-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - USD at 2-month lows

Highlights:

- The USD has been the focus this morning, with the DXY moving to its lowest level for 2 months.

- A big day for sovereign issuance in Europe with Italy and Cyprus holding syndications; the UK, Netherlands, Austria and Germany holding bond auctions while the ESM and Belgium have issued bills.

US TSYS: Modest Paring Of Yesterday’s Gains, JOLTS On The Docket

- Cash Tsys hold only modest cheapening pressure in a slight paring of yesterday’s gains as they outperform core EU FI across the curve. With data starting to come into focus again, today sees JOLTS and factory orders, before ISM services and ADP employment tomorrow all gearing up towards payrolls on Friday. On JOLTS, openings are again seen easing in Feb but have surprised to the upside for the past three months.

- 2YY +3.5bp at 3.999%, 5YY +4.5bp at 3.546%, 10YY +3.9bp at 3.451%, 30YY +2.7bp at 3.655%.

- TYM3 trades 6 ticks lower at 115-08+, just half a tick off session lows but still towards the high of yesterday’s sizeable range of 114-18 to 115-21+. Support remains just below that with the 20-day EMA of 114-13.

- Data: JOLTS Feb (1000ET), Factory orders/final durable goods Feb (1000ET)

- Fedspeak: Gov Cook intro remarks (0830ET), Collins on careers (1345ET), Mester (1845ET, text + Q&A).

- No issuance

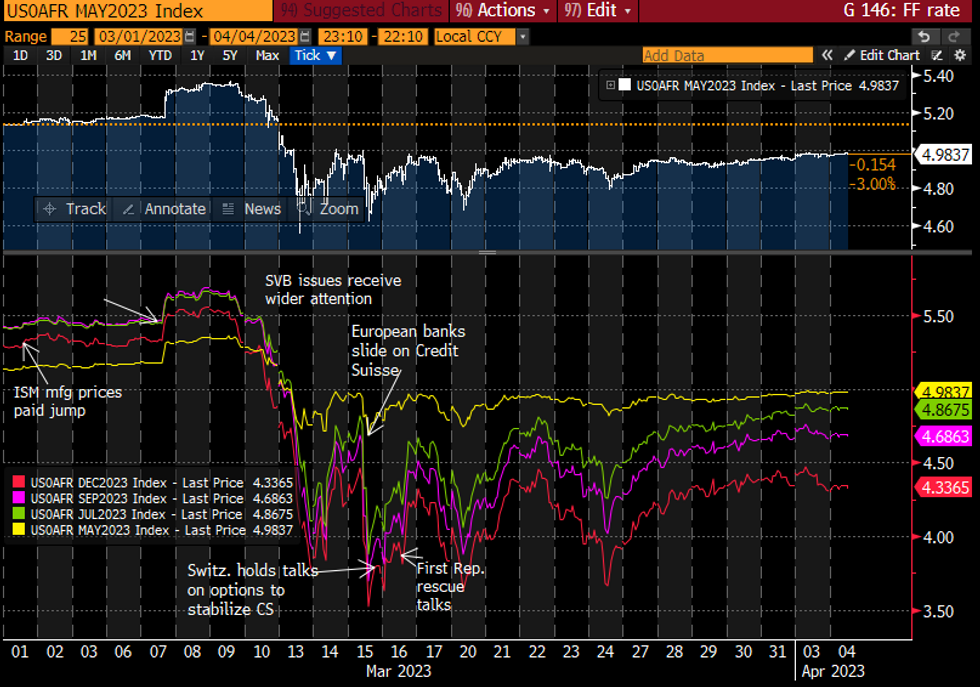

STIR: Fed Rate Path Holding Two Cuts To Year-End

- Fed Funds implied rates for the May FOMC sit close to post-Mar FOMC highs with a 15.5bp hike (+1bp) from the current effective 4.83%.

- Meetings further out have also pushed higher overnight but remain within yesterday’s range: sticking vs current effective, -15bp for Sep (+2bp), -32bp for Nov (+2.5bp) and -50bp for Dec to 4.33% (+3bp).

- Fedspeak: Mester (’24 voter) for the first time since Feb 24 with text + Q&A but not until 1845ET. Before that, Collins (non-voter) and Gov Cook (voter) speak again, with Cook having spoken late yesterday (disinflationary process happening but we’re not there yet, still see inflation from tight labor market).

Source: Bloomberg

Source: Bloomberg

EGB / GILT: Bear Threat In Gilts Remains Present

- In the FI space, Bund futures traded higher Monday, however, the contract maintains a softer tone following last week’s move lower. Price has traded below the 20-day EMA which intersects at 135.66. It represents an important pivot level and the break strengthens a bearish threat. 134.80, the Mar 22 low, has been tested. A breach of this level would open 134.15, a Fibonacci retracement. Initial resistance is at 136.77, the Mar 30 high.

- Gilt futures traded higher Monday and price remains above last week’s low of 102.74 (Mar 31). However, a short-term bearish threat remains present - last week’s move down resulted in a break of support at the 20-day EMA which intersects at 103.77. A clear break of the EMA would signal scope for a continuation lower towards 102.31 next, the 61.8% retracement of the Feb 28 - Mar 20 rally. On the upside, initial resistance is seen at 105.04, 50.0% of the Mar 20 - 31 downleg.

European Issuance Update

Gilt auction result

- It was a strong auction of the 1.125% Jan-39 gilt with the LAP of 68.579 in excess of the pre-auction mid-price of 68.466.

- The average price of 68.600 was also higher than the prevailing price for around 20 minutes ahead of the auction cut-off. The tail of 0.2bp was very tight.

