MNI US MARKETS ANALYSIS - USD on Back Foot, ISM/JOLTS in Focus

Highlights:

- The greenback is under pressure once again, with markets taking a more cautious view of the underlying bullish dollar trend.

- Euro area inflation rose again in December but was at the lower end of economists' expectations.

- US November trade, JOLTS job openings and December services ISM highlight the economic calendar. FOMC Member Barkin is due to speak.

US TSYS: TY Bearish Trend Intact Ahead of ISM Services & JOLTS

- Treasuries are a little off earlier lows but hold a twist steepening ahead of important data in JOLTS and ISM Services reports at 1000ET.

- Cash yields are 1bp lower (2s & 3s) to 1bp higher (30s), twist steepening with 2s10s at 37bps (+1.2bp) having earlier set fresh highs of 37.6bp since mid-2022.

- 10Y yields probed 4.64% earlier today (currently 4.632%), having done so yesterday as well, at seven-month highs.

- TYH5 is within a few ticks of session lows of 108-12+ having held within yesterday’s range throughout, on subdued volumes of 250k.

- A bearish trend condition remains with support at 108-06+ (Dec 26 low) after which lies 108-00 (Fibo projection of Oct 1-14-16 price swing).

- Data: Trade bal Nov (0830ET), JOLTS Nov (1000ET), ISM Services Dec (1000ET)

- Fedspeak: Barkin (0800ET)

- Note/bond issuance: US Tsy $39B 10Y Note re-open - 91282CLW9 (1300ET)

- Bill issuance: US Tsy $85B 42D CMB auction (1130ET)

US TSY FUTURES: Short Setting Most Prominent on Monday

OI data points to a mix of net long setting (TU), short setting (TY, UXY & WN) & long cover (FV & US) during yesterday’s twist steepening of the futures curve.

- Net exposure was added in curve-wide DV01 equivalent terms, with the biggest net DV01 equivalent positioning swing coming via net short setting in UXY futures.

| 06-Jan-25 | 03-Jan-25 | Daily OI Change | OI DV01 Equivalent Change ($) |

TU | 4,315,149 | 4,303,841 | +11,308 | +437,114 |

FV | 6,175,803 | 6,181,267 | -5,464 | -229,048 |

TY | 4,574,904 | 4,559,292 | +15,612 | +1,002,721 |

UXY | 2,204,157 | 2,183,892 | +20,265 | +1,765,803 |

US | 1,919,525 | 1,923,103 | -3,578 | -443,132 |

WN | 1,771,847 | 1,769,524 | +2,323 | +431,137 |

|

| Total | +40,466 | +2,964,594 |

STIR: Fed Rate Path Holds Yesterday Nudge Higher With Data in Focus

- Fed Funds implied rates hold yesterday’s mild increase with ahead of a docket focused on both the November JOLTS and December ISM Services reports at 1000ET.

- Cumulative cuts from 4.33% effective: 2bp Jan, 11bp Mar, 16bp May, 25bp June and 39bp Dec.

- The SOFR-implied terminal yield of 3.985% holds close to recent highs of 4.03% seen late last month and cycle highs of 4.15% back in April.

- In FOMC shuffling, Semafor reported earlier today that Bowman is a top candidate for the VC Supervision role according to several people familiar with the matter after Barr announced his resignation yesterday. That doesn’t surprise us, as we wrote at the time yesterday.

- Today’s Fedspeak is limited to Richmond Fed’s Barkin speaking to the Raleigh Chamber at 0800ET. It shouldn’t be a market mover as the text will be a repeat of Friday’s speech on the 2025 outlook and we don’t expect the Q&A to differ from the tone of more ambiguity on scope for further rate cuts after the 100bps last year, which has been viewed as a necessary recalibration in monetary policy. Previously a ’24 voter, he’s next set to vote in ’27.

STIR: Limited Positioning Swings in SOFR futures on Monday

OI data suggests that net short setting in the reds and greens provided the most meaningful positioning swing on Monday, with little net OI change in the whites and a bias towards long cover seen in the blues.

