-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Trims Last Week's Rally

Highlights:

- USD modestly lower, but holding bulk of last week's rally

- Empire manufacturing, Fedspeak due up

- First round of Turkish elections favours Erdogan in run-off

US TSYS: Slightly Cheaper With Fedspeak, Empire Mfg Headlining Session

- Cash Tsys trade slightly cheaper across the curve in a calm start to the week, in narrow ranges and in line with core EU FI. News that President Biden and Congressional leaders are set to meet on Tuesday, along with “constructive” background talks ahead of the event (although Biden stressed that the talks aren’t there “yet”), garnered most of the attention over the weekend.

- 2YY +1.3bp at 4.000%, 5YY +1.7bp at 3.463%, 10YY +1.7bp at 3.479%, 30YY +1.0bp at 3.799%.

- TYM3 trades 3+ ticks lower at 115-10+ off a low of 15-08+ with cumulative volumes of just 185k. Support remains at 115-01+ (May 9 low)/114-30 (50-day EMA) whilst resistance seen at 116-16 (May 11 high).

- Data: Empire mfg index May (0830ET) barring in mind recent volatility, TIC flows Mar (1600ET)

- Fedspeak: Bostic on CNBC (0730ET), Goolsbee on CNBC (0830ET), Bostic welcome remarks (0845ET), Kashkari moderated Q&A (0915ET), Bostic on BBG TV (1400ET), Bostic media Q&A (1500ET), Gov Cook commencement address (1700ET)

- Bill issuance: US Tsy $57B 13W, $51B 26W bill auctions (1130ET)

STIR FUTURES: Fed Rate Path Nudges Higher Ahead Of Fedspeak Deluge

- Fed Fund implied rates are marginally higher after the weekend. Vice Chair nominee Jefferson late Fri saw the Fed on track to bring inflation down but noted the little progress in core inflation, whilst Barkin (’24 voter) told MNI he sees it appropriate to hold rates where they are but is “very open” to more hikes should the data tell a different story.

- Cumulative moves from 5.08% effective: +2.5bp Jun (+1bp), -6bp Jul (+1bp), -21bp Sep (+1.5bp), -44bp Nov (+1.5bp), -69bp Dec (+1bp) and -92bp Jan (+1bp).

- An impressive 4 x Bostic (’24) today starting 0730ET, plus Goolsbee (’23) at 0830ET, Kashkari (’23) at 0915ET before Gov Cook (voter) at 1700ET gives a commencement address which likely limits mon pol discussions. Bostic last spoke Apr 20, Kashkari May 11 Goolsbee spoke May 12.

Source: Bloomberg

Source: Bloomberg

TURKEY: Erdoğan Best Placed For Run-Off Win With Parliament Majority Assured

With the almost-complete results from the first round of the presidential election pointing towards a run-off between incumbent President Recep Tayyip Erdoğan and Nation Alliance candidate Kemal Kılıçdaroğlu, it is Erdoğan who will go into the 28 May contest more confident of securing a third term in office

- The People's Alliance of nationalist parties that includes Erdoğan's Justice and Development Party (AKP) looks to have also secured a majority in the Grand National Assembly. Andoulou Agency reports the AKP as winning 266 seats with the far-right Nationalist Movement Party (MHP) on 50 seats, giving the alliance at least 316 of the 600 seats in the GNA.

- Retaining a majority in the GNA and only being a fraction of a percent off of winning outright in the first round will give Erdoğan's campaign significant momentum over the coming two weeks. Meanwhile a lacklustre result for the opposition will do significant damage to Kılıçdaroğlu's efforts to convince voters to make him president in the face of an opposition-held parliament.

- The strong likelihood of an Erdoğan presidential win and the AKP-led alliance's retention of a parliamentary majority sees the second-placed scenario fromMNI's Turkey Election Previewset to come to fruition:

- "A win for the status quo would likely see broad policy continuity on the economic, domestic, and foreign policy fronts. A pre-election manifesto from Erdoğan’s AKP offered little in terms of concrete policy indications, beyond broad statements promising the installation of ‘a strong economy team’, a commitment to reducing inflation to single digits and unemployment to 7%."