- On the publication of the results the price of the 1.125% Jan-39 gilt moved higher but failed to reach the average auction price. The majority of those gains have been reversed now (in line with the general move lower in core FI) but we continue to trade slightly above the pre-auction mid-price.

- GBP2.25bln of the 1.125% Jan-39 Gilt. Avg yield 3.78% (bid-to-cover 2.58x, tail 0.2bp).

Dutch auction result

- E4.43bln of the 2.50% Jan-30 DSL. Avg yield 2.563%.

Austria auction results

- E805mln (E700mln allotted) of the 2.00% Jul-26 RAGB. Avg yield 2.631% (bid-to-cover 1.85x).

- E575mln (E500mln allotted) of the 2.90% Feb-33 RAGB. Avg yield 2.891% (bid-to-cover 1.73x).

German auction results

- A weak Index-Linked Bund auction with only E434mln allotted across the two issues (with E600mln having been on offer, so a retention ratio of 27.7%).

- The average price achieved was close to the pre-auction mid-price but there was a notable tail, meaning that the LAP was below the pre-auction mid-price for both issues on offer.

- The size of the 0.10% Apr-33 ILB was increased to E450mln (from an indicated E400mln) while the 0.10% Apr-46 ILB was increased by E150mln (from an indicated E200mln).

- E450mln (E352mln allotted) of the 0.10% Apr-33 ILB. Avg yield -0.11% (bid-to-cover 0.98x).

- E150mln (E82mln allotted) of the 0.10% Apr-46 ILB. Avg yield -0.18% (bid-to-cover 1.13x).

Italy 8-year Green Syndication Update

- Books in excess of E35bln (MNI expects transaction size of E6-10bln), spread set at 0.60% Aug-31 BTP + 8bps

Cyprus 10-year Sustainable Syndication Update

- Size set at E1.0bln, books in excess of E12.5bln, spread set at MS+125bp

FOREX: Cable tests the 1.2500 handle

- The Dollar started the European session flat against G10s, but has since lost some ground, after taking its cue from the Risk On tone, some follow through after Data missed expectations yesterday for Equities.

- The drift lower in Gilt weighted by the supply and the Weaker Dollar has helped the Pound to be the best performer against the Greenback in G10s, and testing the 1.2500 handle at typing.

- Next resistance in Cable comes at 1.2555 2.0% 10-dma envelope.

- AUD is still the red, despite the risk on tone and the offered Dollar, with the Currency in the red after the RBA kept their rate unchanged, which was widely expected.

- The Yen is also in the red, as the USDJPY test the 133.00 handle, led by higher Yields.

- Looking ahead, on the data front sees, US Factory order, JOLTS, final Durable Goods.

- Speakers include, ECB Centeno, BoE Pill, Tenreyro, Fed Cook, Collins, Mester.

FX OPTIONS: NOTABLE EXPIRIES

Big expiry in EURUSD tomorrow.

Of note:

EURUSD 1.06bn at 1.0950.

USDCNY 1.46bn at 6.9000.

EURUSD 4.12bn at 1.0900 (wed).

USDJPY 1.32bn at 133.00 (wed).- EURUSD: 1.0900 (654mln), 1.0950 (1.06bn), 1.1000 (720mln).

- USDJPY: 132.00 (300mln). 132.10 (327mln), 133.00 (992mln), 133.30 (475mln).

- AUDUSD: 0.6750 (216mln), 0.6800 (360mln).

- USDCNY: 6.86 (595mln), 6.88 (381mln), 6.90 (1.46bn).

EQUITIES: EUROSTOXX Breaches Resistance At The March High

- In the equity space, S&P E-Minis maintains a bullish tone. Price has recently breached resistance at 4119.50, reinforcing bullish conditions. The move higher has also resulted in a breach of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4032.81, the 50-day EMA.

- EUROSTOXX 50 futures remain bullish. Price has breached resistance at 4268.00, the Mar 6 high and a key hurdle for bulls. A clear break of it strengthens bullish conditions and opens 4300.00 next ahead of 4324.50, the Jan 13 2022 high (cont). Moving average studies are in a bull-mode set-up and this highlights a broader uptrend. Initial firm support lies at 4146.30, the 20-day EMA.

COMMODITIES: Price Signal Summary - WTI Technical Signals Remain Bullish

- On the commodity front, trend conditions in Gold remain bullish and short-term pullbacks are considered corrective. Note that price action since Mar 20 appears to be a pennant - a continuation pattern. This reinforces bullish conditions and signals scope for an extension higher near-term. The recent test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 marks a firm support, the Mar 17 low - a break would signal scope for a deeper pullback.

- In the Oil space, WTI futures remain in a bull cycle and Monday’s gap higher strengthens this current condition. The contract has touched a high of $81.69, just above resistance at $81.04, the Mar 7 high. A clear break of $81.04 would signal scope for a continuation higher and open $83.04, the Jan 23 high. Key support is seen at $75.72, the Mar 31 high and the gap low on the daily chart. A pullback, if seen, would be considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/04/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Keynote Speech at RES Conference | |

| 04/04/2023 | 1230/0830 | * |  | CA | Building Permits |

| 04/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/04/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 04/04/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/04/2023 | 1630/1730 |  | UK | BOE Pill Speech at ICMB | |

| 04/04/2023 | 1730/1330 |  | US | Fed Governor Lisa Cook | |

| 04/04/2023 | 2245/1845 |  | US | Cleveland Fed's Loretta Mester | |

| 05/04/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/04/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 05/04/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/04/2023 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 05/04/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/04/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/04/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/04/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/04/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/04/2023 | 0900/1100 | * |  | IT | Retail Sales |

| 05/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Panellist at RES Conference | |

| 05/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/04/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/04/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2023 | 1400/1600 |  | EU | ECB Lane Lecture at University of Cyprus | |

| 05/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.