-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: Waiting for the Minutes

Highlights:

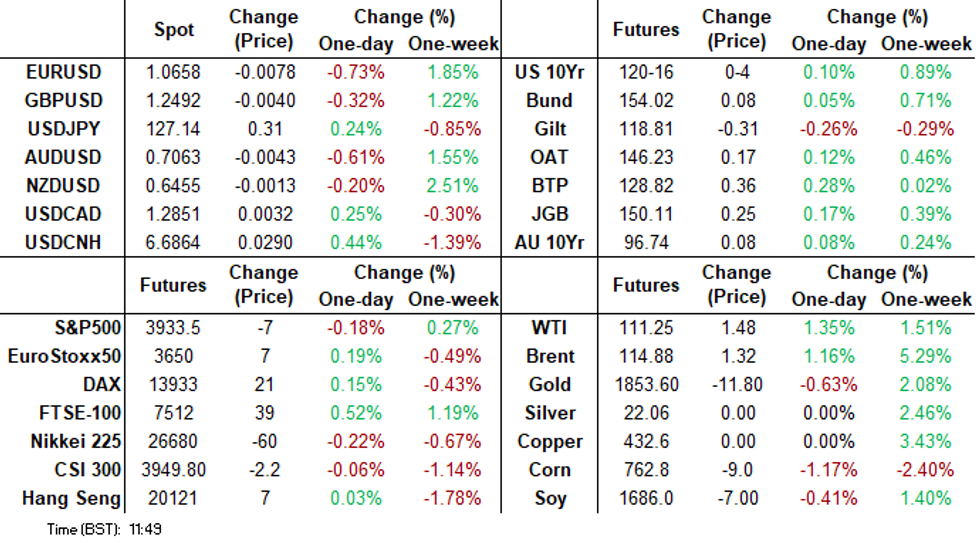

- Market steady ahead of FOMC Minutes release later.

- USD has reversed most of yesterday's losses.

US TSYS: Treasuries Treading Water As FOMC Minutes Eyed

- Cash Tsys sit little changed on the day after yesterday’s surge as markets await the next steer from the FOMC minutes at 1400ET along with sizeable issuance beforehand after yesterday’s solid 2Y note auction.

- 2YY -0.2bps at 2.512%, 5YY +0.2bps at 2.741%, 10YY -0.5bps at 2.743% and 30YY -1bp at 2.956%.

- TYM2 consolidates yesterday’s move higher, sitting 3+ ticks higher at 120-15+ in a narrow range on the day amidst average volumes. The improvement in the current short-term bullish condition sees it next eye resistance at the 50-day EMA of 120-28+.

- Bond issuance: US Tsy $22B 2Y note FRN re-open auction (91282CEL1) at 1130ET before US Tsy $48B 5Y note auction (91282CET4) at 1300ET.

- Bill issuance: US Tsy $30B 119D bill sale at 1130ET

- Data: Weekly MBA mortgage applications of interest after yesterday’s slide in new home sales (0700ET), along with durable goods preliminary release for April (0830ET).