- Net short setting in SFRZ6 provided the most meaningful positioning swing, although positioning movement in individual contracts appeared relatively limited on the day.

| 06-Jan-25 | 03-Jan-25 | Daily OI Change |

| Daily OI Change In Packs |

SFRZ4 | 1,126,247 | 1,121,523 | +4,724 | Whites | -382 |

SFRH5 | 1,131,728 | 1,129,943 | +1,785 | Reds | +16,977 |

SFRM5 | 1,015,249 | 1,025,220 | -9,971 | Greens | +18,327 |

SFRU5 | 816,795 | 813,715 | +3,080 | Blues | -6,144 |

SFRZ5 | 914,521 | 907,450 | +7,071 |

|

|

SFRH6 | 597,497 | 591,247 | +6,250 |

|

|

SFRM6 | 654,399 | 648,683 | +5,716 |

|

|

SFRU6 | 633,019 | 635,079 | -2,060 |

|

|

SFRZ6 | 735,731 | 723,428 | +12,303 |

|

|

SFRH7 | 468,580 | 464,119 | +4,461 |

|

|

SFRM7 | 375,264 | 376,507 | -1,243 |

|

|

SFRU7 | 278,714 | 275,908 | +2,806 |

|

|

SFRZ7 | 288,438 | 292,229 | -3,791 |

|

|

SFRH8 | 226,915 | 228,187 | -1,272 |

|

|

SFRM8 | 160,954 | 158,795 | +2,159 |

|

|

SFRU8 | 111,343 | 114,583 | -3,240 |

|

|

EUROPEAN INFLATION: December EZ HICP Y/Y In Line W/ Cons; Services Back at 4%

Eurozone December flash headline, on a rounded basis, came in in line with consensus at 2.4% Y/Y (2.4% cons; 2.2% prior). After the already-published national releases out (particularly Germany) there was a risk of a 2.5% print. However, Italy data came in below consensus at 1.4% Y/Y vs 1.6% Y/Y expected and this likely brought us back to the 2.4%Y/Y print.

- On a monthly basis, inflation came in at 0.4% (vs 0.4% cons; -0.3% prior). On an unrounded basis, headline HICP was 2.44% Y/Y and 0.36% M/M.

- Core HICP also printed in line with consensus, at 2.7% Y/Y (2.7% cons and prior; unrounded: 2.71% Y/Y, 0.45% M/M).

- Looking at the individual categories, energy moved into positive territory for the first time since July, at +0.1% Y/Y (-2.0% Nov, -6.1% Sep) on the back of both a 0.6% sequential increase and base effects.

- Services inflation increased slightly, remaining sticky, at 4.0% Y/Y (3.9% prior). It has remained around the 4% level for over a year now.

- Non-energy industrial goods inflation decreased slightly, to 0.5% Y/Y, remaining overall soft (vs +0.6% Oct).

- Food, alcohol and tobacco inflation meanwhile remained unchanged at 2.7%.

- Looking at the national-level prints, headline HICP inflation remained stable or accelerated in all but 4 countries in December (Greece, Italy, Malta, Slovakia).

CANADA: Carney & Freeland Seen as Early Frontrunners for Liberal Leadership

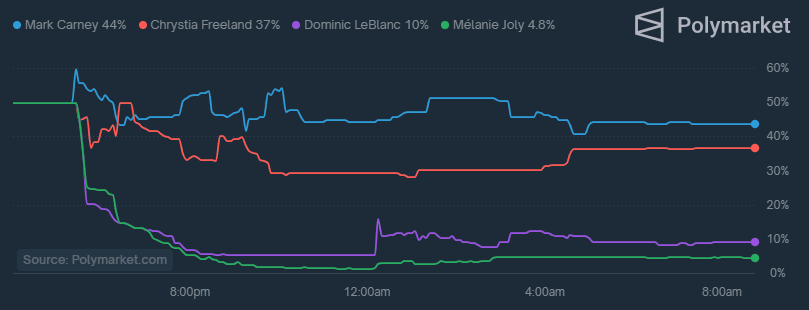

Following the 6 Jan announcement by PM Justin Trudeau that he would be resigning as leader of the governing centre-left Liberal Party of Canada (LPC), focus has turned to who could emerge as his successor as LPC leader and as such prime minister. While nobody has even yet declared their candidacy, political betting markets are showing two early favourites in the form of former finance minister and deputy PM Chrystia Freeland and former BoC and BoE governor Mark Carney. Data from Polymarket shows bettors assigning a 44% implied probability Carney wins the LPC leadership, with Freeland a little behind on 37%. In third and fourth place respectively are incumbent Finance Minister Dominic LeBlanc (10%) and Foreign Minister Melanie Joly (4.6%).

