-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

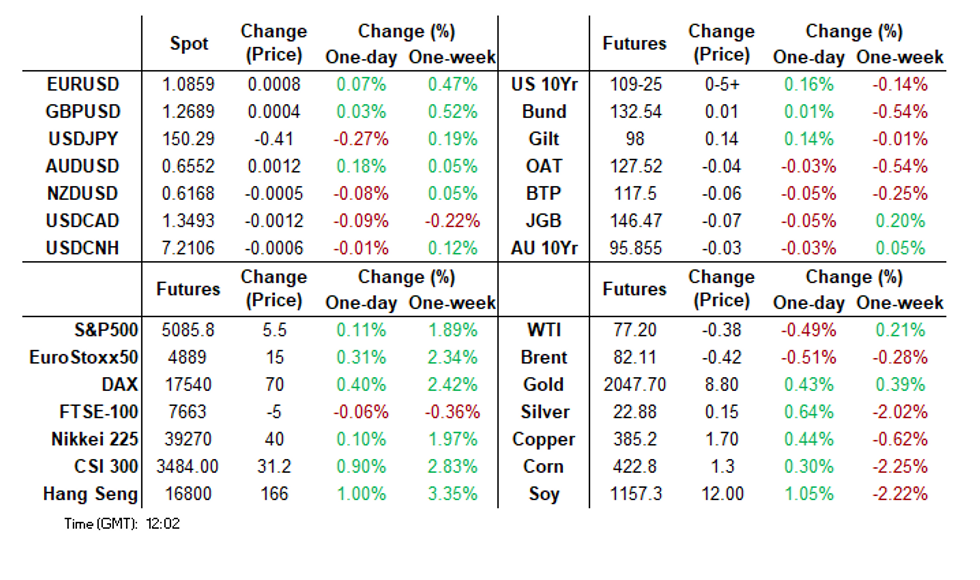

Free AccessMNI US MARKETS ANALYSIS: USD Off Lows & Bonds Off Highs

- BBDXY off lows, JPY outperforms G10 FX peers on Japan CPI.

- Issuance calendar caps early London rally in Bonds.

- U.S. data release calendar busy, BoE's Ramsden also eyed.

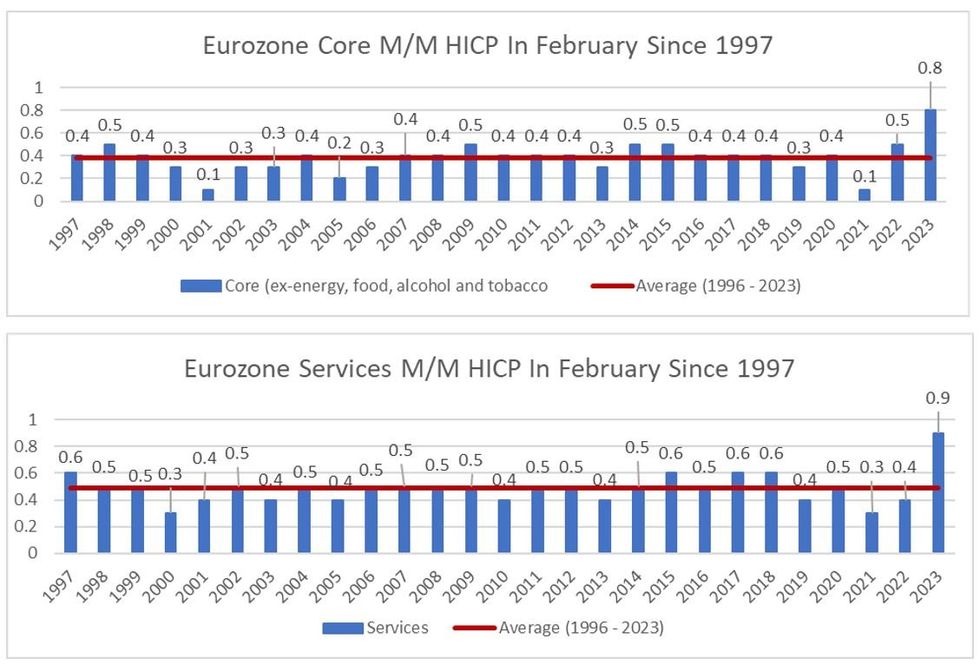

MNI Eurozone Inflation Preview – February 2024

Services Under Scrutiny Ahead Of March ECB Meeting

Eurozone core and headline inflation are expected to resume their downtrends in February on an annual basis, with headline printing a 3-month low 2.5% Y/Y (vs 2.8% prior) and core returning to below 3% for the first time since February 2022 at 2.9% (3.3% prior).

- February marks the first of a two-month sequence that typically sees reaccelerations in non-seasonally adjusted HICP (both core and headline), with March being typically pronounced, though the base effects from an especially strong Feb 2023 (especially in categories such as food) will help keep a lid on the overall print.

