-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Off Highs, Treasuries Off Lows

Highlights:

- UK rates retreat off extremes, but remain elevated after Wednesday CPI

- USD on backfoot, Treasuries off lows into final session of the week

- Data deluge rounds off the week, with PCE, durables and Michigan sentiment due

US TSYS: Richer With Debt Deal Eyed, Heavy Data Docket Including PCE

- Cash Tsys outperform core European FI this morning with a bull steepening led by 2YY currently down 5bps but only chipping away at yesterday’s sizeable sell-off. Politics and debt ceiling headlines will no doubt continue to have an impact as the two sides move closer to an agreement ahead of the Memorial Day long weekend but data otherwise headlines.

- Highlights include PCE, durable goods and the final U.Mich survey after the surprising jump in the 5-10Y measure to its highest since 2011 in the preliminary report, before Mester (’24 voter) speaks and then the early cash close at 1300ET potentially providing some volatility (Globex at 1600ET).

- 2YY -4.8bp at 4.485%, 5YY -3.7bp at 3.876%, 10YY -3.5bp at 3.783% and 30YY -2.2bp at 3.973%.

- TYM3 trades 5 ticks higher at 112-25 off a high of 112-27 but firmly within yesterday’s range to the upside, with subdued volumes of 205k ahead of a heavy data docket. Resistance is seen at 113-25 (May 24 high).

- Data: Monthly PCE report Apr (0830ET), Durable goods orders Apr prelim (0830ET), Adv Goods trade bal Apr (0830ET), Retail/Wholesale inventories Apr/Apr prelim (0830ET), U.Mich consumer survey May final (1000ET), Kansas Fed service index May (1100ET).

- Fedspeak: Mester (’24 voter) speaks on CNBC at 1100ET

STIR FUTURES: Fed Rates Unwind Yesterday’s Gain, Mester On CNBC Later

- Fed Funds implied rates have stabilised since the start of the European session after cooling through Asia hours, unwinding yesterday’s further climb but still holding sizeable increases since Waller and then the FOMC minutes on Wed.

- Pertinent cumulative changes from current 5.08%: +10bps for Jun (-3.5bp), no longer fully pricing a July hike with +20bp (-4.5bp), -1bp cut Nov (-6bp) and -18bp Dec (-6bp). The July terminal of 5.28% is off highs of 5.435% but otherwise at highs since Mar 10.

- Fedspeak: Not showing on BBG but Mester (’24 voter) is due to appear on CNBC at 1100ET. She last spoke May 16 and when talking on sufficiently restrictive rate levels, said “And at this point, given the data we've gotten so far, I would say no, I don't think we're at that rate yet. Because I don't see it equally likely that we'll be increasing the next time versus decrease. However, there's four weeks to go before the June meeting.”

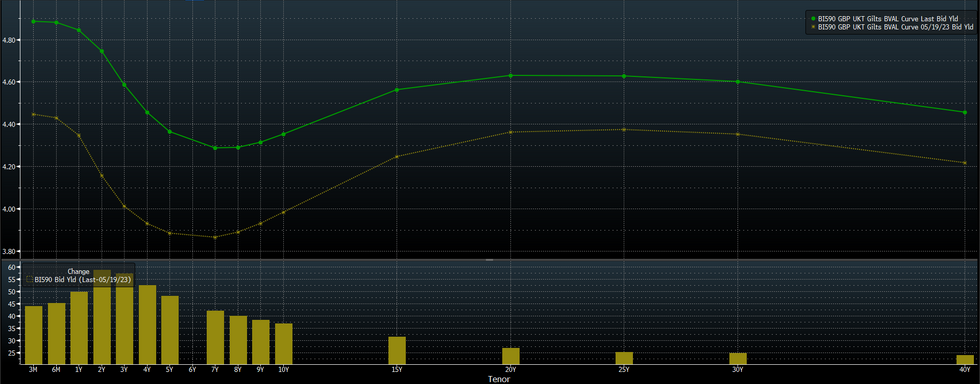

GILTS: Twist Steepening Now Apparent, Wider Bid Allows Recovery From Session Cheaps

The rebound in Bunds from post-SVB meltdown yield extremes and some pre-PCE outperformance for U.S. Tsys has allowed Gilts to recover from session cheaps (last running 2bp richer to 1bp cheaper across the curve, twist steepening, pivoting at 10s) and BoE pricing to tick away from recent cycle extremes (to just below 5.60%), although this week’s moves remain sizeable (see chart below for an overview of week-to-date moves across the Gilt curve). A reminder that numerous fresh year-to-date highs have been registered across the major Gilt benchmarks in recent sessions, with levels not seen since the mini-Budget fallout under former PM Truss being observed.

