-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - WTI Falters Ahead of $84/bbl

HIGHLIGHTS:

- WTI hits new cycle high, but moderates into the NY crossover

- S&P500 on track for longest winning streak since August

- Focus turns to initial jobless claims, Fed's Waller, RBA's Lowe

US TSYS SUMMARY: US Rates Weaker Ahead Weekly Claims

Tsys trading mildly weaker ahead the NY open, in-line with EGBs/Gilts, yield curves modestly flatter after rebounding last couple sessions (5s30s -1.46 at 95.27). Equities weaker (ESZ1 -11.5 at 4516.5), US$ bid (DXY +.097 at 93.65), Gold up 3.85.

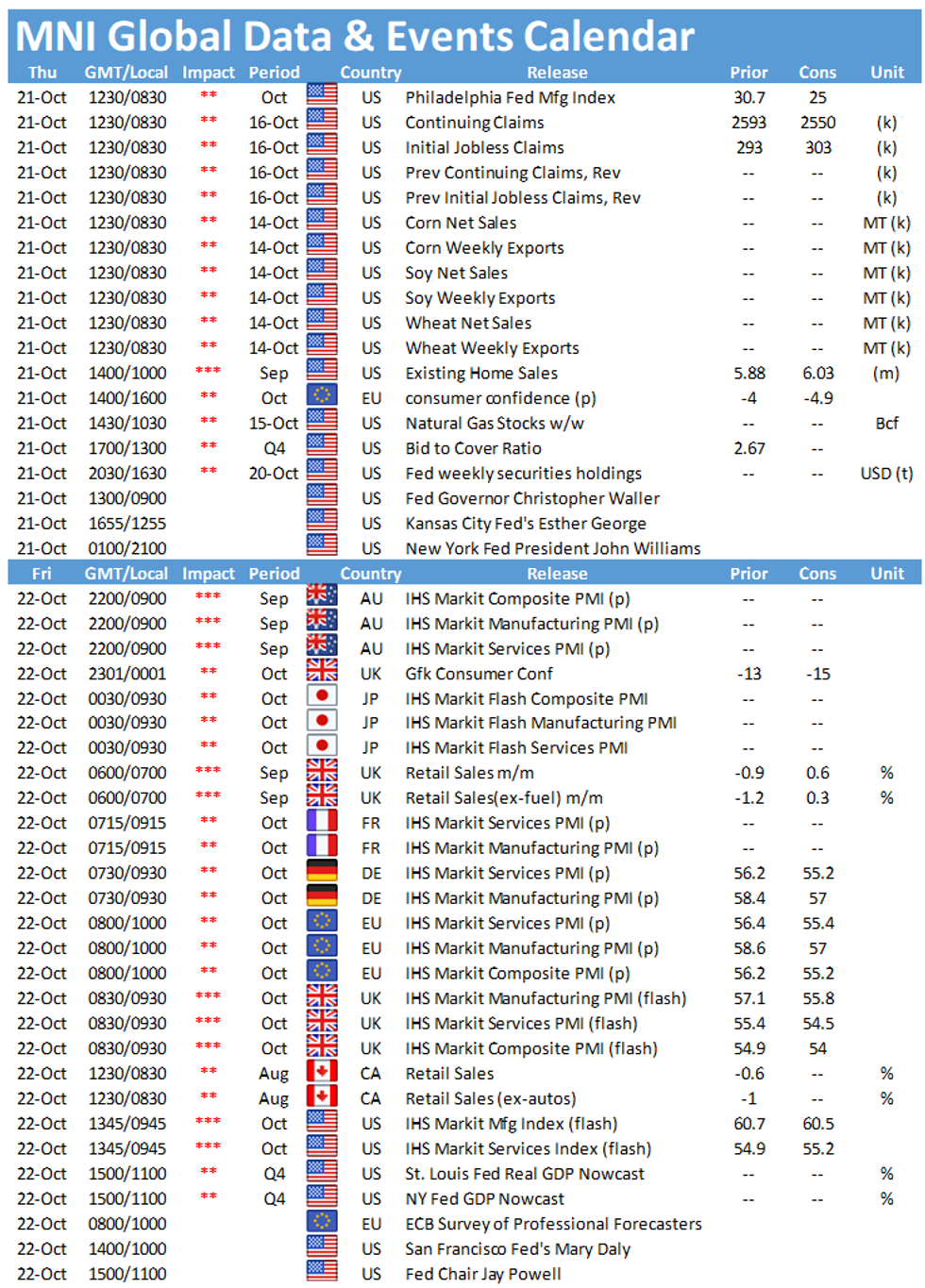

- Moderate volumes (TYZ1>330k) as data picks up: Weekly Claims (297k est; continuing claims 2.548M), Philly Fed Business Outlook (25.0 est vs. 30.7 prior), Leading Index (0.4% est) and Existing Home Sales (6.09M est) at midday.