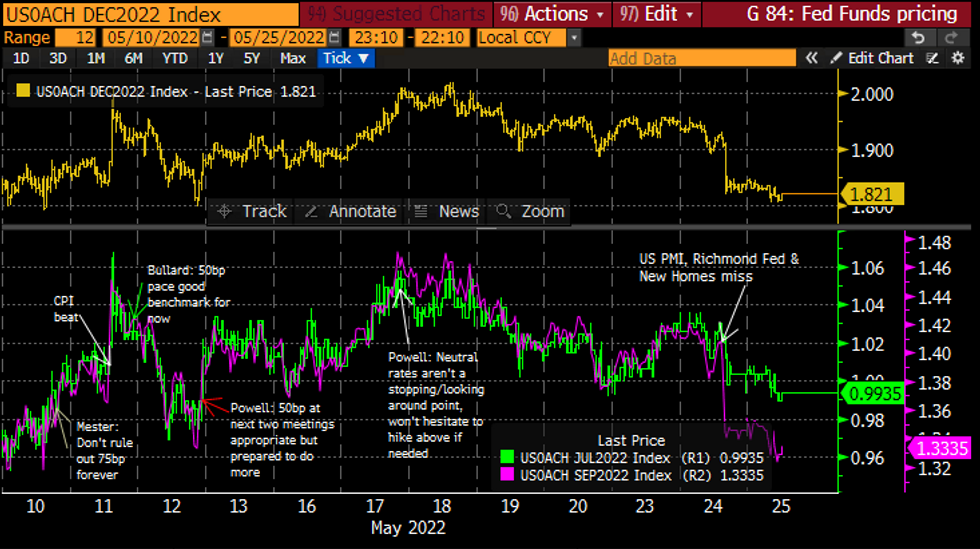

STIR FUTURES: Dipping Below 100bps For Next Two Fed Meetings

- Fed Funds implied hikes continued yesterday’s decline in the European session after little change through Asian hours, coinciding with a move lower in ECB pricing of hikes to year-end in part on ECB’s Panetta seeing a need for gradually exiting negative rates.

- Hikes hold around 52bp for Jun but dip to a cumulative 99bps for July, 133bp for Sep and 182bps for Dec, the latter now down 20bps from last week’s high.

- Fedspeak: Vice Chair Brainard gives a commencement address at 1215ET with focus on the FOMC minutes at 1400ET.

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed Funds futuresSource: Bloomberg

EGB/Gilt: Backing Lagarde

European government bonds have broadly traded firmer this morning alongside gains for equities. The dollar has been on the front foot against G10 FX, while global oil markets have inched higher.

- The gilt curve has twist steepened with the 2s30s spread widening 2bp.

- Bunds have firmed and the curve has bull flattened. Cash yields are now down 1-3bp.

- OATs have outperformed bunds with yields down 3bp and the curve close to flat overall.

- BTPs have slightly outperformed core EGBs. Yields are now down 3-4bp on the day.

- The ECB's Fabio Panetta has stated that while the outlook justifies exiting negative rates, this will be a gradual process. He further stated that the ECB should be ready to intervene to prevent any financial fragmentation.

- Elsewhere, Olli Rehn argued that rates should be at zero by the autumn, with a 25bp hike in July. In addition, both Philip Lane and Klaas Knot indicated their support for President Lagarde's rate roadmap for policy normalisation.

- The final estimate of German Q1 GDP matched the initial estimate.

- Supply this morning came from Germany (Bund, EUR1.724bn allotted). In addition, France is selling a 15-year Green OATei, while Finland and Lithuania are selling 10-year bonds via syndication.

EUROPEAN SUPPLY

German auction result: E2bln of the 1.00% May-38 Bund Avg yield 1.15% (bid-to-cover 1.41x)

Syndications:

- Finland: E3bln WNG of the Sep-32 RFGB (ISIN: FI4000523238). Spread set at MS-15bps.

- Books in excess of E12bln (inc E1.95bln JLM interest).

- France: 0.10% Jul-38 Green OATei (ISIN: TBC). Spread set at 0.10% Jul-36 OATei +12bps.

- Books over E26bln (inc E2.1bln JLMs).

- Lithuania: Jun-32 Lith Eurobond (ISIN: XS2487342649). Guidance: MS+60 bps area

FI OPTION SUMMARY

- ERN2 99.75/99.62/99.25p fly, bough for half and 0.75 in 5k

- ERU2 99.62/99.50/99.37p fly, bought for 1.75 in 4k

- ERU2 99.62/99.75/99.87c ladder, bought for 3 in 4.25k

- ERV2 99.25/99.50/99.75c fly, bought for 6 in 10k

FOREX: USD bid is the early story of the day

- Early story in FX, during the morning European session, has been the bid in USD, taking its cue from Risk once again tilted to the downside.

- The Dollar is up against the majority of the majors, and versus all G10.

- Even the Kiwi, which was the best performer overnight, post the RNBZ rate hike, is now back a touch in the red (0.09%) against the Greenback.

- The worst performer is the SEK, down 1.18% versus the USD.

- Although most pairs still trade within past ranges.

- EURUSD sees support at 1.0642, now at 1.0666 at the time of typing as initial support.