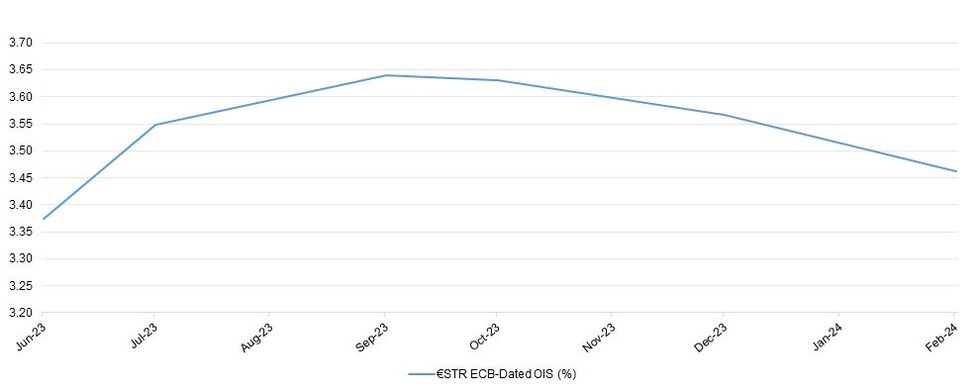

STIRS: Little Net Movement In ECB Pricing Today

The ECB-dated OIS strip essentially hangs on to all of Friday’s modest upward repricing of terminal rate expectations, which was driven by FOMC-pricing related moves. That leaves a terminal ECB deposit rate of 3.75% more or less fully priced come the end of the Bank’s September gathering, followed by ~18bp of cuts being priced by February.

- Weekend ECB speak saw Vice President de Guindos point to the current monetary policy cycle moving into the home stretch, highlighting a meeting by meeting, data-dependent stance, while he also suggested that QT has led to a 60-70bp lift in government bond yields.

- Elsewhere, Bank of Italy chief Visco generally echoed de Guindos, while highlighting that there was too much uncertainty present to predict the Bank’s exact rate path.

- The two stuck to the dovish side of the spectrum, as is their norm.

- We also heard from Slovakian central bank chief Kazimir, who reaffirmed his recent hawkish line of rhetoric, warning of the potential for a longer than previously envisaged round of rate hikes.

- Bundesbank chief Nagel will speak later today, although he provided plenty of hawkish rhetoric recently, so don’t expect too much fresh policy steer from him.

| ECB Meeting | €STR ECB-Dated OIS (%) | Difference Vs. Current Effective €STR Rate (bp) |

| Jun-23 | 3.375 | +22.7 |

| Jul-23 | 3.549 | +40.1 |

| Sep-23 | 3.640 | +49.2 |

| Oct-23 | 3.631 | +48.3 |

| Dec-23 | 3.567 | +41.9 |

| Feb-24 | 3.462 | +31.4 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: AUD on Top as Sell-Side Slates Further Hikes

- AUD remains the best performer in G10 headed through to the European morning, helping the currency snap a small part of the weakness noted across the second half of last week. Last week's gains resulted in a print above key resistance at 0.6806, Apr 14 high and resistance to watch this week is 0.6818, the May 10 high. A clear break of this level is required to reinstate a bullish theme.

- NAB's updated RBA view is also helping aide a bounce - they see two further rate rises to tip the rate target to 4.35% - an outcome not currently well priced across bond and STIR markets.

- The option pipeline this week most notably sees strikes clustered around the 0.67 strike - over A$1.75bln is set to roll off at that mark between now and Friday's cut, turning focus to RBA minutes due tomorrow as well as jobs data and inflation expectations stats on Thursday.

- JPY is at the bottom-end of the G10 slate, edging lower as USD/JPY extends the partial retracement of the early May weakness. The Monday high is within range of the May 5th best at 136.63. Strength through here opens the 200-dma of 137.05 for direction - after which markets have set the stage for new cycle highs above 137.77.

- Data slate is typically light for a Monday, with Empire Manufacturing numbers the highlight. Markets look for the headline to deteriorate to -4.0 from +10.8 previously. The speaker slate is busier, with Fed's Bostic (three appearances!), Goolsbee, Kashkari andf Cook all on the docket. ECB's Nagel and BoE's Pill also make appearances.