- Fed speak: Fed Gov Waller on US economy (0900ET), Atl Fed Bostic on CNBC Closing Bell (1500ET) NY Fed Williams moderated discussion w/ China 40 Forum late (2100ET). Fed chair Powell rounds up wk on Fri 1100ET with policy Blackout starting Fri midnight through Nov 4 (FOMC Nov 2-3, taper annc anticipated).

- Total $85B US Tsy 4/8W bill and $19B 5Y TIPS auctions today. NY Fed buy-op: Tsy 10Y-22.5Y, appr $1.425B.

- Current yield levels: 2-Yr yield is up 0.8bps at 0.3937%, 5-Yr is up 0bps at 1.1655%, 10-Yr is down 1.1bps at 1.6462%, and 30-Yr is down 1.5bps at 2.1192%.

EGB/GILT SUMMARY: Inching Lower

European sovereign bonds have broadly traded lower this morning with stocks similarly posting losses.

- Gilts have weakened with yields pushing up 1-2bp and the curve trading close to flat overall.

- UK public sector net borrowing came in lower than expected for September (GBP21.0bn vs GBP23.2bn survey).

- Bunds trading marginally lower on the day, while the curve is 1bp flatter.

- The OAT curve is similarly slightly flatter with the 2s30s spread 1bp narrower.

- The BTP curve has steepened a touch on the back of the short end inching above yesterday's close and the longer end trading weaker.

- Supply this morning came from France (OATs, EUR7.492bn & OATi/OATei, EUR1.748bn), Spain (Bono/Obli, EUR5.053bn), Ireland (IRTB, EUR750mn). The UK also sold GBP6bn of the 1.50% Jul-56 Green gilt via syndication with books north of GBP74bn.

EUROPE ISSUANCE UPDATE:

France sells:

E3.196bln 0% Mar-25 OAT, Avg yield -0.50% (Prev. -0.57%), Bid-to-cover 2.83x (Prev. 1.79x)

E2.611bln 1.00% Nov-25 OAT, Avg yield -0.44% (Prev. -0.33%), Bid-to-cover 2.88x (Prev. 3.06x)

E1.685bln 0.50% May-26 OAT, Avg yield -0.38% (Prev. -0.53%), Bid-to-cover 3.86x (Prev.1.92x)

E824mln 0.10% Mar-26 OATei, Avg yield -2.29% (Prev. -2.18%), Bid-to-cover 3.37x (Prev. 2.03x)

E299mln 0.10% Mar-32 OATi, Avg yield -1.41% (Prev. -1.01%), Bid-to-cover 3.36x (Prev. 1.89x)

E625mln 0.10% Jul-47 OATei, Avg yield -1.22% (Prev. -0.76%), Bid-to-cover 2.20x (Prev. 2.15x)

Spain sells:

E3.37bln 0% Jan-27 Bono, Avg yield -0.089% (Prev. -0.371%), Bid-to-cover 1.35x (Prev. 2.55x)

E1.683bln 0.85% Jul-37 Obli, Avg yield 0.942% (Prev. 0.972%), Bid-to-cover 1.42x (Prev. 1.55x)

UK GILT SYNDICATION: 1.50% Jul-53 Green gilt - Final terms

Size set earlier at GBP6bn (WNG)

Spread set earlier at 3.75% Jul-52 Gilt -1.0bp (from initial guidance of-1.0/0.0 bps)

Books closed in excess of GBP74bln (inc JLM interest of GBP5.6bln)

FOREX: JPY Recovers Off Lows, But Trend Remains Down

- JPY is the firmest currency on the day, recovering off recent lows as markets book profits on the recent downtick. USD/JPY has shown back below the 114.00 handle, and sits either side of the mark ahead of the NY crossover. Despite the modest bounce in the currency, the outlook remains bearish JPY, with USD/JPY tilted higher while the price holds above 113.38 support.

- Elsewhere, AUD and NZD are softer, falling against most others in a moderation of strength earlier in the week. Some weight has crossed through commodity-tied currencies after China's NDRC warned of a crack down on commodities speculation, headlines that have led to a sharp pullback in China listed metals and coal contracts.

- The USD index is generally firmer, but holds south of the 94.00 and therefore well off recent highs. A modestly flatter yield curve (10y yield lower by 2bps, 30y yields lower by 3bps) is containing dollar strength at these levels.