- But market participant will have an eye on 1.0647, with 1.4bn worth of Option expiry for today.

- Looking ahead, US, Prelim Durable goods is the notable data, but likely more attention on the FOMC later.

- Speakers are also in focus with a packed day, which includes ECB de Cos, Lane, Knot, BOJ Kuroda, BoE Tenreyro, and Fed Brainard

FX OPTION EXPIRY

FX OPTION EXPIRY: Some good sizes for today, but turn your attention to the 31st May (LARGE).

Of note:

EURUSD 1.4bn at 1.0647.

USDCNY 1.7bn at 6.65.

EURUSD 2.41bn at 1.0650 (Friday).

EURUSD 6.19bn at 1.0591/1.0600 (31st May).

GBPUSD 3.32bn at 1.2550 (31st May).

- EURUSD: 1.0600(852mln), 1.0647 (1.4bn), 1.0665 (303mln), 1.0675 (539mln), 1.0730 (787mln).

- EURGBP: 0.8525 (705mln).

- USDJPY: 127 (335mln), 127.50 (325mln).

- USDCAD: 1.2760 (205mln), 1.2770 (226mln), 1.2900 (500mln).

- AUDUSD: 0.7100 (668mln).

- USDCNY: 6.65 (1.7bn).

Price Signal Summary - USDJPY Trades Through Pivot Support

- In the equity space, S&P E-Minis remain below key short-term resistance at 4099.00, May 9 high. The contract remains vulnerable following a fresh trend low last Friday. Attention is on 3801.97, 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont). 3807.50, Friday’s low is the bear trigger. A break of resistance at 4099.00 is required to signal a base. The primary trend direction in EUROSTOXX 50 futures is down. A corrective cycle is still in play however following the recovery from 3466.00, May 10 low. Price last week probed the 50-day EMA, today at 3723.80. A clear break of this average would improve a short-term bullish theme. On the downside, key support and the bear trigger is at 3466.00.

- In FX, EURUSD has this week cleared the 20-day EMA, and 1.0642, the May 5 high. An extension higher would signal scope for a climb towards 1.0840, the base of a bear channel drawn from the Feb 10 high. Initial support is at 1.0533, May 20 low. GBPUSD maintains a firmer short-term tone following this weeks climb above , 1.2525, May 19 high and the 20-day EMA at 1.2503. This opens 1.2638, the May 4 high and a key resistance. Initial firm support lies at 1.2438, May 20 low. USDJPY has traded through support at 126.95, Apr 27 low and an important short-term pivot level. The breach suggests scope for a continuation lower. Current weakness is still considered a correction though and is allowing a recent overbought trend reading to unwind. Attention is on the 50-day EMA, at 125.89.

- On the commodity front, Gold has traded above resistance at $1859.7, the 20-day EMA. This opens the 50-day EMA at $1884.5. The latest move higher is still considered corrective and the trend direction remains down. A resumption of bearish activity would refocus attention on last week’s $1787.0 low (May 16). In the Oil space, WTI futures maintain a firm tone. The contract last week breached resistance at $110.07, Mar 24 high. A resumption of gains would open $116.43, the Mar 7 trend high. Initial support is at $103.24, the May 19 low.

- In the FI space, Bund futures resistance is at $155.33 May 12 high. The trend direction remains down and an extension lower would open 150.49, the May 9 and the bear trigger. The broader trend condition in Gilts remains down. The contract has recently found resistance at 121.07, May 12 high. The bear trigger is unchanged at 116.87, May 9 low.

LOOK AHEAD

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2022 | 0945/1145 |  | EU | ECB Lane Speaks at German Bernacer Prize | |

| 25/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/05/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 25/05/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 25/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/05/2022 | 1515/1615 |  | UK | BOE Tenreyro Panels Discussion | |

| 25/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/05/2022 | 1615/1215 |  | US | Fed Vice Chair Lael Brainard | |

| 25/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/05/2022 | 0045/2045 |  | SK | Bank of Korea policy decision | |

| 26/05/2022 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 26/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 26/05/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 26/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/05/2022 | 1400/1000 |  | MX | Mexican central Bank policy meet minutes | |

| 26/05/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 26/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/05/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 26/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.