Fig. 1: Week-To-Date Moves Across The Gilt Curve

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

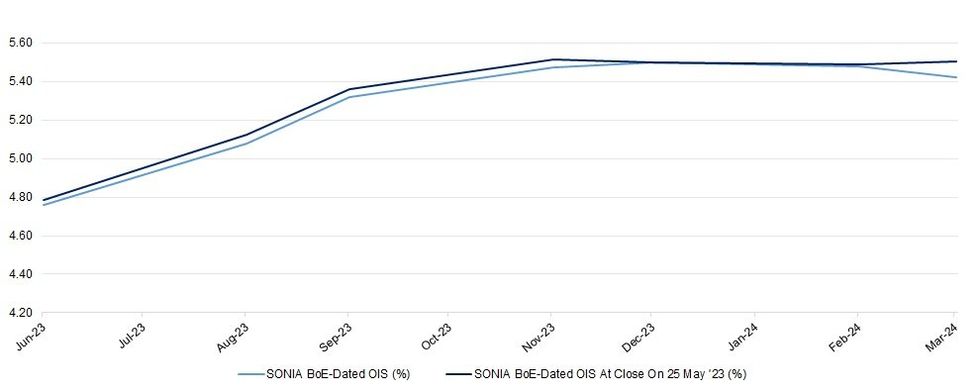

STIR: BoE Terminal Pricing Nudges Away From Recent Highs

BoE terminal rate pricing moderates a touch from intraday (and recent highs) with core global FI a little firmer after an initial round of Gilt cheapening, leaving terminal rate pricing just shy of 5.60% in BoE policy rate terms.

- We haven’t got anything in the way of meaningful UK event risk slated for today, which will mean that wider developments will be at the fore after a frenetic round of CPI-driven hawkish repricing over the past couple of sessions. Just under 110bp of tightening is now priced by the end of December, with market participants eying the elongated weekend.

- A quick reminder that late Thursday saw comments from BoE MPC member Haskel, who indicated his preference to lean against the risk of inflation, which means that further rate hikes cannot be ruled out (although he played down the idea that high levels of inflation are becoming embedded in the UK).

| BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

| Jun-23 | 4.758 | +33.1 |

| Aug-23 | 5.075 | +64.8 |

| Sep-23 | 5.318 | +89.1 |

| Nov-23 | 5.474 | +104.6 |

| Dec-23 | 5.500 | +107.2 |

| Feb-24 | 5.477 | +104.9 |

| Mar-24 | 5.424 | +99.6 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

RATINGS: Friday’s Rating Slate

Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Lithuania (current rating: A; Outlook Stable) & Spain (current rating: A-; Outlook Stable)

- Moody’s on the Czech Republic (current rating: Aa3; Outlook Negative) & Slovakia (current rating: A2; Outlook Negative)

- DBRS Morningstar on Poland (current rating: A, Stable Trend)

FOREX: Data Deluge to Round Off the Week

- The greenback is softer to finish the final session of the week, with the dollar slipping slightly against all others in G10.

- Scandi currencies are seeing some relief, with SEK and NOK off the week's lowest levels but still well within range of nearby support. USD/NOK touched a new cycle high Thursday of 11.0741, and markets have faded back toward the 11.00 handle ahead of the NY crossover.

- The risk backdrop is tentatively softer, with European equities giving back some of the week's late recovery. Most major indices are in the red, helping US futures indicate a mildly lower open Friday.

- Key US releases Friday include prelim April durable goods orders, personal income/spending and the final UMich sentiment survey for May. Markets see a staggered early close due to the US Memorial Day holiday set for Monday.

- The central bank speaker slate is thin to round off the week, with focus remaining on any signs of progress in debt ceiling negotiations given McCarthy's pledge to work through the extended weekend.

FX OPTIONS: Expiries for May26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650-65(E2.8bln), $1.0696-00(E913mln), $1.0765(E639mln), $1.0785-00(E2.7bln), $1.0865-80(E1.7bln), $1.0900(E1.6bln)

- USD/JPY: Y139.00($530mln), Y140.00($995mln)

EQUITIES: Eurostoxx Futures Pare Overnight Gains

- Eurostoxx 50 futures have traded lower this week and the contract remains soft - for now. The 50-day EMA, at 4266.60, has been pierced and this signals scope for weakness towards 4233.00, the May 4 low and a key short-term support. A break of this level would strengthen bearish conditions. On the upside the bull trigger is at 4409.50, the Nov 18 2021 high (cont) and a major resistance.

- S&P E-minis traded lower Wednesday and this resulted in a test of the 50-day EMA at 4125.79. A clear break of this average would highlight a stronger short-term reversal and expose 4062.25, the May 4 low and a key support. Price did recover yesterday. A continuation higher would refocus attention on initial key resistance at 4227.25, the May 19 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

COMMODITIES: WTI Futures Pullback Follows Failure to Overcome 50-Day EMA

- WTI futures traded lower Thursday and the pullback means that - for now - the contract has failed to overcome resistance at the 50-day EMA, which intersects at $74.31. Recent short-term gains are considered corrective, however, a clear breach of the 50-day EMA would highlight a stronger bullish theme and expose $76.74, the Apr 28 high. Support to watch lies at $69.39, the May 15 low. A break would be bearish.

- The bear cycle in Gold remains intact as the yellow metal extends the downtrend that started on Apr 26. This week’s break lower paves the way for a move towards $1933.6, trendline support drawn from Nov 3 2022. A clear break of the trendline would reinforce bearish conditions and open $1903.5, a Fibonacci retracement. Key resistance and the bull trigger is at $2063.0, May 4 high. Initial firm resistance is $1985.3, the May 24 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/05/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/05/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/05/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 26/05/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.