- Weekly US jobless claims data takes focus going forward, with speeches also due from Fed's Waller and RBA's Lowe. Earnings season continues, with reports from Intel and AT&T among the highlights Thursday.

FX OPTIONS: Expiries for Oct21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1734-40(E1.4bln)

- EUR/GBP: Gbp0.8460(E615mln)

- USD/JPY: Y115.30($610mln)

- AUD/USD: $0.7470-75(A$726mln)

- NZD/USD: $0.6950(N$2.3bln)

- USD/CAD: C$1.2650($1.0bln)

- USD/CNY: Cny6.4300($505mln), Cny6.4400($1.2bln)

Price Signal Summary - USDJPY Dips Considered Corrective

- In the equity space, S&P E-minis are holding onto the bulk of recent gains and remain above the 4500.00 handle. This week's climb signals potential for stronger gains near-term and attention is on 4539.50, Sep 3 high and the bull trigger. EUROSTOXX 50 futures are consolidating and recent price action appears to be a bull flag. The focus is on 4200.50, Sep 24 high.

- In FX, EURUSD traded higher yesterday and this week has breached its 20-day EMA. The break signals scope for a stronger short-term corrective bounce and a resumption of strength would open the 50-day EMA that intersects at 1.1699. Support is at 1.1572, Oct 18 low. GBPUSD has this week traded above resistance at 1.3795, 76.4% of the Sep 14 -29 downleg. Further gains would open 1.3913, Sep 14 high. USDJPY maintains a bullish tone and traded to a fresh trend high yesterday. Attention is on 114.99, 1.50 projection of the Apr 23 - Jul 2 - Aug 4 price swing. Dips are considered corrective.

- On the commodity front, Gold remains below recent highs. The sharp reversal lower on Oct 15 highlights a potential bearish threat. Short-term resistance has been defined at $1800.6, the Oct 14 high. Support to watch is at $1746.0, Oct 6 low. These levels represent key short-term directional triggers. WTI trend conditions remain bullish. The focus remains on $85.01, 1.00 projection of the Sep 21 - Oct 6 - 7 price swing.

- In the FI space, trend conditions remain bearish. Bund futures traded to a fresh trend low yesterday and confirmed a resumption of the underlying downtrend. This has exposed 167.98, 2.382 projection of the Sep 9 - 17 - 21 price swing. Resistance is at 169.92, Oct 14 high. Gilt futures remain vulnerable. A resumption of weakness would open 123.27, 2.00 projection of the Aug 31 - Sep 17 - 21 price swing. Resistance is at 125.27, the Oct 14 high.

EQUITIES: US Futures Moderate as S&P500 Approaches Record High

- US futures trade in minor negative territory, with the e-mini S&P off around 10 points. Nonetheless, the near-term outlook remains bullish, with both the S&P and the EuroStoxx50 futures showing above the 50-day EMAs to tilt the outlook more positive.

- A stronger close for the S&P500 today would mark the seventh consecutive session of gains, the longest winning streak for the index since early August.

- European trade is similarly negative, with most markets off around 0.2%. Materials and energy names are providing a headwind to headline markets, while real estate, consumer staples and tech names trade more firmly.

- Earnings remain a focus, with the likes of Intel and AT&T making up the headlines Thursday. Full earnings schedule with expectations and timings found here: https://marketnews.com/mni-us-earnings-schedule-fo...

COMMODITIES: WTI Edges Off A Fresh Cycle High

- The Dec-21 WTI future printed a new cycle high in Asia-Pac trade at $83.96/bbl, with strength stalling just ahead of the psychological $84/bbl handle. Both WTI and Brent crude futures have rolled off the overnight highs as the greenback reclaims some lost ground and recovers off the overnight lows.

- Elsewhere, the Russian President Putin spoke again on persistently high gas prices, warning that an extended period of high prices would deter consumption among some of Russia's largest trade partners, harming the likes of Gazprom in the longer-run. Reports suggest Russia will have filled its domestic gas stockpiles by the beginning of November, after which priorities could switch to exporting gas, possibly keeping a lid on prices going forward.

- WTI trend conditions remain bullish and the contract has traded to a fresh trend high today. The continued move higher maintains the bullish price sequence of higher highs and higher lows, reinforcing the uptrend. The focus is on $85.01 next, a Fibonacci projection.

- Gold is firmer this week. Attention though is on Friday's sharp sell-off that continues to highlight a potential bearish threat. Key short-term resistance has been defined at $1800.6, the Oct 14 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.