-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD on Backfoot Ahead of Biden-McCarthy Meet

Highlights:

- USD fading ahead of Biden/McCarthy face-to-face

- US retail sales seen bouncing back in April

- GBP weakness on soft jobs data proves short-lived

US TSYS: Richer Ahead Of Retail Sales, Fedspeak and Debt Ceiling Talks

- Cash Tsys are off best levels but still sit richer on the day, seen in follow through after softer than expected Chinese economic data overnight. It comes ahead of a heavy session, with retail sales and less so IP the pick for data, another heavy slate of Fedspeak and President Biden due to speak with McCarthy and Congressional leaders at 1500ET for ~90 minutes after McCarthy yesterday poured cold water on weekend optimism.

- 2YY -3.1bp at 3.979%, 5YY -4.3bp at 3.425%, 10YY -3.6bp at 3.466%, 30YY -2.8bp at 3.814%.

- TYM3 trades 9 ticks higher at 115-16+ off an earlier high of 115-18+ and through yesterday’s Empire Mfg induced high of 115-15+. It has pushed off support at the 115 level (115-01+ May 9 low, 114-30+ 50-day EMA) but remains some way off resistance at 116-16 (May 11 high).

- Data: Retail sales Apr (0830ET), NY Fed services activity May (0830ET), IP Apr (0915ET), Cap util Apr (0915ET), Business inventories Mar (1000ET), NAHB housing index May (1000ET).

- Fedspeak: Mester (0815ET), Barr (1000ET), Williams (1215ET), Logan (1515ET), Bostic & Goolsbee (1900ET)

- Bill issuance: US Tsy $36B 52W bill auction (1130ET)

STIR FUTURES: Fed Rates Drift Lower Ahead of Retail Sales, Heavy Fedspeak

- Fed Funds implied rates have drifted lower overnight in keeping with ECB pricing little changed to incrementally lower, but remain off yesterday’s post Empire lows.

- Cumulative moves from current 5.08% effective: +2.5bp Jun (-0.5bp), -6bp Jul (-1.5bp), -21bp Sep (-1.5bp), -45bp Nov (-2bp), -69bp Dec (-2bp) and -94bp Jan (-2.5bp).

- Another heavy schedule of Fedspeak: Mester (’24), VC Barr House testimony (voter), NY Fed’s Williams (voter) and Logan (’23) as well as repeat Goolsbee (’23) and Bostic (’24) after yesterday.

- Williams last week broadly stuck to FOMC guidance for someone typically at the more dovish end. Logan last spoke Apr 20 (watching for further, sustained improvement in inflation), as did Mester (favors raising above 5% but urges prudence).

Source: Bloomberg

Source: Bloomberg

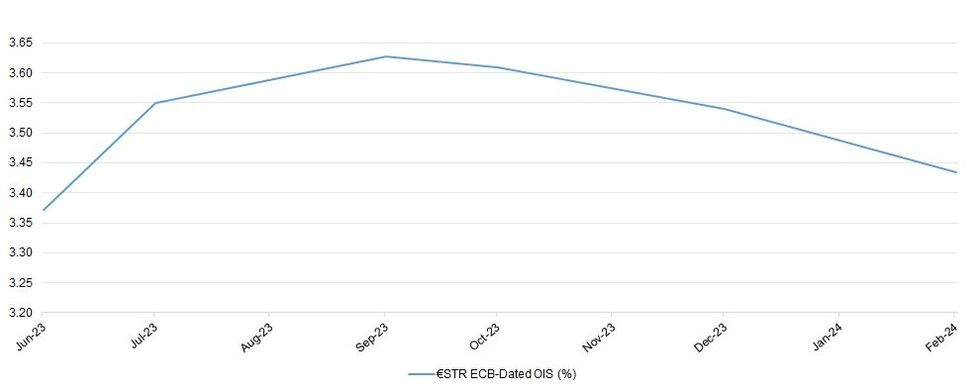

ECB-Pricing Little Changed To A Touch Softer On The Day

ECB-dated OIS sits little changed to incrementally lower, with terminal rate pricing hovering just shy of fully showing 2 further 25bp rate hikes. Meanwhile, just over 20bp of cuts is priced by the end of the Bank’s February ’24 meeting vs. current terminal rate pricing levels (which is seen come the end of the Bank’s September meeting).

- Early rhetoric from the head of the Greek central bank, Stournaras, stuck to his usual dovish lean. He noted that the current phase of ECB rate hikes is coming to an end, while highlighting the Bank’s data-dependent stance when assessing whether 1 or 2 further rate hikes will be required.

- This, coupled with some feedthrough from another run of softer than expected Chinese economic data has probably provided the modest downward pressure to pricing.

- ECB speak from President Lagarde & Vice President de Guindos is eyed today, with the potential for cross-market spill over surrounding U.S. data and a raft of Fedspeak also on the radar.

- This comes after the latest RTRS poll reiterated the well-trodden idea that the Bank “will hike its key interest rates by 25 basis points at each of the next two meetings, according to economists polled by Reuters, many of whom also said the bigger risk was rates could go higher still in the future.”

| ECB Meeting | €STR ECB-Dated OIS (%) | Difference Vs. Current Effective €STR Rate (bp) |

| Jun-23 | 3.371 | +22.6 |

| Jul-23 | 3.551 | +40.6 |

| Sep-23 | 3.628 | +48.3 |

| Oct-23 | 3.609 | +46.4 |

| Dec-23 | 3.540 | +39.5 |

| Feb-24 | 3.434 | +28.9 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: GBP/USD Completes Post-Data Round-Trip

- GBP/USD has completed a round-trip to sit higher headed into NY hours despite a poor showing from the UK jobs market across April. The pair was initially pressured down to 1.2466 before bouncing sharply to narrow the gap with 1.2550.