- The main area of scrutiny will again be services, which having printed 4.0% Y/Y for 3 consecutive months is overwhelmingly expected to pull back. A figure in the 3.6-3.7% Y/Y area is the base case.

- February’s inflation data will be the last before the ECB’s March meeting and projections. It would take an extraordinary downside surprise in the data to spur even a discussion on a March cut – but the report could play a crucial role in the meeting communications and potential for an April cut.

- Our preview includes analysis of price categories to watch, assessments of underlying inflation trends, outlooks for the French, German, Spanish, and Italian national inflation prints, and sell-side analyst previews.

- Click for FOR FULL PDF ANALYSIS: Feb2024EZCPIPreview.pdf

US TSYS: Mildly Richer With Data And Further Tsy Note Supply Ahead

- Cash Tsys trade between 0.5-1bp richer on the day, whilst 2s10s steps 2bp higher to -41.5bps owing to the new benchmark 2Y.

- TYH4 has kept to tight ranges overnight, at 109-24+ off a high of 109-28, but the trend needle points south with support at 109-09 (Feb 23 low). The June contract should take the front tomorrow with ~85% roll pace.

- Today’s focus should be on data including preliminary durable goods and the Conference Board consumer survey, plus 7y supply after small to modest tails for 2s and 5s yesterday. With the Conf Board, recall that it saw a surprise shunt higher in the labor differential last month which ending up boding well for the January payrolls report.

- Data: Durable goods Jan prelim (0830ET), FHFA house prices Dec/Q4 (0900ET), S&P CoreLogic house prices Dec (0900ET), Conf. Board consumer survey Feb (1000ET), Richmond Fed mfg Feb (1000ET), Dallas Fed services Feb (1030ET)

- Fedspeak: Barr on counterparty credit risk (0905ET incl text)

- Note/bond issuance: US Tsy $42B 7Y Note auction (91282CKC4) – 1300ET

- Bill issuance: US Tsy $80B 42D CMB Bill auction – 1130ET

STIR: Still Holding Close To Three Fed Cuts For 2024

Fed Funds implied rates are unchanged for March as they hold recent gains, but otherwise sit 0.5-1.5bp lower today.

- Cumulative cuts: 0bp Mar, 5bp May, 19bp Jun and 80bp Dec. The latter pulls back after overnight touching a new low of 77bp of cuts for 2024 as it hovers just shy of the three cuts in the median Dec SEP dot.

- Hotter than expected Japan CPI hasn’t had a material impact, nor has KC Fed’s Schmid (’25 voter) towing the FOMC line in his first appearance since being appointed in August. He called for patience before easing monetary policy amidst brisk service inflation.

- He also outlined his preference for a smaller Fed balance sheet via continued QT whilst tolerating some interest-rate volatility. Greater QT focus is likely on Waller and Logan’s discussion on Mar 1.

- VC Supervision Barr (perm. voter) speaks on counterparty credit risk at 0905ET, with more attention on durable goods and the Conference Board’s consumer survey.

STIR: OI Points To Mix Of Net Short Setting & Long Cover In SOFR Futures On Monday

The combination of yesterday's sell off in SOFR futures and preliminary OI data points to the following positioning swings on Monday:

- Whites: Net short setting seemed to dominate in pack terms, with some lighter rounds of apparent net long cover in some contracts.

- Reds: Net short setting was seemingly seen in all contracts.

- Greens: Net long cover seemed to dominate in net pack terms, with an apparent round of net short setting in SFRU6 providing the only exception.

- Blues: An apparent mix of net short setting and long cover, with the latter dominating in net pack terms.

| 26-Feb-24 | 23-Feb-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,123,227 | 1,125,753 | -2,526 | Whites | +21,413 |

| SFRH4 | 1,109,463 | 1,114,956 | -5,493 | Reds | +18,152 |

| SFRM4 | 1,116,988 | 1,097,400 | +19,588 | Greens | -30,844 |

| SFRU4 | 859,277 | 849,433 | +9,844 | Blues | -1,446 |

| SFRZ4 | 1,135,934 | 1,131,801 | +4,133 | ||

| SFRH5 | 675,796 | 675,211 | +585 | ||

| SFRM5 | 721,153 | 707,914 | +13,239 | ||

| SFRU5 | 643,673 | 643,478 | +195 | ||

| SFRZ5 | 722,888 | 760,030 | -37,142 | ||

| SFRH6 | 487,549 | 489,936 | -2,387 | ||

| SFRM6 | 508,447 | 511,197 | -2,750 | ||

| SFRU6 | 322,869 | 311,434 | +11,435 | ||

| SFRZ6 | 303,547 | 306,845 | -3,298 | ||

| SFRH7 | 186,959 | 178,742 | +8,217 | ||

| SFRM7 | 176,855 | 181,857 | -5,002 | ||

| SFRU7 | 150,830 | 152,193 | -1,363 |

FOREX: USD fades early weakness

There's very little change for the Dollar during the early European session, with all G10 pairs/crosses trading within past ranges.