- The latest polling from Angus Reid, carried out prior to Trudeau's announcement, shows Freeland as the prospective candidate that might be best positioned to increase the Liberals' vote share the most. A poll carried out on a sample of 2,406 respondents from 27-31 Dec showed a Trudeau-led LPC winning 13% support, compared to 14% with Carney in charge, 16% with Joly, and 21% with Freeland.

- Much like prospective candidates, the LPC party machinery must also grind into gear. Party president Sachit Mehra confirmed a meeting of the LPC national board of directors to take place this week. The process can be sped up due to 'political circumstances', but the 11 weeks between now and the end of prorogation on 24 March would still be seen as a major truncation of a leadership race.

Figure 1: Betting Market Implied Probability of Winning LPC Leadership, %

Source: Polymarket

FOREX: US Dollar Remains on Back Foot, NZD Outperforming

- Despite yesterday’s rejection of the WaPo Tariff article by President-Elect Trump, the greenback is under pressure once again Tuesday, with markets taking a more cautious view of the underlying bullish dollar trend.

- While some analysts believe there may be some truth behind the details of the tariff article, others believe the resignation of Fed's Michael Barr may also be contributing to the softer greenback, assisted by the initial rally for the US KBW regional banks index in anticipation of less stringent regulations on banks' balance sheets.

- This risk on sentiment has been present in currency markets early Tuesday, with the likes of NZD and AUD outperforming. NZDUSD has now extended the bounce from multi year lows to around 1.75%, and hovers just below the 0.5700 handle. In similar vein EURUSD is back above 1.04, with German inflation data on Monday continuing to underpin a more hawkish short-term reaction for the single currency.

- USDJPY traded multi month highs of 158.42 overnight, however the pair now trades around 80 pips off this level as intervention rhetoric returns. Comments from the Japanese Finance Minister around excessive FX moves and being prepared to act have halted the yen’s decline, although the remarks don't appear to represent an escalation on what has been said recently by officials.

- The Swiss franc is a touch softer on the session following a lower-than-expected core inflation print, with EURCHF trading around 0.9430, close to 2-month highs for the cross.

- US November trade, JOLTS job openings, December services ISM highlight the economic calendar. FOMC Member Barkin is due to speak at the Raleigh Chamber of Commerce.

EUROPEAN ISSUANCE UPDATE

Belgium 10y Syndication: Launched

- E7bln (in line with MNI expectations and same as 2023/24 10-year syndis) of the new Jun-35 OLO. Spread set at MS+66bps (guidance was +68bps area), Books in excess of E88bln.

Slovenia 30y syndication: Spread set

- MNI expects E1.0-1.5bln of the new Apr-55 SLOREP. Spread set at MS+128bp (Guidance was MS+140bps area then MS+135bps area), Books in excess of E3.2bln.

Gilt auction results

- Decent 30-year gilt auction with a 0.3bp tail and lowest accepted price (LAP) above the pre-auction mid-price.

- Result is broadly in line with the Oct and Dec auctions for the same gilt.

- The 4.375% Jul-54 gilt price has moved to exceed that of the average accepted price (AAP) but there was a bit of a concession seen in the 5 minutes ahead of the bidding deadline so we have merely retraced that.

- No notable impact in gilt futures.

- GBP2.25bln of the 4.375% Jul-54 Gilt. Avg yield 5.198% (bid-to-cover 2.75x, tail 0.3bp).

Austria auction results

- E1.15bln (E1bln allotted) of the 2.50% Oct-29 RAGB. Avg yield 2.52% (bid-to-cover 2.75x; bid-to-issue 2.39x).

- E863mln (E750mln allotted) of the 0.70% Apr-71 RAGB. Avg yield 2.925% (bid-to-cover 1.98x; bid-to-issue 1.72x).

Germany auction results

- E4.5bln (E3.472bln allotted) of the 2.00% Dec-26 Schatz. Avg yield 2.18% (bid-to-offer 1.81x; bid-to-cover 2.34x).

