-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI US MARKETS ANALYSIS - USD/JPY Tipped to New Weekly High on Broader BoJ Bond Buys

Highlights:

- USD/JPY hits a new weekly high as BoJ broaden bond buys

- Treasury curve sits bear flatter

- Eurozone CPI points to persistent core problems for ECB

US TSYS: Tsys Bear Flattening Into Month/Quarter End

The Treasury curve has bear flattened in overnight trade Friday, with Eurozone inflation data holding sway early, but US data taking over in the afternoon.

- Jun 10-Yr futures (TY) have traded in an 11 tick range in European trade, last down 7/32 at 114-11.5, The high was set overnight at 114-20 prior to stronger-than-expected French inflation data which sank Bunds and brought TYs to session lows (114-09).

- Eurozone/Italian inflation data at 0500ET was on the weak side and saw a core FI bounce, though that's mostly retraced.

- Attention swiftly turns to data, with Feb PCE the first port of call at 0830ET - core deflator eyed ticking lower M/M. Then MNI Chicago PMI at 0945ET, followed by final UMich survey at 1000ET.

- Heading into the data, May FOMC meeting pricing sits at 15bp (no strong conviction of a hike), up a basis point on the day and steady through June. About 50bp of cuts from the peak are priced in by year-end, the least since Mar 22, and down from 57bp yesterday.

- Month-end dynamics of some note, but Tsy extensions are seen as small.

- Later Friday we hear from Fed's Williams (1500ET), Cook (1745ET), and Waller (2200ET).

- Checking on latest cash levels: 2-Yr yield is up 4.6bps at 4.1659%, 5-Yr is up 2.1bps at 3.7045%, 10-Yr is up 2.1bps at 3.5697%, and 30-Yr is up 2bps at 3.7534%.

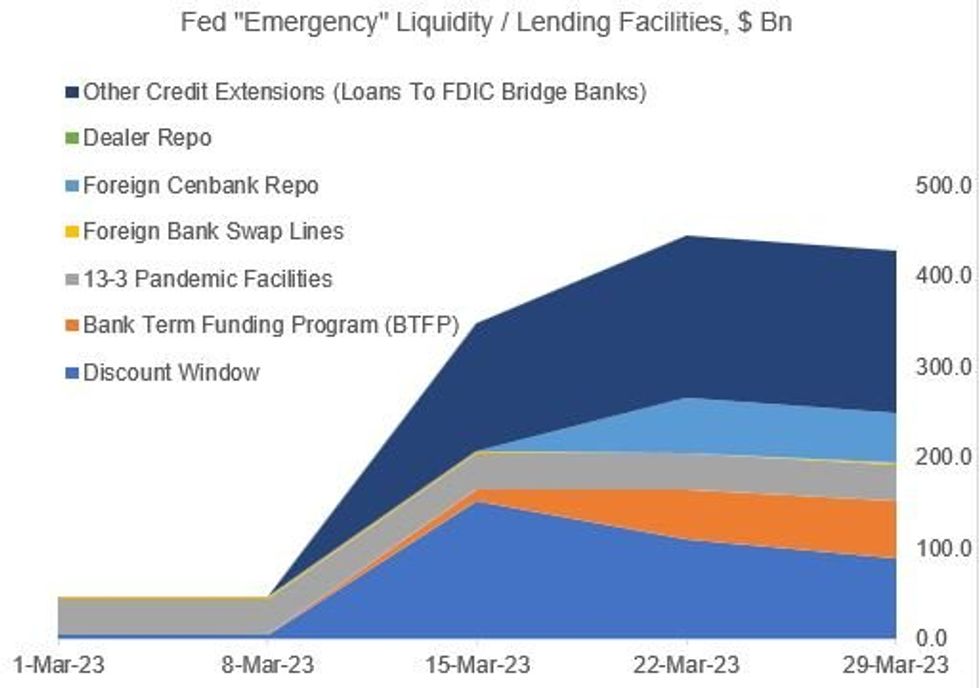

MNI Fed Balance Sheet Tracker - Mar 31, 2023

The latest Fed balance sheet data release shows that liquidity extended to banks dipped slightly in the week to Mar 29 - full analysis has been emailed to subscribers and is available in PDF format here.

- However the overall gains over the past month (ie since fears began emerging about Silicon Valley Bank) remain sizeable, and the gain in system reserves has largely been maintained.

- Other items of interest include an apparent shift in borrowing from the Discount Window to the Fed's new BTFP facility; the US Treasury General Account balance falling to a post-2021 low; and a dip in FIMA repo facility takeup.

FOREX: USD/JPY Pushes to Fresh High as BoJ Broadens Bond Buying

- USD/JPY pressed to a fresh weekly high in late Asia / early European hours as the BoJ outlined their bond-buying schedule for Q2, expanding the maturity range of purchases to incorporate the super-long end of the curve. The tweaked schedule outlines the ability of the BoJ to remain flexible amid global pressures - most notably the recent banking fallout that send global yields lower.

- USD/JPY showed above Y133.50 for the first time since March 17th in response, opening next resistance at the 133.89 100-dma. Progress through here would mark a 50% retracement for the March downleg, but further strength in the pair is needed to reverse the current medium-term bearish signals.

