.

- It is a busy day for central bank speakers with Lagarde, Guindose, Panetta and Schnabel all speaking at the ECB Forum on central banking throughout the day. The BoE's Catherine L Mann is also due to speak on a panel later today.

EUROPE ISSUANCE UPDATE: UK, Dutch Sales

UK DMO sells GBP 2bln 1.25% Jul-51 Gilt, Avg yield 1.332% (Prev. 0.972%), Bid-to-cover 2.05x (Prev. 2.41x), Tail 1.1bp (Prev. 0.5bps)

Netherlands sells E4.915bln new 0% Jan-29 DSL, Avg yield -0.251%, Price 101.850

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXX1 169/168ps, bought for 26 and 26.5 in 20k

DUZ1 112.10/112.00ps, bought for 2.25 in 4k

SX7E (17th June 2022) 120c, bought for 1.75 in 10k.

UK:

SFH2 99.80/99.70/99.60p fly 1x3x2, bought for -0.25 in 7,565x23,695x15,130

SFIH2 99.80/99.90/99.95 broken call fly, bought for 1.5 in 2k

FOREX: Solid Yields Lead USD Index Toward Bull Trigger

- The greenback trades well headed into the Tuesday session, with the USD Index showing above last week's highs and narrowing the gap with the bull trigger at August 20th's 93.729. The greenback is following yields higher - as has been the case since the beginning of the week - with the 10y yield today already showing above 1.54% and the highest level since mid-June.

- Bond strength comes alongside equity weakness, with core markets off around 1% or so. The risk-off theme has filtered into growth proxies and high beta FX, leading NZD to trade at the bottom of the pile alongside NOK (which trades off despite firm oil prices).

- JPY is failing to benefit from the stock market weakness, keeping the USD/JPY uptrend intact as it targets the July highs of 111.66.

- US trade balance data and the September consumer confidence release are the data highlights Tuesday, with appearances from ECB's Lagarde, Schnabel and Panetta due as well as Fed's Evans, Powell, Bowman and Bostic.

FX OPTIONS: Expiries for Sep28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1765-75(E1.5bln), $1.1790-00(E1.5bln), $1.1839-40(E525mln)

- USD/JPY: Y110.00-10($850mln), Y110.40-50($1.2bln)

- GBP/USD: $1.3700-20(Gbp520mln)

- AUD/USD: $0.7235-40(A$620mln), $0.7250-55(A$1.4bln)

- USD/CAD: C$1.2600-15($1.6bln), C$1.2675($1.6bln), C$1.2800-10($1.6bln)

- USD/CNY: Cny6.4500($1.0bln), Cny6.4530($1bln)

Price Signal Summary - S&P E-Minis Back Below The 50-Day EMA

- In the equity space, S&P E-minis are off recent highs and have traded below the 50-day EMA today - the average intersects at 4410.41. A deeper sell-off would highlight a bearish threat and the risk of a pullback towards the key support at 4293.75, Sep 20 low. Price needs to break above 4472.00, Sep 27 high to trigger a resumption of the most recent climb. EUROSTOXX 50 has also pulled away from recent highs and is weaker again today. A deeper pullback would expose the key support at 3974.00, Sep 20 low. Resistance has been defined at 4200.50, Sep 24 high.

- In FX, EURUSD outlook remains bearish. The focus is on key support at 1.1664, Aug 20 low. GBPUSD remains above key support at 1.3602, Aug 20 low. Triangle support at 1.3637 remains intact too and a breach of the 1.3636/02 zone is required to trigger a deeper sell-off. A resumption of gains would open 1.3789, the 50-day EMA. USDJPY has traded through 110.80, Aug 11 high. The break strengthens a bull case and opens 111.66, Jul 2 high and the bull trigger. The USD Index (DXY) key resistance resides at 93.73, Aug 20 high and the bull trigger. A break would confirm a resumption of the uptrend that started May 25.

- On the commodity front, the Gold trend needle still points south and the focus is on $1742.5, 76.4% of the Aug 9 - Sep 3 rally. WTI futures continue to defy gravity and the focus is on $78.24 - 1.236 projection of the Aug 23 - Sep 2 - Sep 9 price swing

- In FI, Bund futures remain in a clear downtrend and are trading lower this morning confirming a resumption of the current bear cycle. This opens 169.46 next, 1.50 projections of the Sep 9 - 17 - 21 price swing. Gilt futures remain heavy and are also trading lower. The focus is on 124.96, 1.236 projection of the Aug 31 - Sep 17 - 21 price swing. Treasuries trending lower too. Scope is seen for weakness towards 131-03+, the Jun 25 low.

EQUITIES: Tech Sector Leads Europe, US Futures Lower

- Stocks across Europe are retracing, with the EuroStoxx50 off around 1.5% at pixel time, matched by the downtick in French, and German indices. The UK's FTSE-100 is also lower, but the dip is far less pronounced thanks to strength in the likes of BP and Royal Dutch Shell.

- In US futures space, the NASDAQ is leading the decline, indicating a lower open to the tune of 1.5%. The e-mini S&P is also lower and has dipped below 4400. Nonetheless the index remains well above last week's lows of 4293.75.

- Tech weakness is also evident across Europe, with the sector comfortably the poorest performer on the continent. Losses are lead by semi-conductor names and chipmakers, indicating a tough session for the US equivalents later today.

COMMODITIES: Supply Crunch Continues, Brent Higher For Sixth Session

- WTI and Brent crude futures remain solidly in positive territory, with supply crunch concerns prevalent across markets. Brent crude futures trade above $80/bbl for the first time since late 2018, keeping the near-term uptrend intact and working against the WTI-Brent spread, which now sits close to its widest levels of the year.

- WTI futures maintain a bullish outlook and this week's strong start, as the contract continues to climb. Last week's break of $73.58, the Jul 6 high and bull trigger confirmed a resumption of the uptrend and has paved the way for further gains near-term. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards $80.00 further out.

- Gold remains bearish. The yellow metal last week traded through former support at $1742.3, Sep 20 low. This confirms a resumption of the current short-term bear cycle and signals scope for a move towards key support at $1690.6, Aug 9 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.