EQUITIES: Bear Threat in E-Mini S&P Remains Present Despite Most Recent Gains

- A bull cycle in the Eurostoxx 50 futures contract remains intact. Yesterday’s strong rally highlights a reversal of the recent corrective pullback and attention is on resistance at 5040.00, the Dec 9 high. Clearance of this level would confirm a resumption of the bull cycle that started on Nov 21 last year. On the downside, initial firm support lies at 4921.43, the 50-day EMA. A break of 4829.00, the Dec 20 low would reinstate a bearish theme.

- A bear threat in the S&P E-Minis contract remains present despite the most recent gains. The reversal lower from the Dec 26 high, highlights the end of the Dec 20 - 26 correction. Attention is on 5866.00, the Dec 20 low and a key S/T support. Clearance of this level would strengthen a bearish theme. Initial firm resistance is 6107.50, the Dec 26 high. A breach of this hurdle would highlight a bull reversal and open key resistance at 6178.75, the Dec 6 high.

COMMODITIES: WTI Futures Holding on to Bulk of Recent Gains

- WTI futures are holding on to the bulk of their recent gains. A stronger reversal to the upside has exposed key short-term resistance at $76.41, the Oct 8 high. A firm resistance at $71.97, the Nov 7 high, has been breached, strengthening a bullish theme. On the downside, a reversal lower would expose support at the 20-day EMA, at $70.78. This average is seen as a key short-term support.

- A bear threat in Gold remains present despite the latest recovery. The yellow metal traded sharply lower on Dec 18 and the move undermines a recent bull theme. A resumption of weakness would open key support at $2536.9, the Nov 14 low. The first firm support to watch is $2583.6, the Dec 19 low. On the upside, a resumption of gains would instead signal scope for a climb towards resistance at $2726.2, the Dec 12 high.

| Date | GMT/Local | Impact | Country | Event |

| 07/01/2025 | 1330/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 07/01/2025 | 1330/0830 | ** | Trade Balance | |

| 07/01/2025 | 1355/0855 | ** | Redbook Retail Sales Index | |

| 07/01/2025 | 1500/1000 | * | Ivey PMI | |

| 07/01/2025 | 1500/1000 | *** | ISM Non-Manufacturing Index | |

| 07/01/2025 | 1500/1000 | *** | JOLTS Jobs Opening Level | |

| 07/01/2025 | 1500/1000 | *** | JOLTS Quits Rate | |

| 07/01/2025 | 1630/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 07/01/2025 | 1800/1300 | ** | US Note 10 Year Treasury Auction Result | |

| 08/01/2025 | 0030/1130 | *** | CPI Inflation Monthly | |

| 08/01/2025 | 0700/0800 | Flash CPI | ||

| 08/01/2025 | 0700/0800 | ** | Retail Sales | |

| 08/01/2025 | 0700/0800 | ** | Manufacturing Orders | |

| 08/01/2025 | 0745/0845 | ** | Consumer Sentiment | |

| 08/01/2025 | 0745/0845 | * | Foreign Trade | |

| 08/01/2025 | 1000/1100 | ** | EZ Economic Sentiment Indicator | |

| 08/01/2025 | 1000/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 08/01/2025 | 1000/1100 | ** | PPI | |

| 08/01/2025 | 1000/1000 | ** | Gilt Outright Auction Result | |

| 08/01/2025 | 1000/1000 | ** | Gilt Outright Auction Result | |

| 08/01/2025 | 1005/1005 | BOE's Woods Financial Services Regulation hearing | ||

| 08/01/2025 | 1200/0700 | ** | MBA Weekly Applications Index | |

| 08/01/2025 | 1315/0815 | *** | ADP Employment Report | |

| 08/01/2025 | 1330/0830 | *** | Jobless Claims | |

| 08/01/2025 | 1330/0830 | Fed Gov Waller | ||

| 08/01/2025 | 1500/1000 | ** | Wholesale Trade | |

| 08/01/2025 | 1530/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 08/01/2025 | 1700/1200 | ** | Natural Gas Stocks | |

| 08/01/2025 | 1800/1300 | *** | US Treasury Auction Result for 30 Year Bond | |

| 08/01/2025 | 1900/1400 | *** | FOMC Minutes | |

| 08/01/2025 | 2000/1500 | * | Consumer Credit | |

| 09/01/2025 | 2330/0830 | ** | Average Wages (p) |