Weekly CFTC Update Sees EUR Net Position Hit New 52w High

- Friday's CFTC positioning update saw MXN, CAD and JPY net position creep higher in the week ending May12, while the NZD, AUD and CHF position retreated.

- The EUR net long position inched higher (+0.3% of open interest) to 179,422 - a new 52 week high - mirrored in MXN, which also hit a 52w high at 27.4% of open interest.

- The GBP net position Z-score remains the highest among the currencies surveyed at +1.97, with CAD the weakest at -1.03. GBP's small net long remains within range of the best levels in 12 months: rising to 1.9% of OI last week, vs. The 52w high of 2.5%.

Full table here:

FX OPTIONS: Expiries for May15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.0bln), $1.0890-05(E760mln) $1.1000-10(E1.1bln), $1.1200(E1.3bln)

- GBP/USD: $1.2390-00(Gbp632mln)

- AUD/USD: $0.6438-50(A$1.2bln)

- USD/CAD: C$1.3500-05($950mln)

- USD/CNY: Cny6.6500($2.8bln), Cny6.9500($1.6bln)

EQUITIES: E-Mini S&Ps Recover from Friday Lows Though Remain Within Recent Ranges

- Eurostoxx 50 futures remain in consolidation mode. Price is trading above support at 4239.10, the 50-day EMA. The recent move down is considered corrective and the broader uptrend is intact. A resumption of gains would signal scope for a test of 4363.00, the Apr 21 high and a bull trigger. Clearance of this level would confirm a resumption of the uptrend. A clear break of the 50-day EMA is required to signal a top.

- S&P E-minis remain in consolidation mode and continue to trade above the 50-day EMA, which intersects at 4107.61. An extension higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would instead highlight a bearish threat.

COMMODITIES: Gold Below Recent Highs But Trend Conditions Still Technically Bullish

- WTI futures have pulled back from recent highs. The recent recovery that started May 4 is considered corrective and the move higher has allowed an oversold trend condition to unwind. Initial resistance is at $73.93, the Apr 28 low ahead of $76.92, the Apr 28 high. On the downside, the recent print below $64.58, the Mar 20 low and a key support, reinforces a bearish theme. A clear break of it would confirm a resumption of the broader downtrend.

- Gold remains below its recent highs but trend conditions remain bullish. The yellow metal has recently breached resistance at $2048.7, the Apr 13 high to confirm a resumption of the broader bull cycle. This maintains the positive price sequence of higher highs and higher lows and moving average studies remain in a bull-mode set-up. The focus is on $2070.4, the Mar 8 2022 high ahead of the all-time high at $2075.5. Key support is 1969.3, the Apr 19 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/05/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/05/2023 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 15/05/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/05/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/05/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/05/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/05/2023 | 1315/0915 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/05/2023 | 1400/1000 |  | CA | BOC Financial System Survey report | |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/05/2023 | 1600/1700 |  | UK | BOE Pill Monetary Policy Report Q&A | |

| 15/05/2023 | 2000/1600 | ** |  | US | TICS |

| 15/05/2023 | 2100/1700 |  | US | Fed Governor Lisa Cook Fed Governor Lisa Cook | |

| 16/05/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 16/05/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 16/05/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 16/05/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 16/05/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/05/2023 | 0900/1100 | *** |  | EU | GDP (p) |

| 16/05/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2023 | 0900/1100 | * |  | EU | Employment |

| 16/05/2023 | 0900/1100 | ** |  | IT | Italy Final HICP |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/05/2023 | - |  | EU | ECB de Guindos in ECOFIN Meeting | |

| 16/05/2023 | 1215/0815 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2023 | 1230/0830 | *** |  | CA | CPI |

| 16/05/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/05/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 16/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/05/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2023 | 1400/1000 | * |  | US | Business Inventories |

| 16/05/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/05/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/05/2023 | 1615/1215 |  | US | New York Fed's John Williams | |

| 16/05/2023 | 1915/1515 |  | US | Dallas Fed's Lorie Logan | |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.