- NOK/SEK has turned lower to reflect the moderation in Brent oil prices so far Friday, but the cross remains well off the nearest notable support at the Mar20 low of 0.9725.

- The USD is generally firmer, but remains within the March downtrend channel drawn off the March 8th high. Data releases pick up into the US crossover, with February PCE, personal income & spending, the final UMich sentiment reading as well as the March MNI Chicago PMI. Markets look for the PMI to deteriorate slightly to 43.0 from 43.6.

- A number of central bank speakers are also on the docket, with ECB's Lagarde & Vujcic as well as Fed's Williams and Cook set to speak.

FX OPTIONS: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.6bln), $1.0800(E1.7bln), $1.0850(E1.2bln), $1.0900(E648mln), $1.0950(E1.1bln), $1.1000(E532mln)

- USD/JPY: Y130.00($762mln), Y131.00($1.0bln), Y132.00($665mln), Y133.85-00($655mln), Y136.00-20($1.3bln)

- GBP/USD: $1.2000(Gbp515mln), $1.2100(Gbp693mln)

- AUD/USD: $0.6550(A$808mln)

- USD/CAD: C$1.3600($1.5bln), C$1.3900($1.2bln)

BONDS: BTPs Outperform As Soft Euro Inflation Data Brings Bunds Off Lows

For the second consecutive session, Eurozone inflation data has been the main market driver in the European morning, with US PCE and Chicago PMI eyed later.

- An early upside surprise in the French prelim March inflation report saw Bunds sell off and ECB hike pricing pick up further, but the move was partially reversed as Italian CPI came in well below expectations, leading to a downside miss in overall Eurozone inflation.

- Bunds went from session lows to near session highs and BTPs rallied strongly on the Italian CPI miss, with the overall impact being 10Y spreads compressing 4.2bp.

- ECB depo hike pricing pulled back about 8bp as well (terminal still up 1.2bp on the day to 3.61%), with BoE peak Bank Rate retreating around 4bp (last 4.69%).

- ECB's Lagarde and Vujcic have scheduled appearances later.

- The US curve remains bear flattened, with Fed May hike pricing remaining slightly firmer (1bp) overnight at 15bp (60% implied probability of a 25bp raise).

- We get several key data points to close out the week/month/quarter: Feb PCE release, MNI Chicago Business Barometer, and final UMichigan sentiment.Late Friday, Fed's Williams and Cook make appearances (Waller speaks over the weekend).

EQUITIES: Week's E-mini S&P Rally Shifts Targets to 4119.50 Mar 6 High

- Eurostoxx 50 futures traded higher Thursday. The contract has cleared resistance at 4164.00, the Mar 22 high. This cancels a recent bearish threat and confirms a resumption of the bull cycle that started Mar 20. A continuation higher would open key resistance at 4268.00, the Mar 6 high. Moving average studies are in a bull-mode set-up and this suggests the broader uptrend is intact. Initial firm support lies at 4034.00, the Mar 24 low.

- S&P E-Minis are trading higher. Price has breached resistance at 4073.75, Mar 22 high. The contract is also once again trading above the 50-day EMA - the average intersects at 4023.39. The break of 4073.75 strengthens bullish conditions and signals scope for a climb towards 4119.50, the Mar 6 high. Key short-term support lies at 3937.00, the Mar 24 low. A break of this support would be bearish. Initial support lies at 4012.49, the 20-day EMA.

COMMODITIES: WTI Futures Breach 20-Day EMA, 50-Day EMA Marks Next Key Resistance

- WTI futures continue to trade at this week’s highs. Price has breached resistance at the 20-day EMA which intersects at $72.80. The break is a short-term bullish development and a continuation higher would expose the 50-day EMA, at $74.94. This average represents the next key resistance point. On the downside, initial firm support lies at $66.82, the Mar 24 low. A break of this level would be bearish.

- Trend conditions in Gold remain bullish and the recent short-term pullback is considered corrective. Note that price action since Mar 20 appears to be a pennant - a continuation pattern. This reinforces bullish conditions and signals scope for an extension higher near-term. The recent test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 marks a firm support, the Mar 17 low - a break would signal scope for a deeper pullback.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/03/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/03/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/03/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 31/03/2023 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students | |

| 31/03/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/03/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2023 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 31/03/2023 | 1900/1500 |  | US | New York Fed's John Williams | |

| 31/03/2023 | 2145/1745 |  | US | Fed Governor Lisa Cook | |

| 31/03/2023 | 0200/2200 |  | US | Fed Governor Christopher Waller | |

| 01/04/2023 | 0630/0830 |  | EU | ECB de Guindos Panels Ambrosetti Event | |

| 03/04/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0030/1030 | * |  | AU | Building Approvals |

| 03/04/2023 | 0030/1030 | ** |  | AU | Lending Finance Details |

| 03/04/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 03/04/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 03/04/2023 | 0630/0830 | *** |  | CH | CPI |

| 03/04/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/04/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 03/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 03/04/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/04/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/04/2023 | 1400/1000 | * |  | US | Construction Spending |

| 03/04/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.