- A wave of USD sales helps boost major pairs to fresh intraday highs mid-morning, with markets looking through the soft ZEW release to catch up with the pull lower in US yields overnight. A recovery off the lows in most equity futures markets also helping pressure the greenback.

- Volumes remain marginally below recent averages for this time of day across most major pairs - the outlier being GBP after the poor jobs data this morning - with activity just over 50% above the norm for 1000BST.

- Focus turns to Biden's looming schedule, with a debt ceiling focussed meeting with McCarthy due to take place in the Oval Office for ~90minutes at 1500ET/2000BST. The face to face follows McCarthy's comments late yesterday: "We are nowhere near reaching a conclusion,” and ongoing staff-level meetings are “not productive at all.”

- The April US retail sales report crosses later today, followed by industrial production and capacity utilization data. Meanwhile, Canadian CPI is expected to show a further slowdown in price pressures. Fed's Mester, Barr, Williams, Goolsbee and Logan make for a busy Fed speaker schedule, with ECB's Lagarde appearing at an awards presentation for former German Chancellor Merkel.

FX OPTIONS: Expiries for May16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0710(E517mln), $1.0815-20(E555mln), $1.0895-00(E675mln), $1.0950-65(E925mln), $1.0995-00(E813mln)

- AUD/USD: $0.6700-10(A$1.3bln)

EQUITIES: E-Mini S&Ps Trading Above 50-Day EMA, Move Higher Will Open May 1 High

- Softer than expected Q1 corporate performance metrics, as well as negative revisions to the near-term EPS and broader performance projections from Home Depot bias e-minis away from their recovery highs, with the name last showing a little over 4% lower pre-market. The company also flagged a deepening of broad-based pressure across the business. Inflationary pressures faced by consumers (diverting spending elsewhere) and the move away from the COVID-refurbishment trends present some headwinds for the company. S&P 500 e-minis last sit the best part of 0.2% softer vs. settlement after paring overnight losses at one stage of European morning trade.

- Eurostoxx 50 futures continue to consolidate. Price is trading above support at 4241.90, the 50-day EMA. The recent move down is considered corrective and the broader uptrend is intact. A resumption of gains would signal scope for a test of 4363.00, the Apr 21 high and a bull trigger. Clearance of this level would confirm a resumption of the uptrend. A clear break of the 50-day EMA is required to signal a top.

- S&P E-minis are unchanged and remain in consolidation mode. Price is trading above the 50-day EMA, which intersects at 4109.27. An extension higher would open key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would resume the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would instead highlight a bearish threat.

COMMODITIES: Gold Technical Conditions Bullish Despite Slight Dip Lower Tuesday

- WTI futures remain below recent highs. The recovery that started May 4 appears to be a correction and the move higher has allowed an oversold trend condition to unwind. Initial resistance is at $73.93, the Apr 28 low ahead of $76.92, the Apr 28 high. On the downside, the recent print below $64.58, the Mar 20 low and a key support, reinforces a bearish theme. A clear break of it would confirm a resumption of the broader downtrend.

- Gold trend conditions remain bullish. The yellow metal has recently breached resistance at $2048.7, the Apr 13 high. This confirmed a resumption of the broader bull cycle and maintains the positive price sequence of higher highs and higher lows. Moving average studies remain in a bull-mode set-up. The focus is on $2070.4, the Mar 8 2022 high ahead of the all-time high at $2075.5, the Aug 7 2020 high. Key support is 1969.3, the Apr 19 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2023 | 0900/1100 | *** |  | EU | GDP (p) |

| 16/05/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2023 | 0900/1100 | * |  | EU | Employment |

| 16/05/2023 | 0900/1100 | ** |  | IT | Italy Final HICP |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/05/2023 | - |  | EU | ECB de Guindos in ECOFIN Meeting | |

| 16/05/2023 | 1215/0815 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2023 | 1230/0830 | *** |  | CA | CPI |

| 16/05/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/05/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 16/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/05/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2023 | 1400/1000 | * |  | US | Business Inventories |

| 16/05/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/05/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/05/2023 | 1615/1215 |  | US | New York Fed's John Williams | |

| 16/05/2023 | 1915/1515 |  | US | Dallas Fed's Lorie Logan | |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee | |

| 17/05/2023 | 2350/0850 | *** |  | JP | GDP |

| 17/05/2023 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 17/05/2023 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 17/05/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/05/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2023 | 0900/1100 |  | EU | ECB Elderson Panels Beyond Growth Conference | |

| 17/05/2023 | 0930/1130 |  | EU | ECB Panetta Presentation on Digital Euro Kangaroo Group Event | |

| 17/05/2023 | 0950/1050 |  | UK | BOE Bailey Keynote Speech at British Chambers of Commerce | |

| 17/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/05/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/05/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 17/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/05/2023 | 1515/1715 |  | EU | ECB de Guindos Closes IESE Banking Meeting | |

| 17/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.