- The Dollar saw some small downside early continuation, with DXY hovering at session low, and tested its lower part of its against the ZAR, MXN, NOK, INR, JPY, SEK, CZK, and MYR during the European Equity cash open, with Risk tilted to the upside.

- The Japanese CPI beat has kept the Yen as the best performer in G10, up 0.29% against the Greenback, but still within that 150.00/151.00 range.

- AUD is the second best performer, taking its cue from the Risk On tone, but is off the best level at the time of typing.

- AUDUSD exchanges hands at 0.6550, and further extension higher will have market participants keeping a close eye on the large option expiry for today, with 3bn at 0.6595/0.6600.

- Cable made another attempt at the 1.2700 handle, failed last Thursday at 1.2709, but failed again today at 1.2697, and is now testing 1.2672 its intraday low.

- A clear break through the 1.2709 level, will open back to 1.2759, not a tech level, but where the pair was trading pre US February NFP.

- Looking ahead, main focus on the data front for today will be on the US prelim Durable Goods.

- Speakers include, ECB Elderson, BoE Ramsden, and Fed Barr.

FX OPTIONS: Expiries for Feb29 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0800 (1.14bn), 1.0805 (507mln), 1.0810 (396mln), 1.0840 (637mln), 1.0850 (890mln), 1.0855 (372mln), 1.0875 (241mln), 1.0900 (312mln), 1.0910 (687mln), 1.0925 (731mln)

- GBPUSD: 1.2645 (275mln), 1.2650 (1.01bn).USDJPY: 150.00 (1.18bn), 150.20 (951mln), 151.00 (782mln)

- USDCAD: 1.3550 (500mln)

- AUDUSD: 0.6545 (257mln), 0.6550 (501mln), 0.6595 (889mln), 0.6600 (2.12bn)

EQUITIES: S&P E-Minis Bull Cycle Remains In Play

The trend condition in S&P E-Minis remains bullish following last week’s gains and pullbacks are considered corrective. The move higher continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 5000.90, the 20-day EMA. A resumption of gains would open vol-band based resistance at 5137.13.

- The bull cycle in EUROSTOXX 50 futures remains firmly intact and the contract is holding on to its recent gains. Moving average studies are in a bull-mode position too, highlighting positive market sentiment. Sights are on 4904.40 next, the 2.236 projection of the Nov 8 - 24 - 28 price swing. Initial firm support lies at 4747.70, the 20-day EMA.

COMMODITIES: WTI Resistance Remains Intact

Recent price activity in Gold has defined key resistance at $2065.5, the Feb 1 high, and key support at $1984.3, the Feb 14 low. Both levels represent important short-term directional triggers. A clear break of the Feb 1 high would highlight a short-term reversal and open $2088.5, the Dec 28 high. For bears, clearance of $1984.3 would expose an important support and bear trigger at $1973.2, the Dec 13 low.

- Recent gains in WTI futures still appear corrective at these levels and key short-term resistance at $79.09, the Jan 29 high, remains intact. Clearance of this level would alter the picture and highlight a bullish development. A break would open $81.70, 76.4% of the Sep 19 - Dec 13 bear cycle. Support to watch lies at $71.49, the Feb 5 low. A breach of this level would reinstate the recent bearish theme and pave the way for a move towards $69.79, the Jan 3 low. Initial support lies at $75.56, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/02/2024 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 27/02/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2024 | 1340/1340 |  | UK | BOE's Ramsden at Association for Financial Markets | |

| 27/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/02/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1405/0905 |  | US | Fed Vice Chair Michael Barr | |

| 27/02/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/02/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 27/02/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/02/2024 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 28/02/2024 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 28/02/2024 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 28/02/2024 | 0700/0800 | ** |  | SE | PPI |

| 28/02/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 28/02/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/02/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/02/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 28/02/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/02/2024 | 1100/1200 |  | EU | ECB's Lagarde and Cipollone in G20 and CB Governors meeting | |

| 28/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/02/2024 | 1330/0830 | * |  | CA | Current account |

| 28/02/2024 | 1330/0830 | * |  | CA | Payroll employment |

| 28/02/2024 | 1330/0830 | *** |  | US | GDP |

| 28/02/2024 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/02/2024 | 1530/1530 |  | UK | BOE's Mann at FT future forum event 'The economic outlook..' | |

| 28/02/2024 | 1700/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2024 | 1715/1215 |  | US | Boston Fed's Susan Collins | |

| 28/02/2024 | 1745/1245 |  | US | New York Fed's John Williams | |

| 29/02/2024 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/02/2024 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.